What is Working Capital?

Working capital is the difference between the current assets and current liabilities of a company, reflecting on its short-term liquidity.

As a measure of short-term liquidity, working capital measures how much current assets are there to cover current liabilities.

Current assets refer to the resources that cash convertible within one year, such as cash, accounts receivable, and inventory. Current liabilities are the obligations the company needs to settle within the same period, like accounts payable, accrued expenses, and short-term debt.

The process of working capital management revolves around managing a company’s current assets and liabilities so that the company can cover short-term debt obligations with current assets.

For example, the company can pay its suppliers and vendors from the cash collected from customers or can pay its trade creditors via cash-in-hand or other current assets.

Maintaining the cash flow involves balancing accounts receivables with accounts payables. The efficiency of collection and operational efficiency is measured by calculating various ratios like inventory turnover ratio, cash collection ratio, current ratio, quick ratio, etc.

A positive working capital indicates the company’s ability to cover its short-term liabilities with its assets. A negative working capital can signal financial distress, meaning the company struggles to meet its immediate obligations or routine expenses.

Importance of Working Capital

Without adequate working capital, a company might struggle to meet its obligations, resulting in financial difficulties and, in extreme cases, bankruptcy.

Working capital keeps the business running. It funds routine business activities like:

- Paying wages

- Paying salaries

- Paying vendors

- Paying for raw materials, utilities, etc.

The “working” in working capital means capital that is needed to keep the business running.

If working capital is insufficient, short, or negative, then it means that the company’s current assets cannot or are insufficient to fund regular business operations. In such a scenario, the company will need to resort to financing its working capital. Working capital financing includes techniques like:

- Bank Overdraft

- Working capital loan from the bank

- Invoice factoring

- Revolving credit facilities

- Trade credit

- Bank guarantee

- Secured or unsecured loans

- Bills of exchange

Getting working capital financed comes with interest payments. However not being able to pay for raw materials, wages, etc., can lead to a work stoppage, eventually leading to a closure. In the case of economic recessions, when companies have low liquidity, negative working capital, or no access to cash, then there are frequent plant/factory closures.

