Understanding Overhead Allocation

Overhead allocation is a critical aspect of cost accounting, enabling businesses to distribute indirect costs across various departments and products accurately.

What’s covered in the article

Overhead allocation is a process used in cost accounting to assign indirect costs to cost objects, such as products or departments. These indirect costs, also known as overhead costs, include expenses that are not directly tied to a specific product or service but are important for the overall operation of the business. Examples of overhead costs include rent, utilities, and administrative salaries.

The main purpose of the overhead allocation is to provide a more accurate picture of the cost of producing a product or giving service. By allocating overhead costs, businesses can determine the true cost of each product or service, which can inform pricing decisions, budgeting, and financial analysis.

Overhead allocation is particularly important for businesses that produce various products or services, as it helps ensure each product or service bears its fair share of the overhead costs.

Without overhead allocation, businesses may overestimate the cost of some products and underestimate the cost of others, leading to inaccurate pricing and potentially harming profitability.

In the context of managerial accounting, by tracking and allocating overhead costs, managers can identify areas where costs are higher than expected and take steps to reduce them, leading to more efficient operations and higher profit margins.

Types and Examples

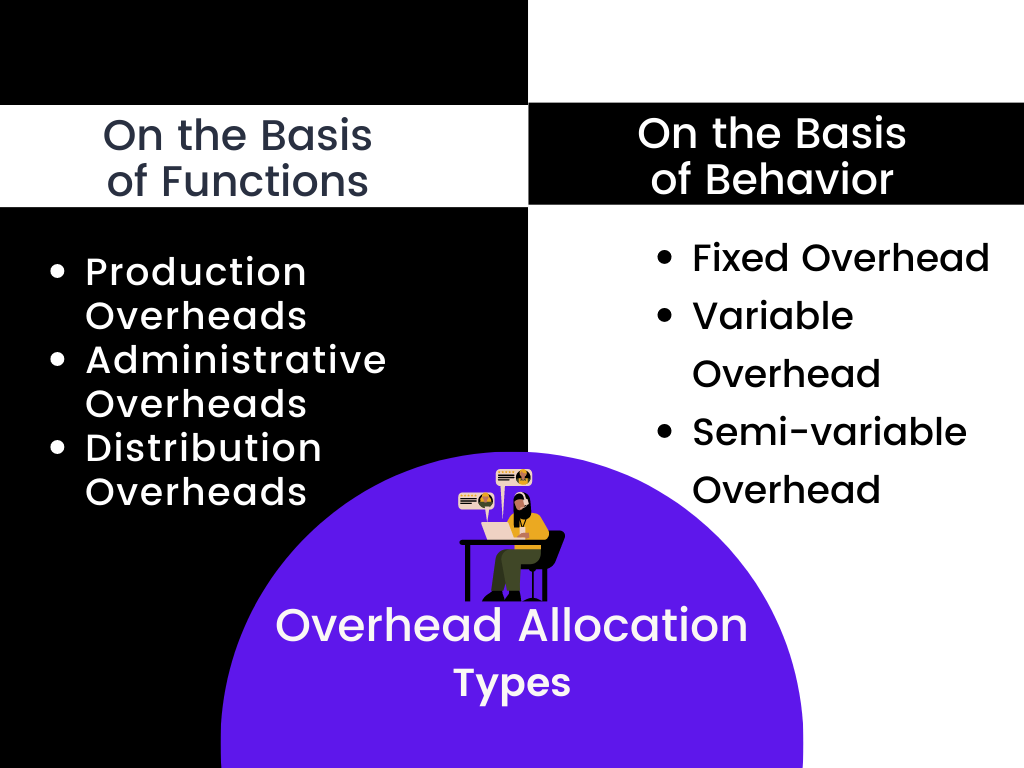

Overhead costs can be categorized in various ways, each providing a different perspective on the nature and behavior of these costs. Understanding these categories can help businesses make more informed cost management and allocation decisions.

On the Basis of Functions

Production Overheads

These are the costs associated with the production process but cannot be directly attributed to a specific product unit. Examples include depreciation of production equipment, factory rent, wages of factory workers and other manufacturing overheads.

