What is Accrual Accounting Method?

The accrual accounting method records financial transactions when revenues and liabilities are incurred, regardless of when the cash is exchanged.

[ez-toc]

The word ‘accrual’ refers to the entries made in the books based on the revenues and expenditures that have not been exchanged in cash. The accrual accounting method is one of the two major accounting methods, the other being cash accounting.

Accrual accounting is the preferred method of accounting for businesses and regulating bodies as it gives an accurate indication of business performance compared to cash-based accounting.

Accrual accounting records accruals on the balance sheet that denotes future and possible cash transactions. It utilizes the concept of receivables and payables. Accounts receivable is an asset account, and accounts payable is a liability account.

Accrual accounting is complex compared to the cash basis method, but it is much more reliable and represents the true and unambiguous picture of business finances.

Using accrual accounting, companies disclose their current and expected cash flows. It also informs the underlying business transactions, not just those in cash.

When Should the Accrual Basis of Accounting be Used?

The accrual basis of accounting is the more acceptable, detailed, and authentic method of financial accounting. Still, this method is only affordable for some businesses and corporations and is optional in some cases.

Most companies do not have a choice of choosing an accounting method other than an accrual basis because of the GAAP and IRS guidelines and requirements.

The IRS released the Revenue procedure 2000-2022 to guide S and C corporations, sole proprietorships, and home businesses in choosing their accounting method.

The American Institute of Certified Public Accountants AICPA has published the following conditions in their Journal of Accountancy that bind the use of accrual basis accounting method:

- C corporation with average annual gross receipts of more than $5,000,000 for the past three years.

- Tax shelters and companies with C corporations as partners that have produced gross receipts of $5,000,000 for the past years must also use the accrual accounting method.

- Companies that sell merchandise must use accrual basis accounting compared to service-providing businesses, which can use cash accounting. In other words, accrual basis accounting is the acceptable method for companies that carry inventory as a material income-producing factor.

At the same time, accrual accounting is a hard choice for small businesses as it is more complicated. A small business owner can handle the company’s cash accounting or with a fresher accountant’s help. But for the accrual basis of accounting, he will have to hire an expert. In addition to the sparing of additional resources, accrual accounting for such businesses will call for further staff handling.

Besides, a business that is just starting and has no intention of shifting from cash basis accounting may be at a loss with accrual accounting. A small loan or liability can skew the small financial picture of the setup.

Who can use the Accrual Basis of Accounting?

Most businesses usually use the accrual basis of accounting. IRS and the generally accepted accounting principles (GAAP) recognize accrual basis as the standard and acceptable method of accounting.

However, the IRS states that qualifying small businesses and taxpayers can have the choice of choosing their suitable method of accounting. These include service-provider and home-based small businesses, for which inventory is not a material income-producing factor.

Small business owners who pass the sales test for cash accounting, i.e., less than $1 million for the last three years, get to choose the cash accounting method, but they are not required. In effect, all businesses can use accrual accounting, but there may be better choices.

When a company chooses a method of accounting, it is mentioned in the accounting policies that contain all the accounting policies and standards adopted by the company.

These accounting policies are only advisable to change with intelligent logic and prior permission from the company’s board members.

Advantages of the Accrual Method

Accrual accounting is considered the best practice accounting process because of its transparency and detail.

As global accounting bodies aim to bring parity in different accounting standards, there is emerging consensus to adopt an accrual basis of accounting universally. Here are some of the major advantages of using accrual accounting:

GAAP Compliance

The accrual basis of accounting is advocated under generally accepted accounting principles (GAAP) and international financial reporting standards (IFRS). Companies should record revenues and expenses in the year when they are billed or brought to books, irrespective of when they are paid or received. That is why companies and businesses eventually shift to the accrual method of accounting even if they had started small using the cash accounting method.

Accuracy

The main reason regulating bodies such as FASB and SEC require the accrual accounting method is that it shows a more accurate picture of the company’s profits and losses. Accrual accounting is more accurate as it records revenue when it is earned and expenses when it is incurred, matching them side by side.

Transparency for Investors and Lenders

Publicly traded companies listed under the U.S. Securities and Exchange Commission (SEC) must share their financial statements publicly to ensure transparency. Businesses should prepare financial reports on an accrual basis for a true depiction of the financial health of the business concern, which the investors then use to make wise decisions.

A company needs audited financial statements for international funding, which again demand the accrual accounting method. Lenders can only lend an amount to a business with sufficiently reliable financial documents and legal compliance. So, for companies that intend to expand or are already operating on high stakes, there is no way safer than accrual accounting.

Disadvantages of the Accrual Method

As accrual accounting is the legally acceptable, more accurate, and detailed basis of accounting, it has several advantages in the long term. If a company operates on a cash basis, then an accrual basis is less practical in this case. But there are better alternatives for some sizes and types of businesses. Maintaining an accrual basis is much more suitable for large and growing businesses than stores, shops, or other similar micro-commercial establishments.

