What Is Invoice Reconciliation?

Invoice reconciliation is matching invoices and bank statements to prevent payment errors for goods and services sold or received.

The purpose of reconciling invoices is to ensure payment accuracy for goods or services a business receives.

What’s covered in the article

Invoice reconciliation gives the business owner insights into whether the bills are paid according to due dates and payment terms, how much is being paid to each vendor, and whether the company is paying out more than it should on vendor invoices.

It is an important part of the accounts payable process for any business as it helps to ensure financial accuracy and compliance with financial and accounting regulations.

Need And Benefits of Invoice Reconciliation

The need for invoice reconciliation arises from the importance of accurate financial management for any business. Here are some specific reasons why invoice reconciliation is necessary and also beneficial:

Identify Billing Mistakes

By reconciling invoices with respective purchase orders, and delivery receipts, businesses can identify billing mistakes, such as incorrect prices or quantities, which can be corrected before payment.

Monitor Payments

Invoice reconciliation helps prevent overpayments and underpayments, which can result in financial losses for a business. Businesses can avoid unnecessary costs by ensuring accurate payments reflect the goods or services received.

Detect and Prevent Fraud

Invoice reconciliation helps detect and prevent fraud, such as double-billing or billing for goods or services that were not provided. It helps to protect a business’s financial assets and reputation.

Maintain Good Vendor Relationships

Accurate and timely payment through invoice reconciliation also helps maintain good vendor relationships, which is important for ongoing business partnerships.

Comply with Financial Regulations

With a proper invoice reconciliation process, businesses can comply with financial and accounting regulations, avoiding penalties and legal issues.

Improve Financial Management

Understanding invoice reconciliation aids businesses in better managing their accounts payable and tracking expenses, leading to better financial planning and decision-making.

Overall, invoice reconciliation is crucial for any business that wants to maintain financial accuracy, save costs, prevent fraud, and maintain strong vendor relationships.

Invoice Reconciliation Types

Manual Invoice Reconciliation

Manual reconciliation involves comparing all incoming and outgoing invoices against other financial documents, such as receiving reports or contracts. For example, it may involve checking each line item on the invoice against the purchase order or other documents to ensure they match.

Manual invoice reconciliation can be time-consuming and labor-intensive, but it may be necessary for situations where the business does not have the resources to implement automated solutions.

Automated Invoice Reconciliation

Automated invoice reconciliation uses accounting software tools to match invoice data with other financial documents.

Automated reconciliation can help speed up invoice reconciliation processes, reduce the risk of errors, and provide real-time visibility into financial data. It can also be customized for business needs, such as matching invoice data with billing orders or contracts.

Automated reconciliation is typically used in larger organizations with higher invoice volumes or where accuracy and speed are critical.

Invoice Reconciliation Process

Step 1: Verify Invoice Accuracy And Completeness

Review the invoice data to ensure accuracy and completeness and check for purchase slips or contract compliance.

Step 2: Match Invoice with Purchase Orders

Compare the details on the invoice with those on incoming invoices, such as item descriptions, quantities, and prices. Note any discrepancies and examine specific accounting records.

Step 3: Match Invoice with Receiving Documents

Match the invoice data with receiving documents, such as delivery receipts, packing slips, or inspection reports, to verify that goods or services have been received as stated in the invoice.

Step 4: Investigate and Resolve Discrepancies

If discrepancies are found between the invoice, purchase order, and receiving documents, investigate and resolve them by contacting the vendor, negotiating the invoice terms, or adjusting financial records.

Step 5: Approve Invoices for Payment

Once invoices are accurate and complete, approve them for payment and ensure compliance with financial regulations.

Step 6: Record Payments and Mark Invoices as Paid

Record payments in financial records and mark invoices as paid to maintain accurate financial records.

Step 7: Reconcile Financial Records

Compare financial records to bank statements to ensure accuracy and completeness. Investigate and resolve any discrepancies.

Example

ABC Inc. has received an invoice from a vendor for $5,000 for an office furniture purchase. The invoice is due in 30 days.

ABC Inc. wants to ensure the invoice is accurate and complete before payment approval. So here’s how they might reconcile invoices:

- The accounting department receives an invoice from a vendor for $5,000 to purchase office furniture. It collates all invoices to be reviewed for the reporting period.

- The team compares the invoice data with the purchase order and the delivery receipts to ensure that the goods have been received as stated in the invoice.

- The team noticed the vendor had charged for an additional chair that was not ordered. They contact the vendor and request a credit for the incorrect charge. The vendor agrees to the credit and issues a new invoice for $4,500.

- The accounting department approves the revised invoice for payment since it matches the purchase order and the receiving documents.

- The account operations team records the payment in the financial records and marks the invoice as paid.

At the end of the month, the accounting department reconciles the financial records with the bank statement to ensure that all payments have been processed accurately.

