What are Provisions in Accounting?

Provisions are reserve funds set aside for a specific purpose shown in the company’s balance sheet under the liabilities section.

Provisions are created for any anticipated expense, loss, current obligation arising, income taxes, replacing inventory in case of inventory obsolescence, etc.

What’s covered in the article

Creating provisions helps to reduce uncertainty. For example, a company may generate tax provisions to meet tax liabilities arising in the next assessment year.

Any tax deductions, any other obligation in terms of penalties, etc., can now be easily paid from provisions created and will reduce any student impact on the cash flows or profit for the current accounting period.

The amount recorded as a provision may be different from the actual cost incurred because it includes interests and penalties that accrue during that period.

What is the Need for Creating Provisions?

Allocation of provisions in accounting remains crucial to cater to two major aspects: depreciation and bad debts. Depreciation depends on the physical asset and the amount spent on it over a lifetime.

Creating provisions improves financial forecasting by setting aside funds in a provision. A company can better predict its future financial performance and make more informed decisions about budgeting and planning.

At the same time, the approximate cost of provision for bad debts would depend on individual company budgets and their prior experience.

Types of Provisions and Examples

Provisions are a way to account for the risks your company takes. In accounting, provisions are not just one type of expense—they include all expenses like insurance and taxes.

One of the most common reasons to create provisions is bad debt. The approximate cost of provision for bad debt would depend on individual company budgets and their experience with bad debt.

However, depending on the operating industry, a company may have provisions created for many cases, including depreciation, sales allowances, pensions, inventory obsolescence, etc.

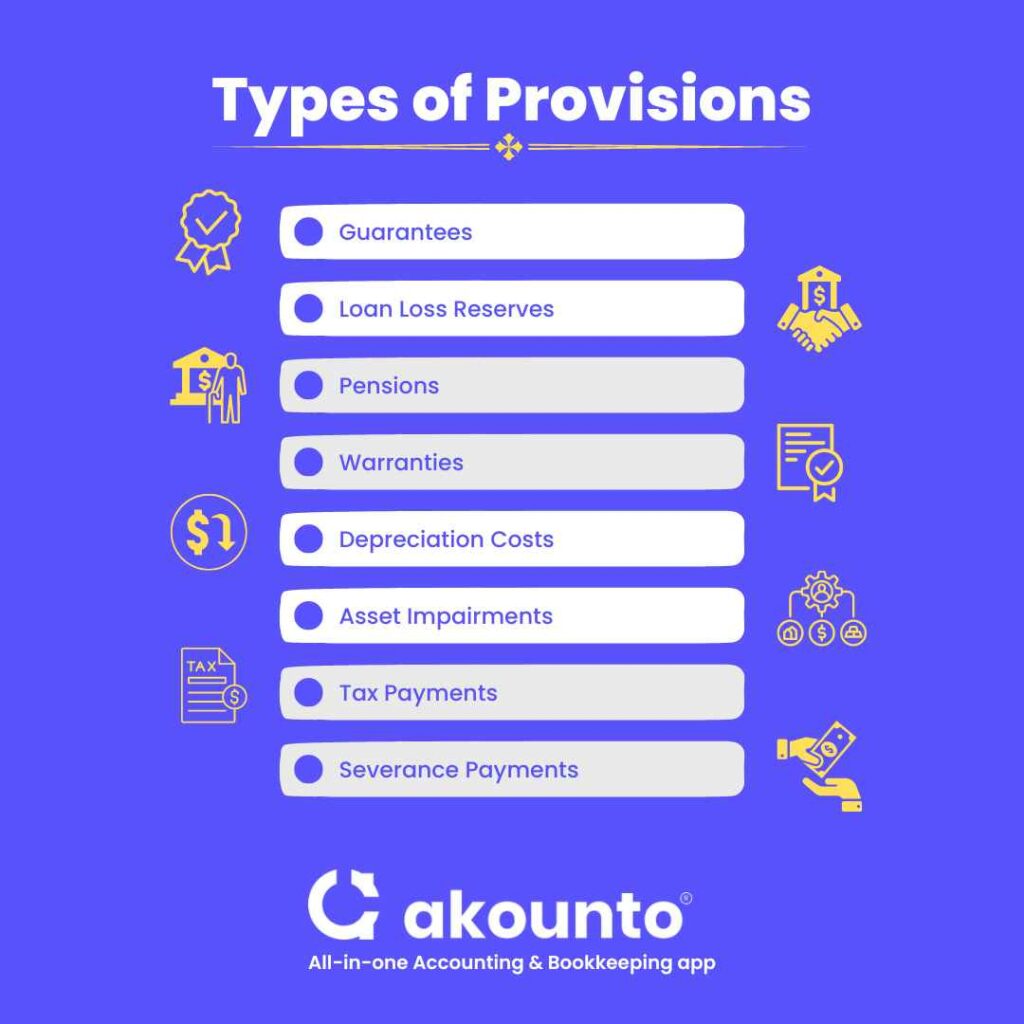

Here are some major types of provisions to know about:

