Define Goodwill in Accounting

Goodwill is an intangible asset representing a company’s reputation, brand value, customer relationships, etc., built over time.

Goodwill emerges when a company purchases another business at a price higher than the fair value of the business’ identifiable assets and liabilities.

It is calculated by subtracting the fair market value of the company’s net identifiable assets and liabilities from the total purchase price.

Under accounting standards of the US GAAP and IFRS, goodwill is identified as an intangible asset with an indefinite life. It is not subject to amortization but must be annually tested for impairment regardless of whether the acquisition is a stock sale or Section 338. It ensures that the carrying value is not more than the fair value.

Goodwill impairments may occur if the acquired assets are no longer in line with the financial results that were previously expected during their purchase. In such cases, the company needs to write down the value of goodwill and record the impairment as an expense in its income statement.

Goodwill is recorded in the acquiring company’s balance sheet under the long-term assets account.

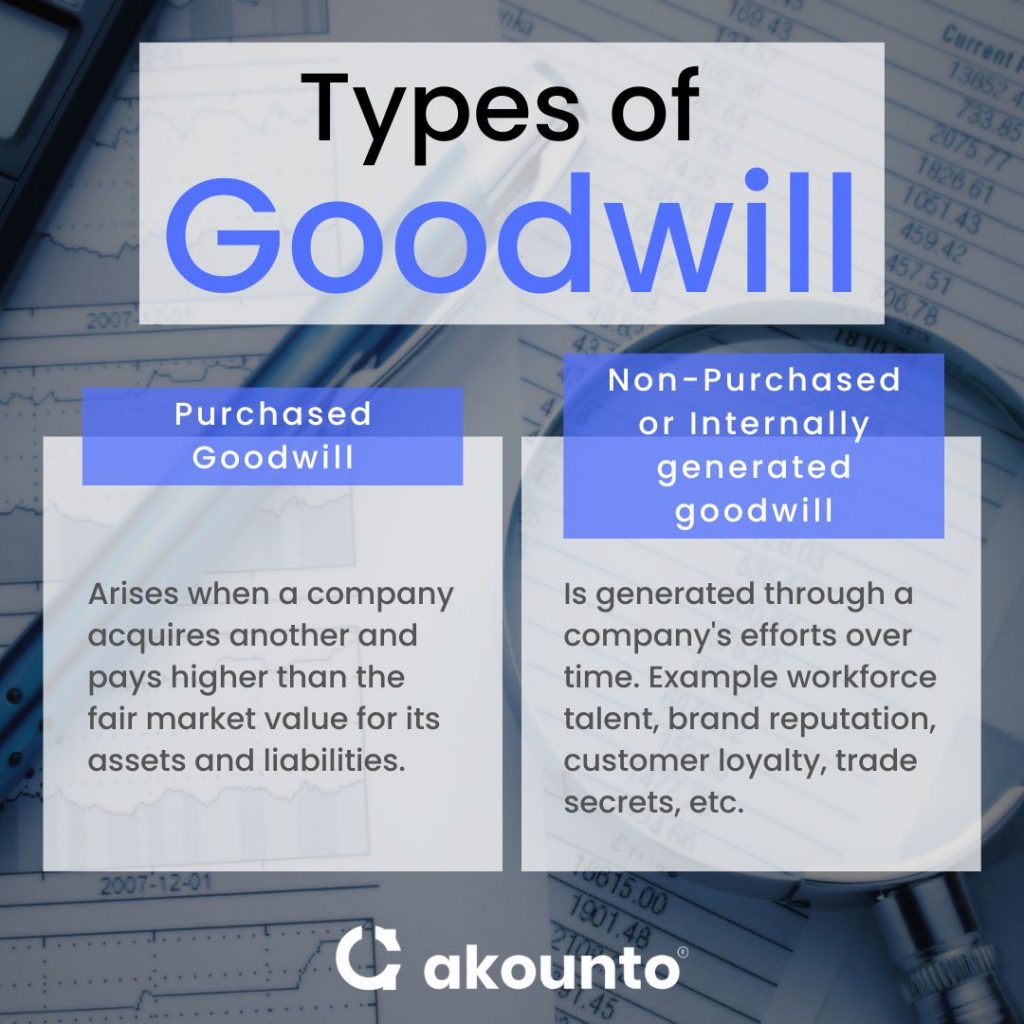

Types

There are two types of goodwill in accounting these include;

Purchased Goodwill

Purchased goodwill arises when one company acquires another and pays higher than the fair market value of assets of the acquired company’s assets and liabilities. It is recorded on the acquirer’s balance sheet as an intangible asset and is the only type of goodwill recognized on the company’s accounts.

Non-Purchased or Internally generated goodwill

Internally generated goodwill is the goodwill generated through the company’s efforts. These types of goodwill are not recorded on the balance sheet as it is not acquired through a transaction. But is considered to be valuable and can be a factor in determining a company’s overall value.

Example of Internally generated goodwill

- Workforce talent: can count as goodwill if it is competent and continuously innovates, increasing the chances of the company becoming flexible to changing market conditions, bringing in higher cash flows, and ensuring overall long-term success.

- Brand reputation: is a collective perception of a business’s brand, products, and services in the marketplace. Reputation as goodwill is beneficial in attracting and hiring new talent, entering newer markets, garnering feedback, and winning trust.

