What Is An Invoice?

An invoice is a seller’s document issued to a buyer, itemizing goods or services provided and the corresponding amount due for it.

[ez-toc]

An invoice functions as a request for payment for goods or services rendered. It includes the seller’s and buyer’s details, itemized list of products or services with corresponding quantities and prices, payment terms, due dates, and applicable sales tax or discounts.

How Does An Invoice Work?

The invoice process begins when a seller completes a sale or delivers services to a customer.

The seller creates an invoice outlining the transaction specifics and sends it to the buyer. An invoice is a legal document that establishes the obligations and terms between the buyer and seller.

The buyer uses the invoice to verify the accuracy of the transaction and make the necessary payment, while the seller relies on it to track sales, manage cash flow, and maintain proper financial records.

Both the seller and the buyer maintain records of invoices for accounting and auditing purposes. These records serve as a reference for future inquiries, tax compliance, financial reporting, and reconciliation.

An invoice is vital for documenting the exchange of goods or services in a business transaction.

Steps Involved In Invoice Processing

- The first step in invoice processing is creating invoices. Next, the seller creates an invoice using a standardized invoice template or invoice software, including essential information such as the seller and buyer contact details, invoice number, invoice date, and itemized list of products, quantities, and prices.

- Upon receiving the invoice, the buyer reviews it for accuracy and completeness to ensure the expected goods are delivered.

- In a business setting, the buyer’s accounts payable department handles the internal processing of invoices. The team records the invoice details, assigns relevant cost centers or general ledger codes, and validates the invoice against internal controls or approval workflows.

- Once the invoice is approved, the buyer proceeds with payment processing. It can involve issuing a check, initiating a bank transfer, or using electronic payment methods like credit cards or online payments.

- After payment reconciliation, the invoice is typically stored in an organized and secure manner. For example, in paper-based systems, invoices may be filed physically, while digital systems store invoices electronically for easy retrieval and long-term recordkeeping.

Need And Significance

Invoices are pivotal in business transactions and are important for sellers and buyers. Here are some key reasons why invoices are essential:

Record Keeping

Invoices serve as formal records of transactions, documenting goods or services provided, prices, quantities, and terms.

Timely Payments

Invoices request timely and accurate payments from buyers to sellers, specifying amounts due and payment terms.

Financial Management

Invoices help track sales, revenue, and outstanding payments, enabling effective cash flow management.

Dispute Resolution

Invoices serve as evidence to resolve conflicts or discrepancies regarding delivered goods or payments.

Compliance And Taxation

Invoices ensure compliance with legal and tax obligations, providing essential documentation and facilitating accurate recordkeeping. Invoices are valuable evidence during tax audits or inquiries, helping businesses substantiate their reported income, expenses, and eligible deductions.

Professional Image

Well-designed and accurate invoices convey professionalism, credibility, and attention to detail.

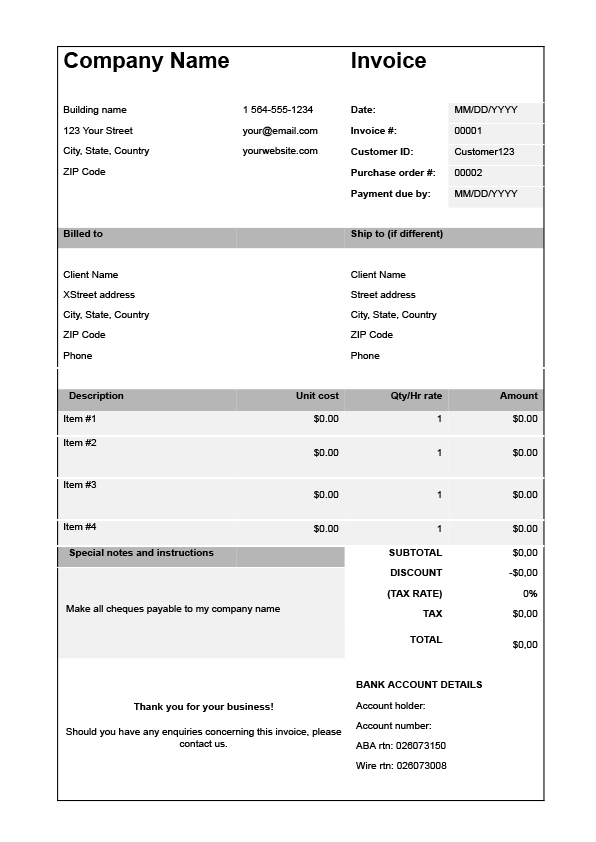

Components

To know how to fill out an invoice, let’s start by understanding its components.

