What is a General Ledger?

The general ledger is a complete record of a company’s financial transactions organized by accounts.

The transaction data in a general ledger is separated and organized into accounts for assets, liabilities, revenues, investments, etc., with each account reflecting a unique category of financial transaction.

What’s covered in the article

A general ledger is a central repository of a business’s financial transactions. The accounts in the system are arranged with the balance sheet accounts on the top, followed by the income statement accounts.

Role of General Ledger

A general ledger account is important as it serves the following purposes:

- Record-keeping: The primary purpose of a general ledger is to record all the financial transactions made by a business. It includes several accounts like income, expenses, assets, liabilities, etc.

- Financial Reporting: As the general ledger ensures that all financial activities are recorded accurately and consistently, it helps create accurate accounting and financial statements for the business.

- Auditing: A well-maintained general ledger aids in auditing the financial records of any business. Auditors can review the ledger records to ensure that all the internal records match the company’s financial activities.

- Analyzing Business Performance: The general ledger offers a comprehensive overview of the financial health of any business. It helps analysts stay informed about the business performance and recognize the areas that need to be improved.

- Account Balancing: Account balancing helps businesses ensure that all their accounts are balanced. In other words, it means that the debits and credits in each account balance each other, making it easier to spot discrepancies.

- Preparing Financial Statements: Accurate ledgers aid in preparing financial statements, including a balance sheet, income statement, and cash flow statement of a business.

General ledgers serve the following purposes:

- Budget Forecasting: A general ledger offers all the crucial data required for budgeting and financing. Businesses can use the ledger’s information to make their financial projections.

- Tax Reporting: General ledgers aid in preparing tax reports and filing tax returns conveniently. Besides, it helps businesses to comply with the tax regulations set by the IRS and avoid penalties.

- Informed Decision: The general ledger also helps the investors with the financial reports. It provides a clear picture of a business’s financial health while aiding investors in making informed investment decisions.