Administrative Overheads

These are the costs related to the overall administration of the business. They include salaries of administrative staff, office rent, and office supplies.

Selling Overheads

These costs are associated with the selling and marketing activities of the business. They include advertising costs, sales staff salaries, and commissions.

Distribution Overheads

These are the costs incurred in delivering the product to the customer. They include transportation costs, warehousing costs, and packaging costs.

On the Basis of Behavior

Fixed Overhead

These are costs that remain constant regardless of the level of production or sales. Examples include rent, insurance, and salaries of permanent staff.

Variable Overhead

These costs change in direct proportion to the level of production or sales. Examples include direct materials, labor, and power consumption.

Semi-variable Overhead

These costs have both fixed and variable components. For example, a utility bill might have a fixed base charge plus a variable charge based on usage.

Overhead Rate

The overhead rate represents the overhead costs allocated to each unit of a cost center, such as a product or a department. The overhead rate is typically expressed as a rate per unit of a certain base, such as per direct labor hour or per machine hour.

The choice of the base for the overhead rate depends on the nature of the business and the type of overhead costs. For example, a manufacturing business might track labor hours as the base if labor is a significant component of its production process. On the other hand, a business that relies heavily on machinery might use machine hours as the base.

The overhead rate is a key tool for cost management and decision-making. By comparing the overhead rate to actual costs, managers can identify areas where costs are higher than expected and take steps to reduce them, leading to more efficient operations and higher profit margins.

The overhead rate can be used to price products or services. By adding the overhead rate to the direct costs of a product or service, businesses can ensure that they are covering all of their costs and setting a price that provides a reasonable profit margin.

Formula and Interpretation

The formula for calculating the overhead rate is quite straightforward. It is calculated by dividing the total overhead costs by the total quantity of the allocation base. The formula is as follows:

Overhead rate = Total Overhead Costs / Total Quantity of Allocation Base

The allocation base could be direct cost relating to labor hours, machine hours, or any other measure relevant to the business and the type of overhead costs.

For example, a manufacturing company has total overhead costs of $500,000 for a given period, and the total direct labor hours for that period are 10,000 hours. Using the above figures, the overhead rate would be calculated as follows:

Overhead Rate = $500,000 / 10,000 hours = $50 per direct labor hour

It means, the company incurs $50 in overhead costs for every direct labor hour. This rate can be used to allocate overhead costs to products based on the number of direct labor hours needed to manufacture each product.

The overhead rate measures the indirect costs associated with producing products or delivering a service. By comparing the overhead rate to actual costs, managers can identify areas where costs are higher than expected and take steps to reduce them. It can lead to higher efficiency in operations and higher profit margins.

Methods

There are several methods for allocating overhead costs, each with its strengths and weaknesses. The choice of method is based on the nature of the business, the type of overhead costs, and the business’s specific needs. Here are some of the most common methods:

Direct Labor Hour Method

This method allocates overhead costs based on the number of labor hours. It is simple to understand and implement, but it may not be accurate if overhead costs are not closely related to labor hours.

Machine Hour Method

This method allocates overhead costs based on the number of machine hours. It is suitable for businesses that rely heavily on machinery in their production process.

Direct Labor Cost Method

This method allocates overhead costs based on direct labor costs. It is suitable for businesses where labor is a significant component of production costs.

Production Unit Method

This method allocates overhead costs based on the number of units produced. It is suitable for businesses that produce a single product or a few similar products.

Activity-Based Costing (ABC)

This method allocates overhead costs based on activities that drive the costs. It is more accurate and detailed than the other methods but is also more complex and time-consuming to implement.

Formula and Calculation

The formula for overhead allocation depends on the method being used. However, the general principle is to divide the total overhead costs by an allocation base to get an overhead rate and then multiply this rate by the actual quantity of the allocation base for each cost object. Here are the formulas for the common methods:

- Direct Labor Hour Method: Overhead Rate = Total Overhead Costs / Total Direct Labor Hours. Then, Allocated Overhead = Overhead Rate x Actual Direct Labor Hours for each cost object.

