Defining and Understanding Continuing Operations

Continuing operations are the business’s ongoing and core activities that generate revenue and are expected to persist in the foreseeable future.

Continuing operations are essential to overall performance and sustainability and are reported in the income statement.

[ez-toc]

Examples of continuing operations include the sale of goods or services, manufacturing activities, rental income, and routine administrative expenses.

Significance

Continuing operations are the primary source of revenue, ensuring financial stability and viability in the long run.

Understanding continuing operations is crucial for evaluating a company’s financial health, profitability, and long-term prospects, as it provides insights into the core activities that contribute to its ongoing success.

From a stakeholder perspective, understanding and evaluating continuing operations provide invaluable insights. Investors rely on the consistent revenue generated from core activities to assess the company’s profitability and potential return on investment.

Lenders and creditors also consider continuing operations a key factor in determining the company’s creditworthiness and ability to meet financial obligations.

Continuing operations also serve as an indicator of the company’s competitive position in the market. By consistently delivering products or services, businesses can establish brand loyalty, customer trust, and a strong market presence, leading to a competitive edge.

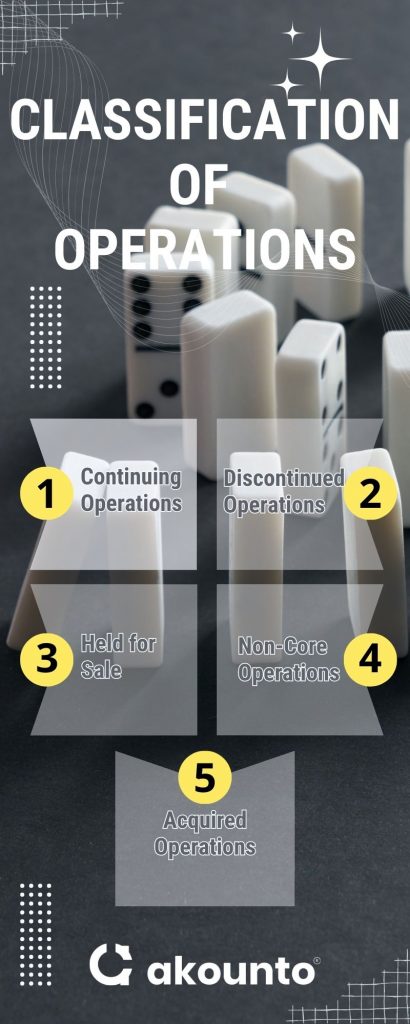

Classification of Operations

- Continuing Operations are the ongoing and regular activities that generate revenue consistently over time. Focusing on these activities, investors and stakeholders can assess the company’s performance and make informed decisions about its value and potential for growth.

- Discontinued Operations are when a company eliminates a segment of its business. The discontinued operations are either wound down or sold off, and their financial results are reported separately from continuing operations. The separate reporting of discontinued operations provides transparency about their impact.

- Held for Sale refers to assets classified as being available for sale in the near term. It occurs when a company plans to sell off a portion of its operations or assets and is presented separately in the income statement.

- Non-Core Operations are unrelated to a company’s business or core competencies. These operations may include peripheral or diversification efforts that are outside the focus of the company’s activities.

- Acquired Operations are businesses purchased or acquired by a company. These may have been previously independent or part of a parent company and are integrated into the acquiring company’s businesses.

Examples

- Sales and Distribution: Ongoing sales and distribution activities of a retail company, including selling products through physical stores, online platforms, or both.

- Manufacturing and Production: Regular manufacturing operations of a food processing company, producing and packaging food products for distribution.

- Service Provision: Continual provision of services by a consulting firm, such as offering advisory services, strategic planning, and implementation support to clients.

All the above demonstrate different types of continuing operations across various industries.

Income from Continuing Operations

Income from continuing operations refers to the profit generated by a company’s core and ongoing business activities, excluding any extraordinary or non-recurring items.

It represents the financial performance resulting from the business’s regular business activities, such as sales of goods or services, minus the associated costs and expenses incurred in producing and delivering those goods or services.

Let’s consider a company, ABC Electronics Inc. In their most recent income statement, ABC Electronics reported the following figures:

Sales Revenue: $1,000,000

Cost of Goods Sold: $600,000

Other Operating Expenses: $250,000

We start with the gross profit to calculate the income from continuing operations.

Gross Profit = Net Sales – Cost of Goods Sold => $1,000,000 – $600,000 = $400,000

Next, we subtract the other operating expenses.

Gross Profit – Operating Expenses = Income from Continuing Operations

$400,000 – $250,000 = $150,000

In this example, ABC Electronics generated an income from continuing operations $150,000.

Components

- Revenues: are the monetary inflows a company earns from its core business operations.

- Expenses: are the charges incurred by a company in its day-to-day business operations. It includes income tax levied on a company’s taxable income. It is calculated based on applicable tax laws, regulations, and rates.

- Gains and Losses: in the context of income from continuing operations, refer to the positive or negative financial changes arising from events or transactions outside business operations. They are excluded when calculating income from continuing operations as they occur from selling assets, investments, or other exceptional events.

