Understanding Acid-Test Ratio

The acid-test ratio (quick ratio) measures a company’s ability to meet its short-term liabilities using its most liquid current assets. It excludes inventory from the equation due to its relatively lower liquidity.

What’s covered in the article

A company’s acid test ratio plays a critical role in evaluating its financial health, including the company’s ability to cover short-term liabilities efficiently. When assessing a company’s liquidity, it is crucial to consider the composition of its current assets.

Calculating the acid test ratio involves taking items from the company’s balance sheet.

The acid-test ratio focuses on the most liquid assets, which include cash, cash equivalents, and marketable securities while excluding inventory. This exclusion allows a more conservative analysis of a company’s short-term liquidity position.

The acid-test ratio is a crucial indicator for a small company, highlighting its ability to access cash to pay off immediate liabilities quickly. Unlike the current ratio, which includes all current assets, the acid-test ratio focuses on the most liquid assets.

This distinction is particularly important for companies with low inventory turnover or industries where inventory is not readily convertible to cash, such as a service-oriented company.

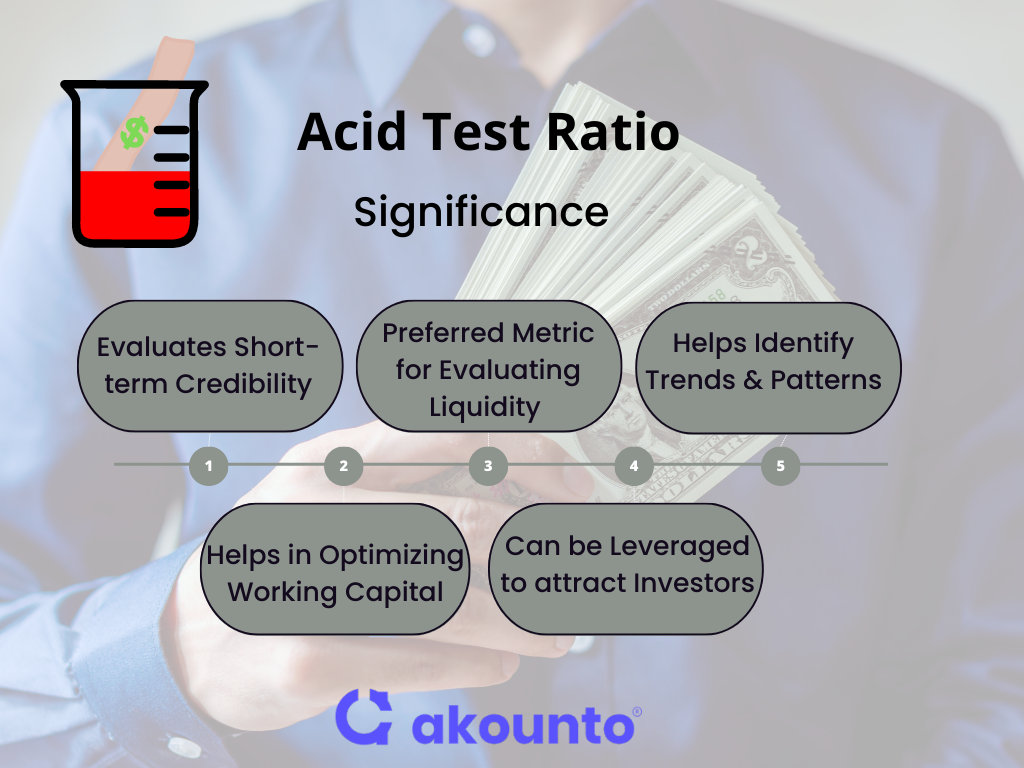

Significance

The quick ratio is a critical indicator for a small company to evaluate its liquidity and ability to pay off immediate liabilities promptly. It is one of the key liquidity ratios used to assess a company’s short-term financial health and stability.

Lenders and investors consider the acid-test ratio a preferred metric when evaluating a company’s liquidity position. Its conservative approach provides a more accurate assessment of a company’s ability to pay for its short-term obligations.

A high acid-test ratio indicates that a company has enough short-term investments and liquid assets to cover its short-term liabilities promptly. This instills confidence in potential investors and creditors, showcasing the company’s financial stability and reliability.

A low acid-test ratio may raise concerns about a company’s liquidity and its capacity to meet immediate financial obligations.

A company may need to explore strategies to improve its liquidity position, which include:

- Optimizing cash management practices,

- Enhancing collection processes for accounts receivable,

- Making adjustments to the composition of their current assets.

Ensuring enough liquid assets and managing short-term investments effectively are vital for maintaining a healthy acid-test ratio.

Monitoring the acid-test ratio over time allows a company to identify trends and patterns in its liquidity position. It empowers them to make proactive adjustments, such as managing working capital and optimizing the balance between short-term assets and liabilities, to maintain a healthy financial standing.

By focusing on the company’s current assets, including accounts receivables, and excluding inventory, the acid-test ratio provides insights into a business’s ability to pay immediate obligations.

A company can leverage this ratio, other liquidity metrics, and working capital ratios to make informed financial decisions, attract potential investors, and ensure long-term financial stability.

