Introduction to Non-Cash Expenses

Non-cash expenses are expenditures that do not involve a direct cash outflow but are still recorded in the company’s income statement.

[ez-toc]

They represent costs that impact the reported earnings but do not affect a company’s cash flow or reserves. These expenses are crucial in accounting as they help accurately reflect the company’s financial health.

Examples of non-cash expenses include depreciation and amortization, which account for the gradual wear and tear of assets over time, and stock-based compensation, which represents the cost of equity given to employees.

Understanding non-cash expenses is essential for accurate financial modeling and analysis. They may not decrease the cash reserves, but non-cash expenses reduce the company’s reported profits, potentially leading to future losses. Therefore, non-cash expenses are important in a company’s balance sheet and overall financial standing.

Types

Depreciation Expense

Depreciation is a non-cash expense representing the gradual wear and tear of tangible assets, such as machinery or buildings, over their useful life. The annual depreciation expense is calculated based on the purchase price of the asset and its estimated useful life. While it doesn’t involve a direct cash outflow, depreciation reduces a company’s profit and the reported value of fixed assets.

Amortization Expense

Amortization is similar to depreciation but applies to intangible assets, such as patents or trademarks. The amortization expense is calculated over the asset’s useful life and reduces the company’s profit and the value of its intangible assets on the balance sheet. Like depreciation, it’s a non-cash expense that doesn’t involve a direct cash outflow.

Unrealized Gains and Losses

Unrealized gains and losses are non-cash expenses related to investments or assets that have changed in value but have not yet been sold. For example, if a company’s shares increase, it records an unrealized gain. Conversely, if the shares decrease in value, it records an unrealized loss. These non-cash transactions don’t involve any actual cash flow until the asset is sold.

Bad Debts

Bad debts are another type of non-cash expense. When a company sells goods on credit, it records the sale as an asset (accounts receivable). However, if the customer fails to pay, the company must write down the asset’s value, creating a bad debt expense. This reduces the company’s profit and the value of its assets on the balance sheet without affecting its cash flows.

Stock-Based Compensation

Stock-based compensation is a non-cash expense where a company grants shares or stock options to employees or executives. While it doesn’t involve a direct cash outflow, it dilutes the company’s shares and is recorded as an expense on its income statement.

Non-cash Expense Examples

Example 1: Depreciation

Suppose a small business purchases a machine for $10,000 with a useful life of 10 years. The company would record a depreciation expense of $1,000 each year. This annual depreciation is a non-cash charge that reduces the company’s net income on the income statement, even though no cash payment is made.

Example 2: Stock-Based Compensation

Consider a tech startup that offers stock options as part of the compensation package to the employees. If the company grants $50,000 worth of stock options in a year, it records a $50,000 stock-based compensation expense on its income statement. This is a non-cash expense as it doesn’t involve a cash payment but reduces the company’s net income.

Example 3: Unrealized Losses

Imagine a company that invests in shares of another company. If the market value of these shares decreases, the company records an unrealized loss on its income statement. This unrealized loss is a non-cash item as it doesn’t involve a cash payment. However, it reduces the company’s net income and represents a decrease in its investment value.

Accounting Adjustments

Non-cash expenses require specific accounting adjustments to accurately reflect a company’s financial health. These adjustments primarily impact the company’s income statement, the calculation of operating profit, and tax implications.

Company’s Income Statement

The company’s income statement records non-cash expenses such as depreciation, amortization, and stock-based compensation. Even though they don’t involve cash payments, they reduce the company’s reported earnings. These expenses are added to the net income in the cash flow statement to show the cash flow from operating activities accurately.

Calculation of Operating Profit

Non-cash expenses also affect the calculation of operating profit. While they reduce the net income, they are considered operating expenses and are included in the calculation of operating profit or EBIT (Earnings Before Interest and Taxes). This is because they represent the cost of using assets to generate revenue.

Impact on Taxes

Non-cash expenses can also have tax implications. Since these expenses reduce the company’s reported earnings, it can lower its taxable income, potentially reducing the taxes owed. For example, depreciation and amortization are tax-deductible expenses in many jurisdictions.

