What is a Transposition Error?

A transposition error is a reversal of digits while manually recording transactions in the accounts’ books.

For example, when a bookkeeper records $2869 instead of $2689, it is called a transposition error.

What’s covered in the article

Transposition errors or accounting errors are typographical errors that may cause overestimation and underestimation of the values in the financial statements.

How to Detect a Transposition Error?

Transposition Errors are divisible by 9

Although there is no specific indicator to know if the transposition error exists, a mathematical solution to spot transposition error is possible by a magical number “9”.

If the difference between the reversed digits is evenly divisible by”9″ and leaves no remainder, then a transposition error exists.

Example:

| Correct amount | Wrong amount | Difference |

| 685 | 658 | 27 |

| 982 | 928 | 54 |

| 6598 | 6958 | 360 |

The above differences are all divisible by 9, which indicates that a transposition error exists.

Another way to identify a transposition error is when there is a difference between the debit side and the credit side of the trial balance. However, this is not a well-followed trick, as due to the double entry method, the same amount gets added to the trial balance’s credit and debit side.

Where Does the Transposition Error Occur?

Transposition error may occur wherever the numbers are involved. Following are the instances where these errors can occur

- Raising invoices

- Recording of Journal entries

- Transfer to ledger accounts

- Trial balance

Transposition errors can also occur while writing down the address, phone number, Zip codes, etc.

Examples to Explain Transposition Error

The transposition error can be of many types. Here are a few examples that may have an impact on the business.

Example – 1: Journal entry error

ABC Ltd. made a sale of $1,928 in January 2023. Instead of debiting accounts receivable with $1,928, the accounts personnel debited $1,298.

Wrong Entry

| Account | Debit ($) | Credit ($) |

| Accounts receivable | 1,298 | |

| Sales | 1,298 |

Correct Entry

| Account | Debit ($) | Credit ($) |

| Accounts receivable | 1,928 | |

| Sales | 1,928 |

Due to the transposition error, accounts receivable and sales have been understated by $630.2.

Example – 2: Error in payroll

The employees of XYZ Inc. are paid $42 per week. But the bookkeeper erroneously records $24 in the books of accounts.

Difference due to transposition error = $42-$24 = $18 per week

This transposition error leads to lower wages for the employees and also causes tax miscalculations.

Impact of a Transposition Error

The unintentional errors may sometimes be insignificant but can cause severe consequences if they are material to the financial statements.

Example: If a bookkeeper erroneously records $89 instead of $98, a difference of $9 may not be material to the business profit. But if he records $5,863,00 instead of $ 5,683,00, the difference of $ 18,000 may result in an untrue financial picture and a gross misrepresentation of the business profit.

Incorrect transactions deliver a misleading picture to potential shareholders and other authorities regarding the performance of a business.

The problems can be listed as follows:

- Overstatement of expenses

- Misstated tax forms due to tax miscalculations

- Inaccurate financials

- Misstated financial reports

Difference between a Transcription Error and a Transposition Error

Transcription error is when the data is wrongly entered, input, or copied. While transposition error is when the values are interchanged (transposed).

Transcription errors are data entry errors caused by human operators or optical character recognition (OCR) programs, while transposition errors are most of the time due to human carelessness.

Example of transposition error: When the term Important (Correct) is entered as Importnat (Wrong)

Example of transcription error: When the word “proper” (Correct) is entered as “propar” (Wrong). Note it is wrongly entered and not an interchange of letters.

How to correct transposition errors?

Companies can rectify transposition errors by recording a reverse journal entry that involves the same accounts.

Example: Rent paid to the landlord – $23,000, the amount recorded in the books of accounts – $32,000. The overstatement of $9,000 can be rectified by recording an additional journal entry.

Wrong entry recorded in the books of accounts

| Account | Debit ($) | Credit ($) |

| Rent | 32,000 | |

| Cash | 32,000 |

Reversal entry to be recorded

| Account | Debit ($) | Credit ($) |

| Rent | 9,000 | |

| Cash | 9,000 |

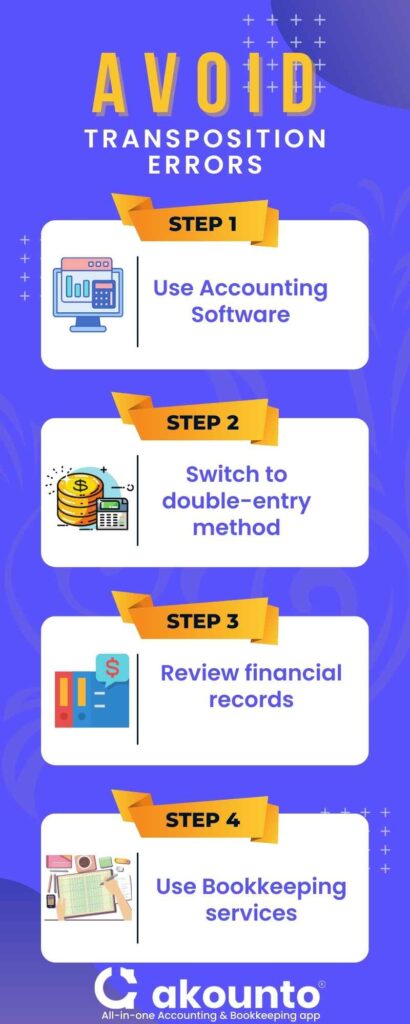

How to avoid transposition errors?

- Use accounting software. It is prominent that manually entering data is the foremost reason for the arousal of transposition errors. Now in the digital era also, these mistakes are bound to happen. So to avoid such errors, instead of manually recording entries, companies may go for accounting software that automates the entire accounting cycle. The accounting software identifies inaccuracies and helps to minimize errors.

- Double-entry system – Small businesses follow a single-entry system which is the root cause of such transposition errors. A double-entry system helps to avoid such mistakes because every entry affects two ledgers. The double-entry system facilitates the generation of an error-free trial balance.

- Review the financial records – Reviewing financial records such as bank books, cash books, and general ledger can reduce the chances of these errors.

- Use Bookkeeping Services – In-house recordkeeping and accounting can be cumbersome and complex for startups, small businesses, and freelancers. They may need to improve in competency or be updated with changes in accounting standards. Subscribing to professional bookkeeping services can be economical and also productive in the long run. Bookkeeping professionals are experienced in various industries, offer financial advice and guidance, and prepare the right documentation for taxes.

Conclusion

Transposition errors and transcription errors are common wherever human intervention is involved.

In that case, businesses require accounting software that automates the reconciliations in the books of accounts to avoid such errors.

Akounto’s accounting software offers comprehensive services to reduce errors and help the business. To know more, visit our website to save time and cost.