Guarantees

A guarantee is when a secondary firm assumes duty for an obligation or debt that the original company’s economic resources cannot cover. In most cases, the guarantor business is a related party or one that benefits from the success of the defaulting business.

The guarantor will repay any unpaid sums the original business owes because it has guaranteed the loan amount. The guarantee may be unconditional or subject to performance, meaning that the borrower must comply with specified requirements.

Loan Loss Reserves

A loan loss provision is funds allocated by banks to cover uncollected loan payments or losses. The loan loss provisions reserve covers the entire or a part of the unpaid debt.

When a company’s assets lose value due to rising interest rates or changes in credit quality, a cash reserve known as a loan loss provision is set aside.

The funds set aside reflect how much money might become necessary to reimburse lenders if this occurs. It is also a tool for banks to assess their overall financial health.

Pensions

Pensions are the most common type of provisions that are payable from one year to the next, and they’re used to pay for probable future expenses as well.

Warranties

Warranties have been recognized as an allowed expenditure under Income Tax. That is because warranty repairs reduce the profit of a business and are thus regarded in the liability account. These provisions are paid annually or at a fixed time, such as the end of each year or month.

They’re usually included in purchase agreements and rental contracts because they protect against any damage caused by faulty products or services.

Depreciation Costs

When reflecting asset values in tax returns and financial statements, a provision for depreciation considers that the value of fixed assets, for example, plants and equipment, depreciates over time.

Asset Impairments

Asset impairments occur when a drastic or unusual drop in the fair value of an asset or a group of assets. This could be due to changes in economic conditions or government or companies’ policy decisions.

A provisional amount for asset impairment helps level the sales after discarding it. Asset impairment is when an asset’s value is lower than the market value in the current year.

Tax Payments

The total tax a company anticipates for the current year is known as the provision for income tax. The tax provision is considered under income tax liabilities in a company’s balance sheet as it is an estimated amount of the company’s income taxes to be paid in the same year.

The tax provisions of a company are calculated by adjusting the gross income for admissible and inadmissible expenses multiplied by the applicable tax rate. A lot of companies use tax deductions as a provision to reduce the total taxable income.

Severance Payments

An involuntary separation payout is when an employee’s employment with a company ends due to circumstances beyond their control (such as layoffs) or is dismissed or retires.

These provisions are meant to compensate the employee with unused vacation time and leave credits, and other benefits related to the length of service they have provided to the company. It is a way to be prepared for a probable future expense.

What is the Difference Between Provisions and Funds?

- A provision and a fund are financial terms that refer to the setting aside money or assets for a specific purpose or business expenses.

- A provision is a liability created for a known or expected future expense.

- In contrast, a fund is a pool of assets set aside for a specific purpose and is not recorded as a liability on the balance sheet.

- Both provisions and funds are used to manage and mitigate risks, but they are used differently and with different objectives.

- When defining “what are provisions,” the main difference is that in funds, the real money is set aside in a separate account. While in provisions, the money is just allocated on paper from the corpus.

Provisions, Contingent Assets, and Contingent Liabilities

IAS 37, or International Accounting Standard 37, is adopted by International Accounting Standards Board. IAS 37 is an international financial reporting standard related to “Provisions, Contingent Liabilities, and Contingent Assets.”

