Understanding Business Expenses

Business expenses, a fundamental concept in business operations, refer to the costs incurred by a company while conducting its operations. These costs range from rent and utilities to employee salaries, marketing, and office supplies. Understanding business expenses is crucial for several reasons.

What’s covered in the article

Firstly, business expenses directly impact a company’s profitability. The lower the expenses, the higher the potential profit. Therefore, effective management of business expenses can lead to significant cost savings.

Secondly, business expenses play a pivotal role in tax calculations. Many of these expenses are tax deductible, meaning they can be subtracted from a company’s gross income to reduce its taxable income. This can lower tax liability, further enhancing the company’s bottom line.

Understanding business expenses aids in strategic decision-making. By analyzing the types and amounts of expenses incurred, business owners can identify areas for cost reduction and allocate resources more efficiently.

In the context of tax deductions, not all expenses qualify. The Internal Revenue Service (IRS) stipulates that for a business expense to be deductible, it must be both “ordinary and necessary” for business operations. Hence, understanding which expenses are deductible and how to properly track and record expenses is essential for maximizing tax savings.

Difference between Personal and Business Expenses

Personal expenses are the costs incurred in daily life that are not directly related to the business operations.

Personal expense lists include home mortgage or rent, personal vehicle expenses, groceries, and personal entertainment.

While these expenses are necessary for personal life, they are not tax-deductible, and the business owner must not claim personal expenses.

Business expenses are the costs directly associated with running a business, for example, office rent, salaries, marketing costs, and office supplies. These expenses are tax deductible, reducing taxable income and, consequently, reducing the overall tax bill.

There are instances where personal and business expenses can overlap. For example, if a small business owner uses his personal car for business purposes, a portion of the vehicle expenses can be considered business expenses.

Most business owners operate a business from home during the initial phase; a portion of home expenses can be classified as business expenses. In such cases, it’s crucial to accurately calculate and record the business portion of these expenses.

Using a business checking account separate from a personal account can help track business expenses more effectively. Additionally, business accounting software can assist in tracking business expenses, ensuring that personal and business expenses are clearly distinguished.

