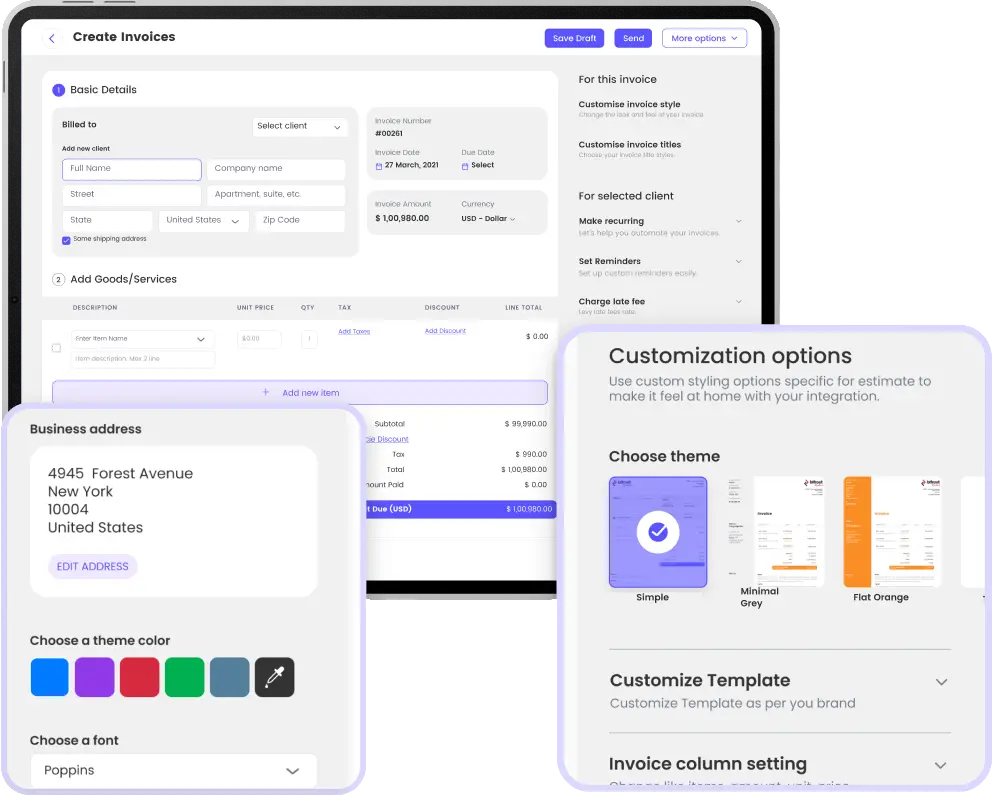

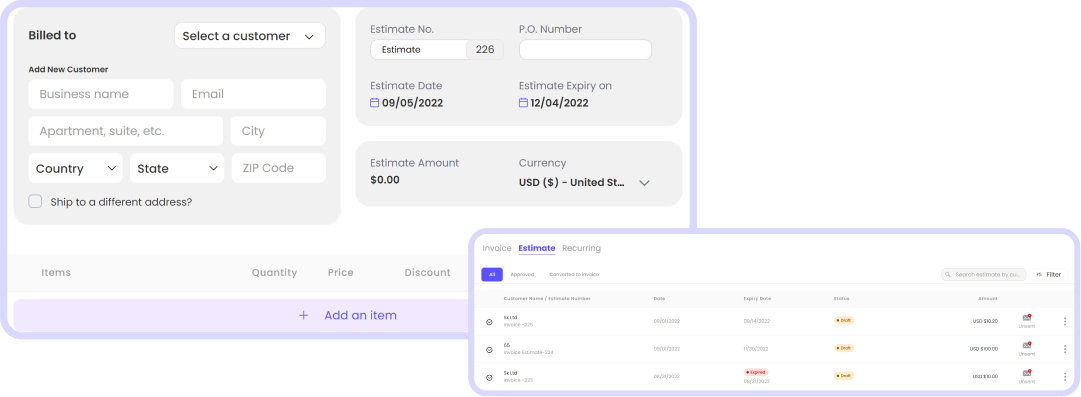

Get paid two times faster with invoice customization

Create a personalized invoice with the colors and emblem of your institution, and mention the conditions as well. The student's information, the costs, the payment information, and a thank-you message are all you need to get started.

