What is a Perpetual Inventory System?

A perpetual inventory system is a real-time computerized system that constantly monitors and updates inventory levels as goods are received, sold, or returned.

[ez-toc]

The perpetual inventory system provides businesses with real-time information on inventory levels, allowing them to make informed purchasing and sales decisions and reduce inventory holding costs.

How Does the Perpetual Inventory System Work?

The perpetual inventory system assigns a unique tracking code to each product, allowing for continuous updating of inventory counts as goods are bought and sold.

- A perpetual inventory management system provides up-to-date information on inventory levels; regular physical stock counts may still be necessary to maintain accuracy.

- The system uses POS (Point-of-sale) integration to track inventory levels. When a product is sold, it is automatically deducted from the inventory count, and when a product is received, it is added to the inventory count.

- Whenever a product is sold or purchased, the cost of goods sold (COGS) is automatically recalculated.

- The system adjusts reorder points automatically to maintain optimal inventory levels based on historical data on demand fluctuations.

- Purchase orders are generated automatically and sent to suppliers when an item or SKU reaches its reorder point.

- When including new inventory in the stock count, products are scanned into inventory using warehouse management software (WMS) when they are received at the warehouse.

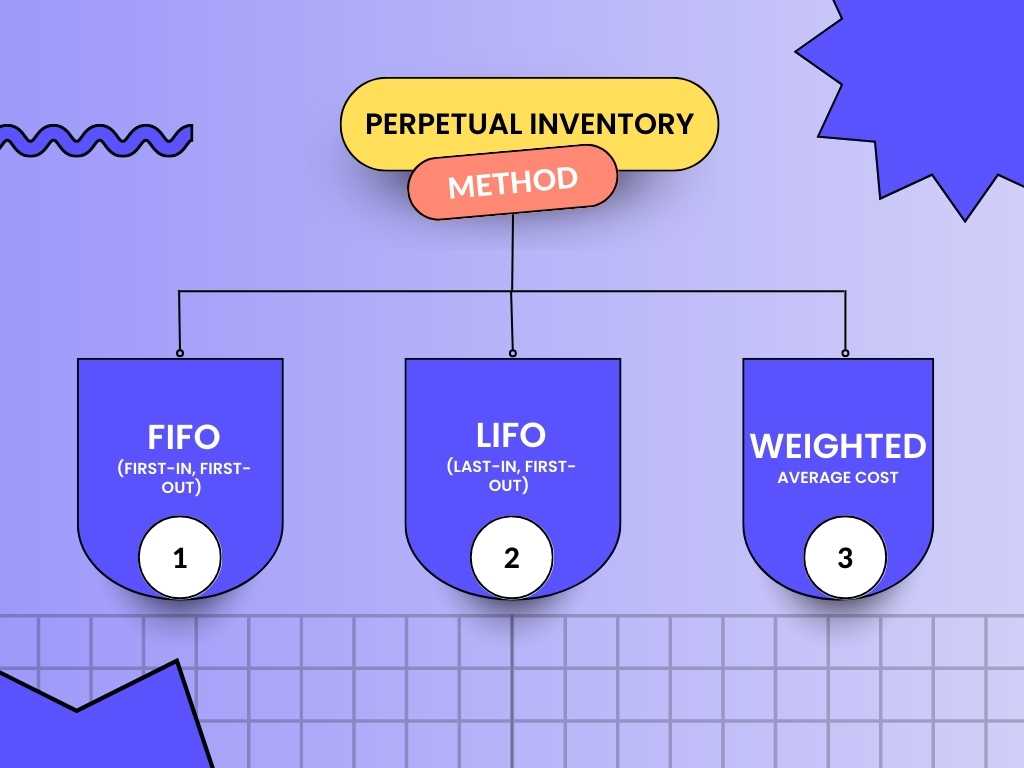

Perpetual Inventory Methods

Fifo (First-In, First-Out) Method

In the FIFO inventory valuation method, the items purchased first are sold first.