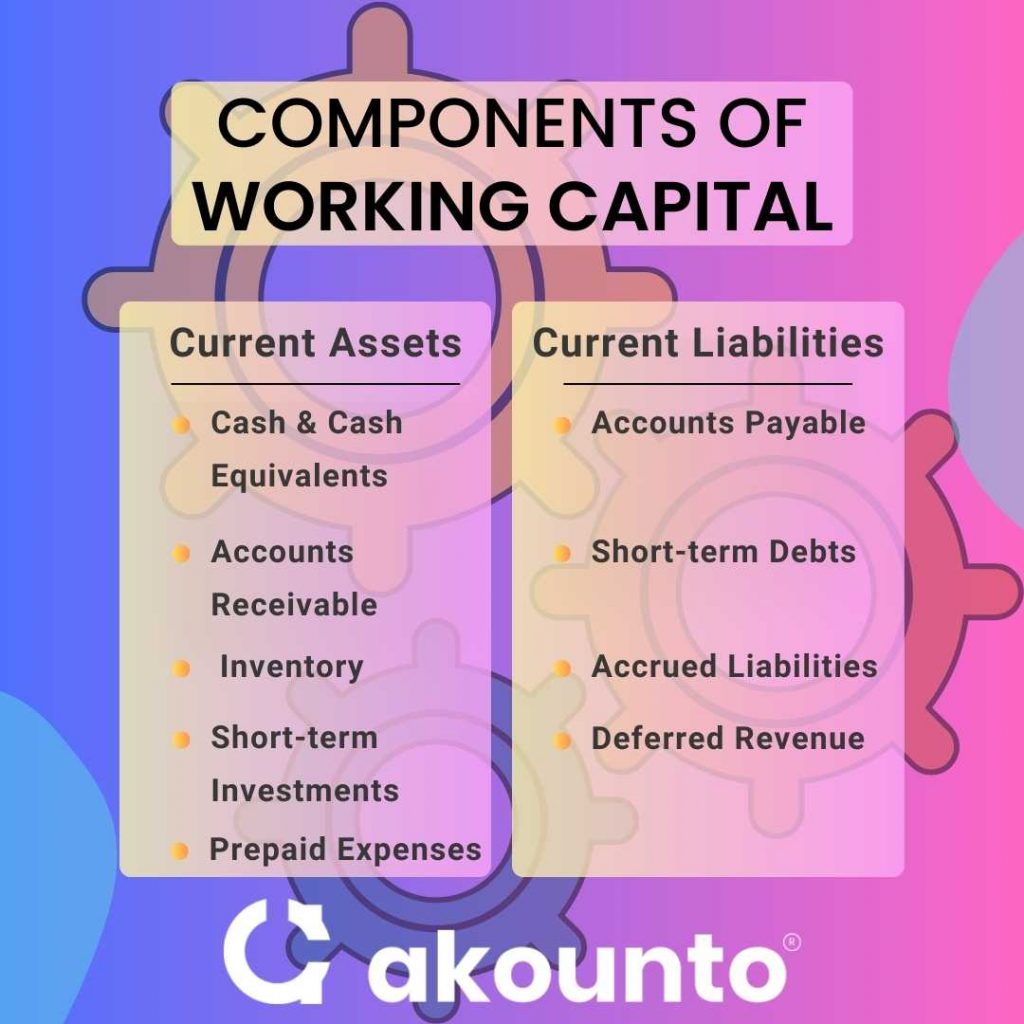

Components of Working Capital

Working capital has two main components, each crucial in managing a company’s short-term financial health. These are Current Assets and Current Liabilities.

Current Assets

The company’s current assets are the liquid assets that are cash-convertible within a year. These typically include:

- Cash and Cash Equivalents: The liquid assets, such as bank balances, coins, bills, money orders, and short-term government bonds.

- Accounts Receivable: Amounts owed to the entity by its customers for goods or services delivered but not yet paid for.

- Inventory: Goods ready for sale or raw materials for production.

- Short-term Investments: Investments that are readily marketable and are cash convertible within a year, such as money market funds, commercial papers, or treasury bills.

- Prepaid Expenses: Payments for goods or services to be received in the future.

Current Liabilities

Current liabilities are the company’s short-term financial obligations that must be paid within a year. These generally include:

- Accounts Payable: Amounts the company owes suppliers for goods or services already received but not yet paid for.

- Short-term Debts: Debts that must be paid within a year, such as bank overdrafts or short-term loans.

- Accrued Liabilities: Expenses incurred but not yet paid, such as salaries, rent, utilities, and taxes.

- Deferred Revenue: Payments received in advance for goods or services to be delivered in the future.

Working Capital Cycle

The working capital cycle (cash conversion cycle) means the time a company needs to convert net current assets and liabilities into cash.

Working capital cycle measures how long a company’s money is tied up in its day-to-day operations before it gets converted into cash.

The cycle involves the following steps:

- Purchasing Inventory: This is the first step in the cycle, where a company spends cash on buying inventory for production or resale. Money spent here increases the company’s current assets.

- Production and Sales: The inventory is then used to produce goods or kept for resale. Once the goods are sold (on credit), the inventory decreases, and receivables increase.

- Collection of Accounts Receivable: The company then collects payment from its customers, decreasing receivables and increasing cash.

- Payment of Liabilities: Finally, the company pays its suppliers (accounts payable), reducing cash and decreasing current liabilities.

The length of the working capital cycle can significantly impact the company’s liquidity, profitability, and overall financial health.

A shorter cycle is generally preferable as it means the business is converting its working capital into cash more quickly, helping to maintain cash flow and meet short-term obligations.

A prolonged working capital cycle might indicate inefficiencies in managing inventory, accounts receivable, or accounts payable, which could strain the company’s resources.

