In depreciation and amortization, the cost of the acquired asset is allocated proportionately throughout the asset’s life according to the applicable accounting standards.

Allocating the cost of the asset in the books of accounts for its useful life is called “prorating the cost of the asset.” Businesses prorate the cost because most of the assets degrade or suffer wear and tear during their use and may need to be scrapped or replaced at the end of their useful life.

What’s covered in the article

Amortization and depreciation are subject to different accounting standards. Both are noncash expenditures, and both depreciation and amortization appear as a reduction in the assets on a balance sheet.

It is not a matter of amortization vs depreciation because both are somewhat similar. The key difference comes in their application.

The difference between the two is that amortization applies to intangible assets, while depreciation applies to a company’s tangible assets.

Depreciation and amortization are not just limited to the company’s balance sheet, which reduces the value of an asset annually, impacts the company’s total tax liability, and reduces the reported profits.

In this article, we will discuss everything about these two methods of accounting, explain the differences between amortization and depreciation, and provide some examples for each.

Amortization vs. Depreciation: Key Differences

| Points of Difference | Depreciation | Amortization |

| Accounting method | Reduction in cost of physical assets over their useful life | Reduction in intangible asset’s cost over its projected useful life |

| The formula for Calculation of Expense | Annual Depreciation = (Cost of Tangible Asset-Salvage Value)/Useful Life | Annual Amortization= (Cost of Intangible Asset)/Useful Life |

| Applicability of amortization vs. depreciation | Only tangible assets can be depreciated, so depreciation only applies to physical assets. | Intangible assets do not depreciate, so amortization applies for calculating their value. |

| Implementation: Depreciation and Amortization | Tangible assets can use a straight-line method or accelerated depreciation. | Amortization for intangible assets only uses the straight-line method for the calculation of amortization expense. |

| Residual Value | Tangible assets have a resale or salvage value. | Intangible assets do not have a resale value, which can also be seen in the amortization formula. |

| Expense Recognition for Taxation Benefits | Depreciation can be recorded as an expense on the income statements and used for tax relief. Depreciation, in the form of accelerated depreciation, can be more beneficial for tax benefits by showing higher expenses in the initial years. | Amortization can also be recorded as an expense on the profit and loss statements and can provide tax benefits. But it does not offer any method other than the straight-line method for expense calculation. This way, it provides less room for tax benefits than depreciation. |

Detailed Explanation

The business purchases or invests assets, known as capital expenditure, where assets are acquired to increase revenues directly. Amortization and depreciation are two methods of accounting that calculate the reduction in asset value on the balance sheet as the life of the asset is being used up. Both align with the matching principle of GAAP and IFRS, and both depreciation and amortization expenses count as tax deductibles.

Since fixed assets have a salvage value and intangible ones don’t, they use different methods for accounting. The depreciation method applies to fixed assets, and the amortization method is used for intangible assets.

Depreciation methods can be straight-line, declining balance, double-declining, or accelerated depreciation method, depending on the asset’s nature and depreciation choice. Some businesses choose accelerated depreciation so that the asset declines in value faster in the earlier years of life. This gives a greater tax credit to the company in the earlier years of the asset’s life.

Amortization, on the other hand, only uses the straight-line method. Businesses cannot manipulate it to get better tax returns in a specific reporting period.

What is Amortization?

Amortization refers to spreading cost or expensing intangible assets over their lifespan. Common examples of intangible assets that need amortization include patents, copyrights, trademarks, customer lists, trade names, proprietary assets, franchise agreements, employee relations, and human capital.

The straight line method is normally used for amortization, where the same value/ amount is deducted from the opening value of the asset every year. The annual amortization expense is a noncash expenditure that is posted to the income statement.

Using the straight line method, the business can completely write off the value of an intangible asset. The straight line method is advantageous because intangible assets cannot be resold and do not hold any salvage value.

Some examples of intangible assets that undergo amortization are:

- Patents & Trademarks

- Copyrights

- Permits and Rights

- Non-compete agreements

- Franchise agreements

When to use amortization?

Companies use amortization for loans and for expensing intangible assets. Loan amortization schedules project the repayment of the principal amount and the applicable interest expense. The interest expenses are then deducted for tax purposes.

Amortization of intangibles matches the cost or expense of an asset with its related revenue. This aligns with the matching principle of the Generally Accepted Accounting Principles (GAAP). This accounting method distributes the cost or value of an intangible asset over its projected useful life. Intangible assets do not have a resale or a salvage value, so amortization simply uses the straight-line basis for expensing the cost. The same amount is expensed every reporting period so that the sum equals the total cost or value of the asset.

Amortization as a term is often confused related to its usage. You must have heard about the “amortization schedule,” which is associated with the case of mortgage and loan payments. While amortization here, we are talking about is related to the accounting method of charging the depreciation of intangible assets.

What is Depreciation?

Depreciation refers to the expensing or reducing the cost of fixed assets over their useful life. Tangible assets include real estate property, plants, machinery, equipment, buildings, offices, vehicles, furniture, and other tangible items that a business acquires and owns.