Formula

The acid-test ratio calculation involves using a simple formula that assesses the relationship between a company’s most liquid current assets and its short-term liabilities. The formula to calculate acid-test ratio is as follows:

Acid-Test Ratio = (Cash + Cash Equivalents + Marketable Securities) / Current Liabilities

This acid test ratio formula focuses on the most liquid assets (quick assets) that can be readily converted into cash to meet short-term obligations. By excluding inventory, which may not have high liquidity, the acid-test ratio provides a more conservative measure of a business’s ability to cover its immediate liabilities.

Components

- Cash: This includes the physical cash on hand and any cash held in bank accounts that can be accessed immediately.

- Cash Equivalents: These are highly liquid assets that are readily converted into cash within a short period, typically within 90 days or less. Examples: Treasury bills, certificates of deposit (CDs), and money market funds.

- Marketable Securities: These are short-term investments that can be easily sold or traded in financial markets. Marketable securities typically include government bonds, corporate bonds, or shares of highly liquid stocks.

- Current Liabilities: These are the company’s short-term obligations that are due within a year. Examples: accounts payable, short-term loans, accrued expenses, and any other outstanding debts that need to be paid off in the near future.

By dividing the total cash, cash equivalents, and marketable securities by the total current liabilities, the quick ratio provides a snapshot of a company’s ability to pay for short-term obligations using its most liquid assets.

Calculating the quick ratio provides valuable insights into the company’s financial health, highlighting its ability to pay short-term obligations efficiently or the need to generate more cash.

Examples

Example 1

Company ABC has the following information from its balance sheet:

Cash: $10,000

Cash Equivalents: $5,000

Accounts Receivable: $8,000

Inventory: $12,000

Prepaid Expenses: $3,000

Short-Term Investments: $15,000

Current Liabilities: $20,000

Calculate the acid test ratio.

Solution

To calculate the acid-test ratio by considering only quick assets, we exclude inventory and prepaid expenses from the calculation:

Quick Assets = Cash + Cash Equivalents + Accounts Receivable + Short-Term Investments = $10,000 + $5,000 + $8,000 + $15,000 = $38,000

Acid-Test Ratio Formula = Quick Assets / Current Liabilities

= $38,000 / $20,000 = 1.9

In this example, we focused on the quick assets, the most liquid current assets, excluding inventory and prepaid expenses.

By considering only these quick assets in the calculation, we obtained an acid-test ratio of 1.9. This ratio indicates the company’s ability to cover its short-term liabilities using readily available assets.

Example 2

Balance Sheet extract of Company DEF:

Cash: $25,000

Accounts Receivable: $12,000

Short-Term Assets: $20,000

Short-Term Debt: $8,000

To calculate the acid-test ratio:

Company’s Acid-Test Ratio = (Cash + Accounts Receivable + Short-Term Assets) / Short-Term Debt = ($25,000 + $12,000 + $20,000) / $8,000 = $57,000 / $8,000 = 7.125

Factors Affecting Acid Test Ratio

- Total current liabilities: Higher liabilities can lower the acid test ratio, indicating a potential strain on short-term liquidity.

- Total current assets: Larger liquid assets positively impact the acid test ratio, reflecting a stronger ability to meet immediate obligations.

- Liquidity ratio: The acid test ratio serves as a liquidity indicator, showing a company’s capacity to cover short-term liabilities efficiently.

- Short-term obligations: Increased short-term debts can decrease the acid test ratio, suggesting a higher risk of liquidity challenges.

- High ratio: A higher acid test ratio signifies better liquidity and the ability to handle short-term financial obligations with ease.

- Low acid test: A lower acid test ratio implies a potential liquidity concern, indicating a limited ability to meet immediate liabilities.

- More liquidity: Companies with abundant liquidity tend to have higher acid test ratios, indicating a robust short-term liquidity position.

- Other industries: Acid test ratio benchmarks may differ across industries based on unique liquidity requirements and business dynamics.

- Financial statements: The acid test ratio is calculated using information from a company’s financial statements, providing insights into its liquidity.

- Money owed: The amount of outstanding debts and accounts payable affects the acid test ratio, impacting the overall liquidity position.

Acid-Test Ratio vs. Current Ratio

| Metrics | Acid-Test Ratio | Current Ratio |

| Definition | Measures a company’s ability to meet short-term liabilities using its most liquid current assets. Excludes inventory. | Evaluates a company’s ability to meet short-term obligations by comparing all current assets to current liabilities. Includes inventory. |

| Calculation | Acid-Test Ratio = (Cash + Cash Equivalents + Marketable Securities) / Current Liabilities | Current Ratio = Current Assets / Current Liabilities |

| Focus | Emphasizes most liquid assets, excluding inventory, for a conservative assessment of short-term liquidity. | Considers all current assets, including inventory, for a broader view of short-term liquidity. |

| Purpose | Measures immediate liquidity and capacity to meet immediate financial obligations. | Assesses overall short-term financial health and ability to cover current liabilities. |

| Interpretation | Higher ratio indicates stronger liquidity and greater ability to cover short-term obligations promptly. | Higher ratio suggests higher proportion of current assets to current liabilities, reflecting a more favorable liquidity position. |

| Limitations | May not provide a complete picture of liquidity as it excludes inventory and other factors affecting short-term obligations. | Can be influenced by the inclusion of inventory, which may not accurately reflect immediate liquidity. |

Conclusion

The acid-test ratio is a valuable financial metric that assesses a company’s ability to meet short-term liabilities using its most liquid assets. It provides insights into a company’s immediate liquidity and financial health, allowing stakeholders to make informed decisions.

Sign in to Akounto and get in touch with our experts to streamline your accountin process today.