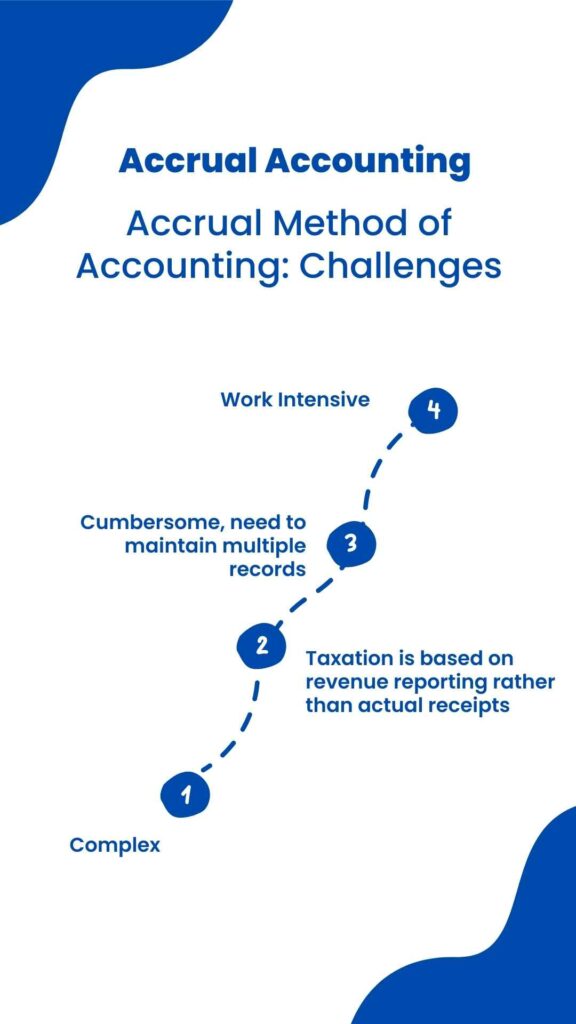

Let us see some of the disadvantages of accrual accounting:

Complex and Expensive

Accrual basis accounting has extensive and clear guidelines listed by the IFRS and the GAAP. So, a business owner cannot look into it himself. Businesses need expert advice and accountants to comply with these guidelines and legal regulations.

Also, hiring accountants will be an additional cost burden for small and medium-range businesses just starting. Accrual accounting is also considered complex because a company may appear profitable on paper, and its bank accounts may be empty.

Work-intensive Accounting Method

In addition to the professional accountants for accrual basis accounting methods, you will also need sufficient human resources to deal with the double-entry journal entries, frequent financial reporting, and even more frequent accounts receivable and accounts payable reports.

The salesperson at point-of-sale must be trained in recording transactions and taxes for accrual accounting.

Taxes

Accrual accounting allows you to report revenue generation when the sale is incurred instead of waiting for cash flow. In this situation, you will also be paying taxes on income and revenue you may still need to receive.

Accrual vs. Cash Basis Accounting

The key difference between the two accounting methods is that the accrual method recognizes expenses and revenues in the same reporting period as they are incurred. In contrast, the cash basis accounting system recognizes a transaction when the cash is paid or received.

So, the main difference lies in the timing; that is, when do you record income or the expenses incurred? It will impact revenue reporting and cost measurement. The decision-making process and reporting requirements may need different revenue recognition methods.

The cash basis of accounting leaves room for manipulation, as a company can delay cash payments till a reporting period ends. So that it can defer income taxes till it is feasible for the company’s financial condition. And this is one big reason why governing bodies such as the Internal revenue service (IRS) and IFRS prefer the accrual basis of accounting.

Read our post to understand the differences between the cash basis and accrual accounting methods in detail.

Examples

Example of Accrued Revenue

- Company A provided IT services worth $7000 to company B in February. Company B receives the bill for the services rendered when company A releases its invoices before closing the books for February.

A double-entry journal for February under the accrual basis accounting method will look like this:

| Debit | Credit | |

| Accounts receivable-Company B | $7000 | |

| Revenue | $7000 |

Company B sends a check to the service provider on March 15, which gets deposited the same day. Journal entries for March should look like this:

| Debit | Credit | |

| Cash | $7000 | |

| Accounts receivable-Company B | $7000 |

Example of Accrued Expenses

- An athletes’ garments store purchased $5,000 worth of sales inventory from the manufacturer on March 15. The store received an invoice from the manufacturer on April 1 and released the payment on April 10.

March

| Debit | Credit | |

| Inventory | $5000 | |

| Accounts payable-Manufacturer | $5000 |

April

| Debit | Credit | |

| Accounts payable-Manufacturer | $7000 | |

| Cash | $7000 |

Choosing a legally suitable method of accounting can take time and effort. The same goes for dealing with financial reporting, recording transactions, revenues, and expenses, and filing taxes with the complex accrual accounting method. Adhering to sound financial best practices saves time, is pragmatic, and helps meet various compliances.

Let the experts handle these accounting matters for your business so that you can focus on what you are an expert in!

Sign up with Akounto today for professional bookkeeping services!