Introduction to Operating Profit Margin

The company’s operating margin represents the profits remaining after subtracting the COGS (cost of goods sold) and operating expenses from the revenues within a specific period.

What’s covered in the article

The operating margin estimates the profits earned before non-operating expenses are settled by establishing a relationship between the company’s operating income (EBIT) and revenue.

The operating profit margin, a profitability ratio, is interchangeably used with operating margin, operating income margin, operating income percentage, and operating profitability ratio.

The operating margin measures the percentage of a company’s revenue that is retained as operating profit. This is a significant metric for investors as it reflects the business’s profitability and allows for convenient comparisons between competing businesses or industries.

This metric provides insights into how efficiently the company generates profit through its core operations.

It is expressed per sale, accounting for variable costs but excluding interest and taxes (EBIT). A good operating profit margin serves as a valuable ratio for assessing the profit-earning capacity of an entity. It showcases the revenue left after all expenses are paid, indicating the value added by the business.

Higher operating margins are generally considered more favorable than lower margins and can be compared among similar competitors within the same industry.

Analysts, creditors, and investors rely on this metric to evaluate business performance, as it helps them gauge the return on their investment. Lenders also find it useful in assessing loan repayment capacity, as profitability is a crucial criterion.

Significance of Operating Profit Margin

The operating profit margin is an important measure that provides valuable insights into a company’s financial performance and operational efficiency. It quantifies the percentage of profit a business generates from each dollar of sales derived from its core operations.

Operating profit is instrumental in assessing how well a company manages its operations, controls costs, and compares to other companies within the same industry.

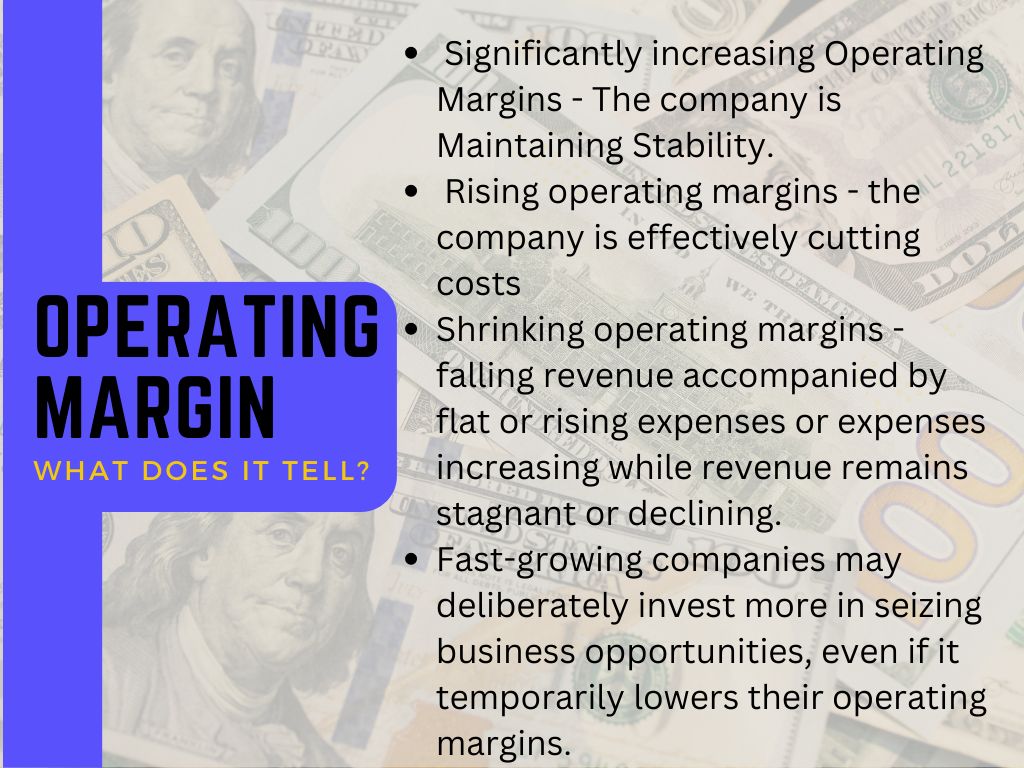

Steadily increasing operating margins indicate a balance between revenue and expenses. The company is maintaining stability when both are growing at a similar pace.

Rising operating margins imply that revenue is growing faster than expenses or that the company is effectively cutting costs.

Shrinking operating margins may indicate scenarios such as rising expenses surpassing revenue growth, falling revenue accompanied by flat or rising expenses, or expenses increasing while revenue remains stagnant or declining.

Fast-growing companies may deliberately invest more in seizing business opportunities, even if it temporarily lowers their operating margins.

The highly variable operating margin shows significant business risks, while consistent improvement in operating margins suggests enhanced performance.

Calculating Operating Margin

The operating margin is a significant financial ratio measuring the relationship between a company’s operating profit (EBIT) and revenue.

To calculate a company’s operating income, deduct the operating expenses (OpEx) from the gross profit. The gross profit is obtained by subtracting the cost of goods sold (COGS) from the revenue generated in a specific period.

Operating income represents the earnings that remain after accounting for all expenses related to the company’s core operations. This includes both COGS and OpEx. The cost of goods sold comprises direct costs like materials and direct labor.

Operating expenses encompass selling, SG&A (general and administrative expenses), and R&D (research and development) expenses, excluding interest and taxes.

Operating Profit Margin Formula

Operating Margin (%) = EBIT / Revenue

The operating margin is expressed as a percentage by dividing the operating profit (EBIT) by the revenue and multiplying the result by 100.

