Average Charges

Hiring a bookkeeper becomes indispensable when dealing with intricate financial systems. However, the cost of hiring a bookkeeper varies depending on several factors. For instance, a business might consider employing a part-time or in-house bookkeeper, depending on its requirements.

What’s covered in the article

In the USA, the average hourly cost for a part-time bookkeeper ranges from $11 to $50. But, if you opt for an in-house bookkeeping solution, the average monthly salary typically falls between $500 and $5,000.

It’s important to note that the charges also depend on the bookkeeper’s experience and skills.

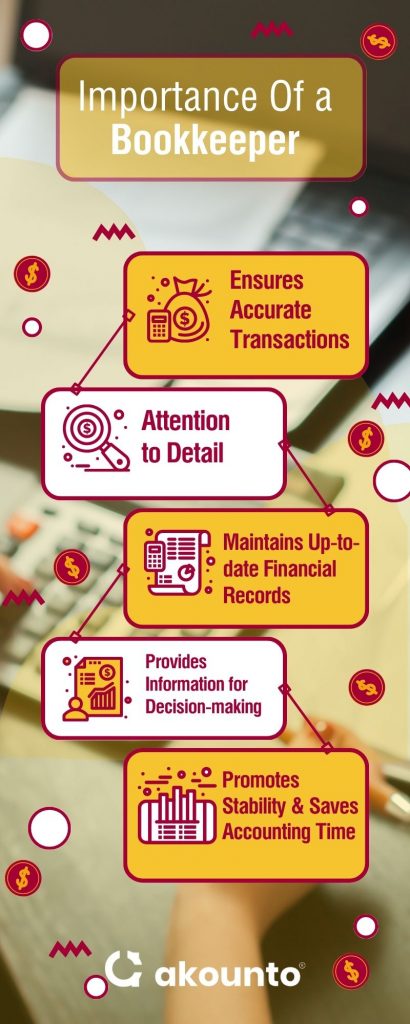

Importance Of Bookkeeper

You can manage your finances as a solopreneur with limited business operations. But as your business reaches the growth stage, more than basic bookkeeping capabilities may be required in the long term.

Hiring a bookkeeper can feel like a luxury for small to medium businesses. But, the time of every entrepreneur is valuable. So, choosing to handle bookkeeping by yourself is not a great choice.

A bookkeeper is important when it comes to managing the financial aspects of a business. However, his role goes beyond numbers and spreadsheets.

The below-mentioned points explain the importance of a good bookkeeper. They also tell why a business owner should avoid doing their bookkeeping.

- A bookkeeper ensures that all financial and business transactions are accurate and organized.

- Bookkeepers are vigilant. They pay attention to detail. So your financial records are more reliable.

- Bookkeepers perform the task of inputting receipts, maintaining employee timesheets, and paying vendors.

- They help businesses keep their financial records up-to-date. So businesses can keep up with the legal and financial requirements.

- Bookkeepers make available clear financial information which helps small businesses in improved decision-making.

- The key benefit of a bookkeeping service is that it saves an entrepreneur much time. As a result, the entrepreneur can focus on nourishing the business more.

When evaluating the cost of hiring a bookkeeper, it is essential to consider the additional benefits that contribute to the overall value they bring to your business.

A proficient bookkeeper can enhance your financial operations, promote stability, and empower you to make well-informed decisions that drive long-term success.

