What Is Direct Write-Off Method?

The direct write-off method allows businesses to account for bad debts only when it is classified as uncollectible receivables.

What’s covered in the article

An accounts receivable account is written off from the financial statements only when considered uncollectible.

How To Use the Direct Write-Off Method?

The direct write-off method is used to record the bad debt expense. It is done to ensure that bad debt records are accurate.

The company begins with identifying all uncollectible accounts. These bad debts are usually the amount of the accounts receivable. Once identified, it credits the accounts receivable and debits the bad debts expense.

For example, a shop sells semiconductor parts to customers on credit. The business fulfills an order of $20,000 worth of parts. If the company is certain that a customer cannot repay its debt, it identifies the account receivable as uncollectible.

The shop will move the uncollectible amount from the accounts receivable to a bad debt account. The journal entry should be as follows:

| Account | Debit | Credit |

| Bad Debt | $20,000 | |

| Accounts Receivable | $20,000 |

But if the customer plans to pay back the product, the company can reverse the accounting transaction. Here is the entry of reversal:

| Account | Debit | Credit |

| Bad Debt | $20,000 | |

| Accounts Receivable | $20,000 |

The payment can be recorded as follows:

| Account | Debit | Credit |

| Cash | $20,000 | |

| Accounts Receivable | $20,000 |

It’s important to note that unpaid invoices are a part of the accounts receivable balance. An unpaid invoice is considered an asset and shall be debited in the bookkeeping.

Companies should also note that the direct write-off method is inconsistent with matching principles. In the direct write-off method, a bad debt is reported only when it is written off from the customer’s account. And it is done after the initial sale has taken place.

Recording bad debts through the direct write-off method affects only the bottom line of income in the current period. It does not affect the sales period.

The direct write-off method is mandatory for U.S. Income Tax reporting. Bad debts can be deducted from the total taxable income while filing the annual tax returns. The IRS mandates that small businesses compute their deductions using the direct write-off technique.

Direct Write-Off Method Vs Allowance Method

Below are some ways the direct write-off method and allowance method differ from one another.

- The direct write-off method doesn’t consider a bad debt expense until there is no expectation of recovery. The allowance method estimates a bad debt and records them in the same sales period.

- The generally accepted accounting principles (GAAP) does not hold the direct write-off method valid since it does not follow the matching principle. The direct write-off method records the expense and revenue in different periods. GAAP validates the use of the allowance method to create financial statements. It is because the allowance method follows the matching principle that GAAP mandates.

- Publicly held companies cannot follow the direct write-off method. Public-held companies only follow the allowance method during financial reporting because it is allowed by GAAP. Publicly traded corporations are not to use the direct write-off method.

- The direct write-off and allowance methods record the bad debt in different periods. The direct write-off method lets small business charge the bad debt expense account when they believe they won’t be able to recollect the invoice. In the allowance method, they are expected to estimate the amount annually.

