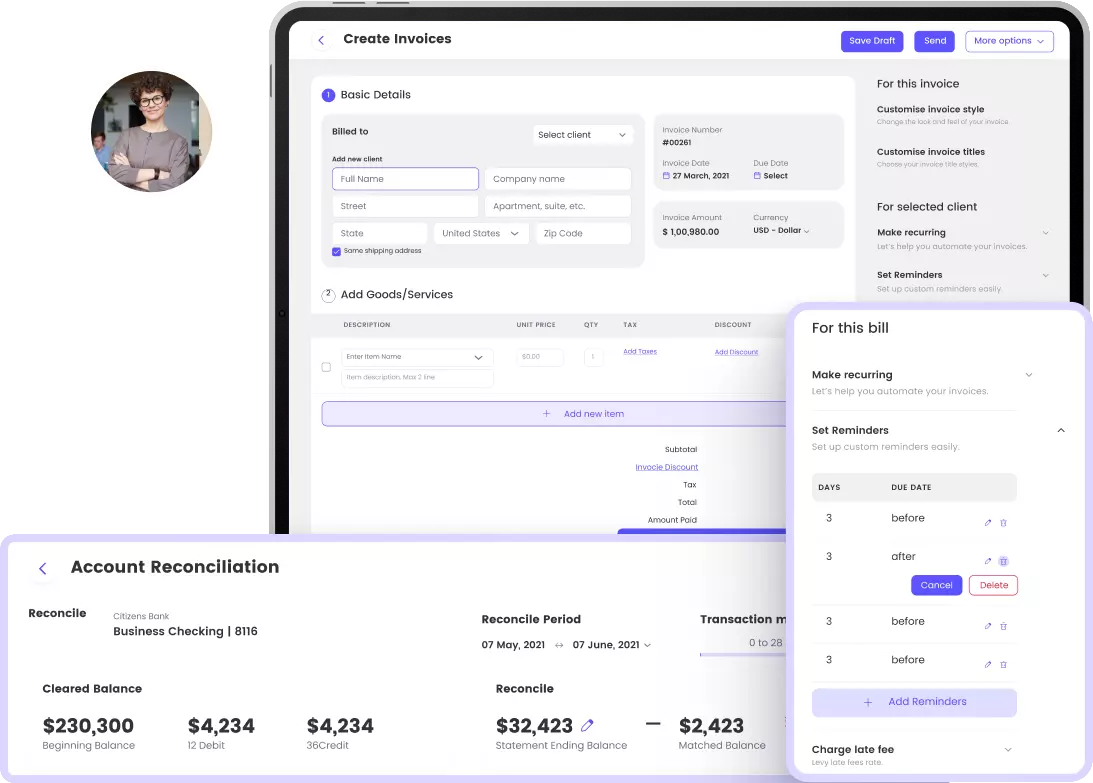

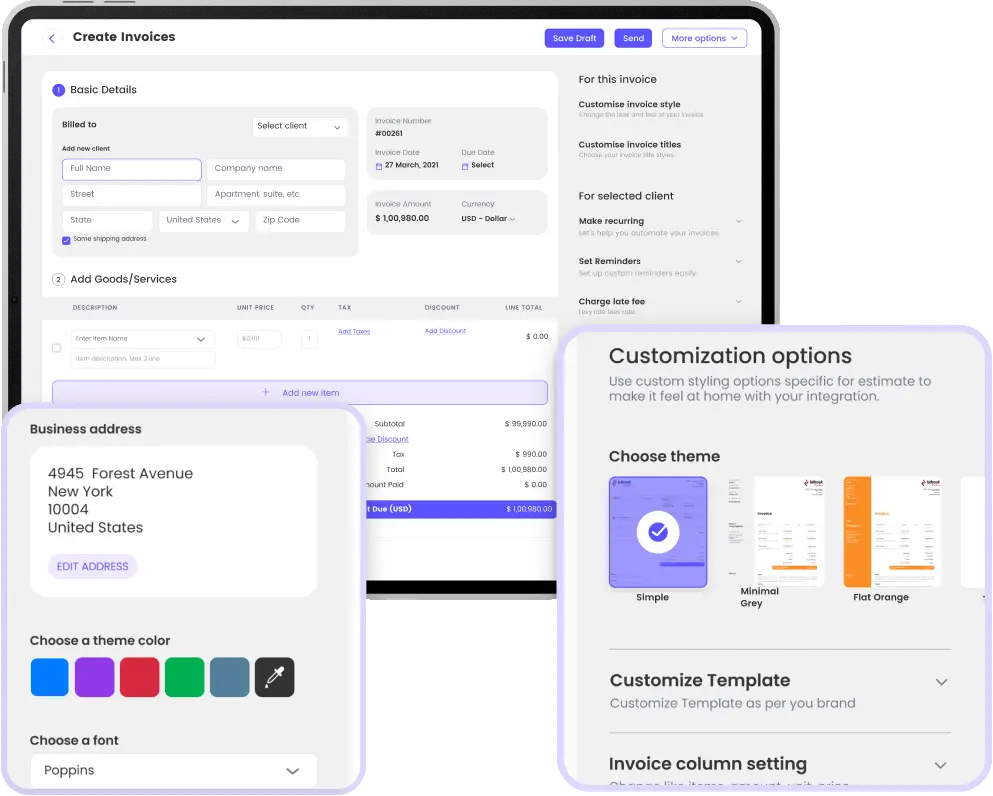

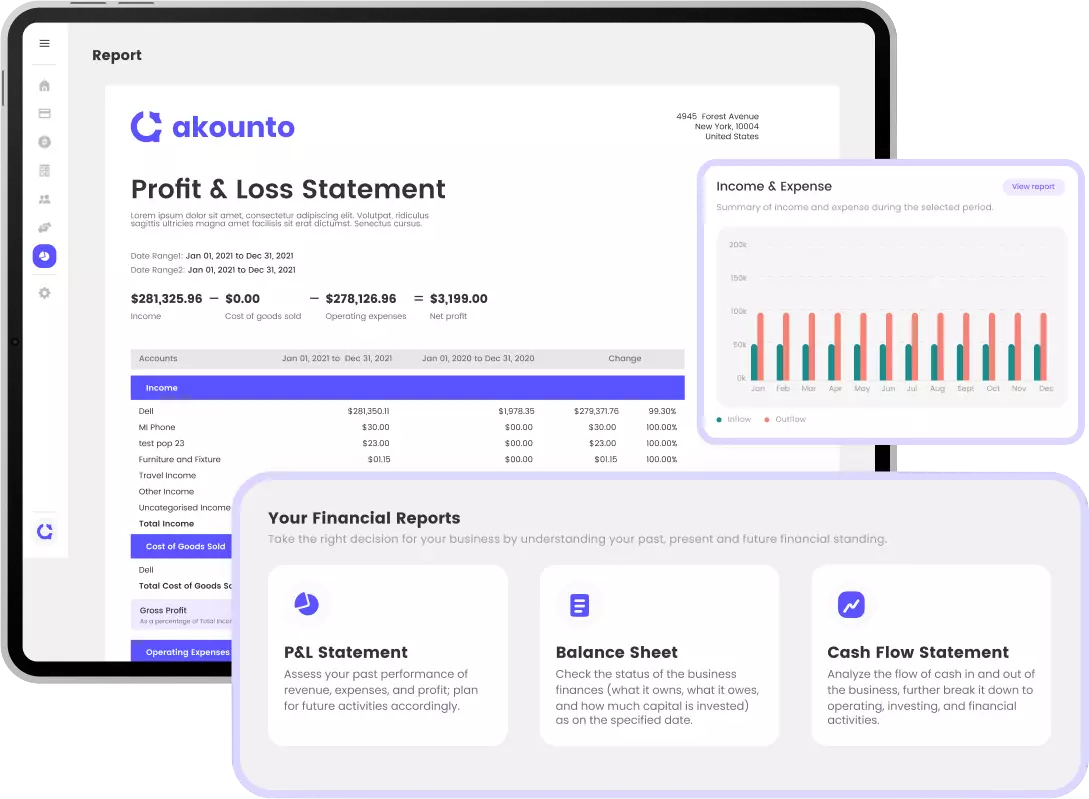

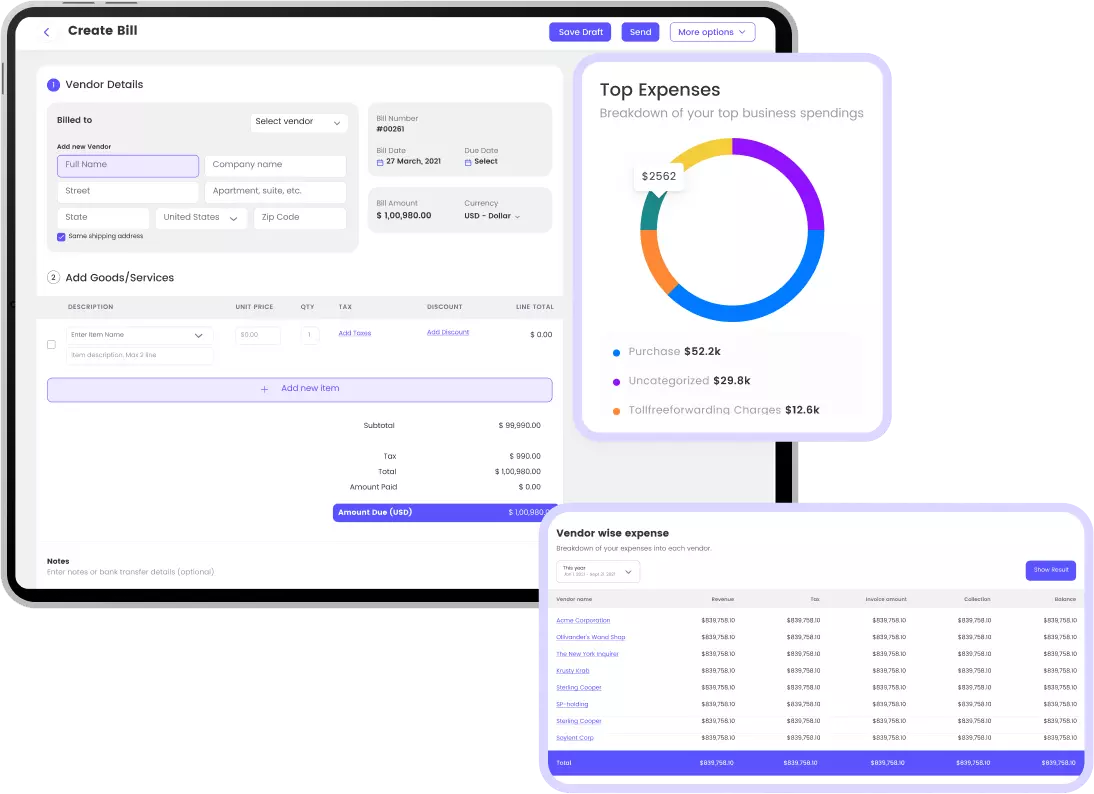