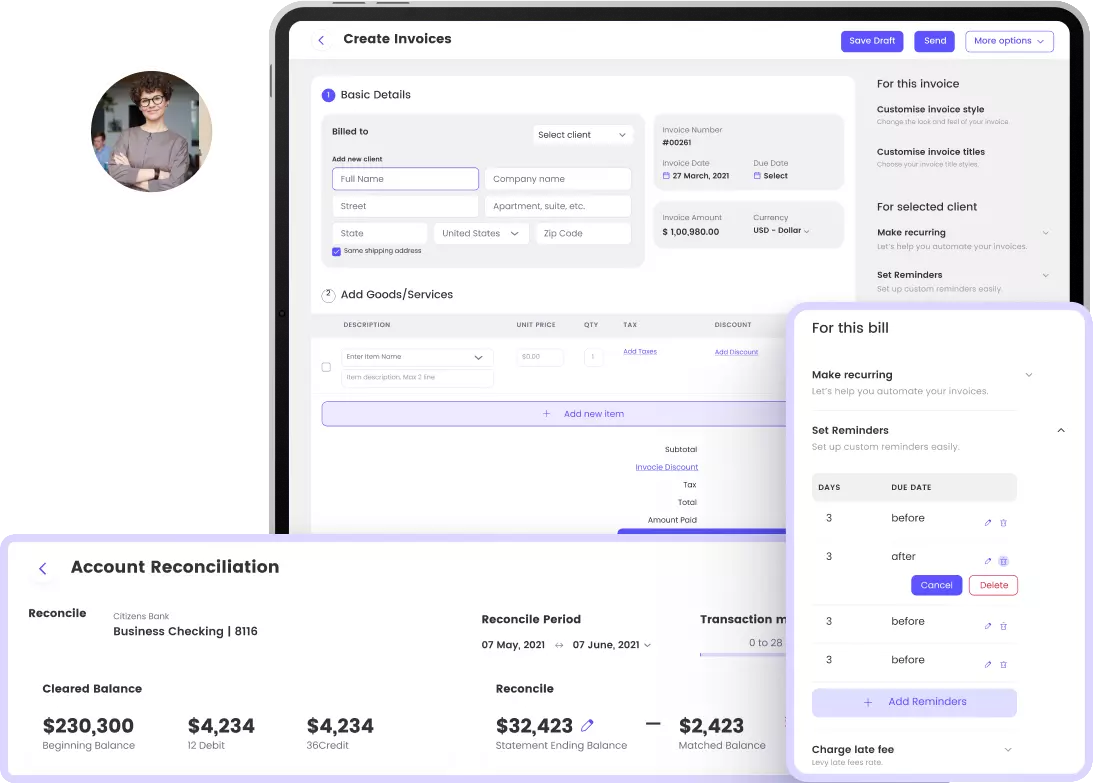

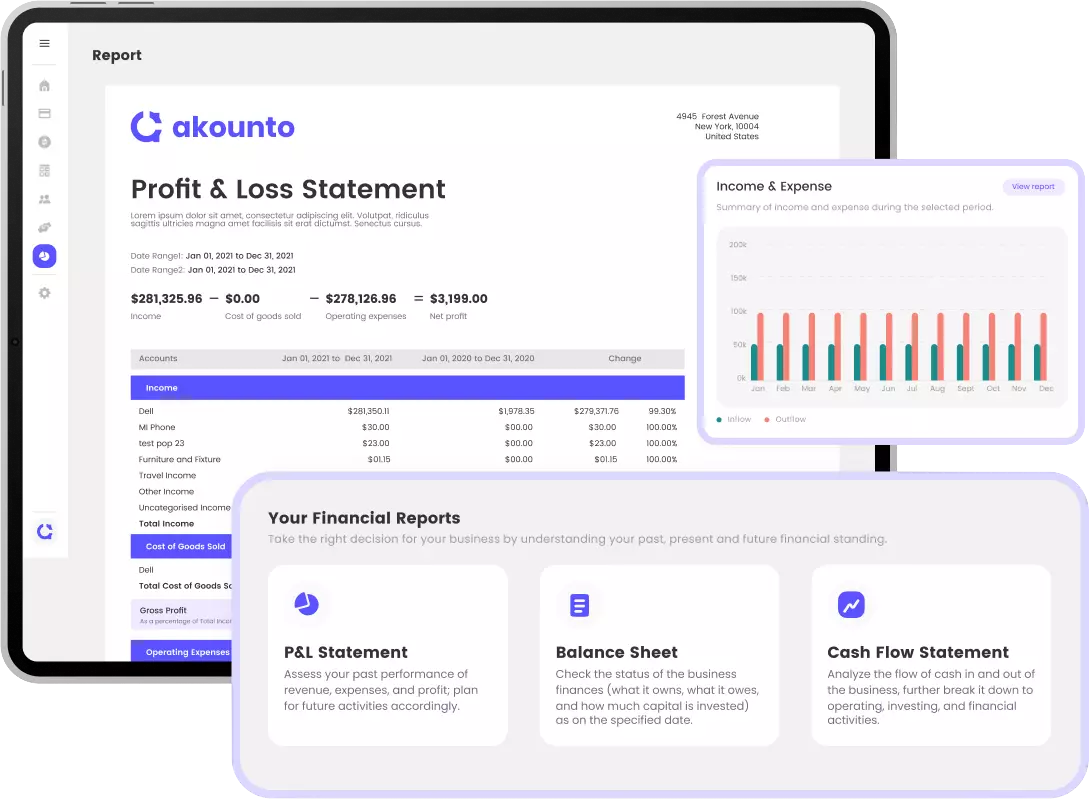

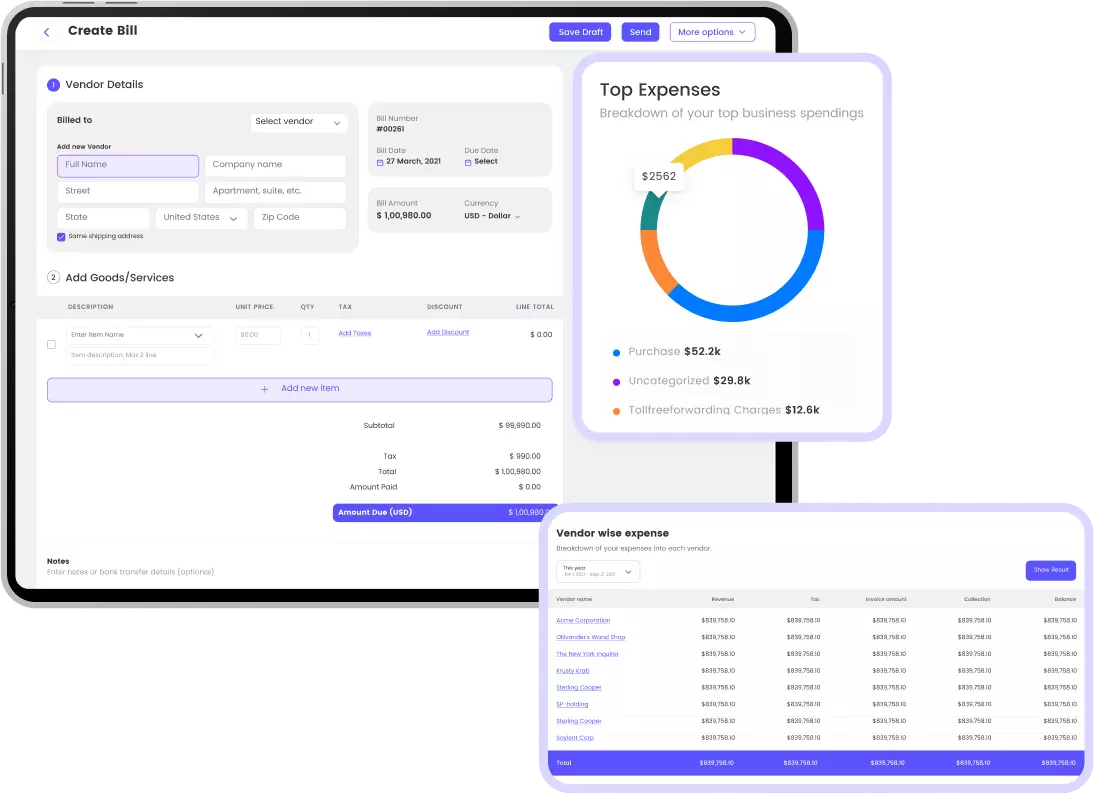

Automate reminders for late tuition fees and accept online payments to expedite accounting tasks. To save time and guarantee that you get paid twice as quickly, use the school accounting software from Akounto.

Get Started