What is Virtual Bookkeeping?

Virtual bookkeeping refers to providing remote bookkeeping services to clients using cloud-based software, allowing flexibility and cost-effectiveness.

What’s covered in the article

As businesses adapt to the digital age, virtual bookkeeping has become a popular and effective solution for managing finances. Virtual bookkeeping is becoming increasingly popular among companies, particularly small and medium-sized enterprises (SMEs), seeking to reduce costs and increase efficiency.

A virtual bookkeeper typically works remotely and provides online bookkeeping services. He may be in a different city or country and communicate with clients via email, phone, or video conferencing.

All financial transactions and documents are stored in secure cloud-based software, allowing for easy access by the bookkeeper and the client.

Why should a Business hire a Virtual Bookkeeper service?

There are various reasons why a business owner might choose to hire a virtual bookkeeper instead of a traditional bookkeeper:

- Cost savings: Remote bookkeepers do not require office space, equipment, or other expenses associated with a physical office presence, making them a more cost-effective option for small business owners than a traditional bookkeeper.

- Flexibility: A remote bookkeeper can work remotely and flexibly, allowing businesses to access bookkeeping services as needed without worrying about staffing or scheduling constraints.

- Scalability: Virtual services can easily scale to meet a company’s growing needs, enabling businesses to focus on core operations.

- Expertise: Accounting and bookkeeping experts often provide virtual bookkeeping services, which can provide additional value to business owners who may not have a strong financial background.

- Bookkeeping software: Virtual bookkeepers are often well-versed in bookkeeping software and can recommend the best software for business needs, set it up, and manage it.

- Data entry: Online bookkeepers can also handle data entry, saving time and money for small business owners who may be stretched thin and cannot afford an in-house bookkeeper.

- Streamlined communication: Use digital tools to communicate and store financial documents, streamline communication, and reduce the risk of errors.

- Enhanced data security: Cloud-based software offers advanced security measures, reducing the risk of data breaches.

How Virtual Bookkeeping Works?

Role and Responsibilities of a Virtual Bookkeeper

A virtual bookkeeper remotely provides bookkeeping services to businesses, typically via cloud-based accounting software. They are responsible for maintaining accurate, reliable, and up-to-date financial records, providing compliance with accounting standards, and providing financial reports to business owners. The responsibilities are:

- Basic bookkeeping tasks: A virtual bookkeeper handles basic bookkeeping tasks such as recording financial transactions, tracking expenses, and maintaining financial statements.

- Financial reporting: He prepares financial reports such as balance sheets and income statements for businesses, which helps business owners make informed decisions.

- Communication: He communicates with business owners to ensure accurately and updated accounting records and addresses queries or doubts.

Functions of a Virtual Bookkeeper

- Use of accounting software: A virtual bookkeeper uses accounting software to manage accounting records (cash flow, balance sheet, income statement, ledgers, etc.) and generate financial reports. They ensure that the software is set up correctly and that it is being used effectively.

- Reconciliation of accounts: Reconcile accounts with bank statements to ensure fair reporting and matching actual and reported transactions.

- Timely financial reporting: Maintains up-to-date books and prepares financial reports regularly to provide business owners with the financial data they need to make informed decisions for the company’s finances.

- Expertise: Provides businesses with expert advice and guidance on financial matters, helping them to achieve their financial goals without needing a physical office presence.

In addition to their primary responsibilities, virtual bookkeepers may also perform various functions to support a business’s financial management, such as:

- Budgeting: They can help businesses create and monitor budgets, allowing them to allocate resources more effectively and plan for future expenses.

- Financial analysis: They can analyze financial data and identify trends or potential issues impacting a business’s performance.

- Payroll processing: A virtual bookkeeping business can also offer payroll services, ensuring that employees are paid accurately and on time.

- Tax planning: He/she may work with a tax professional to help businesses plan for and minimize their tax liabilities.

- Financial forecasting: Using historical financial data to project future revenues, expenses, and cash flow, helping small businesses make informed decisions about growth and investments.