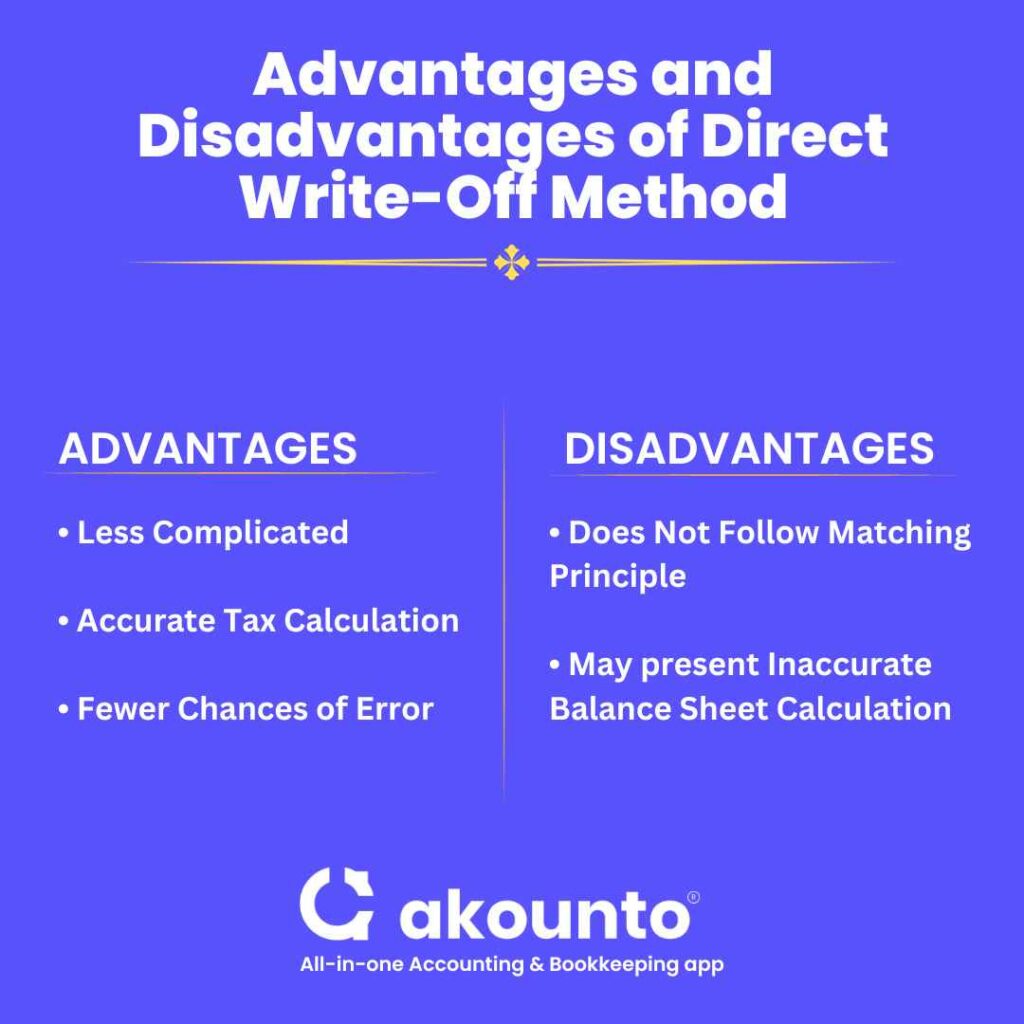

What are the Advantages of the Direct Write-Off Method?

- Less Complicated: Direct write-off provides an easier method of recording transactions because it only requires one journal entry to write off the bad debt from the accounts receivable.

- Accurate Tax Calculation: The IRS allows a company to write off your bad debts from their annual tax returns. But the IRS requires an accurate amount of bad debt. And thus, businesses have to file the tax return only using the direct write-off method. It also minimizes any chances of errors while calculating tax returns.

- Fewer Chances of Error: The allowance method requires you to estimate an amount. In the direct write-off method, an actual amount is accounted for. Thus, it helps avoid any misstatement while recording bad debt expenses.

What are the Disadvantages of the Direct Write-Off Method?

The direct write-off method can be beneficial for businesses. But it also has many drawbacks. Some disadvantages of utilizing the direct write-off method are as follows:

- Does Not Follow The Matching Principle: The matching principle states that companies must report expenses in the same period they incurred. The direct write-off method doesn’t realize bad expenses in the same accounting period as the sales. For example, if the company sells its product in January, it might not have realized bad debts until March. A direct write-off happens in a different year than when the sale is made.

- Inaccurate Balance Sheet Calculation: In the direct write-off method, when customers owe the company, it is directly recorded in the accounts receivables. But if they are uncollectible accounts receivable, it gives a false image of accounts receivables.

Direct Write-Off Method And GAAP

The GAAP doesn’t validate the direct write-off method.

As per GAAP, it is mandatory to match the revenue with expenses in the same accounting period. But with the direct write-off method, the expense might be recorded in a different accounting period than the sales period, implying that GAAP principles are not complied with by the direct write-off method. Thus, GAAP only allows the allowance method while making financial statements.

Why is Direct Write-Off Method Not Used In the Accounting Profession?

GAAP urges that revenue and expenses be treated within the same accounting period.

GAAP requires to use of the allowance method among the two methods. As the direct write-off method does not conform with the matching principle (reporting expenses in the same period the related revenue is earned), GAAP prohibits this method.

The direct write-off method distorts the financial statements as it allows reporting losses and revenue in different periods. It makes it difficult to estimate the overall asset and expenses, overstating the net income in the balance sheet.

Bottom Line

If you are a business owner who requires regular insights about recording accounts, Akounto contributes to corporate citizenship by helping maintain accurate books of accounts. Expert support helps in responsible decision-making and safeguarding the stakeholders’ interests.

Sign in to Akounto and get in touch with our experts to get your questions answered today.