Introduction

Liquid assets are quickly converted into cash without significantly affecting their market value and are often referred to as “cash equivalents” due to their high liquidity and ease of conversion.

What’s covered in the article

When it comes to personal finance, liquid assets are important as they provide:

- A safety net

- Ready money for investment opportunities

- Cushion for taking risks

- Financial security

- Ability to absorb inflationary shocks

- Meeting emergency expenditures

- Meeting debt obligations

In corporate finance, liquid assets on a corporate balance sheet signals:

- Ability to keep business afloat

- A healthy working capital cycle

- Efficient cash collection cycle

- Operational efficiency i.e. ease of running daily business operations

- Ability to meet short-term obligations, such as accounts payable or payroll, without disrupting regular operations

- Measure of short-term creditworthiness

- Ability to sustain during recessions and cash crunches in the economy

- Ability to take advantage of growth opportunities

- Less reliance on over-drafts and commercial borrowings

The presence of liquid assets on a company’s balance sheet is often seen as a sign of financial stability, as it indicates the company’s ability to handle unexpected costs or downturns in revenue.

They provide security and flexibility; they may not offer the same potential for long-term growth as other investments. Therefore, seeking advice from a financial advisor or investment adviser is essential to balance liquidity and growth.

Significance

Liquid assets are important in personal and corporate finance due to their accessibility and fairly easy cash conversion.

Corporate Finance

Liquid assets are critical to a company’s financial health as they provide the necessary funds to meet short-term obligations. Their ability to quickly convert these assets into cash without losing their market value makes them a reliable resource during financial emergencies or downturns in revenue.

Liquidity depends on several factors, including the established market for the asset, the ease of transferring ownership, and the time it takes to sell or liquidate it.

Cash on hand is considered the most liquid asset, followed by funds in a checking account, money market, and savings account. Other common liquid assets in a corporate setting include accounts receivable, short-term investments, and marketable securities.

Personal Finance

Liquidity forms the backbone of an individual’s financial security; it includes cash, savings accounts, checking accounts, money market accounts, and other assets that can be easily converted into cash.

Liquid assets like savings accounts and money market funds also serve as emergency fund, providing financial stability in case of job loss, health emergencies, retirement age, or other unforeseen expenses.

Certain liquid investments and mutual funds can be considered liquid if they can be easily sold without significant penalties or losses.

Liquid assets should be balanced with other investments for long-term financial growth. The interest rates on highly liquid assets like savings accounts are typically lower than the potential returns from less liquid ones like stocks or real estate.

Examples

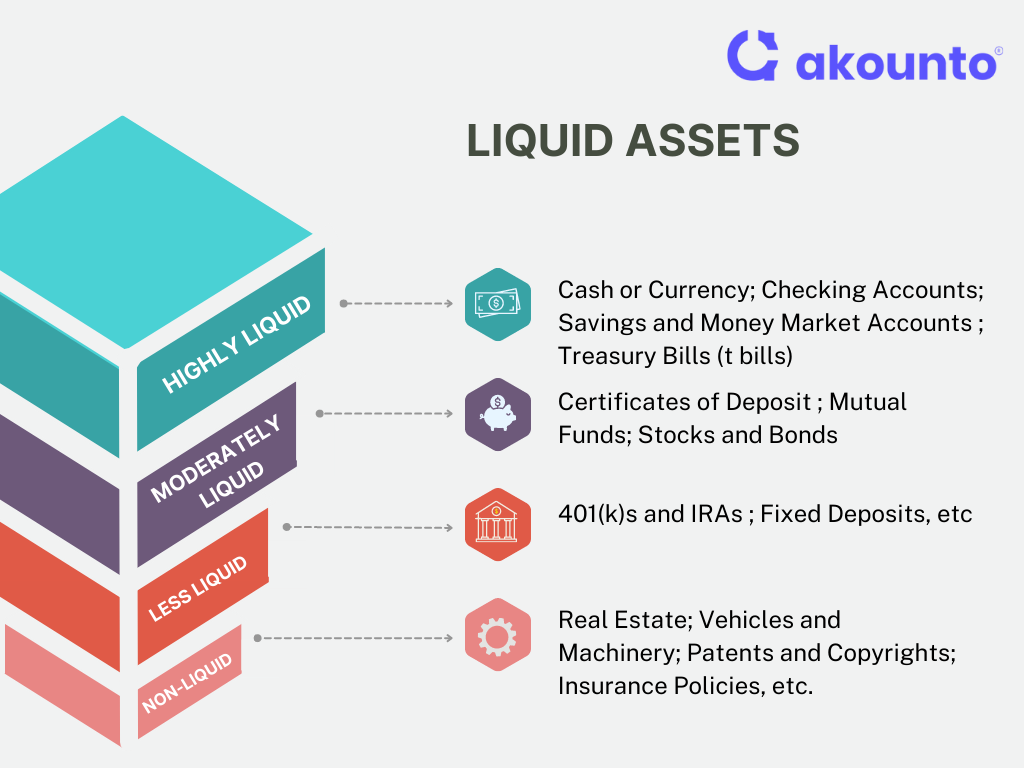

Highly Liquid

These assets can be converted into cash almost instantly:

- Cash or Currency: The most liquid asset, readily available for transactions.

