What is the Margin of Safety in Accounting?

The margin of safety is the ratio between the revenue and the breakeven point. The margin of safety is a type of financial ratio that gives the number of sales and profits a company generates after breaking even with the fixed and variable costs such as production and service costs.

What’s covered in the article

The margin of safety for a company is a strong measure of the stability and market sustainability of a company. The significance of this ratio can be gauged from the fact that it is the safe amount of revenue that a company can afford to lose before it hits zero profit.

Investors look at the margin of safety to see which stocks and securities are the safest to buy. Stocks with a market price lower than their estimated intrinsic value are said to have a good safety margin for value investors.

Business owners can use this margin of safety to take risks, expand their operations, and ensure growth. In this way, these safety calculations protect the investor from the downside risk. For investors, the margin of safety signals the protection of their investments from any downside risk.

How to Calculate Margin of Safety?

To calculate the margin of safety, you need to determine the breakeven point and the budgeted or forecasted sales of the company. If you need the margin of safety to make a decision, you need to have the estimated sales output given by the market trends, sales history, and customer intentions.

A bigger margin of safety will ensure a lower risk with a certain business decision.

If you want to calculate the current safety margin your business has after a certain manufacturing and sales output, you need to have the actual sales data. This will tell you how successful a business voyage has been and whether it is worth scaling or not.

Subtract the breakeven sales from the actual or budgeted sales, and you can have the margin of safety and hence the expected profitability. Calculating the break-even point accurately is crucial for a helpful and accurate safety margin. This will require vigilant tracking of all the costs incurred.

Books usually express the margin of safety as a percentage for a clear comparison. Breakeven analysis is essential in the calculation of the safety margin. It should include all possible production and service costs, including the machinery’s repair and shipping costs.

So, a margin of safety percentage truly expresses the ‘safety’ and ‘cushion’ a certain business operation has, thus helping the investor’s financial decisions and the company’s future financial modeling.

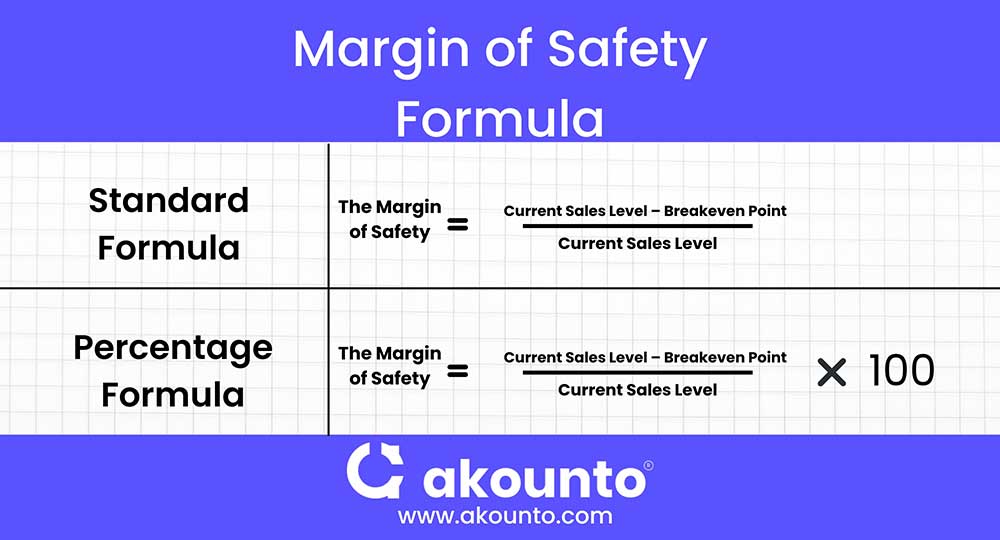

The Margin of Safety Formula

The margin of safety formula in its standard form is given by:

The Margin of Safety = (Current Sales Level – Breakeven Point) / Current Sales Level

For the percentage safety formula:

The Margin of Safety = (Current Sales Level – Breakeven Point) / Current Sales Level x 100

This margin of safety formula directly lands you on the percentage of profits or revenue a company has generated after breaking even with the costs, which reflects the success of a business operation. You can replace the ‘current sales level’ with forecasted sales for strategizing business and see how much sales a business operation has to lose safely.

The Margin of Safety formula can also be expressed in dollar amounts or number of units:

The Margin of Safety in Dollars = Current Sales figure – Breakeven Sales

The Margin of Safety in Units = Current Sales Units – Breakeven Point

Examples

An athleisure manufacturing brand projects the sale of 35,000 clothing pieces in June. Each unit has a selling price of $20.

Break-even point in units = Fixed costs/Contribution margin per unit

=$15,000/$12

=1250 units.

This company has to sell 1250 units to break even with its fixed and variable costs for the month of June.

Breakeven Point (BEP) in dollars:

Break-even point in units × Selling price per unit

= 1,250 units × $20

= $25,000

To calculate the margin of safety:

Actual sales level – Break-even sales

= $70,000 – $25,000

= $45,000

$45,000 out of $70,000 makes around 64.29%, which will be the margin of safety percentage for this company for June. $45,000 divided by a unit selling price of $20 makes 2250 units in the safety buffer, which means it can lose 2250 sales before it breaks even with its expenses.

In other words, if the projection of market trends and demand goes somewhat wrong, the company can afford a loss of 2250 units, before it suffers loss.

What’s a Good Margin of Safety Percentage?

Investors go for companies with a high safety ratio, so there is a sufficient buffer between current or forecasted sales and non-profitability. A low margin indicates that a slight change can drastically affect the revenues and profits of the company and that there is a need for increasing sales volume or bringing a more profitable product mix.

Investors will, in most cases, steer clear of companies and businesses with a margin of safety percentage lesser than 20 percent. But, in fact, no ‘good’ or ‘sufficiently safe’ margin of safety fits all companies and businesses.

A certain margin of safety may not be safe for two different companies with different prices of their units. Take, for example, a margin of safety of $30000. Company A has a unit selling price of $30, and company B has a unit selling price of $10,000.

Company A can afford to lose 100 sales before it stops producing profit. At the same time, Company B needs only three sales to break even. $30000 is a high margin for Company A but a narrow one for company B.

In this particular case, the margin of safety in dollars is the same, but the safety sales for each are different. There are certain factors to consider before you decide what margin of safety will be ‘sufficiently safe’ for a company or which formula of safety margin your business needs.

Calculating the product’s intrinsic value and then the safety margin using the breakeven analysis is important for healthy business decisions. Market trends and projections can go wrong, so a business needs to stay prepared to a certain degree for that. The margin of safety formulas helps get closer to that.

You can also visit the Akounto blog for all the details and education you need related to accounting.