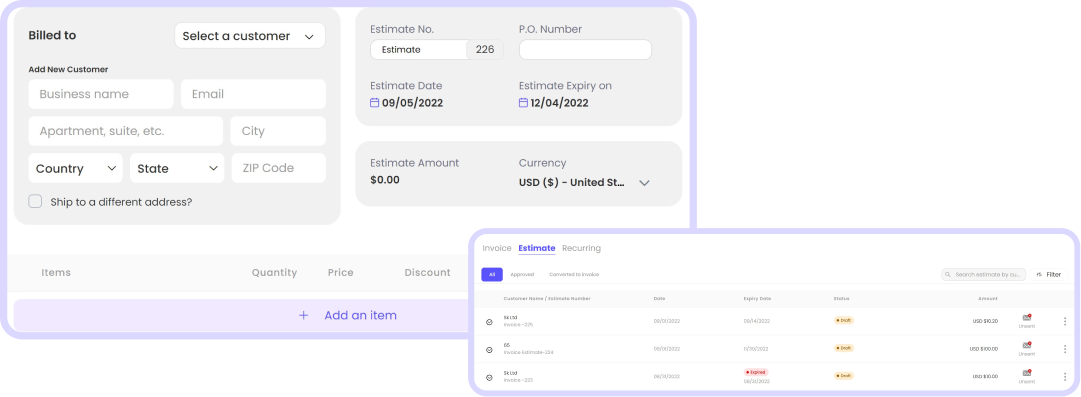

Simplify and streamline startup invoicing

Work more efficiently using simple invoicing software for startups that keeps track of every payment. Create itemized, multi-currency invoices. Thank your customers with customized emails based on the many professional templates offered by Akounto.

Get Started