The higher the operating margin, the more efficiently the company converts revenue into operating profit.

Examples

Example 1

Following are the details of Company A

Total revenue = $20 million in revenue,

Cost of Goods Sold (COGS) = $8 million

Operating Expenses (SG&A) = $3 million

Calculate operating profit margin.

Solution

To calculate the operating margin, first calculate the operating profit, which will be revenue minus operating expenses and COGS.

Operating Profit = Revenue – COGS – Operating Expenses

Operating Profit (EBIT) = $20 million – $8 million – $3 million = $9 million

Operating margin formula

Operating Margin (%) = EBIT / Revenue

Operating Profit Margin (%) = ($9 million / $20 million) * 100 = 45%

In the above example, Company XYZ has an operating profit margin of 45%, meaning it retains $0.45 in operating profit for every dollar of revenue generated.

Example 2

The income statement of ABC Corporation:

Gross Sales: $1,000,000

Sales Returns: $50,000

Cost of Goods Sold: $300,000

Labor Expenses: $100,000

General & Administration Expenses: $150,000

Calculate Operating Margin.

Solution

To calculate the operating profit margin, first, find the net sales by subtracting the sales returns from the gross sales.

Net Sales = Gross Sales – Sales Returns = $1,000,000 – $50,000 = $950,000

Next, deduct the COGS, labor, and general & administration expenses from the net sales to determine the operating profit.

Operating Profit = Net Sales – COGS – Labor Expenses – General & Administration Expenses = $950,000 – $300,000 – $100,000 – $150,000 = $400,000

Using the operating margin formula, we can calculate the operating profit margin: Operating Margin (%) = (Operating Profit / Net Sales) 100 = ($400,000 / $950,000) 100 = 42.1%

The company’s operating margin is 42.1%.

Factors Affecting Operating Margin

- Industry Competition: Intense competition within the industry can impact operating margins. Companies may face pressure to lower prices to remain competitive, affecting profitability.

- Pricing Strategy: The pricing strategy that balances competitiveness with profitability can influence operating profit margins.

- Cost of Goods Sold (COGS): The cost of producing goods or delivering services is a significant factor. Effectively managing COGS can improve profit margins, as higher costs can squeeze profitability.

- Operating Expenses: Fixed costs, such as rent and salaries, remain relatively constant regardless of production levels, while variable costs, like raw materials and utilities, fluctuate with production.

- Economies of Scale: Companies that benefit from economies of scale can achieve lower costs per unit, leading to higher profit margins. Scaling operations can enhance profitability.

- Product Mix: Products or services with higher margins contribute to improved overall profitability.

- Efficiency and Productivity: Operational efficiency and productivity levels affect profit margins. Streamlined processes, effective resource utilization, and optimized operations can boost profitability.

- Market Conditions: Changes in customer preferences or economic downturns can influence pricing and overall profitability.

- Technology and Innovation: Adopting innovative technologies and continuous improvement initiatives can enhance efficiency, reduce costs, and improve profit margins.

- Excess Inventory: Holding excess inventory can lead to increased operating costs and lower profit margins.

Limitations of Operating Margin

- Operating margin excludes non-operating income and expenses, such as interest and taxes.

- The operating margin does not consider the company’s financing structure or capital investments.

- Operating margin ignores the impact of one-time or extraordinary items on profitability.

- Operating margins may not capture variations in accounting methods across different companies.

- Operating margin does not provide a comprehensive view of a company’s financial performance.

- Does not account for differences in industry norms or benchmarks.

- The operating margin does not consider business operations’ timing and cyclical nature.

- Temporary fluctuations may influence operating margins in revenue or expenses.

- The operating margin does not reflect the company’s ability to generate cash flows or manage liquidity.

Other Profit Margin Ratios

- Operating Cash Flow Margin: This ratio measures the percentage of operating cash flow generated from a company’s total revenue. It indicates how effectively a company converts sales into cash flow from operations.

- FCF Margin: Free Cash Flow Margin shows the percentage of free cash flow a company generates from its total revenue. It reflects the company’s ability to generate cash after meeting capital expenditures and working capital needs.

- EBITDA Margin: EBITDA Margin measures the profitability of a company’s core operations by expressing earnings before interest, taxes, depreciation, and amortization (EBITDA) as a percentage of total revenue. It provides insights into operational efficiency and profitability.

- Adjusted EBITDA Margin: Adjusted EBITDA Margin is similar to EBITDA Margin but excludes certain non-recurring or non-operational items from the calculation. It provides a more accurate picture of a company’s ongoing operating profitability.

- NOPAT Margin: Net Operating Profit After Tax Margin represents the percentage of net operating profit after deducting taxes from total revenue. It assesses a company’s profitability after accounting for tax expenses.

- Pre-Tax Profit Margin: Pre-Tax Profit Margin calculates the percentage of pre-tax profit generated from total revenue. It indicates a company’s ability to generate profits before accounting for taxes.

- Net Profit Margin: Net Profit Margin gives the percentage of net profit earned from total revenue. After accounting for all expenses, including taxes and interest, it reflects a company’s overall profitability.

Conclusion

Operating profit margin is a vital financial metric that assesses a company’s profitability and efficiency in generating profit from its core operations. It provides insights into a company’s capability to control costs, manage expenses, and compare performance within an industry. It has limitations and should be used with other financial ratios for a comprehensive analysis.

Get the latest accounting information at Akounto and unlock your business potential with our accounting software.