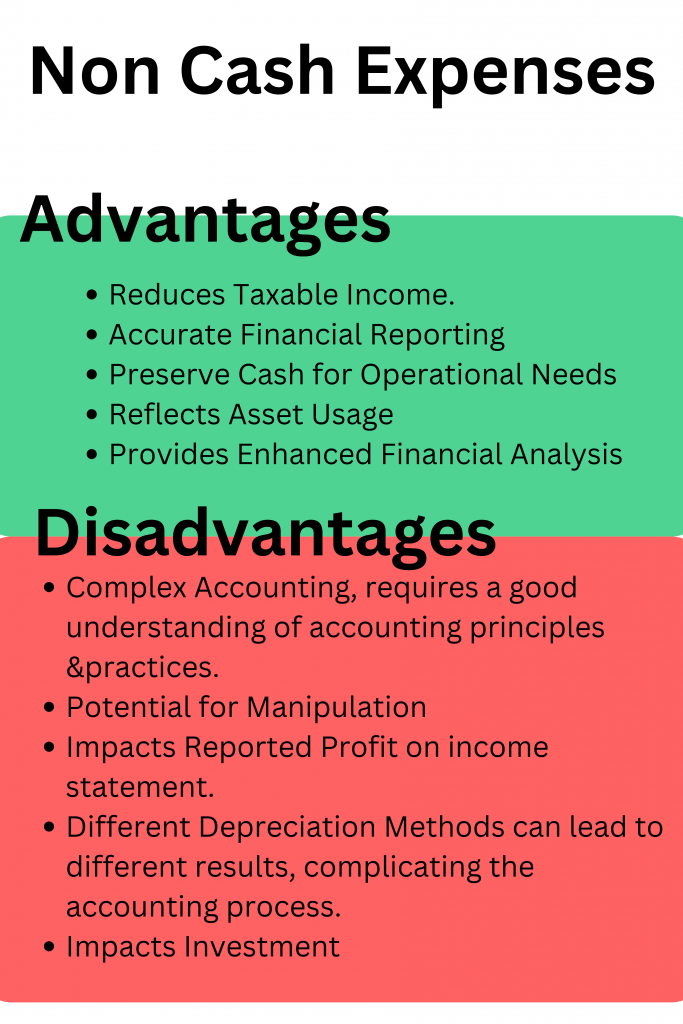

Advantages

- Tax Benefits: Non-cash expenses such as depreciation and amortization can reduce a company’s taxable income, potentially leading to tax savings.

- Accurate Financial Reporting: By accounting for the wear and tear of assets over time, non-cash expenses like depreciation and amortization help provide a more accurate picture of a company’s financial health on its financial statements.

- Cash Flow Management: Non-cash expenses do not involve actual cash outflows, allowing businesses to preserve their cash for other operational needs, and do not impact the cash flow statement.

- Reflects Asset Usage: Depreciation and amortization reflect the usage of fixed and intangible assets over time, helping businesses track and manage their assets effectively.

- Enhanced Financial Analysis: Non-cash expenses are crucial for financial analysis, impacting key metrics like net profit and free cash flow.

Disadvantages

- Complex Accounting: Accounting for non-cash expenses can be complex and requires a good understanding of accounting principles and practices.

- Potential for Manipulation: Companies can manipulate non-cash expenses to inflate their reported earnings or free cash flow.

- Impacts Reported Profit: Non-cash expenses reduce a company’s reported profit on its income statement, which might not reflect its actual cash profit.

- Depreciation Methods: Different methods of calculating depreciation can lead to different results, adding another layer of complexity to the accounting process.

- Impacts on Investment Decisions: Investors and analysts must understand and adjust for non-cash expenses when making investment decisions, adding to their analysis workload.

Conclusion

Non-cash expenses serve as strategic tools in financial accounting. They simultaneously reduce reported profits, thereby mitigating tax liabilities, while also possessing the potential to misrepresent financial health through artificial losses. These expenses circumvent the cash flow statement, directly impacting the income statement. Thus, they play a dual role, offering tax advantages and influencing the perceived financial performance of a company.

Use Akounto’s accounting software to see the financial performance of your business in real time and track all your profits, cash and non-cash expenses from its intuitive dashboard.