Depreciation is an accounting method that represents how much value of an asset has been used, which accounts for an expense on the income statement. The remaining useful lifespan of the asset counts as the asset of the company. The depreciation expenses are tax deductible, which helps the business gain tax benefits.

A physical asset could have some remaining value at the end of its useful life, which could be sold for scrap or resale. So, to calculate depreciation, the asset’s salvage value, resale value, or scrap value is subtracted from its original cost.

For example, a fixed asset is used for a period after which it is replaced or sold. The cost of the fixed asset is then prorated over the expected life, with some portion annually expensed and deducted from its book value.

The annual depreciation value is then claimed for a tax deduction for the same accounting period until the usable life of the fixed asset is expired.

A depreciation rate can be different for different assets. Some assets have accelerated depreciation, while some have slower depreciation, e.g., vehicles.

When to use depreciation?

Machinery, plant, equipment, and land property are expensive. Companies can use depreciation to spread the cost to match the expense with related revenue throughout the lifespan of the asset instead of realizing a huge amount in a single reporting period.

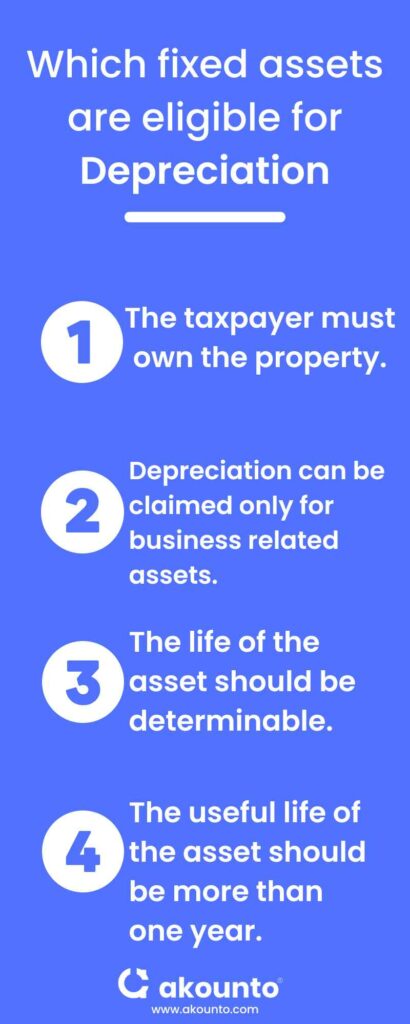

According to IRS, the taxable entity can claim depreciation for the property after meeting the following requirements:

- The taxpayer must own the property.

- Depreciation can be claimed only for business related assets.

- The life of the asset should be determinable.

- The useful life of the asset should be more than one year.

Under the generally accepted accounting principles (GAAP), the matching principle requires the business to match the expense or cost of an asset with the benefit of its use over time. Expense depreciation is not an actual cash outflow. The company may pay for the asset in full amount in the beginning, but for taxation and financial reporting purposes, it has to be expensed out for a longer period.

Businesses also use another method of depreciation called the accelerated depreciation method. In this depreciation method, the company depreciates the asset faster than the traditional method, such as the straight-line method.

Under accelerated depreciation, the financial statements record bigger deductions in the asset’s book value in earlier years than in later years. This method provides a greater tax credit for the company in the earlier years of depreciation.

Popular methods for calculating depreciation for this accounting method include

- Double declining balance method

- Declining or aggressive balance

- Sum-of-years-digit method

Examples

A goods manufacturing company buys a vehicle for its shipping department. The approximate helpful life of the vehicle is 5 years, costing $10,000. The residual value is 10% of the purchase price.

Here is how we will calculate the depreciation expense per annual reporting period of the business:

Annual depreciation = (Cost of Tangible Asset-Salvage Value)/Useful life

Vehicle costs= $10,000

Residual/ salvage value: $10,000 x 10% = $1,000

Depreciation: Remaining vehicle cost = $9,000

Annual depreciation= $9,000/5= $1800

Each annual reporting period, the company expenses $1800 out of its $10,000 assets for five years.

The vehicle is a tangible asset with a salvage value, but amortization applies to intangible assets such as licenses, grants, and patents. Here is an example of how to calculate annual amortization expenses.

A goods transport company bought the right of way for $800 million for 20 years. It is a legal permission with no tangible existence, so it does not have a salvage value either.

Annual amortization = Value of Toll/Useful Life

=$800 million/20

=$40 million

The company will depreciate $40 million every annual reporting period as an amortization expense for 20 years.

Final words

The choice of amortization vs depreciation depends on the type of asset in question. There are IRS guidelines for choosing between the two, and a wrong choice will not just hamper financial reporting but will also impact legal compliance.

Amortization and depreciation are similar concepts but different accounting treatments.

Visit the Akounto blog to get expert articles on every subject related to accounting. Basic knowledge of your business’s accounts will make you a better decision-maker!