- Checking Accounts: Funds in these accounts can be easily withdrawn.

- Savings and Money Market Accounts: Savings account allows for easy access to funds, although there may be some restrictions on monthly transactions. In contrast, money market investment accounts can be liquidated on short notice.

- Treasury Bills (t bills): These are short-term securities issued by the U.S. government that can be sold in the open market.

Moderately Liquid

These assets can be converted into cash within a few days:

- Certificates of Deposit: These are time deposits with a bank or credit union with a specific maturity date.

- Mutual Funds: These funds can be sold, and the cash can be received within a few business days.

- Stocks and Bonds: These can be sold on the open market, although the time to receive cash can vary.

Less Liquid

These assets may take weeks or months to convert into cash:

- 401(k)s and IRAs: While these retirement accounts can be liquidated, they often come with penalties for early withdrawal.

- Fixed Deposits: These are time-bound deposits with a bank that can be liquidated before maturity, often with a penalty.

Non-Liquid (Illiquid assets)

Non-liquid assets cannot be easily converted into cash:

- Real Estate: Selling a property can take months, and the market value may fluctuate.

- Vehicles and Machinery: These assets may require time to find a buyer and may depreciate over time.

- Patents and Copyrights: These intangible assets may have value but can take time to sell.

- Insurance Policies: These can have cash value but are not easily liquidated.

Liquidity and Short-term Creditworthiness

Liquidity is a measure of a company’s short-term creditworthiness and its ability to meet its financial obligations. A company with high liquidity has enough cash or liquidity to pay off its debts as they come due, which is crucial for maintaining the trust of creditors and investors.

For instance, stocks and bonds are considered liquid because they can be sold on the open market relatively quickly. However, the speed at which these assets can be sold and converted into cash can depend on market conditions.

On the other hand, assets like real estate or machinery are considered less liquid because they can take significant time to sell, and their market value may fluctuate.

While liquid assets like cash or savings accounts provide security, they often offer lower returns than illiquid investments like stocks or real estate. Therefore, understanding liquidity is crucial for making informed financial decisions and planning for both short-term needs and long-term goals.

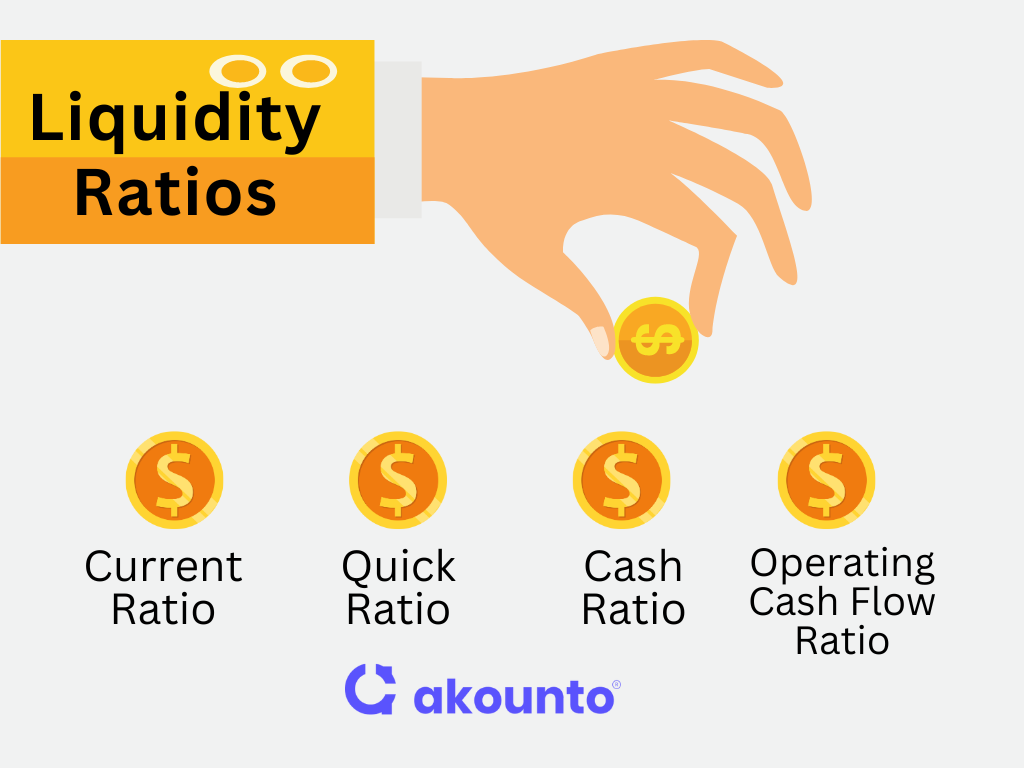

Liquidity Ratios

Liquidity ratios are financial metrics used to measure a company’s short-term creditworthiness. These ratios provide insights into a company’s operational efficiency, financial health, and how effectively it can generate cash to pay its debts. They are particularly important to creditors and investors as they reflect the company’s short-term financial strength.