- Machine Hour Method: Overhead Rate = Total Overhead Costs / Total Machine Hours. Then, Allocated Overhead = Overhead Rate x Actual Machine Hours for each cost object.

- Direct Labor Cost Method: Overhead Rate = Total Overhead Costs / Total Direct Labor Costs. Then, Allocated Overhead = Overhead Rate x Actual Direct Labor Costs for each cost object.

- Production Unit Method: Overhead Rate = Total Overhead Costs / Total Production Units. Then, Allocated Overhead = Overhead Rate x Actual Production Units for each cost object.

For example, let’s say a company has total overhead costs of $500,000 and total direct labor hours of 10,000 hours. The overhead rate using the direct labor hour method would be $50 per hour ($500,000 / 10,000 hours).

If a product requires 2 hours of direct labor to produce, the allocated Overhead for this product would be $100 ($50 per hour x 2 hours).

Apportionment and Absorption

Apportionment and absorption are two key processes that help ensure that overhead costs are accurately and fairly assigned to cost objects such as products, services, or departments.

Apportionment

Apportionment involves dividing overhead costs among different cost centers or cost objects based on a relevant basis. The aim is to distribute the costs in a way that reflects the extent to which each cost center or cost object has contributed to the incurrence of the cost.

For example, if a company’s overhead costs include the rent for a factory that houses multiple production departments, the rent could be apportioned based on the square footage occupied by each department. If one department occupies 50% of the factory space, it would be apportioned 50% of the rent cost.

Apportionment can be done on a direct or step-down basis. Direct apportionment assigns costs directly to the cost centers that incur them. Step-down apportionment, also known as sequential or reciprocal apportionment, involves a more complex process where costs are first apportioned to service departments and then re-apportioned to production departments.

Absorption

Absorption, also known as overhead recovery, involves applying the apportioned overhead costs to the cost objects. It is typically done by calculating an overhead absorption rate, which is then multiplied by a measure of activity for each cost object.

For instance, if the overhead absorption rate is calculated based on direct labor hours, a product that requires 10 hours of direct labor would be assigned ten times the overhead rate in overhead costs.

Absorption ensures that all costs of production, including overhead costs, are reflected in the cost of each product or service. It is important for pricing decisions, as it ensures that the price set for each product or service covers all production costs.

Apportionment and absorption ensure that overhead costs are fairly distributed and fully accounted for in the cost of products or services.

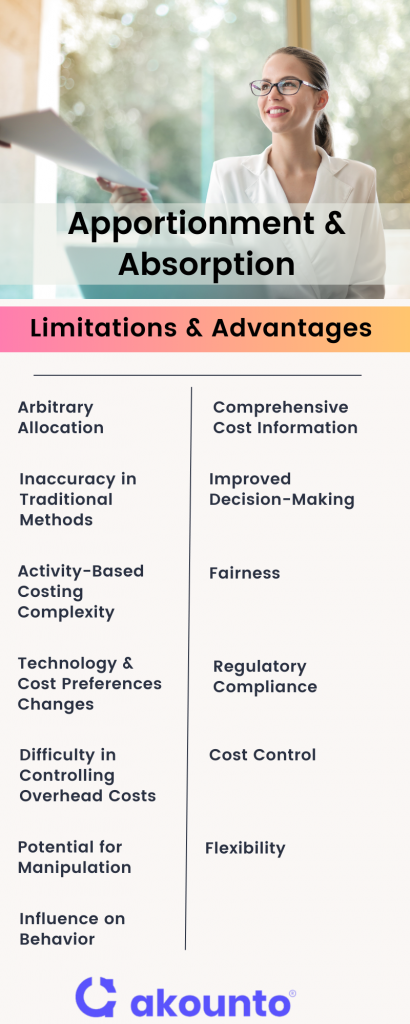

Limitations

- Arbitrary Allocation: The choice of allocation base may not accurately reflect the actual consumption of overhead resources by different cost objects.

