What is a Periodic Inventory System?

A periodic inventory system is an inventory management method where inventory is tracked physically at specific pre-defined intervals.

What’s covered in the article

Under the periodic inventory method, companies update the inventory only once in a certain accounting period, in contrast to the perpetual inventory system, where an inventory is updated continuously, such as after every purchase or sale.

How does it Work?

The periodic inventory system works in the following steps:

- At the start of the accounting period, the company records the value of the inventory it has on hand from the previous accounting period.

- The company will also record all its purchases during the said period.

- When the period ends, the company physically counts the inventory on hand to determine the ending inventory balance.

- The company calculates the cost of goods sold by subtracting the ending inventory balance from the sum of the beginning inventory balance and the actual cost of purchases made during the accounting period.

Cost of goods sold (COGS) = Beginning inventory + Purchases – Closing inventory

- All inventory-related transactions are then recorded in the financial statements of the company.

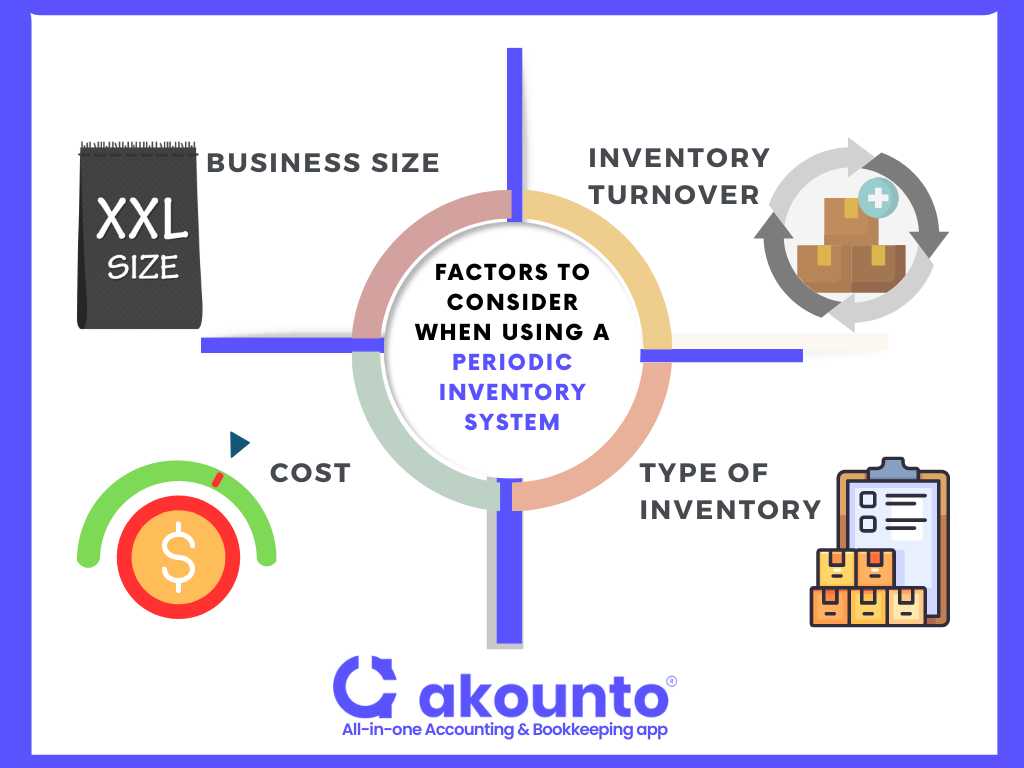

Factors to Consider When Using a Periodic Inventory System

- Business Size: Periodic Inventory Systems are more suitable for smaller businesses with small inventory levels.

- Inventory Turnover: Businesses with a high inventory turnover will encounter frequent losses with a periodic inventory system. Perpetual systems are more suitable for these.

- Cost: Periodic systems are generally less expensive, as they don’t need experts or sophisticated software. But the expenses can quickly escalate for large inventory levels and high inventory turnovers.

- Type of Inventory: Businesses that deal in goods with short shelf lives require frequent inventory counts so a perpetual inventory system would suit them.

Which Businesses Use Periodic Inventory Systems?

According to the Generally accepted accounting principles (GAAP) by FASB, companies can use either the periodic system or the perpetual system. But, the following businesses should prefer using the periodic inventory accounting method:

- Small retail and convenience stores that sell a limited number of products, especially if they do not have a computerized inventory tracking system

- Small manufacturers only produce a limited range of products, and keeping a physical inventory count makes more sense for their resources.