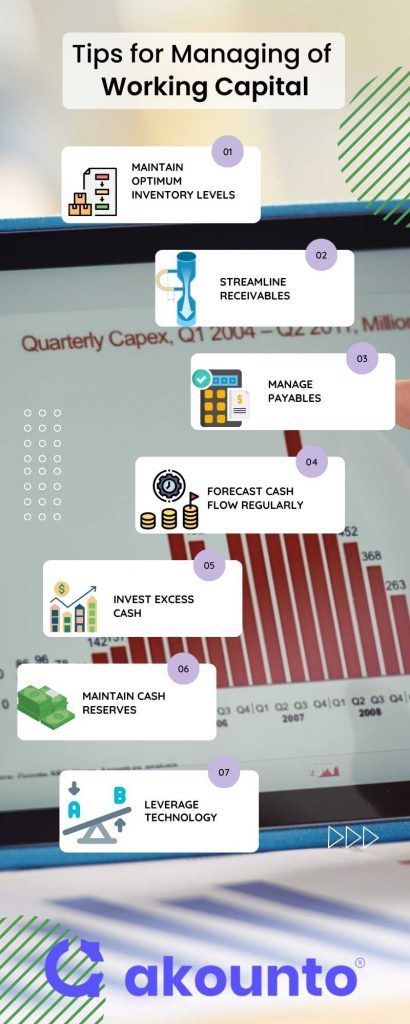

Tips for Managing the Working Capital Cycle

- Efficient Inventory Management: Maintain an optimum inventory level to avoid excess stock and potential obsolescence. Use techniques like Just-In-Time (JIT) to reduce inventory holding period.

- Streamline Receivables: Implement strategies to accelerate receivables, such as offering early payment discounts or using invoice financing services. Regularly review the credit terms provided to customers.

- Manage Payables: Negotiate favorable credit terms with suppliers, such as extended payment periods or discounts for early payment. This can help to manage the cash outflows effectively.

- Regular Cash Flow Forecasting: Regularly forecast short-term and long-term cash flows. This will enable you to plan, meet financial obligations, and identify potential shortfalls in advance.

- Invest Excess Cash: If the company has excess cash, consider short-term investments that can be easily liquidated. This will ensure that the cash is not sitting idle and is earning a return.

- Maintain a Cash Reserve: Always maintain a certain level of cash reserve to meet any unexpected expenses or to capitalize on any investment opportunities.

- Leverage Technology: Use modern accounting software and tools to more effectively track, analyze, and manage working capital components.

Working Capital Formula and Calculation

Working capital formula or Net Working Capital = Current assets – Current liabilities

A positive net working capital indicates the company has enough resources to cover its short-term liabilities. In contrast, a negative net working capital means a potential liquidity problem, as the company might struggle to meet its short-term obligations.

Positive working capital is often associated with strong financial health.

Negative working capital means the company might struggle to meet its short-term obligations. While generally a sign of potential liquidity issues, negative working capital isn’t always unfavorable. Some businesses operate efficiently with negative working capital if they can quickly convert their accounts receivables or inventory into cash.

The calculation of a company’s working capital might slightly differ based on the industry and the type of business.

Some businesses might exclude certain items from current assets or liabilities based on their liquidity or solvency requirements.

Examples

Example 1: Basic Calculation

Consider a small business with current assets of $500,000 and current liabilities of $200,000. Calculate working capital:

Working Capital Formula = Current Assets – Current Liabilities Working Capital = $500,000 – $200,000 = $300,000

The company has positive working capital of $300,000, suggesting it has sufficient resources to cover its short-term obligations.

Example 2: Detailed Calculation

Let’s consider a larger enterprise with the following current assets and liabilities:

Current Assets:

- Cash: $100,000

- Accounts Receivable: $200,000

- Inventory: $300,000

- Marketable Securities: $100,000

Current Liabilities:

- Accounts Payable: $200,000

- Short-term debt: $100,000

- Accrued Expenses: $50,000

Working Capital Formula = (Cash + Accounts Receivable + Inventory + Marketable Securities) – (Accounts Payable + Short-term Debt + Accrued Expenses) Working Capital = ($100,000 + $200,000 + $300,000 + $100,000) – ($200,000 + $100,000 + $50,000) = $350,000

Again, the enterprise has a positive working capital, indicating a strong liquidity position.

Example 3

Consider a Fortune 500 Company’s working capital. Their balance sheet shows their current assets were $143.71 billion, and their current liabilities were $105.72 billion.

Working Capital Formula = Current Assets – Current Liabilities Working Capital = $143.71 billion – $105.72 billion = $37.99 billion

With significant positive working capital, the company can robustly cover short-term liabilities, contributing to its financial stability.

Working Capital Ratio and Interpretation

The Working Capital Ratio (Current Ratio) is a key indicator of a company’s short-term financial health and liquidity. To calculate working capital, divide current assets by current liabilities:

Working Capital Ratio = Current Assets / Current Liabilities

This ratio gives stakeholders an idea of the company’s ability to repay its short-term liabilities (debts and payables) with its assets (cash, inventory, receivables).