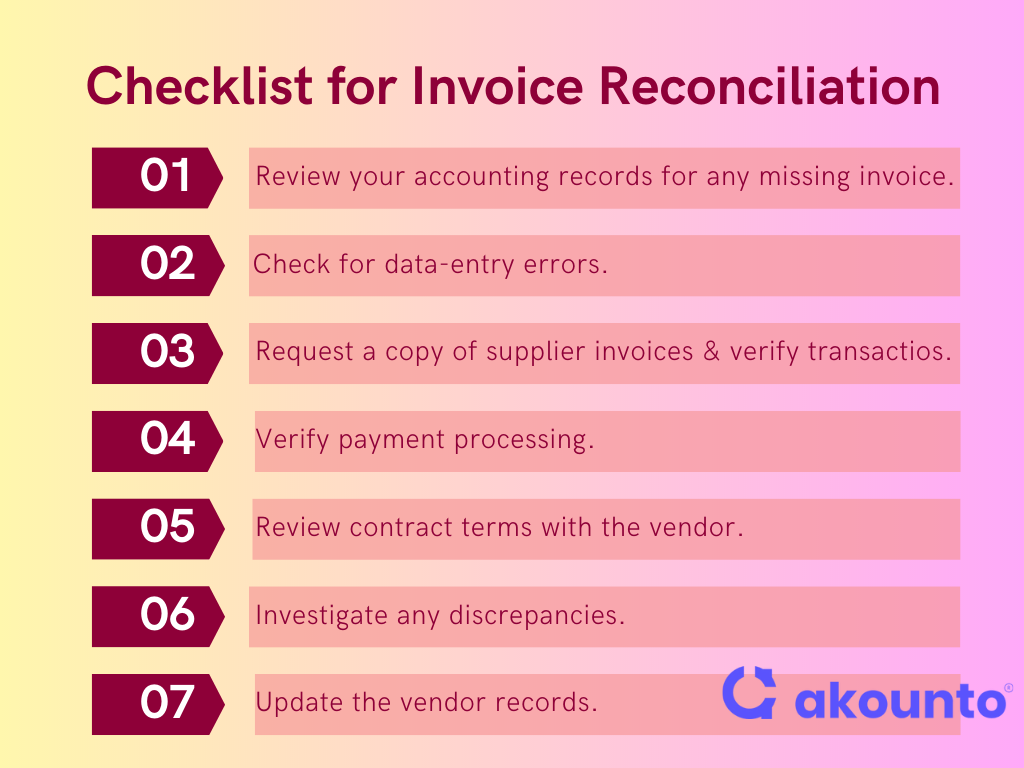

Checklist for Invoice Reconciliation

Here’s a checklist to help you reconcile an invoice when you encounter discrepancies:

- Double-check your records: Review your accounting records to ensure you have not missed any invoices or payments.

- Check for data entry errors: Verify the correctness of all data entered, including invoice numbers, amounts, and payment dates.

- Contact the vendor: Request a copy of supplier invoices, payment receipts, or other supporting documents to verify the transaction details.

- Verify payment processing: Confirm that payment processes have been applied to the correct invoice and are processed.

- Review contract terms: Review contract terms with the vendor to ensure invoiced amounts are correct and there are no unauthorized charges.

- Investigate discrepancies: Investigate any discrepancies and attempt to reconcile the differences. If necessary, seek assistance from the vendor or an accountant.

- Update financial records: Once the discrepancies have been resolved, update the vendor records to reflect the correct transaction details.

Automation and Invoice Reconciliation

Automation has revolutionized many business processes, and invoice reconciliation is no exception. Businesses can streamline invoice reconciliation by leveraging automation technology and improving efficiency, accuracy, and speed.

Automated Matching

Automating invoice reconciliation has significant benefits, including matching invoices with purchase orders and receipts. It ensures that all invoices are legitimate, thus preventing the payment of fraudulent invoices.

Real-Time Reporting

Real-time reporting provides businesses with up-to-date information on the status of their invoices, like overdue payments or outstanding invoices. Businesses must track such information to maintain accurate financial records and plan their cash flow.

Faster Processing

Eliminating manual processes and automating matching bank statements significantly reduces the time to reconcile invoices. It also automatically flags discrepancies, enabling businesses to quickly identify errors and take corrective actions.

By leveraging automation, businesses can improve their financial management, save time, and optimize their processes for better results.

Challenges in Invoice Reconciliation

Here are some common challenges that businesses face in the invoice reconciliation process:

- Inaccurate Data: One of the biggest challenges is inaccurate data, such as missing invoice details. It is also prone to human errors, like typos and incorrect data entry, resulting in inaccuracies and discrepancies requiring additional time and resources.

- Time-Consuming: Manual invoice reconciliation can be time-consuming, particularly for large organizations with high volumes of invoices. It can lead to delays in the payment process, impacting supplier relationships and cash flow.

- Fraud: Fraudulent invoices can be difficult for businesses to detect, particularly when the reconciliation process is done manually. It can result in lost revenue and damage to the business’s reputation.

Conclusion

Automation resolves invoice reconciliation, saving time and improving accuracy. Businesses can implement best practices such as data audits, communication with suppliers, and fraud detection software to reduce the impact of these challenges.

Tired of spending hours on accounting processes for your small business? Let Akounto help! Our user-friendly platform streamlines accounting tasks, freeing up your time to focus on expanding your business. Check out the Akounto website to learn more about its services!