Defining Equity

Equity in accounting represents the ownership interest in a company. It is the residual interest in the company’s assets of an entity after deducting liabilities.

[ez-toc]

Equity is the value of an asset after all debts and other obligations have been paid. It is often called “net assets” or “residual interest.”

In a business context, equity refers to the value that would be returned to a company’s shareholders if all of the business’s assets are liquidated and debts paid off, thereby called shareholders’ equity, stockholders’ equity, or owner’s equity.

Equity in accounting is crucial as it provides a clear picture of a company’s financial position to investors, financial analysts, and accounting firms. It is a key component of a company’s balance sheet, one of the most important financial statements for assessing its financial performance.

The term equity is also used in several other related contexts. For instance, personal equity refers to an individual’s net worth, calculated as personal assets minus personal liabilities.

In essence, equity signifies the true value of an entity and plays a pivotal role in financial decision-making. It is a dynamic value that changes with the fluctuations in assets and liabilities, and understanding it is essential for both businesses and individuals.

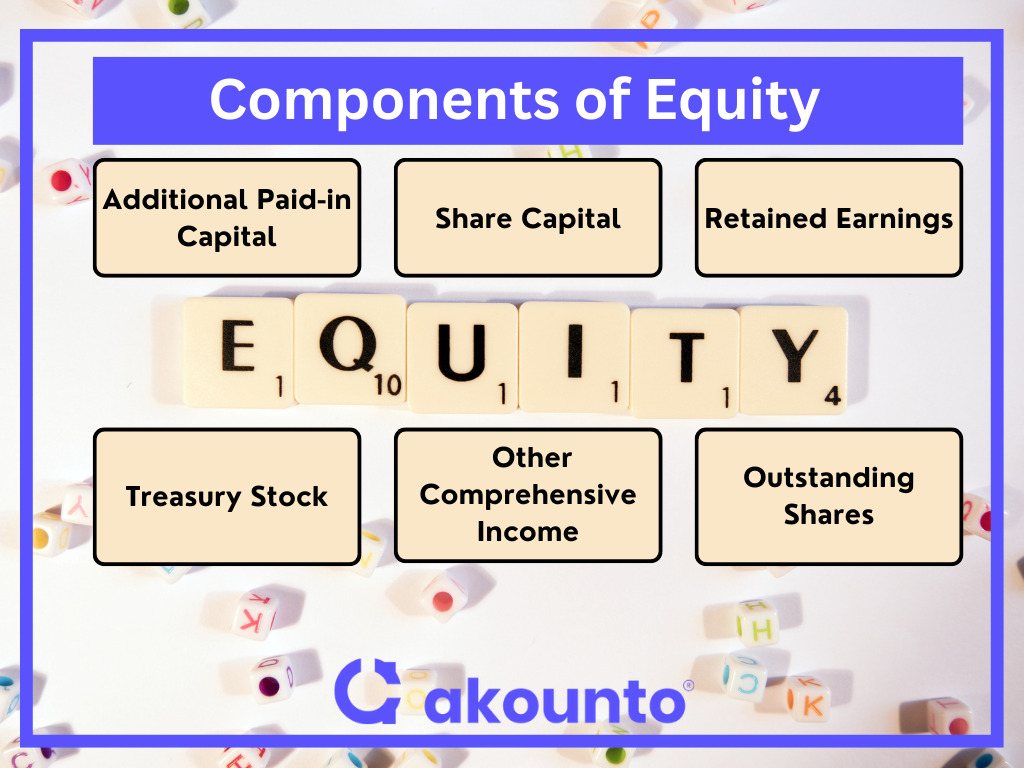

Components of Equity (Owner’s Equity)

Shareholders’ equity (stockholders’ equity) is a company’s total assets minus its total liabilities. It represents the net value of a company and is a critical component of its balance sheet.

Shareholders’ equity comprises several elements, each playing a unique role in a company’s financial structure.

Share Capital

Share capital, or contributed capital, is the total amount of money a business has received from shareholders in exchange for shares of stock. It is a key component of a company’s equity and is listed on the balance sheet. Share capital can be broken down into two categories:

Common Stock

Common stock represents shares that give a portion of ownership in a company. Common shareholders can vote at shareholders’ meetings and receive dividends. Common stock value depends on the company’s performance and market perception.