- Inaccuracy in Traditional Methods: Traditional methods, typically use a single cost driver, may not accurately allocate overhead costs, especially in complex, multi-product environments. It can lead to product cost distortions and suboptimal decision-making.

- The complexity of Activity-Based Costing: While activity-based costing (ABC) provides a more accurate allocation of overhead costs, it is also more complex and time-consuming to implement. It requires detailed knowledge of the activities that drive overhead costs and the resources consumed by these activities.

- Changes in Technology and Cost Preferences: Changes in technology and business practices can make some allocation bases less relevant over time. For example, automation can reduce the relevance of direct labor as a basis for allocation.

- Difficulty in Controlling Overhead Costs: Overhead costs are often less controllable than direct costs. It can make it difficult to reduce overhead costs in response to changes in activity levels.

- Potential for Manipulation: There is potential for manipulation in allocating overhead costs. Managers may be tempted to allocate more costs to products or departments with higher budget allowances, which can distort product costs and profitability analysis.

- Influence on Behavior: The method of allocation can influence managerial behavior. For example, if overhead is allocated based on direct labor hours, managers might be incentivized to reduce labor hours, even if this is not in the company’s best interest.

Advantages

- Comprehensive Cost Information: Overhead distribution provides a complete picture of the costs associated with producing a product or delivering a service. By including overhead costs, businesses can ensure that their pricing and profitability analysis reflect the full cost of production.

- Improved Decision-Making: The information provided by overhead cost distribution can support various managerial decisions, from pricing and product mix decisions to budgeting and performance evaluation. Managers can make more informed decisions by understanding the full cost of different cost objects.

- Fairness: Overhead cost distribution can help ensure that costs are fairly distributed among different cost objects. It can be particularly important in businesses that generate a wide variety of products or services, where some cost objects may consume more overhead resources than others.

- Regulatory Compliance: Overhead allocation may be required for financial reporting or regulatory compliance. For example, government contracts often require businesses to allocate overhead costs in a specific way.

- Cost Control: Cost allocation can support cost control efforts by making overhead costs more visible. Managers can identify areas where overhead costs are more than expected and take steps to reduce these costs.

- Flexibility: Overhead allocation methods can be adapted to suit the needs of different businesses. For example, a business that relies heavily on labor might use direct labor hours as the allocation base. In contrast, a business that uses a lot of machinery might use machine hours.

Uses in Managerial Accounting and Cost Accounting

Managerial Accounting

- Product Pricing: Overhead allocation helps determine a product’s total cost, which is essential for setting the right price. By including overhead costs, managers ensure that the price covers all production costs, not just direct costs.

- Profitability Analysis: Overhead allocation allows managers to assess the profitability of different products, services, or departments. By allocating overhead costs, managers can see the full cost of each cost object and compare it to its revenue to determine its profitability.

- Decision Making: Overhead allocation provides important information for decision-making. For example, if a product’s allocated overhead costs are too high, managers might consider ways to reduce these costs or discontinue the product.

Cost Accounting

- Cost Control: Overhead allocation helps identify areas where costs are higher than expected. By analyzing allocated overhead costs, cost accountants can identify opportunities for cost reduction.

- Budgeting and Forecasting: By predicting future overhead costs and how they will be allocated, businesses can plan for the resources they will need.

- Financial Reporting: Overhead allocation is required for financial reporting under various accounting frameworks. It ensures that the costs reported in financial statements reflect the full cost of production.

- Costing Systems: Overhead allocation is a key component of traditional costing systems and activity-based costing systems. In traditional costing, Overhead is allocated based on a single cost driver, such as machine hours. In activity-based costing, Overhead is allocated based on multiple cost drivers that reflect the activities that cause the costs.

Conclusion

Overhead allocation is a critical process in cost accounting as it provides valuable insights into the full cost of production and helps the business make an informed decision regarding pricing, profitability analysis, and performance evaluation, which promotes fairness in cost distribution.

But it is important to note that overhead allocation is an estimation process. The accuracy of allocating direct and indirect costs depends on the chosen method and the availability of reliable cost data. So, the overhead allocation rate should be reviewed periodically to ensure its relevance to the ever-changing nature of business operations.