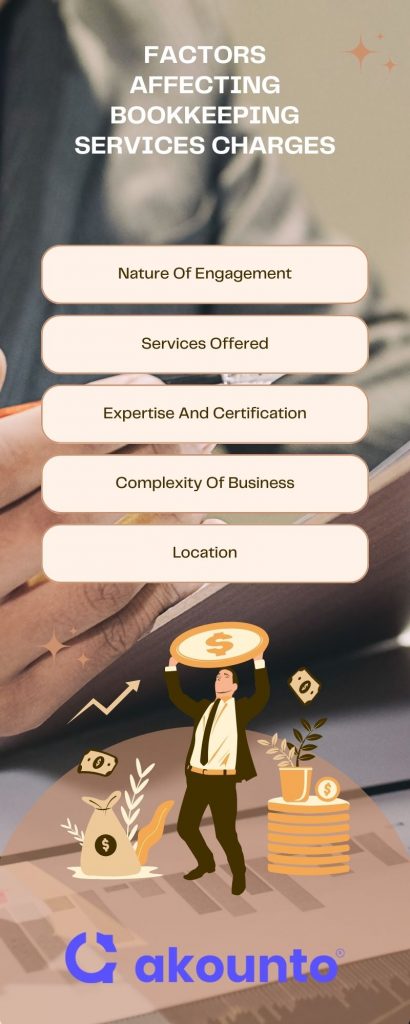

Factors Affecting Bookkeeping Services Charges

The below-mentioned factors affect the basic bookkeeping costs.

Nature Of Engagement

The basic bookkeeper cost depends upon the nature of engagement. Hiring a part-time bookkeeper or outsourced bookkeeping services are cost-effective options. However, in-house bookkeepers are generally more expensive.

Services Offered

Bookkeepers do a lot more than only record transactions. They keep track of your business’s finances. They help manage the bank account and help prepare customer invoices.

Bookkeepers also prepare for tax season and file taxes. The more comprehensive services they offer, the higher their charges will likely be.

Expertise And Certification

Bookkeepers with specialized expertise or professional certifications may charge higher rates.

Complexity Of Business

The complexity of a business’s monetary transactions and operations can impact the charges.

Some businesses have many revenue streams and complex expense tracking. Such businesses might have more complex bookkeeping needs. So, they result in higher charges.

Location

The demographic location of a business can also influence bookkeeping charges. Rates can vary based on factors like the cost of living and local market rates for these services.

Nature Of Employment/ Engagement

The nature of employment is one of the biggest factors that affect hiring costs. The mean hourly wage for bookkeeping and accounting services in the United States is $43.82. On the other hand, the mean annual salary for these services is $91,140.

There are three common types of nature of employment:

Part-Time

Hiring a part-time bookkeeper allows businesses to have professional help. But this help is available for only a few hours weekly or monthly.

Part-time bookkeepers often charge clients an average hourly rate of $20. The rate can go as high as $50 per hour. The charges for part-time bookkeeping also depend on their experience and location.

Full Time (In-House)

Having a full-time in-house bookkeeper offers dedicated support throughout the workweek.

An in-house bookkeeper usually receives a fixed monthly salary as a full-time employee. The industry averages for salaries of a full-time bookkeeper range from $3,000 to $4,500 per month.

Outsourced

Outsourcing bookkeeping to a third-party provider is a popular option for many businesses. Outsourced bookkeeping can be more cost-effective and a great choice for small and medium businesses.

Usually, an outsourced bookkeeper charges a business owner $250 to 2,000 per month.

Services Rendered

The services of a bookkeeper can vary based on the bookkeeping needs of a small business.

Bookkeepers offer the below-mentioned services.

- Recording Transactions: Bookkeepers are responsible for data entry. They maintain a systematic record of monthly transactions using bookkeeping software or manually.

- Accounts Receivable And Accounts Payable Management: They manage the accounts receivable and payables. They track customer payments, send invoices, and follow up on outstanding payments.

- Bank Reconciliation: A bookkeeper reconciles the business’s bank accounts.

- Financial Reporting: Bookkeepers help small business owners in generating reports regularly. These statements include balance sheets, income statements, and cash flow statements.

- Payroll Processing: Some bookkeepers also handle payroll processing. They calculate employee wages, deductions, and taxes. Bookkeepers also ensure that all employees receive their payments on time.

- Tax Preparation Support: They assist in preparing financial records and reports for tax purposes.

- Financial Analysis And Interpretation: A bookkeeper may help analyze financial ratios and trends. They assist business owners in understanding the financial implications of their operations.

