What is Bad Debt Expense?

Bad debt expense is a significant component in financial statements as it addresses uncollectible debts. Recognizing bad debt expense, including deferred tax assets, is essential for transparent financial reporting and compliance with accounting principles.

Bad debt expense relates to doubtful accounts, such as accounts receivable and accounts payable, that may not be recovered.

Accountants record bad debt expenses in a dedicated account, known as the bad debt expense account, to track uncollectible debt accurately, accounts receivables, and accounts payable.

[ez-toc]

By promptly recognizing bad debt expenses in the same accounting period as actual credit sales, companies adhere to generally accepted accounting principles and gain insights into their financial performance.

Bad debts happen from various sources, including customers, suppliers, partners, or employees, and their proper estimation, recognition of bad debt expenses, and recording are crucial for maintaining financial stability and managing risks effectively.

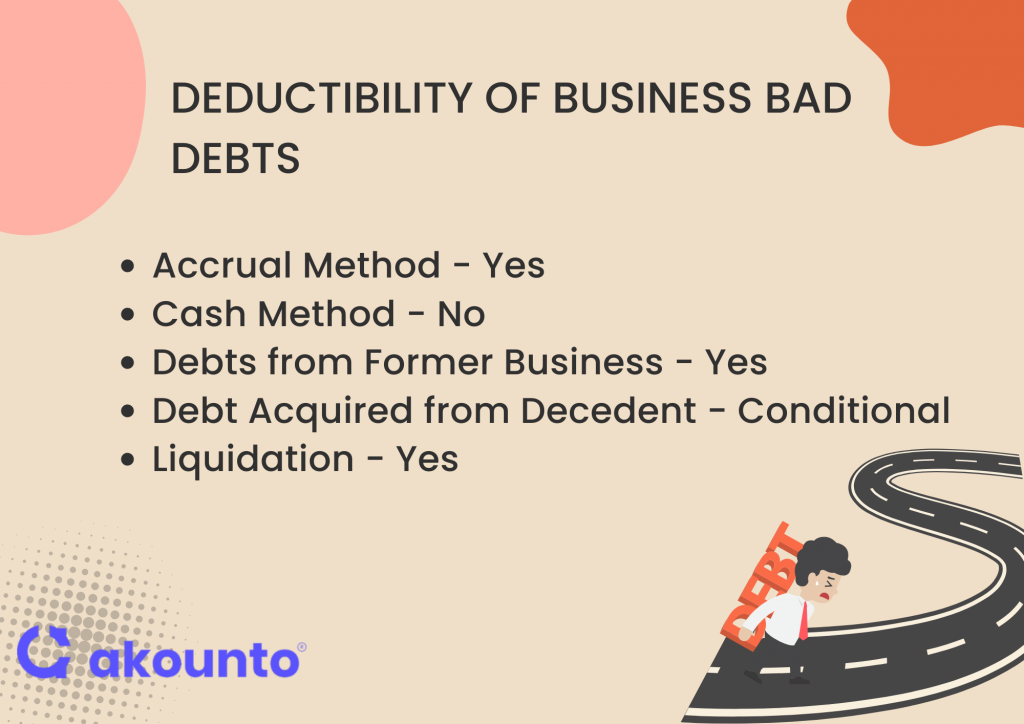

Deductibility of Business Bad Debts

Regarding bad debt deductions for businesses, some specific criteria and guidelines must be followed as given by IRS.

- Accrual Method: Under the accrual method, you can claim a bad debt deduction if the uncollectible amount was previously included in your income. The nonaccrual-experience method provides flexibility by not requiring the accrual of income that is not expected to be collected.

- Cash Method: With the cash method, income is reported upon receipt of payment; thereby, a small business cannot file a claim for a bad debt deduction for amounts never included in your income, such as unpaid customer bills.

- Debts from Former Business: If you sell your business but retain its receivables, any subsequent uncollectible debts are still considered business bad debts.

- Debt Acquired from a Decedent: Losses from debts acquired from a decedent’s business are treated similarly to losses from debts acquired through a business purchase. If closely related to the trade or business, the loss is a business bad debt; otherwise, it becomes a nonbusiness bad debt.

- Liquidation: When liquidating a business, any uncollectible accounts receivable that you retain are treated as business bad debts.

Impact on Financial Statements

Effect on the Income Statement

Bad debt expense is a key variable on a company’s income statement as it directly influences reported revenue and net income. Recognizing and accurately recording bad debt expense when they occur is crucial. This practice ensures the income statement reflects the company’s profitability with transparency.