Here are some key liquidity ratios:

- Current Ratio: This ratio measures a business’s ability to meet short-term liabilities with short-term assets. A higher current ratio indicates better short-term financial health.

- Quick Ratio (Acid-Test Ratio): This ratio is a stricter measure of liquidity as it excludes inventory from current assets. It assesses a company’s capacity to use its cash or quick assets immediately to pay its current liabilities.

- Cash Ratio: The most conservative liquidity ratio measures the business’s ability to pay for its current liabilities with just cash and cash equivalents.

- Operating Cash Flow Ratio: This ratio measures how a company covers its current liabilities with the cash flow from its core business operations. This ratio explains a company’s short-term liquidity in terms of its most liquid assets – its operating cash flow.

Factors Affecting Liquidity

Several factors can influence the liquidity of an asset, impacting how quickly it can be converted into cash. Here are some key factors:

- Type of Asset: The nature of the asset plays a significant role in its liquidity. Cash and cash equivalents, like savings accounts, are the most liquid. Stocks and bonds, while still liquid, may take a few days to convert into cash due to the need to find a buyer. Assets like real estate or machinery are considered illiquid as they can take significant time to sell.

- Market Conditions: The liquidity of an asset can also depend on the state of the market. For instance, it may be more difficult to sell stocks and bonds quickly during a market downturn without incurring a loss.

- Business Operations: For businesses, operational factors can affect liquidity. A company with efficient inventory management and strong sales may have higher liquidity due to faster cash conversion cycles.

- Economic Environment: Broader economic conditions can impact liquidity. In times of economic uncertainty, investors may prefer to hold onto cash or liquid assets, making it more difficult to sell more illiquid assets.

- Legal and Regulatory Factors: Certain assets may have legal or regulatory restrictions affecting liquidity. For example, withdrawal penalties can make retirement accounts less liquid.

Money Market and Liquid Assets

The money market is a crucial financial market segment where entities trade in short-term, highly liquid financial instruments. It is a hub for governments and corporations to secure short-term loans, typically with a maturity of less than one year.

The high liquidity of money market instruments means they can be rapidly converted to cash, often within a single business day.

A money market account pools money from numerous investors (similar to a mutual fund) to invest in highly liquid money market instruments, offering higher interest rates than standard savings accounts and providing facilities like ATM withdrawals, making them an attractive option for investors seeking a blend of liquidity, safety, and yield.

Investments in individual stocks also offer liquidity, as shares in publicly traded companies can be swiftly bought or sold on an exchange. However, the liquidity of stocks can fluctuate based on the stock’s nature and market conditions.

Liquid and Non Liquid Assets

A liquid asset can be readily converted into cash without significantly affecting its market value. In contrast, a non-liquid asset, also known as an illiquid asset, cannot be easily converted into cash or would significantly lose its value in the conversion process.

The key feature of a liquid asset is its marketability, meaning it can be bought or sold quickly in the market without causing a drastic change in its price.

The conversion of non-liquid assets into cash often requires a considerable amount of time. It may involve a significant decrease in value due to factors like depreciation, market conditions, or transaction costs.

Liquid Assets and Financial Statements

Liquid assets are typically listed under the current assets section of the balance sheet.

Current assets are characterized by cash convertibility within a year or the business’s operating cycle. By their nature, they are highly convertible and readily available.

Listing liquid assets on the balance sheet allows stakeholders, including investors, creditors, and analysts, to assess the company’s liquidity position and ability to meet short-term obligations.

Guidelines for Representation

The IRS and the SEC provide the following guidelines on how to represent liquid assets in financial statements:

- Balance Sheet Presentation: Liquid assets are typically reported as current assets on the balance sheet. They are listed in order of liquidity, with the most liquid appearing first.

- Cash and Cash Equivalents: They include bank accounts, petty cash, and short-term investments with a maturity of three months or less, which are presented separately in the balance sheet.

- Marketable Securities: Marketable securities, including stocks, bonds, and other investments that can be easily bought or sold in the market, are reported at fair market value on the balance sheet.

- Accounts Receivable: Accounts receivable, representing amounts owed to the company by customers or clients, are classified as a current asset. They are reported at their net realizable value, which reflects the estimated collectible amount.

Both the IRS and SEC require proper disclosure of liquid assets in the financial statements. This includes providing sufficient information about these assets’ nature, valuation, and risks.

Learn more about how assets play an important role in a business and how they are valued and entered into the books of accounts: Assets in Accounting.

Conclusion

Managing liquidity is important for a small business. Having sufficient funds is essential for running daily business operations as well as being prepared for any emergency. Lack of liquidity resulted in the collapse of many big companies during the 2008 financial meltdown despite having robust fixed assets and long-term investments.

Use the accounting software Akounto, to track your cash flows and get detailed reports to manage liquidity in your business.