What are Investing Activities?

Investing activities involve buying and selling assets and investments that are not part of a company’s main business operations.

Cash flow from investing activities means the cash inflows and outflows related to the sale or purchase of long-term assets and other non-operating activities.

What’s covered in the article

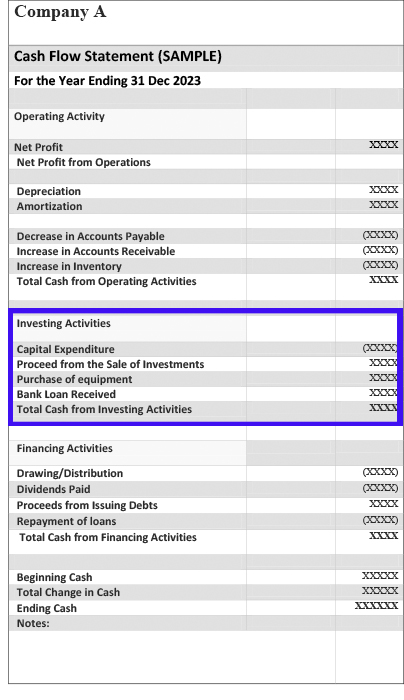

The company’s cash flow statement has a section titled “Cash flow from investing activities,” which provides insight into the company’s investments in long-term assets, such as fixed assets, marketable securities, and non-current assets.

Understanding cash flow from investing activities is crucial for investors and businesses alike, as it sheds light on the company’s investment strategy and ability to manage its long-term assets effectively.

Analyzing cash stream from investing activities and other financial statements, i.e., the income statement and balance sheet, helps assess the company’s overall financial health and growth potential.

Understanding Investing Activities

Investing activities encompass a wide range of transactions that impact a company’s long-term assets, which are essential for maintaining and growing its operations. These activities can include acquiring and disposing of fixed assets, such as PPE (property, plant, and equipment), as well as investments in marketable securities, long-term investments, and business acquisitions.

Businesses must manage their investing activities efficiently, which involves assessing the potential return on investment (ROI) for each opportunity and strategically allocating resources to capitalize on those with the highest potential for growth and profitability.

A positive cash flow from investing activities implies that a company has generated more cash from selling its long-term assets than it has spent purchasing new ones.

Negative cash flow from investing activities suggests that a company has invested heavily in acquiring new long-term assets, potentially in pursuit of growth and expansion.

Examples

To better understand cash flow from investing activities and their impact on a company’s cash flow statement, let’s explore some common examples:

- Purchase of fixed assets: When a company acquires fixed assets like new property, machinery, land, or equipment (PPE) to support its operations or expand its production capacity, it is considered an investing activity. The cash outflow associated with these purchases results in a negative cash flow from investing activities.

- Sale of fixed assets: Conversely, when a company sells its PPE, the cash inflow generated by the sale proceeds leads to a positive cash position from investing activities. This cash inflow can fund other investments or support the company’s operations.

- Investments in Marketable Securities: The cash outflow related to acquiring these securities contributes to a negative cash flow from investing activities.

- Sale of Marketable Securities: Companies may sell these securities to raise funds or reallocate their investments based on their financial goals.

- Business Acquisitions: When a company acquires another business or a stake in another company, it is considered an investing activity. The cash outflow associated with business acquisitions leads to negative cash flows.

- Disposal of Business Interests: If a company divests a portion of its business or sells its stake in another company, the proceeds from the sale contribute to a positive cash flow.

Impact of Investing Activities on Liquidity

Investing activities play a significant role in shaping a cash flow statement, as they can directly influence the company’s financial health, liquidity, and growth potential.

The impact of investing activities on the cash flow statement can be positive and negative, depending on the company’s approach to managing its investments.

Positive Impact

- A positive cash flow from investing activities highlights that a company has generated more cash inflows than outflows from its long-term investments. This could signify that the company is effectively managing its assets and generating profits from the sale of investments or divestitures.

- A consistently positive cash stream from investing activities may also suggest that the company is more focused on short-term profits than long-term growth, as it is liquidating its long-term assets to generate cash.

Negative Impact

- Negative cash flow from investing activities underlines that a company has spent more cash on acquiring long-term assets than it has generated from its sale. While this could indicate a more aggressive growth strategy and investments in the company’s future, it may also lead to reduced liquidity in the short term.

- A consistently negative cash flow can cause concern, especially if the company’s operating cash flow is insufficient to cover the investments. It may also indicate that the company’s investment strategy is not generating the desired returns, impacting its financial health.

By closely monitoring the cash flow from investing activities and comparing it with other financial statements like the income statement and balance sheet, stakeholders can understand the company’s overall financial performance comprehensively.

Format and Line Items

Cash flow items from investing section of the cash flow statement:

- Sale or purchase of fixed assets like property, plant, and equipment (PPE)

- Sale or purchase of marketable securities

- Collection or payment of loans and other receivables/payables related to investing activities

Net cash flow from investing activities:

- Cash inflows from investing activities – Cash outflows from investing activities

Other Types of Cash Flows

Apart from cash flow from investing activities, the cash flow statement also comprises two other essential sections of a cash flow statement: operating activities and financing activities.

These sections and investing activities provide a comprehensive picture of a company’s cash inflows and outflows during a specific period.

From Operating Activities

- Operating activities reflect the cash flow generated from a company’s core business operations, such as sales of goods or services and payments to suppliers or employees.

- Examples: Inflows

- Cash payments received from customers

- Interest and dividends received from investments

- Examples: Outflows

- Payments to suppliers and employees

- Interest paid on loans

- Income taxes paid

From Financing Activities

- Financing activities represent the cash transactions related to a company’s capital structure, such as issuing or repurchasing stocks, issuing or repaying debt, and paying dividends.

- Examples: Cash inflows

- Proceeds from issuing stocks or bonds

- Borrowings from loans or lines of credit

- Examples: Cash outflows

- Repayment of loans or other debt

- Dividends paid to shareholders

- Repurchase of company shares

Investing Activities and Financial Reporting

- Balance Sheet: Investment activities, such as acquiring or disposing of fixed assets or investments in marketable securities, impact the balance sheet by increasing or decreasing the company’s long-term asset holdings.

- Income Statement: Gains or losses from the sale of assets, or income from investments, such as dividends or interest, can be included in the income statement.

- Cash Flow Statement: Investing activities’ is a part of the cash flow statement, which is a part of financial statements as mandated by law. Cash flow from investing activities provides insights into the company’s investments in long-term assets, such as fixed assets, marketable securities, and non-current assets.

Conclusion

Understanding cash flow from investing activities and their impact on the cash flow statement is essential for evaluating a company’s financial health and growth potential. Stakeholders can make informed decisions about the company’s overall performance, investment strategy, and long-term prospects by analyzing investing activities alongside operating and financing activities.

Using cloud-based accounting software like Akounto helps small businesses prepare accurate cash flow statements and a variety of financial reports that helps in informed decision-making. Visit Akounto’s website to know more.