To estimate the potential uncollectible accounts, companies take into account historical data, economic conditions, and customer payment history, among other factors. These bad debt estimates ultimately impact net income by reducing the reported revenue.

Implication on the Balance Sheet

The balance sheet also gets impacted by bad debts, primarily within the realms of accounts receivable and allowance for doubtful accounts. When bad debts increase, uncollectible accounts or receivables also rise.

The accounts receivable balance needs adjustment to represent the actual collectible amount accurately. This adjustment is made by decreasing the accounts receivable balance and creating an allowance for doubtful accounts, a contra-asset account on the balance sheet. The balance in this allowance account is derived from the company’s estimate of potential bad debts.

Compliance with Generally Accepted Accounting Principles (GAAP)

To comply with GAAP, bad debt expenses must be recorded during the same accounting period when the related credit sales or services were recognized as revenue. This practice aligns the financial statements with the matching principle, ensuring that revenues and their associated expenses are matched within the correct accounting period.

Disclosure Requirements for Bad Debt Expense

Companies need to disclose their accounting policies for estimating bad debt expense, significant changes in these estimation methods, and any known or potential risks related to uncollectible accounts to provide an accurate financial snapshot of their standing.

Companies must align their financial statements with the matching principle to ensure that revenues are matched with their associated expenses in the appropriate accounting period.

Disclosure Requirements

Companies are required to provide the following information regarding bad debt expense:

- A description of the accounting policies used to estimate bad debt expense.

- Details of significant changes in estimation methods.

- Any known or potential risks related to uncollectible accounts.

Methods for Estimating

To ensure that the financial statements accurately reflect the company’s financial situation, companies must assess and record bad debt expenses. Two commonly used methods include the Percentage of Sales Method and the Accounts Receivable Aging Method.

Percentage of Sales Method

The Percentage of Sales Method, also known as the sales method, is a widely used technique to estimate a company’s bad debt expenses. The premise of this method is that a certain percentage of credit sales will inevitably result in bad debts.

To calculate bad debt expenses using the Percentage of Sales Method, companies determine a specific percentage based on historical data, industry averages, or past experience. This percentage is applied to the total credit sales to estimate the bad debt expense.

For example, if a company has $1,000,000 in credit sales and, based on historical trends, 2% of credit sales are expected to be uncollectible, the bad debt expense would be $20,000 ($1,000,000 * 2%).

This method aligns with the matching principle as it recognizes the bad debt expense in the same period when the corresponding revenue was recognized.

Accounts Receivable Aging Method

The Accounts Receivable Aging Method is another commonly used approach to estimate bad debts. This method involves analyzing the company’s accounts receivable based on the length of time the receivables have been outstanding.

The accounts receivable are categorized into various age buckets (e.g., 0-30 days, 31-60 days, 61-90 days, over 90 days), and a higher percentage of uncollectibility is associated with older receivables based on the company’s historical collection patterns.

For instance, if a company determines that 2% of receivables outstanding for 30 days or less are uncollectible, 5% of receivables outstanding for 31-60 days are uncollectible, and 10% of receivables outstanding for more than 60 days are uncollectible, they would apply these percentages to the amounts in each category of their receivables to calculate the total estimated bad debt expense.

This method provides a more detailed analysis of the likelihood of uncollectibility and helps the company manage its collection process more effectively.

While the Percentage of Sales Method is straightforward and easy to use, the Accounts Receivable Aging Method provides a more nuanced view of potential bad debts, allowing for a more accurate prediction and better management of accounts receivable.

How to Record Bad Debt Expense?

Allowance Method

The Allowance Method is the preferred approach for recording bad debt expenses. It involves estimating the amount of uncollectible accounts receivable and creating an allowance for doubtful accounts. Here’s a breakdown of the process:

- Estimating Bad Debt Expense: Companies use historical data, industry benchmarks, and other relevant factors to estimate the percentage of receivables that may become uncollectible. This estimated amount is recorded as bad debt expense.

- Creating the Allowance for Doubtful Accounts: The estimated bad debt expense is then recorded as a contra-asset account called the allowance for doubtful accounts. This allowance reduces the accounts receivable balance and reflects the expected uncollectible portion.

- Adjusting Entries: At the end of each accounting period, companies review and adjust the allowance for doubtful accounts based on actual experience and changes in circumstances. Adjustments ensure the allowance account reflects an accurate estimate of potential bad debts.

- Recording Actual Bad Debts: When specific customer accounts are identified as uncollectible, they are written off against the allowance for doubtful accounts. This write-off reduces both the accounts receivable balance and the allowance account.