- Customer loyalty: A company with a loyal customer base can generate consistent revenue and potentially increase its value through them. Loyal customers are a valuable source of word-of-mouth marketing and referrals, helping the company attract new customers and increase revenue.When calculating goodwill in accounting, firms gauge whether a company has a rabid, stable, or low base of engaged customers who intrinsically trust it, as loyalty adds value.

- Trade secrets: are confidential information (like recipes, formulas, manufacturing processes, etc.) that give a company a competitive advantage. They are considered goodwill assets as the company develops and maintains them.

- Brand recognition: is the level of awareness consumers have of a particular brand and its products. It can be built through advertising, marketing, and providing quality products or services to customers. Also, if a company enjoys strong brand recognition. It is in a position to charge premium prices for its products or services, increasing its revenue and overall value.

Factors Affecting Goodwill

- Nature of the business: refers to the type of products or services that the company deals with or renders, its customer demand, market competition, and the laws, rules, and regulations that affect the business.

- Capital requirement: More buyers will consider purchasing a firm that requires a low capital investment, gives a high return on investment, is low risk, and has a good reputation. It will consequently increase the goodwill of a business.

- Business Location: If a business is located in a premium location, it will likely attract more customers and enjoy higher goodwill than in a more remote location.

- Trademarks, patents, and intellectual property rights: will enhance the goodwill of a business as they give it certain monopoly rights in the market.

- Quality Products and Services: Businesses committed to selling good quality will likely earn higher goodwill than those providing inferior products and services.

- Management of Efficiency: A business with effective management enjoys high profitability, improving its brand recognition and goodwill.

How to calculate goodwill?

Formula

Goodwill is generally determined as the difference between the purchase price paid for an acquired/target business and the fair market value of the identifiable net assets and liabilities acquired. The formula for calculating goodwill is as follows;

Goodwill = Purchase Price of target Company – Fair value (of Assets + Liabilities)

Steps

- Determine the net book value of all assets from the target company’s balance sheet. It includes fixed assets, current assets, noncurrent assets, intangible assets, and liabilities assumed by the acquiring company.

- Find out the fair value of net identifiable assets. Identifiable assets include all the assets and liabilities acquired in the acquisition, which can be identified and measured separately, such as inventory, accounts receivable, accounts payable, PPE, and other liabilities. Accountants need to estimate the fair value per the acquisition date.

- Calculate the fair value adjustment by subtracting the book value from the fair value of the assets and liabilities acquired.

- Calculate the excess purchase price. Excess purchase price (EPP) is the net of actual price consideration and the net book value of the target company.

- Calculate goodwill. Subtract the excess purchase price and the fair value adjustments from the purchase price. The resulting figure obtained would be the goodwill that will appear in the acquirer’s balance sheet when the deal closes.

Numeric Example

Company B acquires Company ABC Inc. for a purchase price of $500,000. The fair value of assets is 3,50,000, and liabilities are 150,000. Calculate goodwill based on the data given below.

Solution: First, calculate the total fair value of the acquired company, which is net assets minus liabilities.

=> 3,50,000 – 150,000 = $2,00,000

Second, subtract the excess purchase price from the fair value of net assets acquired company. => $500,000 – $200,000 = $300,000

The goodwill of Company B will be $300,000 on the balance sheet.

Valuation of Goodwill

Valuation of goodwill refers to determining the goodwill asset’s monetary value in a company’s financial statements. Goodwill must be valued when a triggering event results in the fall of the fair value of goodwill below the current book value. These may include events:

- Admission, retirement, or death of a partner.

- Changes in profit sharing ratio.

- Loss due to the damages caused by the breach of contract, infringement, or interference with a business opportunity.

- Business/Professional practice’s merger, acquisition, or separation.

- Bankruptcy & reorganization.

- Conversion of a C corporation to an S corporation.

- When the enterprise dissolves, the sale of the business needs to be accomplished.

Goodwill valuation helps investors and stakeholders understand a company’s true value and potential for future growth. Internal experts or external valuation specialists can conduct the valuation.

There are three methods of goodwill valuation; Super Profits Method, Average Profits Method, and Capitalization Method.

Goodwill vs. Other intangible assets

| Basis | Goodwill | Other intangible assets |

| Nature | It is the premium paid over the fair value of assets for acquiring a company. Goodwill cannot be independently bought or sold. | Include licenses, patents, trademarks, intellectual property rights, etc., that can be independently bought or sold. |

| Asset Life | It has an indefinite life. | They have a definite useful life. |

| Valuation | It is determined by subtracting the purchase price and the fair value of identifiable net assets. | Valuation is based on their acquisition cost development expenses. |

| Amortization & Impairment | It is not subject to amortization but must be annually tested for impairment at the reporting unit level. | The assets may be subject to amortization and impairment over their estimated useful life if events or circumstances indicate a potential decrease in their value. |

| Reporting | It is reported as a separate line item on the balance sheet. | They are presented below the tangible assets in the balance sheet. |

| Disclosure | It requires disclosure of reporting units, impairment tests, and goodwill amount allocated to each business combination. | It requires disclosing assets’ useful life, amortization methods, and impairment losses. |

Final Thoughts

Goodwill is an intangible asset that is generally acquired during the purchase of a company, but it can also be built internally by training employees, providing quality products, and growing its customer base through acquisition.

Businesses can only record the goodwill of the business they have acquired, whereas internal goodwill cannot be classified as an asset though they are considered to be the company’s inherent strength.

To learn more about accounting topics that affect your business, visit Akounto Blog.