- General Financial Management Support: They might also guide cash flow management. Bookkeepers can also help with budgeting and financial planning.

Certifications

Certifications in the field of bookkeeping validate the professional competence of a bookkeeper.

Holding a certification shows that a bookkeeper has a higher level of knowledge. It provides an added assurance to businesses seeking bookkeeping services.

Here are some main certifications for bookkeepers:

Certified Bookkeeper (CB)

The American Institute of Professional Bookkeepers (AIPB) presents this certification. To earn this certification, bookkeepers must pass a comprehensive examination.

This examination covers several topics. These include adjusting entries, payroll, depreciation, inventory, and internal controls.

Certified Public Bookkeeper (CPB)

NACPB, or the National Association of Certified Public Bookkeepers, administers this certification.

CPB requires a combination of education, experience, and successful completion of an examination. In addition, it covers various aspects of bookkeeping. These aspects include financial statements, payroll, taxes, and ethics.

Bookkeeping Vs. Accounting Services

Bookkeeping and accounting services are closely related. But both serve different purposes in managing a business’s financial affairs.

Understanding the basic differences between these two functions is essential for businesses. It helps them choose the right support.

Here is a comparison of bookkeeping and accounting services:

| Aspect | Bookkeeping Services | Accounting Services |

| Role | Recording financial transactions | Analyzing and interpreting financial data |

| Focus | Day-to-day financial tasks and data entry | Overall financial management and strategy |

| Scope | Limited to recording and organizing financial transactions | Broader scope, including financial analysis and planning |

| Activities | Maintaining general ledger, recording transactions | Preparing financial statements, analyzing financial data |

| Frequency | Regular, ongoing basis | Periodic or on-demand basis |

| Level of Expertise | Basic accounting knowledge | Advanced accounting knowledge |

| Decision-making | No direct involvement in strategic decisions | Provides financial insights for decision-making |

| Compliance | Ensuring accurate record-keeping and compliance | Compliance with financial regulations and standards |

| Financial statements | Not responsible for preparing financial statements | Prepares financial statements and related reports |

| Tax Preparation | May assist in organizing financial data for tax filing | Handles tax planning, preparation, and filing |

| Cost | Generally lower compared to accounting services | Generally higher due to the higher level of expertise |

Online Bookkeeping Service With Accounting Software

As a business expands, it may become challenging to carry on bookkeeping manually. Accounting software can streamline the activities of a bookkeeper.

An online bookkeeping service helps businesses stay up-to-date with their financial records. So, handling finances becomes simpler.

Accounting software offers the following advantages to a business.

- Online bookkeeping utilizes cloud-based accounting software. Users can access information from anywhere and at any time.

- Accounting software is user-friendly and makes organizing data more efficient.

- Online bookkeeping eliminates the need for manual entry and reduces the chances of errors.

- Real-time financial reporting provides instant insights into a company’s financial health. Businesses can engage in quick decision-making.

- Online bookkeeping services allow many users to access the software. So, collaboration among team members becomes possible.

- The information that businesses store on the cloud remains safe and secure. It provides higher security to a business.

- Accounting software helps bring scalability and flexibility to business operations. So, accounting software caters to the changing needs of businesses as they grow.

- Above all, online bookkeeping is time-saving for a business owner.

Final Words

Every business has unique bookkeeping requirements, and their needs will change as the company experiences growth. It’s up to the company’s decision-makers to determine the best appropriate solution to maximize their profitability and ensure their growth.

Professional bookkeepers can offer valuable insights and analysis of financial data to help businesses control costs and their optimize cash flows. Part-time and outsourced bookkeeping firms are a sound solution for startups and small businesses, while in-house bookkeepers are beneficial for established companies and multinational corporations (MNCs).

Akounto offers expert bookkeeping and accounting services for small business owners with unparalleled accuracy. Visit the website to learn about our clients and services.