Representation in Financial Statements

The income statement represents continuing operations separately from other categories, such as any discontinued operation or extraordinary item. The objective is to give a clear and transparent view of the ongoing financial performance of the company’s core operating activities.

On the balance sheet, continuing operations are typically represented in two main categories:

Net Income and Retained Earnings

Net income represents the company’s profit for a specific accounting period. It includes revenues and deducts expenses. The net income contributes to retained earnings growth, reflecting profits reinvested into the business.

Retained earnings remain relatively stable over time, as they exclude amounts distributed to shareholders through dividends or stock repurchases, unlike net income.

Expenses and Other Liabilities

The income statement includes various expenses incurred by the company in its continuing operations, such as the cost of goods sold, operating and interest expenses, and income taxes. These expenses are deducted from revenues to calculate net income.

Any outstanding liabilities related to continuing operations, such as accounts payable or accrued expenses, are reported as part of the company’s overall liabilities on the balance sheet.

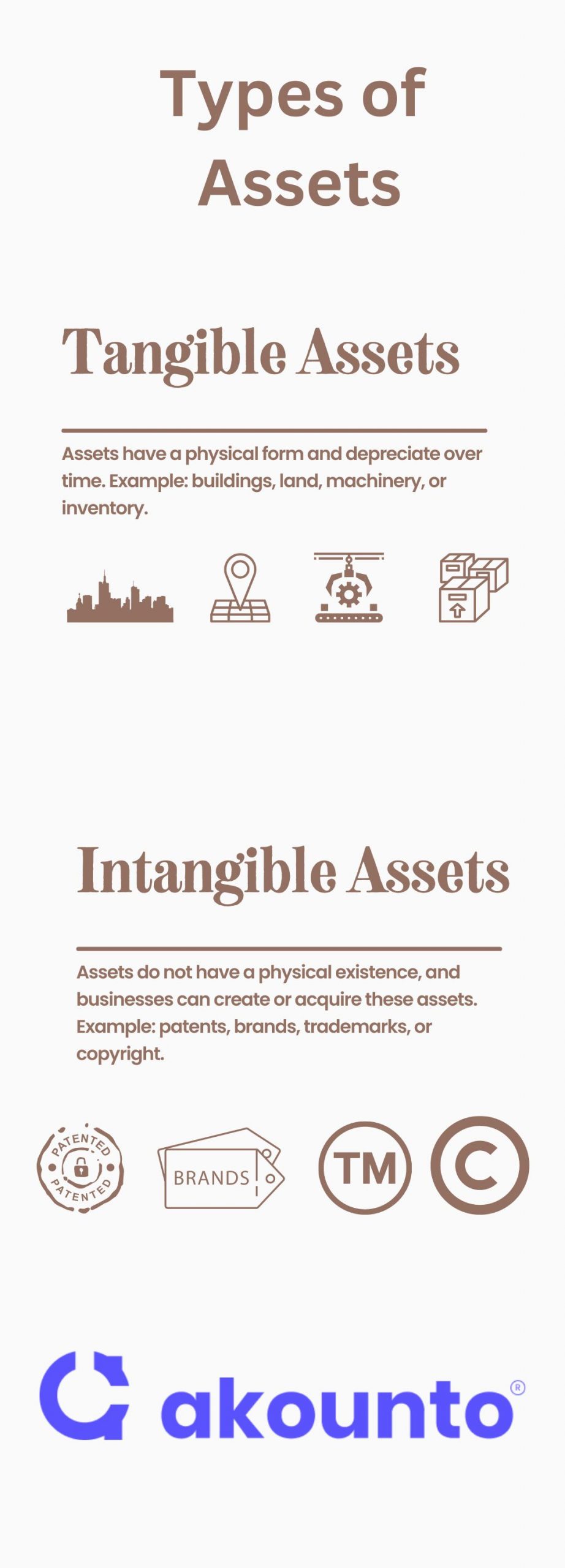

Types of Assets

In assessing the company’s value, tangible and intangible assets play a role.

Tangible assets, like equipment, are considered part of continuing operations if necessary for the company’s future operations.

Intangible assets, like brand value and proprietary software, are typically a part of continuing operations unless deemed worthless by company management. Despite lacking physical form, these assets can influence a company’s performance.

Reporting Requirements

The ASC (Accounting Standards Codification) provides clear instructions for reporting continuing operations, including:

- ASC 220, Reporting Comprehensive Income, offers guidance on presenting and disclosing comprehensive income, including income from continuing operations. It summarizes all items to be included in the statement and the required disclosures related to income from continuing operations.

- ASC 225, Operating Section specifies how gains, losses, revenues, and expenses related to ongoing or continuing operations should be treated and presented in financial statements.

- ASC 230, Statement of Cash Flows specifies the requirements for reporting and disclosing operating cash flows in the statement of cash flows.

- ASC 280, Segment Reporting, provides instructions on reporting information of all segments and divisions in a business in financial statements. For example, a company operating in multiple divisions must disclose income from continuing operations for each segment.

Conclusion

Understanding and managing continuing operations is crucial for financial stability and success. Companies can ensure long-term profitability by focusing on regular business activities and making informed decisions.

Explore the Akounto blog for valuable insights and expert advice to help optimize your business’s financial operations.