What are Financing Activities?

Financing activities encompass a range of transactions aimed at raising and repaying capital, typically involving owners and investors.

Cash flows from financing activities refer to cash inflows and outflows due to transactions related to raising capital for a business during an accounting period.

What’s covered in the article

Raising finances for a company involves movement in and out of the company. There is a cost of raising the capital, for example, interest payments, dividend payments, etc., which are the cash outflows directly related to the activities associated with raising capital.

The movement of capital, or the injection of capital in the business, is the cash inflow that directly impacts the availability of funds within the company. The cash inflow could be in the form of a loan, subscription to equity, purchase of bonds by the investors, etc.

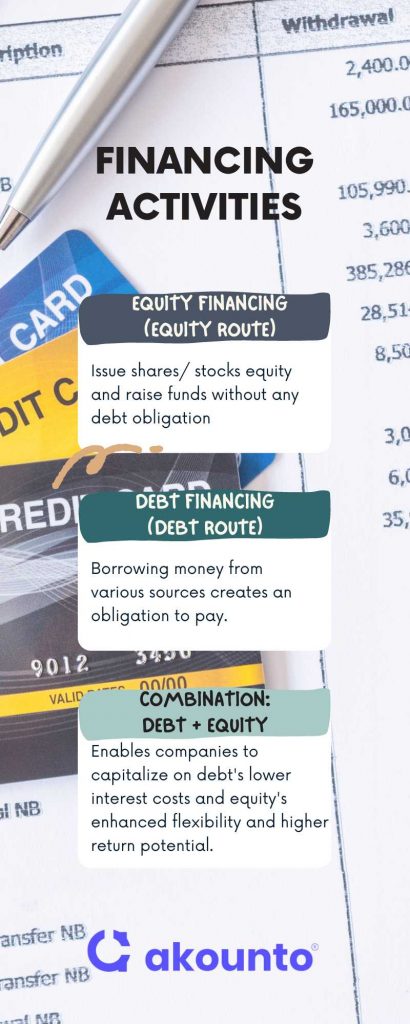

Broadly, the financing activity involves either equity route, debt financing, or a combination of both. Each method has its merits and is followed up by the payment of interest in case of debt and dividend payment in case of debts.

The composition of equity and debt and the choice of either to raise finance directly impacts the company’s capital structure and availability of funds. Capital structure and the ability of the company to raise funds highlight the liquidity and long-term solvency position.

A financing activity is undertaken to raise funds, usually for investing in long-term assets, acquisitions, major operations upgrades, or strategic investments for long-term growth.

Financial analysts, investors, and creditors get deep insights regarding the solvency and liquidity position of the company. The company’s debt-equity composition reflects debt leverage or the risk of over-exposure to debt or equity dilution, which is credible information before lending or investing in a company.

Understanding Financing Activities

Financing activities refer to a broad spectrum of transactions that involve raising capital and repaying capital in terms of long-term debt (loans). The choice of the method to boost capital impacts cash flows and the company’s financial health.

Finance can be raised from equity or debt or their combination. These activities are explained below:

Equity Financing (Equity Route)

Equity financing activity involves:

- Initial Public Offering (IPO) to issue different classes of common stock

- Preferred Stock

- Rights offering to exist shareholders

- Follow-on-offering

- Private Placements

The company can increase its shareholder’s equity and raise funds without any debt obligation by any combination of the above equity financing methods. The company’s ownership gets distributed amongst investors who can get capital appreciation or dividend payments.

There is an inherent risk of equity dilution of existing shareholders and exposure to stringent SEC regulations and stock market dynamics.

Debt Financing (Debt Route)

Debt financing refers to borrowing money from various sources, like institutional investors, retail investors, business loans, etc. The major advantage of the debt route is that no stockholder’s equity is diluted. Still, a legal obligation is to pay fixed interest payments until the principal is paid.

Though taking debt brings effectiveness, the financial risk of regular payments and default impacts the ability to raise further capital. High debt in financial statements represents a threat to long-term liquidity.

Debt- Equity Combination

Companies commonly employ a blend of debt and equity for diverse financial needs, with the ideal proportion dictated by their capital structure. This considers aspects like cost of capital, risk profile, and preferred financial leverage.

Utilizing both financing options enables companies to capitalize on debt’s lower interest costs and equity’s enhanced flexibility and higher return potential. Nevertheless, maintaining a reasonable balance between debt and equity is crucial to avert excessive risk or financial instability.

Monitoring Financing Activities

By analyzing a company’s cash flow statements, particularly the cash stream from financing activities, investors, creditors, analysts, and management assesses how a company raises and allocates funds for its long-term growth.

Analysis of the financing activities section from a cash flow statement, the following insights can be gained:

- The capital structure of a company reveals its financial maneuvering and creditworthiness. How a business raises capital imparts the effectiveness of its financing activities.

- Cash proceeds from investing activities boost positive cash flows but can also cover up any deficit in cash from operating activities.

- Raising debt can be advantageous only if the company is making a profit. By leveraging on debt, the company can minimize its tax implications while the amount to repay loans is fixed, leading to better predictability and financial planning.

