Defining Notes Payable

Notes payable is a liability created when a company signs a written agreement (a promissory note) to pay a certain amount in the future.

The notes payable account is a liability account where these amounts are recorded.

[ez-toc]

The money owed could be to suppliers for raw materials, banks or other financial institutions, or any other party to whom the company owes money.

A promissory note is a legally binding document that details the loan terms, including the principal amount to be paid, the interest rate, and the maturity date. It’s important to note that notes payable can encompass the principal amount and any interest accrued.

Most companies have a notes payable account as they often need to borrow funds for operations or expansions. The notes payable account helps track the outstanding amounts that must be paid.

It’s a critical aspect of a company’s financial health, directly impacting cash flow and liabilities.

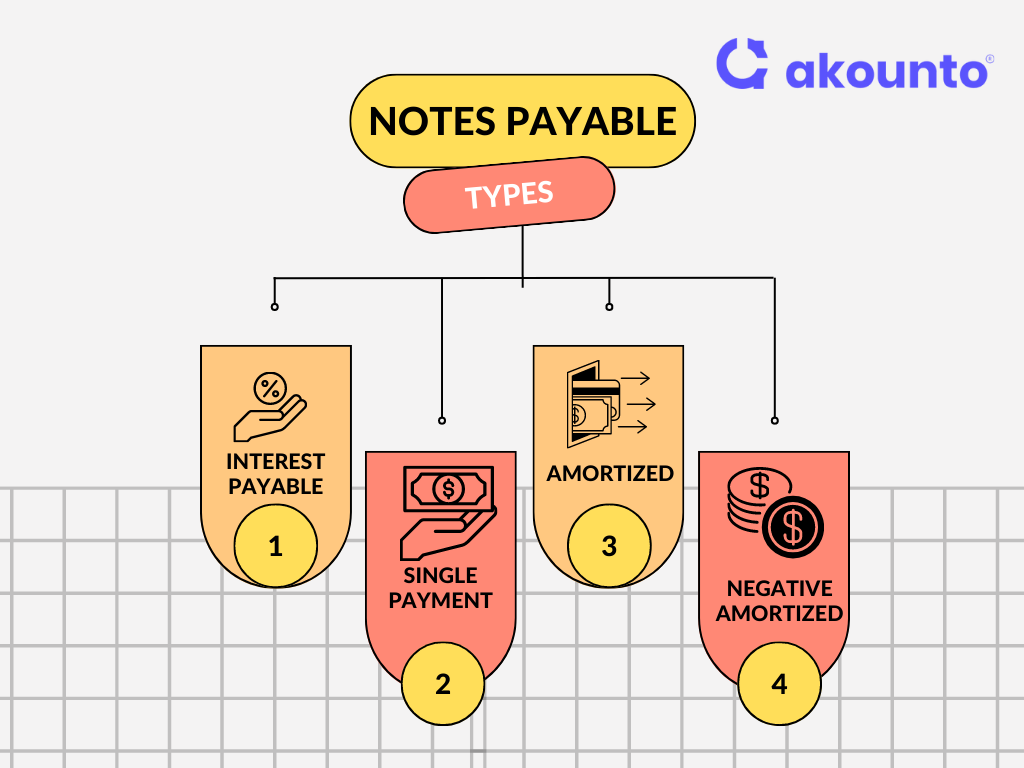

Types

Notes payable are part of a company’s liabilities on the balance sheet, each with unique characteristics that significantly impact a company’s cash account, interest expense, and overall financial health. These types include Interest Payable, Single Payment, Amortized, and Negative Amortized notes payable.

Interest Payable

Interest payable refers to the interest expense a company has incurred on its notes payable but has not yet paid. This type of liability is recorded in the interest payable account in the general ledger. It’s part of the company’s current liabilities and represents the amount owed to lenders, such as banks, as per the terms of the formal loan agreement or promissory note.

Single Payment

A single payment note payable, often used in short-term financing, involves a single lump-sum payment at the end of the loan term. This payment includes both the principal loan amount and the accrued interest. This type of transaction is typically recorded in the notes payable account and the cash account in the company’s books.

