Introduction

Net income, or bottom line, represents the residual amount after deducting all the expenses from the gross income generated over a specific accounting period.

What’s covered in the article

Understanding how to calculate net income is paramount for businesses, especially small business owners.

It offers insights into the company’s financial health and enables informed decisions based on the profit generated.

The company’s income statement, a crucial financial document, prominently displays net income highlighting its significance.

What is Net Income?

Net income, frequently termed as net profit or net earnings, is the amount that remains after all expenses, including operating costs, interest, taxes, and other deductions, have been subtracted from the company’s gross income.

Net income is a definitive measure that captures the essence of a business’s earnings over a specific period. When the term “net income” is used, it often evokes the idea of the bottom line because it is the last line on the income statement, summarizing the financial performance of a business.

If this bottom line is positive, it indicates positive net income, suggesting that the business has earned more than it spent. A negative net income denotes that the expenses surpassed the revenues, leading to a loss.

Net income is not synonymous with taxable income. While net income provides an overview of the business’s earnings, taxable income is the amount on which taxes will be levied, and it might include or exclude certain items not considered in the net income calculation.

Net income might also be called net earnings, underscoring its role in denoting the earnings left after all deductions.

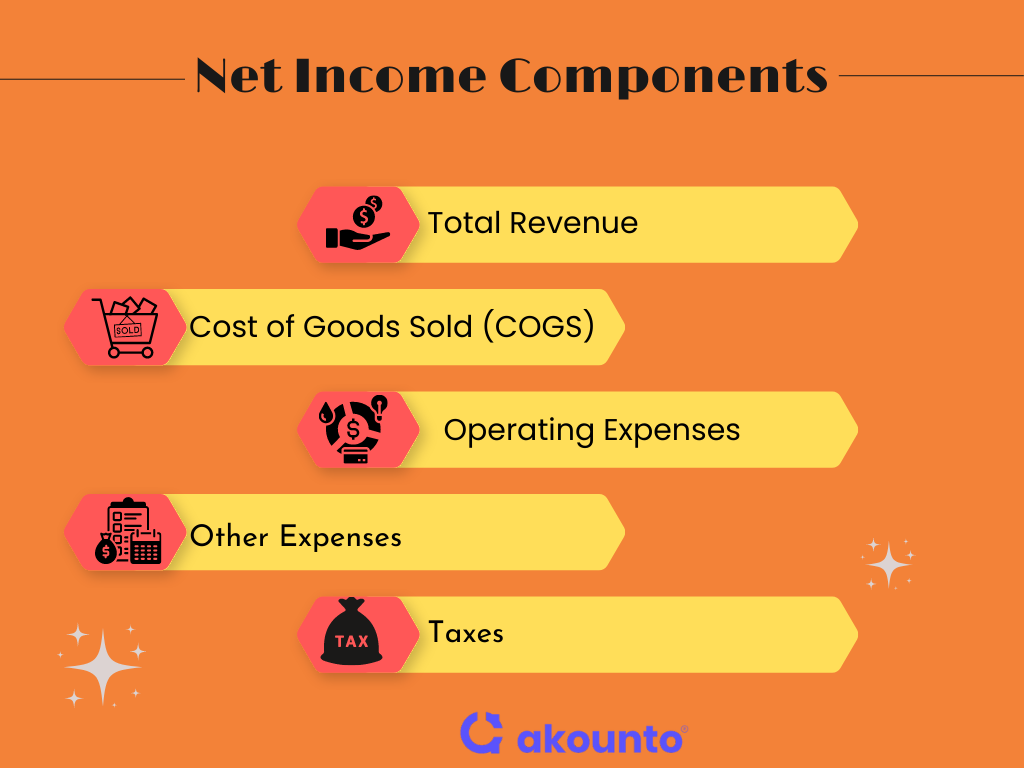

Components of Net Income

- Total Revenue: This is the total amount of money from the company’s primary operations. For example, a retail store’s total revenue would be the sum of all customer sales.

- Cost of Goods Sold (COGS): These are the direct costs of producing the goods a company sells. This might include raw materials, labor, and factory overhead expenses for a manufacturer. If a car company spends $20,000 to produce a vehicle and sells it for $30,000, the COGS is $20,000.

- Operating Expenses: These are the costs incurred in the day-to-day operations of a business, excluding direct production costs. Examples include rent, utilities, marketing expenses, and salaries of non-production staff. For instance, a bookstore would count its sales staff’s salary and rent for its storefront as operating expenses.

- Other Expenses include interest paid on loans, one-time costs for events like lawsuits, or losses from selling long-term assets. For example, if a company pays interest on a business loan, this would be categorized under other expenses.

- Taxes: The amount set aside to cover federal, state, and local taxes. If a company has a pre-tax income of $100,000 and owes 30% in taxes, it would set aside $30,000 for this purpose.

After accounting for all these components, the resulting figure is the net income. It clearly indicates how much profit the company has made after all expenses are considered.

How to Calculate Net Income

Whether a small business owner or an analyst at a large corporation, understanding how to calculate net income is essential for assessing the financial health of any enterprise.