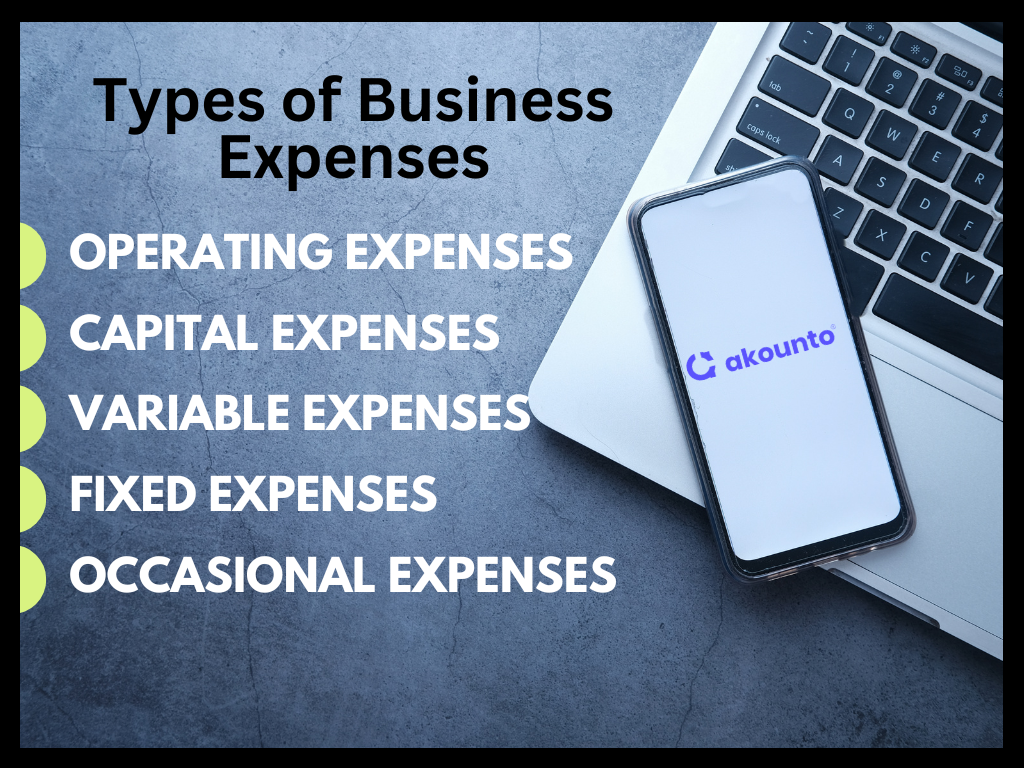

Types of Business Expenses

Understanding the different types of business expenses is crucial for effective business management and tax planning. Business expenses can be broadly categorized into two types: operating expenses and capital expenses.

Operating Expenses

Operating expenses are ordinary and necessary costs; they are the day-to-day costs incurred in running a business. These expenses are fully deductible in the tax year they occur.

Ordinary and Necessary

In business expenses, the term “ordinary and necessary” refers to expenses that are common and accepted in the trade or business and are helpful and appropriate for the business.

When calculating taxable income, these expenses may be deducted from your business’s income. It’s important to note that a business expense must not be indispensable to be considered necessary.

Capital Expenses

Capital expenses are costs related to purchasing assets that have a useful life beyond the current tax year, such as machinery, equipment, and property. These expenses are not fully deductible in the year they are incurred. Instead, they are capitalized and depreciated or amortized over their useful life.

It’s important to note that not all business costs are tax deductible. For example, fines and penalties, political contributions, and certain types of entertainment expenses are not deductible. Additionally, some expenses are only partially deductible, such as business meals and certain business travel expenses.

Variable Expenses

Variable expenses are costs that fluctuate in direct proportion to the volume of business activity. These expenses increase as business activity increases and decrease as business activity decreases. Effective managing variable expenses can lead to significant cost savings and improved cash flow for a small business owner.

Fixed Expenses

Fixed expenses, on the other hand, remain relatively constant irrespective of the level of business activity. These expenses are incurred regularly and are necessary for the ongoing operation of the business. While these expenses are generally consistent, they can change over time due to inflation or renegotiated contracts.

Occasional Expenses

Occasional expenses are costs that do not occur regularly or predictably. These expenses happen occasionally and may not be directly tied to the level of business activity. While these expenses can be harder to predict, business owners need to account for them in their budgeting and financial planning processes.

Tracking business expenses accurately and categorizing them can help business owners manage costs, improve profitability, and make informed financial decisions.

Examples

Common business expense examples are:

Operating Expenses

- Rent and Utilities: The costs for utilities such as electricity, water, internet services, and office expenses used for business operations are also deductible.

- Salaries and Wages: The remuneration paid to your employees, including bonuses and commissions, are deductible business expenses.

- Professional Fees: If you hire a tax professional or an accountant to manage your business accounts or a lawyer to handle your legal matters, their legal and professional fees are tax deductible.

- Marketing Costs: Any costs associated with promoting your business, such as advertising, public relations, and marketing campaign costs, are deductible.

- Interest Expenses: If you have taken out a business loan, the interest you pay is a business expense.

- Bank Fees: Any fees associated with your business bank account, such as transaction fees or account maintenance fees, are deductible.

Capital Expenses

- Equipment Purchase: If a business owner buys machinery or equipment for the business, this is considered a capital expense. At the same time, he cannot deduct the full cost in the year of purchase but can depreciate the cost over the equipment’s useful life.

- Property Purchase: If you purchase a property for the business, this is a capital expense. Similar to equipment, you can depreciate the cost of the property over its useful life.

- Vehicle Purchase: If a small business owner buys a vehicle exclusively for business use, this is a capital expense. The purchase of a vehicle is not a part of tax-deductible business expenses, but the company can depreciate the cost of the vehicle over its useful life.

Variable Expenses

- Lease Payments: If a business leases equipment, the lease payments can vary based on the lease terms and the amount of equipment leased.