Ideal Ratio: The ideal Working Capital Ratio is generally around 2:1, meaning the company has double the current assets than current liabilities. However, this can vary by industry.

Interpretation:

- A ratio above two might suggest the company is inefficient in using its assets to generate profits.

- A ratio under 1 indicates that the company could not pay off its obligations if they came due at that point. This shows a red flag for potential financial trouble.

- A ratio between 1.2 and 2.0 is typically considered healthy.

Examples

Example 1

If a company has $1,000,000 in current assets and $500,000 in current liabilities, its working capital ratio would be:

Working Capital Ratio = $1,000,000 / $500,000 = 2

This is considered an ideal ratio, suggesting the company is in a good position to cover its short-term obligations.

Example 2

Conversely, if a company has $400,000 in current assets and $800,000 in current liabilities, the ratio would be:

Working Capital Ratio = $400,000 / $800,000 = 0.5

This ratio is less than 1, indicating that the entity does not have sufficient current assets to cover its short-term liabilities, which could lead to liquidity problems.

Understanding the working capital ratio and its interpretation is crucial for internal and external stakeholders to make informed decisions about the company’s financial health.

Impact on Liquidity Position

Working capital has a direct impact on a company’s liquidity position. Liquidity means the ease with which a business can convert its assets into cash to pay for short-term obligations. Here’s how working capital influences liquidity:

Current Assets and Liquidity

- Current assets are a company’s most liquid assets, including cash, accounts receivable, and inventory.

- An increase enhances the entity’s ability to pay its short-term debts and operational expenses, thereby improving its liquidity position.

Current Liabilities and Liquidity

- Current liabilities are short-term obligations to be paid within a year, like payables, short-term loans, and accrued expenses.

- An increase in liabilities without a corresponding increase in assets can strain the company’s liquidity.

Working Capital and Liquidity

- Positive working capital signifies that a business can fund its day-to-day operations and has enough cash or liquid assets to satisfy both maturing short-term debt and upcoming operational expenses.

- Negative working capital can signal a liquidity risk but isn’t always negative if the company can generate cash quickly.

Adequate working capital is essential for maintaining the liquidity of a company. Too little working capital can lead to financial distress and potential bankruptcy, whereas too much-working capital suggests that the company is not using its assets effectively to generate revenues.

Working capital forecasting is crucial as it anticipates cash flow needs, ensuring liquidity for day-to-day operations. It aids in avoiding potential working capital deficit, enables timely investment decisions, and helps maintain healthy relationships with creditors by providing prompt payments, thus underpinning the overall financial health of a company.

Working Capital for Small Business Owners

Working capital is particularly significant for small business owners. It is a crucial measure of a company’s short-term financial condition and operational efficiency. Here’s why:

- Small businesses often operate on thin margins and may lack extensive financial reserves. They rely heavily on efficient working capital management to meet their day-to-day expenses, such as payroll, rent, and inventory purchases, to raise cash quickly.

- Proper working capital management helps small businesses ensure they have enough cash flow to handle sudden financial difficulties or seize new investment opportunities.

- A strong working capital position improves the small business’s creditworthiness and can make obtaining financing from lenders or investors easier.

- Small business owners often need to demonstrate adequate working capital to secure contracts, especially in construction industries where upfront costs can be significant.

- Regular monitoring of working capital can alert small business owners to potential financial issues before they become critical.

An example of the importance of working capital management can be seen in the 2008 financial crisis. Large, seemingly stable corporations like Lehman Brothers collapsed due to liquidity issues.

Despite having substantial long-term assets on their balance sheets, these companies found insufficient liquid assets to cover short-term liabilities when market conditions deteriorated.

Conclusion

Working capital is crucial in a company’s financial operations, highlighting its short-term financial position and operational efficiency. Efficient working capital management can help businesses navigate their day-to-day operations smoothly and even survive financial crises.

In this era of digitalization, modern accounting software has made it easier for businesses to monitor and manage their working capital effectively. The technology provides real-time insights into a company’s financials and enables efficient planning, helping businesses remain resilient in the face of financial adversities.