- A long-term debt leads to long-term liabilities on the balance sheet, where repaying long-term loans is a legal compulsion, while raising equity adds to the capital stock, where dividends are only paid if the profits are made.

- A company’s long-term growth strategy is impacted by the choice to raise capital; the capital structure reveals fund utilization, risk exposure, and prospects to achieve long-term growth.

Positive or Negative Cash Flow?

Positive cash flows from financing activities highlight that the company has access to funds for investing in its operations, where cash inflows are greater than cash outflows, underlining that the company can repay long-term loans.

Typically a company raises capital by selling stock, issuing bonds, or obtaining long-term loans.

Negative cash flow from financing activities implies that a company has spent more cash on financing activities than it has received, such as repaying long-term debt, making dividend payments, or buying back treasury stock.

This might not indicate poor financial health, as a company could strategically pay down debt or return value to its shareholders through dividends or stock buybacks.

Examples

To better understand financing activities and their impact on a company’s cash flow statement, let’s explore some common examples:

- Issuing Common Stock: When a company issues common stock to raise capital, the cash inflow generated from the sale of the shares is recorded as a positive cash flow from financing activities.

- Issuing Bonds: The cash proceeds received from the bond issuance are recorded as a positive cash inflow in the financing activities section of the cash flow statement.

- Repaying Long-Term Debt: When a company repays its long-term loans or bonds payable, it leads to a cash outflow in the financing activities section. This repayment reduces the company’s liabilities and signifies a negative cash flow from financing activities.

- Paying Cash Dividends: Dividend payments represent financing activities to return value to shareholders and reduce the company’s retained earnings, contributing to a negative cash flow from financing activities.

- Stock Buybacks: Stock buybacks can be used to return value to shareholders or reduce the number of outstanding shares, which may increase earnings per share and potentially boost stock prices.

- Obtaining a Long-Term Loan: When a company takes out a long-term loan from a financial institution, the cash inflow from the borrowed funds is recorded as a positive cash flow from financing activities.

Impact of Financing Activities

- Cash Inflows and Outflows: When a company raises capital, it records a positive cash inflow in its cash flow statement, indicating that it has received cash from investors or lenders. Conversely, repaying debt, paying dividends, or executing stock buybacks result in cash outflows.

- Capital Structure: Heavy reliance on debt financing may result in higher interest payments, financial risk, and potential cash flow constraints, while more equity financing may have a lower risk profile but faces potential stock dilution.

- Financial Flexibility: Access to diverse financing sources allows a company to fund growth initiatives, manage cash flow, and respond to market changes or opportunities.

- Strategic Decisions: Financing activities can also indicate strategic decisions made by the company’s management, such as prioritizing debt repayment, returning value to shareholders through dividends or stock buybacks, or investing in long-term growth.

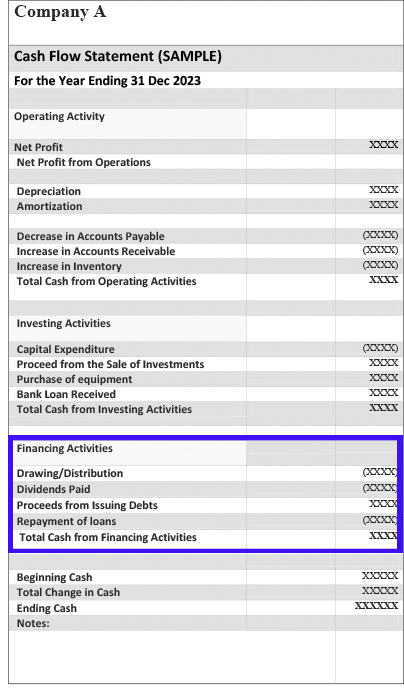

Format and Common Line Items

Financing Activities Section of Cash Flow Statement

- Proceeds from Issuing Common Stock: Cash inflow from selling new common stock shares.

- Proceeds from Issuing Preferred Stock: Cash inflow from issuing preferred stock with preferential rights.

- Proceeds from Issuing Bonds/Notes Payable: Cash inflow from raising capital via debt financing.

- Proceeds from Long-Term Loans: This line item reflects the cash inflow generated when a company borrows money through long-term loans from financial institutions or other lenders.

- Repayment of Long-Term Debt: Cash outflow for repaying long-term loans or bonds payable.

- Dividends Paid: Cash outflow for dividend payments to shareholders.

- Repurchase of Common Stock (Stock Buybacks): Cash outflow for repurchasing own common stock.

- Repayment of Short-Term Loans: Cash outflow for repaying short-term loans or borrowings.

- Payment of Debt Issuance Costs: This line item represents the cash outflow associated with costs incurred during the issuance of debt, such as legal fees, underwriting fees, and other expenses.

Conclusion

Cash flow from financing activities provides insight into a company’s capital raising and allocation strategies. It reveals the firm’s financial health, liquidity, long-term solvency, and its approach to balancing debt and equity financing, ultimately impacting growth and shareholder value.

Positive cash flow from financing activities is a good sign, but negative cash flow from financing activities could result from a strategic decision. Understanding the context and nature of financing activities is important before reaching a definitive conclusion.

Akounto’s accounting software helps to generate accurate cash flow statements for a given accounting year based on the data entered by the user. Visit Akounto’s website to know more.