- Employee Benefit Programs: Costs associated with employee benefit programs can vary depending on the number of employees and the benefits offered.

- Business Purchases: The cost of goods sold, raw materials, or inventory purchases can fluctuate based on sales volume and market prices.

Fixed Expenses

- Business Loans: The monthly payments on business loans typically remain constant over the loan term.

- Maintenance Costs: Regular maintenance costs for equipment or property are generally fixed and predictable.

- Business Expenses List: Subscription fees for business software or services, insurance premiums, and rent are examples of fixed costs that recur regularly.

Occasional Expenses

- Equipment Repairs: Unexpected equipment breakdowns can lead to occasional repair costs.

- Legal Fees: If a business faces unexpected legal issues, it may incur occasional legal fees.

- Marketing Campaigns: A business may occasionally invest in special marketing campaigns or promotional events, leading to irregular expenses.

Deductible Expenses

Even if an expense satisfies the ordinary and necessary requirement, it doesn’t guarantee immediate deduction in the year of payment or occurrence. Certain circumstances may restrict or disallow the deduction of such expenses. It is, therefore, crucial to differentiate between typical business expenses and those that fall into the following categories:

- Expenses are used for determining the cost of goods sold.

- Capital expenses.

- Personal expenses.

Cost of Goods Sold

Any expenses already accounted for in the COGS cannot be deducted again as standalone business expenses. While determining gross profit for the year, the cost of goods sold is deducted from the gross receipts.

Expenses included in calculating the cost of goods sold (COGS) are not deductible again as separate business expenses. However, it’s important to note that.

Capital Expenses

Certain costs incurred by the business must be capitalized rather than deducted. Capital expenses represent investments in a business and are considered assets. There are generally three types of costs that require capitalization:

- Business startup costs

- Business assets

- Improvements

While a business cannot immediately deduct capital expenses, it can recover the amount spent gradually through depreciation, amortization, or depletion.

Personal Expenses

Personal, living, or family expenses are not eligible for deduction. If an expense serves both business and personal purposes, then a business must allocate the total cost between the two parts. Only the business portion of the expense is deductible, while the personal portion remains non-deductible.

Time of Deduction

The timing of deductions for business expenses is governed by the tax accounting method that a business uses. The two common methods are the cash and accrual methods, and the timing of deductions can vary significantly between them.

Cash Method

Under the cash method of record-keeping, you generally deduct business expenses in the tax year you pay them. This method is straightforward and is commonly used by small businesses. For example, if a business owner pays for office supplies or professional fees in 2023, he would deduct these expenses from your 2023 tax return.

Accrual Method

On the other hand, under the accrual method of accounting, accountants generally deduct business expenses in the tax year, regardless of when payment is made. If a firm receives an invoice for marketing expense in December 2023 but doesn’t pay it until January 2024, it would still deduct the invoice amount from your 2023 tax return.

Special Rules for Certain Expenses

Certain types of expenses have special rules regarding the timing of deductions. For instance, capital expenses, such as purchasing business equipment or property, are not fully deductible in the year of purchase. Instead, they are capitalized and depreciated over their useful life, allowing a portion of the cost to be deducted each year.

Similarly, some expenses are only partially tax deductible. For example, business meals are typically only 50% deductible, and certain business travel expenses may have specific deduction limits.

It’s important to note that the IRS has detailed rules and regulations regarding the timing of deductions. IRS Publication 535, Business Expenses, provides comprehensive information on deductible expenses and related laws.

Impact on Income Statement

Business expenses, both operating, and capital, are a significant part of the income statement. They are subtracted from the total revenue to determine the net income or loss. This information is vital for business owners, investors, and stakeholders as it reflects the business’s financial health.

The income statement aids in identifying areas for improvement by highlighting high-cost areas. It also plays a pivotal role in tax planning as deductible expenses reported in the income statement can reduce the taxable income, thereby reducing the overall tax liability.

It’s important for businesses to accurately record and categorize all business expenses to ensure accurate and effective income statement reporting.