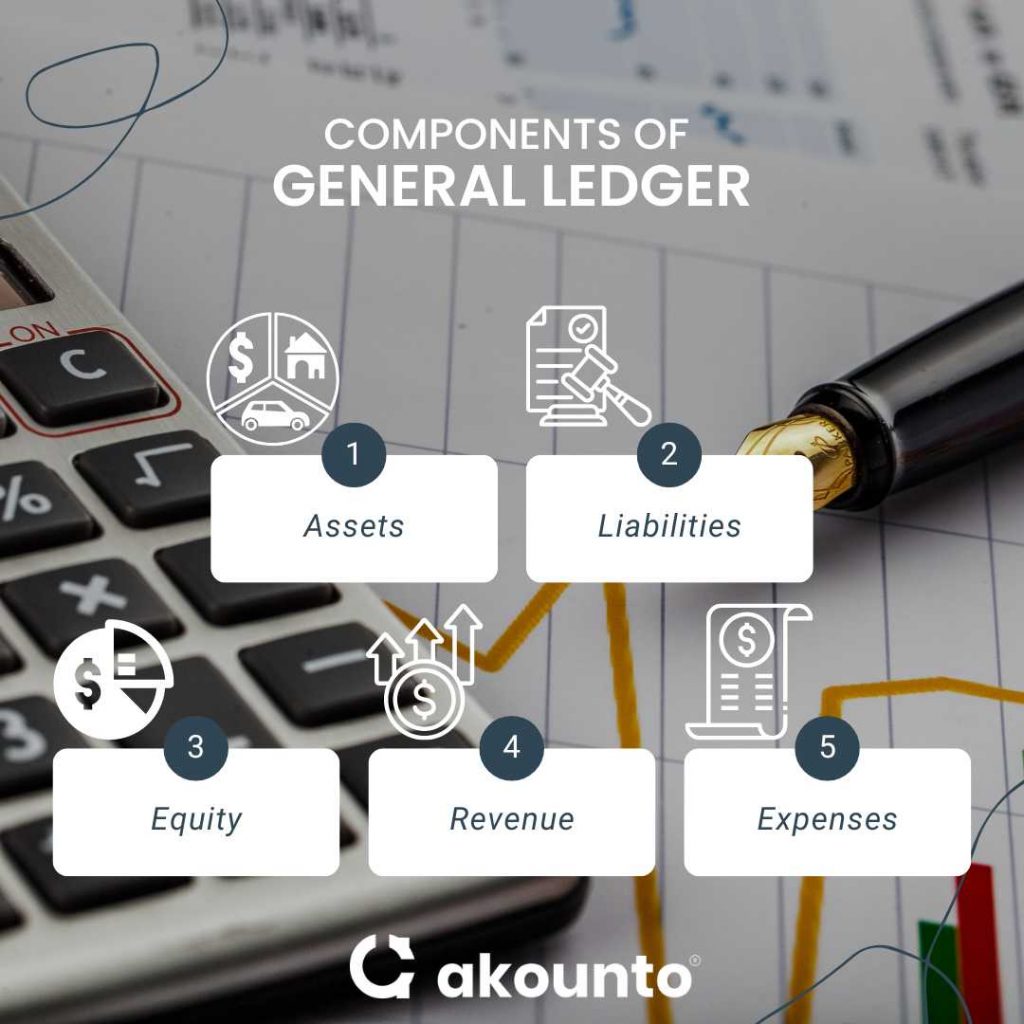

Components of a General Ledger

The general ledger, a central component of a business’s account system, primarily comprises sections and accounts. The available ledger sections are:

- Assets: The asset account comprises the commodities a business owns, such as cash, inventory, equipment, property, vehicles, etc. For example, if a company has $2,000 in cash and inventory worth $20,000, its total assets will be $22,000.

- Liabilities: These are any debts or money owed by the business, which includes loans, credit card balances, accounts payable, etc. For example, if a company has $1,000 in loans and $2,000 in accounts payable, its total liabilities would be $3,000.

- Equity: It refers to the difference between assets and liabilities. In other words, it signifies the business’s ownership stake in the company. From the above examples, the business’s Equity will be $22,000 (Assets) – $3,000 (Liabilities) = $19,000.

- Revenue: It represents the total income a business generates, which can come from several sources, like the sale of goods or services, interest income, dividends, etc. It is also the top line, generally mentioned at the top of businesses’ income statements.

- Expenses: These include any amount spent to continue regular business operations. Expenses include rent, wages, utilities, purchasing inventory, maintenance, etc.

The general ledger accounts include:

- Accounts Receivable: Accounts receivable is any amount owed to the business by its customers. The companies set a time for the customers to make invoice payments for the goods or services they have received.

- Accounts Payable: Accounts payable is any amount owed to the vendors by the business. Businesses must pay the suppliers within a pre-fixed time for the goods or services they have purchased on credit.

- Owner’s Equity: It represents a part of the business’s assets owned by the shareholders or the business owner. For example, if a business records Revenue from sales, the owner’s Equity increases as it represents that the company has earned more money. Similarly, if the company experiences a loss from a sale, the owner’s equity tumbles.

- Revenue Accounts: In the general ledger, the revenue accounts are divided into sub-categories like sales, interest, etc. The sales accounts can be further classified into foreign, domestic, or other categories.

- Expense Account: Any expenses that a business incurs to run its business are recorded in the expense accounts of the general ledger. The expense account can be divided into several entries like rent, fees, maintenance, premium subscriptions, etc.

How does it Work?

The general ledger functions using the double-entry accounting method, meaning each transaction is recorded as a journal entry in two accounts: a debit and a credit. All the debits and credits must balance, so utilizing double-sided entries helps improve the records’ accuracy and accountability.

A fundamental accounting equation is “Assets – Liabilities = Stockholders’ Equity.” The double-entry accounting method ensures that this equation always stays in balance. In other words, if the debits and credits do not balance, the accounting team must have made a mistake in keeping the records.

The double-entry accounting method records the accounting data so that when one asset account increases, the other decreases. And in this way, the accounting equation maintains a net-zero difference.

Examples

Businesses use several general ledger accounts for preparing financial reports, which include:

- Cash Accounts – To record every cash-related transaction. It includes cash receipts and disbursements like payments to suppliers, rent, labor payments, etc.

- Accounts Receivable – To record the transactions related to money owed to the business by its customers. It includes the customers’ invoices to the business for goods or services.