Net Income Formula

The formula for calculating net income is straightforward:

Net Income = Total Revenue − Total Expenses

Where:

- Total revenue represents the total earnings from goods sold or services rendered (or sold) during a specific period.

- Total Expenses encompass all the costs incurred by the business, including the cost of goods sold, operating expenses, taxes, and other ancillary costs.

Examples

Example 1

A startup tech company has a sales revenue of $500,000. Their administrative expenses, including office rent and utilities, amount to $50,000. They also have employee wages totaling $200,000. How do we calculate their net income?

Solution

Using Net Income Formula:

Net Income = Sales Revenue – (Administrative Expenses + Employee Wages)

Net Income = $500,000 – ($50,000 + $200,000) Net Income = $250,000

Example 2

A small business owner has a total income from net sales of $300,000. Their fixed expenses, such as machinery maintenance, amount to $20,000. Living expenses, including social security benefits and Medicare taxes, cost $30,000. They also have interest expenses on a business loan of $10,000. How much is their net profit or a business’s net income?

Solution

Using Net Income Formula:

Net Profit = Total Income – (Fixed Expenses + Living Expenses + Interest Expenses)

Net Profit = $300,000 – ($20,000 + $30,000 + $10,000) Net Profit = $240,000

Example 3

A retail store has net sales revenue of $1,000,000. Their cost of goods sold amounts to $600,000. Operating income, which includes expenses like rent and utilities, is $100,000. They also have to pay dividends of $50,000. Given these figures, calculate the business’s net income.

Solution

Using Net Income Formula:

Net Income = Net Sales Revenue – (Cost of Goods Sold + Operating Income + Dividends)

Net Income = $1,000,000 – ($600,000 + $100,000 + $50,000) Net Income = $250,000

Importance of Understanding Net Income

Understanding net income is paramount for several reasons:

Accrual Accounting Insight

Unlike cash-based accounting, accrual accounting recognizes revenue and expenses when they are incurred, not when the money changes hands. This means net income provides a more accurate picture of a company’s financial health, reflecting non-cash expenses and revenues.

Tax Implications

Both state taxes and federal taxes are calculated based on net income. By comprehending how net income is derived, businesses can better strategize tax-saving measures and anticipate tax liabilities.

Retained Earnings and Dividends

Net income influences the retained earnings on the balance sheet. Some of these earnings may be reinvested in business operations, while others might be distributed as dividends. A consistent net income ensures shareholders receive their dividends and the business continues to grow.

Operational Efficiency

A company’s net income is a direct reflection of its business operations. It indicates how efficiently a business generates profit from its operations, excluding non-operating activities.

Investment Decisions

Investors and stakeholders scrutinize net income to gauge a company’s profitability. A robust net income can attract investments, ensuring the company’s growth and expansion.

Cash Flow Analysis

While the cash flow statement provides insights into the liquidity position, net income, adjusted for non-cash expenses, aids in understanding the actual cash generated through operations.

Benchmarking and Growth

Comparing net income with gross income helps in determining the company’s profitability after all expenses. It serves as a benchmark, guiding businesses in setting future financial goals.

Common Misconceptions and Net Income FAQs

Q1: Is gross income the same as net income?

No, they are distinct concepts. Gross income refers to a business’s total revenue before any expenses are deducted. Net income refers to the amount left after all business expenses, including income tax and other deductions, are taken out from the gross income.

Q2: Why is the income statement essential when discussing net income?

The income statement gives a detailed breakdown of a business’s revenues and expenses over a specific period. It ultimately leads to the calculation of net income, showcasing the business’s profitability. Understanding the income statement is crucial for analyzing how much revenue is transformed into profit.

Q3: How does income tax impact a business’s net income?

Income tax is one of the business expenses deducted from gross income to compute net income. Depending on the tax rate and the taxable income, it can significantly impact a business’s net income. Businesses need to account for income tax to accurately understand their profitability.

Q4: Why is understanding net income important for a business?

Net income is important as it clearly measures a business’s profitability over a specific period. It indicates how effectively a company converts its revenue into profit after deducting all expenses. A consistent positive net income suggests that the business is on a sustainable path, while a negative net income might indicate underlying issues that need addressing.

Role of Accounting Software

Determining net income has become more streamlined and accurate with the advent of accounting software. Such software often comes equipped with a net income calculator, simplifying the process of calculating this crucial financial metric.

By automating the data entry and computation processes, these tools ensure that financial statements are generated with precision, reducing the chances of human error.

Accounting software provides a comprehensive view of a company’s financial health, making it easier for businesses to analyze their profitability and make informed decisions. Investing in reliable accounting software is prudent for any business aiming for financial clarity and efficiency.

Conclusion

Net income is a pivotal metric in understanding a business’s financial health, reflecting its profitability after all expenses. From small business owners to large corporations, comprehending how to calculate and interpret net income is essential for informed decision-making, strategic planning, and attracting investments. With the aid of modern accounting software, ensuring accuracy in these calculations has become more accessible, further emphasizing the importance of net income in today’s business landscape.

Akounto’s all-in-one accounting software can help users generate business reports and provides deep analysis of a company’s financial health. Visit Akounto Website for more information.