- Service-based businesses can use a periodic inventory system to track their office supplies, as they do not have an inventory otherwise.

Difference between Periodic and Perpetual Inventory

|

Periodic Inventory System |

Perpetual Inventory System |

|

|

Definition |

Periodic inventory is updated at a specific period, such as weekly, monthly, or quarterly. |

Perpetual inventory keeps track of the inventory balances continuously. |

|

Tracking Inventory |

Inventory is counted manually |

Every inventory item is tracked using inventory software, such as a barcode |

|

Cost of Goods Sold |

The cost of goods sold is calculated at the end of each accounting period by subtracting the value of ending inventory from the sum of beginning inventory and purchases made during the period. |

The cost of goods sold is calculated in real-time as each item is sold. |

|

Feasibility |

Does not provide real-time inventory valuation; suitable for only small businesses. |

More accurate and efficient as it provides real-time inventory valuation |

|

Requirement |

No accounting software or professional experts required |

Companies need a professional workforce for tracking inventory in the Perpetual system |

Examples of Periodic Inventory Systems

Assume a retail business purchases $1000 worth of inventory, the beginning inventory for the period. Let’s say each unit is worth $5, and so the beginning inventory count equals 200.

Cost of Goods available for sale = $1000

Periodic inventory system journal entries for the bought inventory will be:

|

Purchase account |

(Debit) $1000 |

|

Cash |

(Credit) $1000 |

A temporary account, by the name of the purchase account, will hold the purchased inventory. At the end of the period, the $1000 will be transferred from the purchase account to the inventory account.

|

Inventory account |

(Debit) $1000 |

|

Purchases Account |

(Credit) $1000 |

When the period ends, the physical inventory count reveals the closing inventory to be 150 units. Each unit costs $5, so the physical checked ending inventory is worth $600.

Cost of Goods Sold = Cost of Goods available for Sale -Ending inventory Balances

=$1000-$600 =$400

$400 from the inventory account will be shifted to the COGS account to reconcile the physical and books inventory. The accounting journal entries will look like this:

|

Cost of Goods Sold |

(Debit) $400 |

|

Inventory |

(Credit) $400 |

Advantages and Disadvantages of Periodic Inventory Systems

Advantages

Lower Cost

The periodic inventory system check happens manually and only once in a certain accounting period, so it does not require many resources.

Simpler and Easier

Businesses do not need specialists for a periodic inventory system to manage their inventory. It is just manual counting; a beginner-level team of professionals can keep the record.

Time-Saving

A periodic inventory system requires less record-keeping since the inventory records are updated periodically. For the same reason, business operations do not have to be stopped frequently for inventory management. In these ways, the periodic inventory system saves a lot of time.

Disadvantages

The periodic inventory system’s pros can become cons if it is not chosen for the right business.

Inaccurate

A periodic inventory system does not provide information about the cost of goods sold (COGS) or the inventory in the duration between the checks. This disadvantage will lead to significant adjustments when the inventory count happens and may lead to overstocking or understocking in the interim period.

Risk of Theft

The periodic inventory system increases the risk of theft as the inventory is not frequently updated. The inventory might be present without any record, so its theft may go unnoticed.

Inefficient for Large Businesses

In the case of large inventories, a periodic inventory system may require a shutdown for days for manual checking. It will also require man force, bringing significant loss to the company whenever an accounting period ends. Using “specific identification method” can help, but it does have a steep learning curve.

Challenges of Periodic Inventory

Labor Costs

A periodic inventory system requires a workforce and resources for the manual inventory count, which matters even more for large businesses.

Inaccurate Inventory Valuation

Since the inventory is valued only after a certain period, there could be discrepancies between the actual and the inventory recorded. This inaccuracy challenges the authenticity of the financial reports and the tax files of the company.

Inventory Overstocking and Stockouts

A business can overstock or understock, given that the management is unaware of the current-most inventory accounting records.

Difficulty in Identifying Theft

In the absence of real-time data, it can be difficult to identify inventory shrinkage or theft until the next count, which can result in significant losses for the business.

Conclusion

Periodic and perpetual inventory systems are two accounting methods that suit different businesses differently. The periodic system has its advantages of simplicity and cost-effectiveness but remains challenging for large inventory balances.

Visit the Akounto blog for regular updates about the subject of accounting. Sign up for premium accounting services for your small business, including bookkeeping and financial records management.