Under this perpetual inventory method, the COGS (cost of goods sold) is calculated based on the oldest inventory cost. In contrast, the ending inventory is based on the cost of the most recent inventory items.

Lifo (Last-In, First-Out) Method

The LIFO inventory valuation method assumes that stock items are sold in the reverse order of their purchase and calculates the COGS and ending inventory accordingly.

It means that the COGS is calculated based on the cost of the most recent inventory items, while the ending inventory is based on the cost of the oldest inventory items.

Weighted Average Cost Method

Under this method, the cost of goods sold (COGS) is calculated by dividing the cost of goods available for sale by the total number of units in inventory. It gives an average cost per unit, used to value the COGS and ending inventory.

The average cost per unit is constantly updated as new inventory is purchased or sold.

Formulae in Perpetual Inventory Systems

Ending Inventory

Companies can use the below formula to calculate the ending inventory when using a perpetual inventory accounting system:

Ending Inventory = Beginning inventory + Receipts – Shipments

Example:

Beginning inventory: 100 units

Receipts (purchases or transfers into inventory: 50 units

Shipments (sales or transfers out of inventory: 30 units

Therefore, using the ending inventory formula,

Ending Inventory = 100 + 50 – 30 = 120 units

Economic Order Quantity

The economic order quantity (EOQ) formula is used to determine the optimal order quantity that minimizes the total inventory cost, including ordering, holding, and storage costs.

The formula for calculating EOQ is as follows:

EOQ = в€љ2DS/H

Where,

D = Demand in units per year

S = Order cost per purchase

H = Holding cost per unit per year

Example:

Suppose a company sells 10,000 units annually (D), the per-order cost is $100 (S), and the holding cost per unit per year is $20 (H).

Using the EOQ formula:

EOQ = в€љ[(2 x 10,000 x $100)/$20]

= в€љ(200,000)

= 447.21 (rounded to two decimal places)

Therefore, the company should order approximately 447 units at a time to minimize the total ordering and holding costs.

The EOQ formula helps determine the optimal order quantity for a given item, minimizing inventory costs and ensuring sufficient stock to meet customer demand and satisfaction.

But, the EOQ model also assumes that the demand is constant and there are no constraints on order quantities or lead times.

Cost of Goods Sold (COGS)

Under the perpetual inventory system, the cost of sales grows every time there is a sale, increasing the expense account. These costs represent the direct expenses incurred while producing goods, such as labor and materials costs, and exclude distribution or sales costs.

The COGS formula is as follows:

COGS= BI + P – EI

Where,

BI = Beginning inventory

P = Purchases for the accounting period

EI = Ending inventory

Example:

Beginning inventory (BI): $10,000

Purchases (P): $50,000

Ending inventory (EI): $15,000

Using the COGS formula:

COGS = $10,000 + $50,000 – $15,000 = $45,000

Therefore, the company’s cost of goods sold for the period is $45,000.

Gross Profit

Gross Profit is the difference between revenue earned from selling goods or services and the cost of producing or purchasing them for the accounting period.

The gross profit formula is:

Gross Profit = Revenue – COGS

Example:

A company sells a product for $100, and the cost to produce the product is $60. The company sells 1,000 units of this product during a given period.

Revenue = $100 x 1,000 units = $100,000

COGS = $60 x 1,000 units = $60,000

Using the gross profit formula,

Gross Profit = $100,000 – $60,000

= $40,000

Therefore, the company’s gross Profit for the period is $40,000.