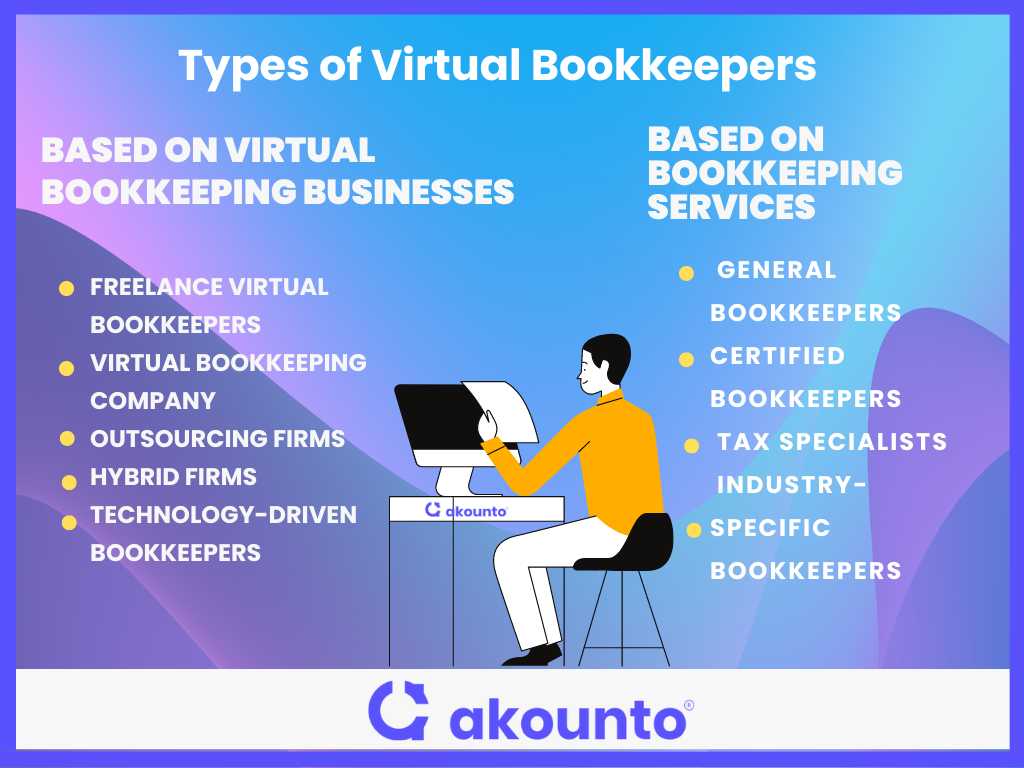

Types of Virtual Bookkeepers

Based on virtual bookkeeping businesses

- Freelance Virtual Bookkeepers: These work independently and offer services to multiple clients.

- Virtual Bookkeeping Company: These companies specialize in providing virtual bookkeeping services to businesses of all sizes.

- Outsourcing Firms: These firms operate in other countries and provide bookkeeping services to businesses in other countries.

- Hybrid Firms: These firms combine traditional with online bookkeeping services to provide businesses with various options.

- Technology-driven Bookkeepers: These bookkeepers use cloud-based bookkeeping software to deliver remote bookkeeping to handle all their accounting needs.

Based on bookkeeping services

- General bookkeepers: These professionals handle basic bookkeeping tasks like data entry and account reconciliation.

- Certified bookkeepers: Certified bookkeepers have completed a rigorous certification process, demonstrating their proficiency in managing financial records and transactions.

- Tax specialists: These bookkeepers specialize in tax preparation and compliance, helping businesses navigate complex tax laws and regulations.

- Industry-specific bookkeepers: Some virtual bookkeepers focus on specific industries, such as e-commerce or real estate, offering tailored services to meet the unique needs of these businesses.

How to Choose a Virtual Bookkeeper

- Identify your bookkeeping needs: Identify what tasks you want your bookkeeper to perform, such as data entry, bank reconciliations, payroll processing, etc.

- Look for a virtual bookkeeping service: Look for a reputable virtual bookkeeping service that provides the level of bookkeeping services you need. Research the service’s reputation, read reviews, and check its website for information about its experience, services, and pricing.

- Check the bookkeeper’s qualifications: Ensure the virtual bookkeeper you’re considering has the necessary qualifications and experience. Look for certifications, such as Certified Public Accountant (CPA) or Certified Bookkeeper (CB).

- Consider the software the bookkeeper uses: Check the software the online bookkeeper uses to ensure it’s compatible with your in-house software, such as Akounto’s cloud-based accounting software. It will ensure that the bookkeeper can easily transfer data back and forth and that you have access to your financial reports in real-time.

- Verify their experience: Verify the virtual bookkeeper’s experience with your specific requirements. Look for a bookkeeper with experience in your industry, especially if you have unique bookkeeping needs.

- Evaluate their communication skills: Effective communication is essential when working with a remote bookkeeper. Choose a bookkeeper who is responsive, clear, and concise in their communication.

- Check their availability: Ensure that he has the availability to meet your needs. This includes their work hours, their response time to questions or concerns, and their ability to provide timely financial reports.

- Discuss pricing and billing: Before hiring a virtual bookkeeper, discuss their pricing and billing structure. Determine if they charge by the hour or have a flat fee and how they bill for additional services.

Tools to consider to streamline bookkeeping services

- Cloud accounting software: It allows you to access financial information from anywhere and collaborate with clients in real-time. Akounto also offers bookkeeping services to its clients.

- Receipt scanning and organization software: Receipt scanning and organization software allow for easy and efficient management of receipts and invoices. These tools automatically extract data from receipts and invoices and categorize them, saving time on manual data entry.

- Time tracking software: Example: Toggl or Harvest can help keep track of billable hours for bookkeeping services.

- Project management software: Asana or Trello can help manage client projects and deadlines, ensuring that bookkeeping services are delivered on time.

- Communication and collaboration tools: Communication and collaboration tools like Zoom, Microsoft Teams, or Slack are essential for virtual bookkeepers to stay in touch with clients and team members and exchange information in real time.

- Data security tools: Virtual bookkeepers should use data security tools such as two-factor authentication, secure cloud storage, and backup systems to protect sensitive client information.

Virtual Bookkeeping vs. Local Bookkeeping

|

Criteria |

Virtual Bookkeeping |

Local Bookkeeping |

|

Location |

Remote |

In-person |

|

Communication |

Electronic |

In-person |

|

Accessibility |

Available 24/7 |

Limited availability |

|

Cost |

Lower cost |

Higher cost |

|

Staffing |

No need for staffing |

Requires staffing |

|

Technology requirement |

High technology like cloud-based accounting software, payment mechanisms etc. |

Basic technology like in-house accounting tools |

|

Expertise |

Specialized expertise as virtual bookkeepers are industry experts |

General expertise |

|

Security |

High security including ISO standards and could computing security |

Moderate security composed of in-house softwares. |

Conclusion

Virtual bookkeeping is a modern approach to traditional bookkeeping that offers businesses several benefits, including cost savings, flexibility, accessibility, and expertise. As technology continues to advance, Virtual Bookkeeping will likely become increasingly common in the accounting industry.

Akounto also offers bookkeeping services and powerful accounting software for hassle-free accounting. Visit Akounto’s website to know more.