- Inventory Accounts – To track the value of goods that a company holds for sale. It involves several metrics, such as the cost of goods sold (COGS), the value of goods, any inventory that has been damaged or lost, etc.

- Accounts Payable – It includes all the transactions related to money a business must pay its suppliers. It is the invoices that businesses receive from the suppliers for the goods or services provided.

- Loans Payable – It tracks all transactions related to any loan taken out by the company. It includes the principal borrowed amount, interests, or any external fees associated with the loan.

- Owner’s Equity- It refers to any money invested by the owners in the business. It involves initial or additional investments made by the owners or any profits retained by the business.

- Retained Earnings Account – It helps track all the profits a business makes that are kept for future use. It includes any gains reinvested in the business or used to pay off the company debt.

- The Depreciation Account – It tracks the depreciation of any fixed asset over time. It contains the cost of the asset, its useful life, and the specific depreciation methods used.

Accounts present in the general ledger income statement are-

- Operating Revenue – It includes sales and service fee revenues.

- Operating Expense – It includes salary expenses, interest expenses, loss on disposal of assets, etc.

General Ledger Transaction Example

Example:

On April 15, 2023, Company ABC Limited sold goods worth $50,000 to its customers. So the entries will be:

| Date | Account Title & Details | Debit | Credit |

| 04-15-2023 | Cash Account | $55,000 | |

| 04-15-2023 | Sales | $55,000 |

General Ledger vs. Balance Sheet

While both the general ledger and balance sheet are essential for any business, there are certain differences, which are-

Records: General ledgers record all transactions daily using the debit and credit accounts. They track a business’s financial transactions from the initial stage of its operations.

A balance sheet doesn’t carry many details like general ledgers but provides a quick overview of a company’s financial health.

Details: A general ledger contains details in several categories, including assets, liabilities, equities, revenue, and expenses.

A balance sheet does not use categories. Instead, it shows the totals for each category that are recorded for a specific period.

Purpose: General ledgers are a central data repository for financial reporting purposes.

The balance sheet primarily shows what a business owns or owes to other parties for its completion date.

Time Frame: A general ledger shows historical data.

The balance sheet records transactions for a specific time period.

| Differences | General Ledger | Balance Sheet |

| Records: | General ledgers record all transactions daily using the debit and credit accounts. They track a business’s financial transactions from the initial stage of its operations. | A balance sheet doesn’t carry many details like general ledgers but provides a quick overview of a company’s financial health |

| Details: | A general ledger contains details in several categories, including assets, liabilities, equities, revenue, and expenses. | A balance sheet does not use categories. Instead, it shows the totals for each category that are recorded for a specific period. |

| Purpose: | General ledgers are a central data repository for financial reporting purposes. | The balance sheet primarily shows what a business owns or owes to other parties for its completion date. |

| Time Frame: | A general ledger shows historical data. | The balance sheet records transactions for a specific time period. |

Drawbacks of Utilizing the General Ledger

There are certain drawbacks of using a general ledger, which include:

- Time-consuming: Recording each transaction manually or through account software could be time-consuming and prone to errors.

- Lack of Real-time Data: It generally provides historical data and doesn’t represent real-time insights into a business’s financial condition.

- Expensive and Complex: Using a general ledger could be costly, requiring specific accounting software and a skilled accountant.

- Limited Transparency: The general ledger is not accessible to all but only to specific business groups. So, transparency and collaboration are limited in the general ledger.

Areas where Small Businesses may go Wrong with General Ledgers

Small businesses often struggle to manage their general ledgers because of the following challenges:

- Incorrect record-keeping can lead to inaccurate financial statements.

- It’s daunting for small businesses to reconcile their accounts regularly, which makes the company’s financial data outdated. Improper tracking of financial transactions also affects the audit process.

- The businesses sometimes overcomplicate the chart of accounts, which makes it challenging to interpret and maintain.

- Improper categorization of expenses by small businesses leads to incorrect tax filings.

Conclusion

A general ledger can help businesses report their financial transactions accurately and consistently while helping investors understand their financial performance. It also allows organizations with hassle-free tax filings and legal compliance.

Sign up with Akounto to keep a proper record of your accounting transactions, important financial statements, and other financial reports. Read our blogs for more details on business accounting.