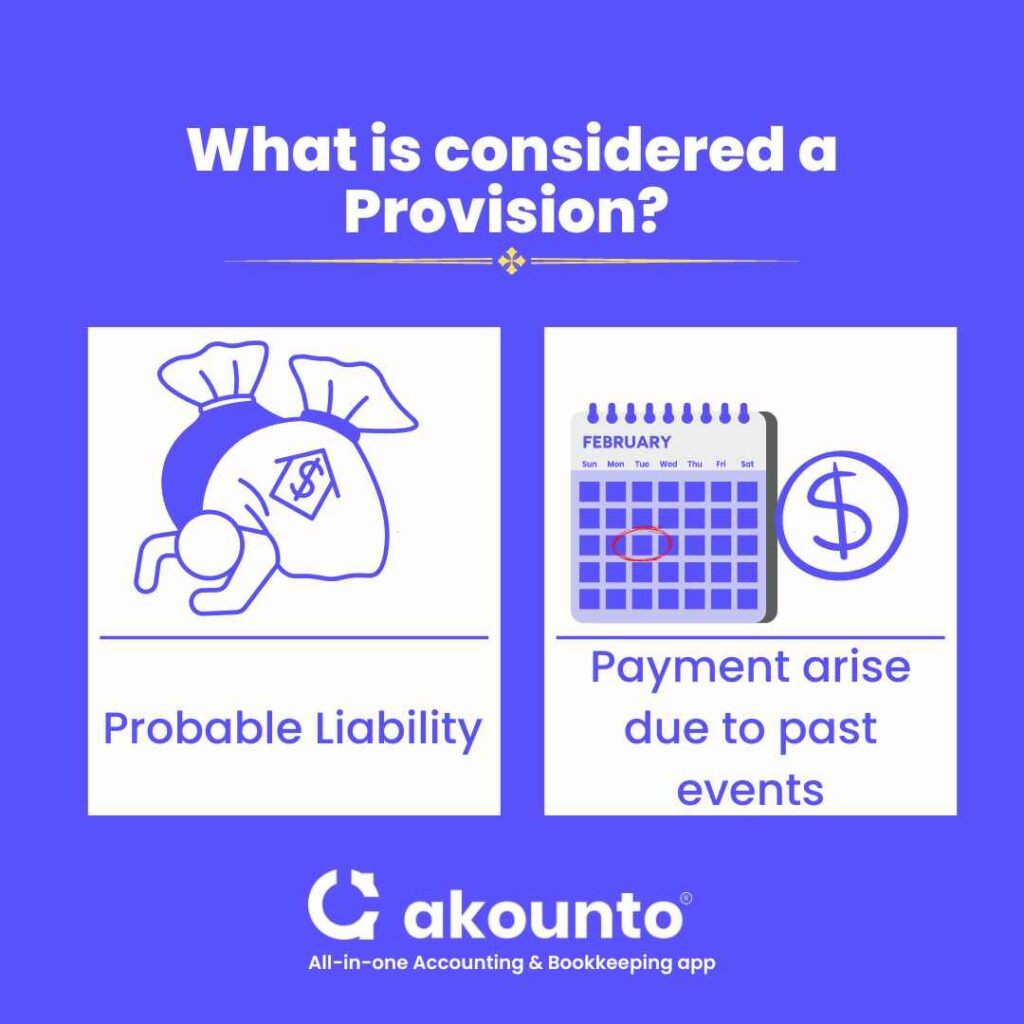

According to IAS 37, the provision is recognized only if it is a present obligation arising due to past events. Any planned expenses, even authorized by the management, cannot be accommodated into provisions, contingent liabilities, and contingent assets.

Contingent Assets

- Contingent assets are possible assets arising from past events, and the company is likely to acquire an asset. It is recognized as a “possible asset.”

- It is not recognized as an asset because it is not certain that the inflow of economic benefit will occur.

- However, it is disclosed in the financial statements when the inflow of economic benefit is probable.

Contingent Liabilities

- Contingent liabilities are potential liabilities arising from past events that the company may be required to settle. It is recognized as “probable liabilities.”

- It is not recognized as a liability because it is not certain that the outflow of economic benefit will occur.

- However, it is disclosed in the financial statements when the outflow of economic benefit is probable.

Bad Debts and Provisions

- Bad debts are amounts a company expects will not be collected from customers.

- Provisions for bad debts are created to set aside funds to cover these expected losses.

- Bad debts are usually considered a form of credit risk, and the provision for bad debts is created as a form of credit risk provisioning.

Advantages and Disadvantages of Creating Provisions

| Advantages | Disadvantages |

| Improved financial forecasting Better risk management Compliance with regulations Enhanced financial stability Increased credibility Improved decision-making | Reduced profitability in the short-term Difficult to accurately predict and measure Could lead to overcautious decision making Costly to maintain and update |

Final Words

Knowing “what are provisions” is important for managers and people at the helm of management. Companies could use provisions or provision-based funds for various purposes. Creating provisions is an important task for businesses, organizations, and governments as it helps to establish clear guidelines and expectations for all parties involved.

With rising complexities in businesses, understanding principles and calculations of provisions are crucial. Visit the Akounto blog to gain a deeper grasp of accounting and maximize the possibilities for your company.