Preferred Stock

This represents the amount received from the issue of preferred shares. Preferred shareholders have a higher claim on dividends and assets if the company is liquidated, but they usually don’t have voting rights.

Outstanding Shares

Outstanding shares refer to the stock currently held by its shareholders, including share blocks owned by institutional investors and restricted stock held by the entity’s officers and insiders. These shares are the company’s equity divided into equal parts. The number of outstanding shares is used in computing key metrics such as a company’s market capitalization and earnings per share (EPS).

Additional Paid-In Capital

Additional paid-in capital (APIC) is the excess value over the par value of shares that shareholders have paid for their shares. It measures the investor’s willingness to pay above the par value for a company’s stock, reflecting their confidence in its potential.

Retained Earnings

Retained earnings are the net income a company has kept rather than paid out to shareholders as dividends. These earnings are reinvested in the company, used to pay off debt, or saved for future use. Retained earnings clearly show a company’s financial health and profit management strategy.

Treasury Stock

Treasury stock refers to the shares a company has bought back from the open market. Companies buy back shares to reduce the number of outstanding shares and increase the value of remaining shares. These shares are deducted from shareholders’ equity.

Accumulated Other Comprehensive Income

Accumulated other comprehensive income refers to unrealized gains and losses not included in net income. These can be from foreign currency transactions, pensions, and changes in the value of investments. It provides a more comprehensive view of a company’s total equity.

Equity in Accounting and Assessing Market Value

Equity in accounting is a critical factor in assessing a company’s market value. Market value (company’s market capitalization) is computed by multiplying the stock’s current market price by its outstanding shares. However, this market value may not always align with the company’s equity as recorded on the balance sheet.

The balance sheet equity represents the book value based on historical costs and accounting principles. On the other hand, the market value reflects the company’s current value as perceived by investors and the market. It considers future growth prospects, market trends, and investor sentiment.

Equity in accounting provides a solid foundation for understanding a company’s financial health, but its market value often drives investment decisions.

Financial analysts and investment bankers often compare these values to determine if a publicly traded company’s stock is overvalued or undervalued.

How is Equity Calculated?

Equity calculation is a straightforward process in accounting. It involves a simple formula that considers a company’s total assets and liabilities.

Formula

The formula for calculating equity is:

Equity = Total Assets – Total Liabilities

Here’s a step-by-step breakdown of the formula:

- Total Assets: This includes everything that a company owns, both tangible assets like cash, inventory, property, and machinery, and intangible assets like patents, copyrights, and goodwill.

- Total Liabilities: These are what the company owes to others, including debts, accounts payable, accrued expenses, and long-term obligations.

- Subtract Total Liabilities from Total Assets: The difference between the total assets and liabilities gives the equity value. This represents the net value or net worth of the company.

This formula is a fundamental equation in accounting and provides a snapshot of a company’s financial health. It’s important to note that positive equity indicates that the company has more assets than liabilities, which is generally a good sign for investors and creditors.

Example

Extract of the balance sheet of XYZ Corp:

- Total Assets: $500,000 (includes cash, inventory, property, equipment, and any intangible assets)

- Total Liabilities: $200,000 (includes debts, accounts payable, and any other financial obligations)

Using the formula for calculating equity:

Equity = Total Assets – Total Liabilities

Following formula: Equity = $500,000 – $200,000 = $300,000

The equity of XYZ Corp, in this case, would be $300,000. This means that after paying off all its liabilities, XYZ Corp would have $300,000 worth of assets remaining, representing the owner’s interest in the company.

Conclusion

Equity in accounting is a vital measure of a company’s financial health and stability. It represents the residual interest in the company’s assets after all liabilities are deducted. Understanding equity in accounting is essential for investors, financial analysts, and business owners as it provides a clear picture of a company’s net worth and financial standing.

Use Akounto accounting software and experience many helpful features, such as recordkeeping, invoicing, etc., to streamline your business.