- Seller Details: Business name, address, tax identification number, and contact details of the seller.

- Buyer Details: Name, address, and contact details of the buyer.

- Invoice Number: A unique identifying number is assigned to each invoice using an invoice numbering system.

- Invoice Date: The date of purchase or invoice billing date.

- Itemized Description: A detailed breakdown of the goods or services, including quantity, unit price, and applicable taxes on the purchase, such as sales tax, value-added tax, excise, customs duties, etc.

- Total Amount Due: The total sum to be paid by the buyer. It is calculated based on the itemized description.

- Payment Terms: The agreed-upon payment terms between the seller and buyer. They generally include the preferred payment method, payment due date, and any late payment penalties or early payment discounts.

- Terms and Conditions: Any specific terms or conditions related to the sale, such as return policies or warranty information.

- Company Logo: The logo or branding elements representing the seller’s company, enhancing professionalism and brand identity.

- Footer Information: Additional details like legal disclaimers, terms of service, or even any referral programs and deals.

5 Steps To Fill Out An Invoice

Knowing how to fill out an invoice can be especially helpful if doing it manually. Here’s how to fill out an invoice in a few easy steps:

- Step 1: Fill out the buyer’s name, address, and contact information.

- Step 2: Assign a unique invoice number to identify the invoice. It should be automatically generated if using software, else input the number manually in sequential order.

- Step 3: Itemize the goods or services provided, including descriptions, quantities, and unit prices, and calculate the total for each item by multiplying the quantity by the unit price.

- Step 4: Include charges and taxes, such as shipping fees or handling costs, and sales taxes, and add them to the subtotal to determine the total amount due.

- Step 5:В Specify the payment details, including the due date and accepted payment methods and add relevant notes or terms specific to the transaction, such as return policies or warranty information. Always double-check the complete invoice properly before issuing it to the buyer, and save a copy of the completed invoice for your records.

Example

Given below is an example of a simplified invoice template:

Adding Discounts On An Invoice

When adding discounts to an invoice, it is essential to provide clear communication with your customers.

Start by determining the type of discount you offer, whether a percentage discount or a specific dollar amount. Once you have identified the discount type, it’s time to incorporate it into the invoice.

To add the discount, place it below the subtotal section of the invoice. Ensure to clearly state the name or description of the discount and indicate the corresponding amount being deducted.

By briefly explaining the discount, such as a promotional offer, loyalty reward, or special event discount, you improve transparency and help customers understand the value they are paying.

Then, calculate the final invoice total by subtracting the discount amount from the subtotal. The final invoice total should be prominently displayed so customers can easily identify the amount they need to pay after applying the discount.

By incorporating discounts into your invoices and providing clear communication, you demonstrate your commitment to customer satisfaction. Customers appreciate transparency and value-added benefits, which can enhance their loyalty and encourage future business interactions.

Moreover, clearly stating the discount and its purpose creates a sense of trust and strengthens the customer-business relationship.

Using Accounting Software For Invoicing

Accounting software improves efficiency by automating the process, where you can generate and send invoices quickly, reducing manual effort and saving time. Such software automatically calculates totals, taxes, and discounts, ensuring accurate and error free invoicing.

Using such software also simplifies the tracking and management of invoices. You can easily track payment statuses, monitor outstanding invoices, and send automated reminders to clients before the due date or for missed payments. It improves cash flow management and helps you stay organized with clear visibility into your invoicing records.

Akounto is one such software that enables businesses to create professional invoices, send them to the right person, accept online payments, and streamline the process to get paid faster. Small business owners can automate recurring invoices and create customized invoices via its free invoice templates, incorporating branding elements like logos.

Akounto’s user-friendly interface and comprehensive features make it an ideal choice for businesses seeking a reliable and efficient solution for their invoicing needs.

Conclusion

Filling out an invoice is simple once you fully grasp the necessary steps. A professional invoice is essential for ensuring payment and finance tracking. Businesses can benefit from excellent invoicing habits, from when to send the invoice to how it’s formatted.

The best way to collect payment and eliminate manual errors is to use automated invoicing software and their free invoice template options to send customized invoices.

Explore more articles on billing and invoicing in our Akounto Blog section today.