Journal Entries in Perpetual Inventory Systems

Using a perpetual inventory system, here are the journal entries to record different transactions:

Purchase Of Goods

| Date | Particulars | Debit (INR) | Credit (INR) |

| XXYYZZ | Inventory | XX | |

| Accounts Payable | XX |

Sale Of Goods

| Date | Particulars | Debit (INR) | Credit (INR) |

| XXYYZZ | Accounts Receivable | XX | |

| Sales | XX |

Record Cost Of Goods Sold

| Date | Particulars | Debit (INR) | Credit (INR) |

| XXYYZZ | Cost Of Goods Sold | XX | |

| Inventory | XX |

Return Of Goods To Supplier

| Date | Particulars | Debit (INR) | Credit (INR) |

| XXYYZZ | Accounts Payable | XX | |

| Inventory | XX |

Perpetual Inventory System Vs. Periodic Inventory System

| Perpetual Inventory System | Periodic Inventory System |

| It continuously updates inventory records for each item bought or sold. | It involves taking periodic physical counts of inventory levels to determine the number of items on hand. |

| It relies on technology, such as barcode scanners and point-of-sale (POS) systems, to automatically update inventory records in real-time. | Inventory records, such as weekly or monthly, are not updated in real-time but rather periodically. |

| It allows businesses to have an accurate view of their inventory levels and make informed decisions on restocking and ordering. | It is simpler and less expensive, but it can lead to inaccurate inventory records if there are errors in counting or tracking inventory. |

| It is best suited for businesses with high-volume or high-value products. | It is best suited for businesses with low-volume or low-value products. |

Perpetual Inventory Vs. Book Inventory

| Perpetual Inventory | Book Inventory |

| It involves continuously updating inventory records for the purchase or sale of each item. | Book inventory is the cost of inventory at hand recorded on a business’s financial statements. |

| It relies on barcode scanners and point-of-sale systems to automatically update inventory records. | It is determined by the inventory cost when it was purchased, minus any depreciation or write-downs. |

| It provides an accurate view of inventory levels and improves the restocking and ordering process. | Book inventory is often used for accounting and tax purposes. |

Advantages of Perpetual Inventory System

- Real-time inventory tracking: Perpetual inventory system provides real-time updates on inventory levels that help businesses make informed decisions about ordering and restocking.

- Better inventory accuracy: As a perpetual inventory system updates inventory records automatically, it reduces the risk of manual errors and improves inventory accuracy.

- Timely identification of stockouts: The system can quickly identify when items are out of stock, thus helping restock faster and avoid lost sales.

- Efficient inventory management: The system helps manage orders more efficiently, reducing the risk of overstocking or understocking.

- Improved customer service: The inventory management system helps businesses identify items in stock, leading to faster order fulfillment and improved customer service.

Disadvantages of the Perpetual Inventory System

- High implementation costs: Perpetual inventory system requires inventory software, barcode scanners, and POS systems, thus being costly.

- Complexity: The perpetual system can be complex to set up and maintain, especially for businesses with large inventories.

- Need for trained personnel: There is a need for trained personnel to operate and maintain inventory data with a detailed paper trail, which can be challenging for small businesses.

- Risk of data inaccuracies: The need for accurate data input and processing can be compromised if there are errors in the data or the technology used to process it.

Is the Perpetual Inventory System Right For Your Business?

Determining if a perpetual inventory system is right for your business depends on the specific needs of your business. Here are some factors to consider:

- Business size: A perpetual inventory management system suits larger businesses with a high inventory volume.

- Inventory value and complexity: A perpetual inventory system can provide more detailed and accurate tracking if your business has a complex or high-value inventory with various product types and categories.

- Cost: Implementing a perpetual inventory system can be costly, requiring specialized software systems and hardware devices.

- Staffing and expertise: A perpetual inventory management system requires trained staff knowledgeable in inventory management and data analysis.

Conclusion

Effective management of inventory is essential for businesses of all sizes to maintain optimal inventory levels, minimize risks of overstocking or understocking, and achieve operational efficiency. Choosing between a perpetual or periodic system largely depends on the business size, inventory value, and inventory management complexity.

Visit Akounto’s blog for accounting knowledge and discover smart tips for running profitable, efficient, cost-effective business operations.