Amortized

Amortized notes payable involve a series of payments over the loan term. Each payment contains a part of the principal amount and the interest expense. This type is common in long-term notes payable, such as bank loans or mortgages. The formal written promise or loan agreement typically outlines the repayment terms.

Negative Amortized

Negative amortized notes payable are less common but can occur when the periodic payments made by the company are less than the interest expense accrued during that period. As a result, the outstanding balance of the loan increases rather than decreases over time. This situation can occur when a company negotiates specific payment terms to manage cash flow effectively.

Examples of Notes Payable

Example 1: Purchase of Equipment

Company A needs to purchase new equipment worth $50,000. However, it doesn’t have sufficient cash on hand.

Company B, the equipment supplier, agrees to provide the equipment now, with Company A promising to pay the amount in six months.

Company A issues a promissory note to Company B for $50,000, due in six months which is to be paid by Company A.

This transaction creates a note payable to Company A.

Example 2: Short-term Loan

Company C needs a short-term loan to manage its cash flow. It approaches Company D, which agrees to lend $20,000 for three months at an interest rate of 5%. Company C issues a promissory note to Company D, promising to repay the principal amount plus interest at the end of three months. This transaction results in a note payable to Company C.

Example 3: Long-term Loan

Company E wants to expand its operations and needs a long-term loan of $200,000. Company F agrees to provide the loan at an annual interest rate of 6%, with the principal to be repaid in five equal annual installments. Company E issues a promissory note outlining the repayment terms to Company F. This transaction leads to an amortized note payable to Company E.

Notes Payable and a Company’s Balance Sheet

Notes payable play a significant role in a company’s balance sheet. As a liability, they represent the amounts a company owes and is obligated to pay in the future. These obligations often arise from transactions such as borrowing money, purchasing goods on a purchase order, or acquiring legal services, with a promissory note outlining the repayment terms.

On the balance sheet, notes payable are classified as current or long-term liabilities. If the note’s maturity date is within one year, it’s listed under current liabilities. However, if the repayment is due beyond one year, it’s considered a long-term liability.

Any accrued but unpaid interest on these notes is recorded in the interest payable account on the balance sheet.

Benefits of Notes Payable

- Access to Funds: Notes payable provide companies with immediate access to funds for operations, expansions, or unexpected expenses.

- Flexible Repayment Terms: The repayment terms, including interest rates and payment schedules, can be negotiated and outlined in the promissory note.

- Preserve Cash Flow: By deferring payment, companies can maintain their cash flow for other immediate business needs.

- Build Credit: Regularly meeting notes payable obligations can help a company build a positive credit history.

- Tax Benefits: Interest expenses related to notes payable can often be deducted from the company’s tax returns, providing potential tax benefits.

Notes Payable vs. Accounts Payable

Notes payable and accounts payable are often considered similar; they may not have a major difference as both are current liabilities and related to credit purchases, but the following table lists finer nuances of them:

| Notes Payable | Accounts Payable | |

| Definition | Notes payable refers to the liability created when a company signs a written agreement, such as a promissory note, to repay a certain amount of money. | Accounts payable refers to the amounts a company owes to suppliers for credit purchases. |

| Documentation | Notes payable are documented with a formal written agreement or promissory note, which outlines the principal amount, interest rate, and repayment terms. | Accounts payable are typically documented with invoices received from suppliers or vendors. |

| Term | Notes payable can be short-term or long-term liabilities, depending on the repayment terms outlined in the promissory note. | Accounts payable are typically short-term liabilities, usually due within one year. |

| Interest | Notes payable usually involve an interest charge, which is outlined in the promissory note. | Accounts payable do not typically involve interest charges unless the payment is overdue. |

| Nature of Transaction | They often result from borrowing money or purchasing goods or services with a formal agreement to pay later. | Accounts payable result from routine business transactions, such as purchasing supplies or services on credit. |

Conclusion

Notes payable are a critical component of a company’s liabilities, representing formal obligations to repay borrowed funds. They play a significant role in shaping a company’s balance sheet and financial health, making their effective management crucial for any business.

Akounto offers an intuitive dashboard where users can track their business finances and notes payable at a glance. Easily track where the funds are coming from and where they are going. For more details, visit our website now.