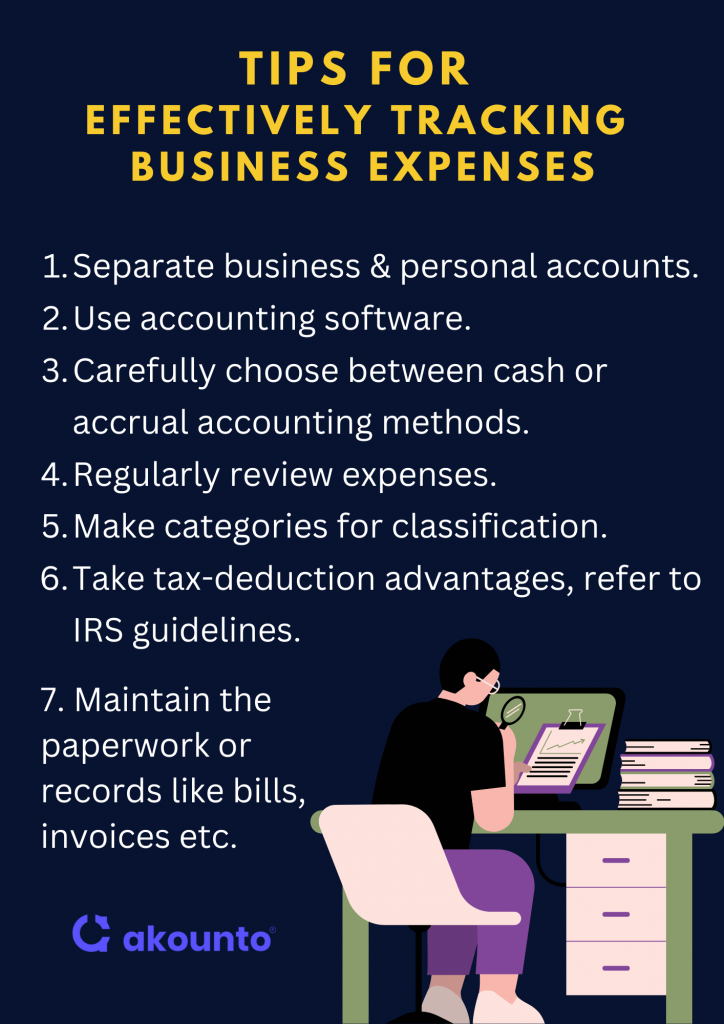

Tips for Effectively Tracking Business Expenses

- Open a Business Bank Account: Having a separate checking account for your business helps to clearly distinguish between personal and business expenses. This makes it easier to review expenses regularly and ensure that only deductible business expenses are claimed.

- Use Accounting Software: Utilize accounting software to automate the process of tracking expenses. This can help in categorizing expenses, recording transactions, and generating reports. It also aids in reviewing expenses and identifying trends or areas of concern.

- Choose the Right Accounting Method: Decide between cash or accrual accounting based on your business needs. This choice will affect when you record income and expenses.

- Regularly Review Expenses: Make it a habit to review your expenses regularly. This help to spot errors or discrepancies, keep track of the cash flow and allow informed financial decision-making.

- Track and Categorize All Expenses: Record all business expenses as they occur and categorize them according to their nature (e.g., office supplies, professional fees, lease payments). This will make it easier to review and deduct expenses at the end of the tax year.

- Take Advantage of Tax Deductions: Understand the IRS publication on deductible expenses and claim all eligible business expense deductions. This can significantly reduce your tax liability.

- Maintain Good Records: Keep all receipts, invoices, and other documents related to your business expenses. Record-keeping is essential for accurate expense tracking and can be invaluable if the IRS audits the business.

Conclusion

Understanding the different types of business expenses – operating, capital, variable, fixed, and occasional – is crucial for effective business management and tax planning. When used for business purposes, these expenses can often be deductible, reducing a company’s tax liability.

Regularly reviewing expenses and maintaining accurate records can help businesses optimize operations, manage costs effectively, and maximize tax savings.

Explore the Akounto blog for valuable insights and expert advice to help optimize your business finances.