Direct Write-Off Method

The Direct Write-Off Method is an alternative to the Allowance Method, but it is generally not in accordance with accepted accounting principles. Under direct write off method, a bad debt expense is recorded only when a specific customer account is deemed uncollectible. Here’s how it works:

- Identifying Uncollectible Accounts: Companies monitor customer accounts and identify those that are no longer expected to be collectible due to financial distress, bankruptcy, or other reasons.

- Recording Bad Debt Expense: Once an account is deemed uncollectible, the company directly writes off the receivable by debiting the bad debt expense and crediting the accounts receivable account.

The direct write-off method recognizes a bad debt expense only when they are deemed uncollectible, resulting in a delay between the occurrence of the bad debt and its recognition.

It’s important to note that the direct write-off method is typically used by small businesses with immaterial bad debts or when the exact timing and amount of bad debts are known with certainty.

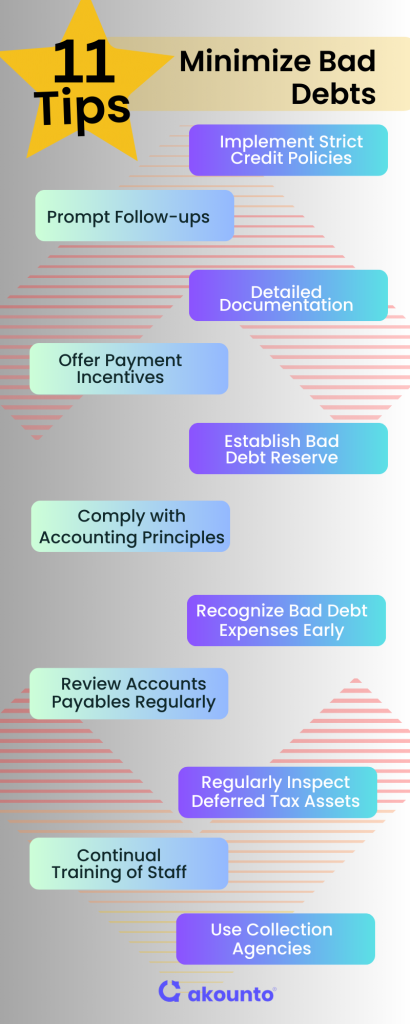

Tips to Minimize Bad Debts

- Implement Strict Credit Policies: Establish credit limits based on a customer’s payment history and creditworthiness. Regularly reviewing customer’s credit scores, and billing and payment cycle, can also help in recognizing potential bad debts.

- Prompt Follow-up: Keep a close eye on accounts receivable aging reports and promptly follow up on uncollected credit sales.

- Detailed Documentation: Keep detailed and accurate records of all transactions. This can assist in dispute resolutions and can also provide valuable insights when assessing potential credit risks.

- Offer Payment Incentives: Encourage timely payments by offering discounts for early payments. This not only improves cash flow but also fosters better customer relationships.

- Use Collection Agencies: If accounts are overdue by a certain period, consider using a collection agency or pursuing legal action to recover the debt.

- Establish a Bad Debt Reserve: As part of recognizing bad debt expenses, setting aside a portion of the company’s revenue each period to cover potential uncollectible accounts can be beneficial.

- Compliance with Accounting Principles: Adherence to accounting principles like the matching principle helps ensure that revenues and their associated expenses are recorded in the same accounting period. This can make bad debt management more efficient.

- Recognize Bad Debt Expenses Early: Recognizing bad debt expenses at the earliest possible time allows for more effective management of financial resources and better planning for deferred tax assets.

- Manage Accounts Payable Efficiently: Regularly reviewing accounts payable reports can provide an early warning of potential bad debts, allowing you to take proactive action.

- Continual Training of Staff: Ensure that your staff is well versed in credit management techniques and has a solid understanding of the importance of recognizing bad debt expenses and complying with accounting principles.

- Regularly Review Deferred Tax Assets: Regular review of deferred tax assets can help ensure they are managed effectively, and any impact from bad debts is appropriately considered.

Final Words

Managing bad debt expense is crucial for maintaining financial health and stability. Prompt recognition of these expenses, adherence to accounting principles, and efficient management of accounts receivable and payable are key to minimizing bad debts.

Companies must ensure accurate financial reporting by employing robust estimation and recording methods, complying with disclosure requirements, and taking proactive measures to reduce uncollectible debts.

Join the revolution of modern accounting and start streamlining your business operations with Akounto today!