Introduction

Reimbursable expenses, also called billable expenses, are costs incurred by an individual on behalf of a company or client. These expenses are typically out-of-pocket costs that the company later reimburses.

What’s covered in the article

Reimbursable expenses can range from travel and lodging costs during a business trip, office supplies purchased for work or even business phone calls made using a personal phone. The key characteristic of these expenses is that the employee, not the company, initially pays from their own pocket.

The key characteristic of reimbursable expenses is that the company reimburses the employee, thus the term “reimbursable expenses.”

Understanding and properly managing reimbursable expenses is crucial for both small businesses and large corporations. It ensures that employees are fairly remunerated for their expenditures and helps the company keep track of its financial obligations.

This is particularly relevant for small businesses, where tight control of expenses can be the difference between success and failure.

However, not all expenses incurred by an individual can be considered reimbursable. The company’s policy, common sense, and the nature of the expense play a significant role in determining whether a cost is reimbursable or not.

For instance, costs that are ordinary and necessary for conducting business, such as travel for a business trip, are typically reimbursable. On the other hand, personal expenses or costs not directly related to the business may not qualify for reimbursement.

It’s essential to have a clear understanding of what constitutes a reimbursable expense within a specific business context. This knowledge can help prevent misunderstandings and disputes and ensure that the process of claiming and reimbursing expenses runs smoothly.

Reimbursable and Non-reimbursable Expenses

It’s crucial to distinguish between reimbursable and non-reimbursable expenses. This distinction helps maintain financial transparency and ensures that employees are adequately compensated for their out-of-pocket expenditures.

Reimbursable expenses are costs that employees incur while performing their job duties. The employee initially pays for these expenses but is later reimbursed by the company.

Common reimbursable expenses include travel costs associated with a business trip, such as airfare, lodging, and meals. Other examples could be office supplies purchased for work, mobile allowances, or even business-related phone calls made from a personal device.

Non-reimbursable expenses are costs that the company does not repay to the employee. These expenses are often personal or unrelated to the employee’s job duties.

For instance, an employee might stay at a luxury hotel during a business trip. If the cost of this hotel exceeds a reasonable amount set by the company’s travel policy, the excess may be considered a non-reimbursable expense.

Similarly, personal expenses, such as valet services or personal grooming items, are typically non-reimbursable as they do not directly contribute to business purposes.

It’s important to note that what constitutes a reimbursable expense can vary from one company to another.

Some companies might reimburse for work-related use of personal devices, while others may provide employees with separate accounts or devices for work purposes, making personal device use non-reimbursable.

Similarly, some companies might combine invoices for all employees on a business trip, while others might require each employee to submit individual expense reports.

Understanding the difference between reimbursable and non-reimbursable expenses is crucial for employees and the company. It helps employees manage their expenses wisely and allows the company to maintain financial control and integrity.

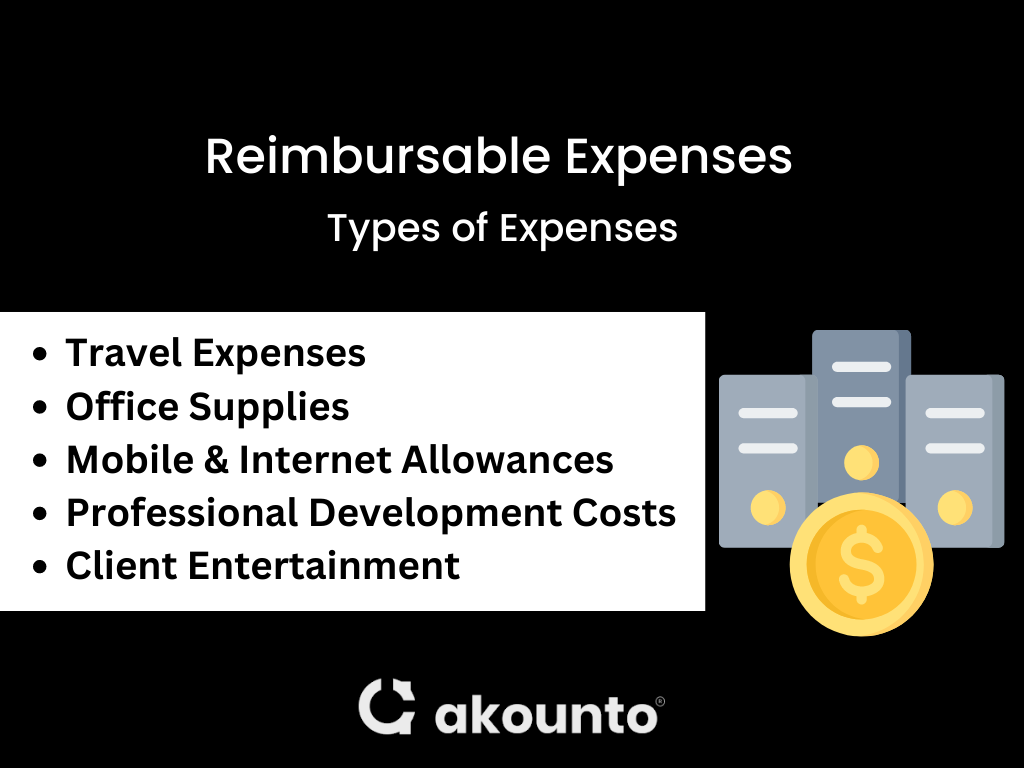

Types and Examples

Travel Expenses

One of the most common types of reimbursable expenses is travel costs. These can include airfare, car rentals, fuel costs, public transportation fares, and lodging costs for overnight stays. Meals during a business trip can also be considered reimbursable, provided they fall within the company’s guidelines for reasonable spending.

Office Supplies

When employees purchase office supplies with their own money for business purposes, these costs are typically reimbursable. This can include items like stationery, printer ink, or even larger items like a work computer or other office equipment if approved by the company.

Mobile and Internet Allowances

In today’s digital age, employees often use their personal devices and internet connections for work. Some companies offer mobile and internet allowances to cover these costs. This can include the cost of business phone calls made from a personal device or a portion of the employee’s internet bill if they work from home.

Professional Development Costs

Some companies reimburse employees for costs related to professional development. This can include the cost of attending seminars, workshops, conferences, or fees for professional certification courses related to the employee’s job role.

Client Entertainment

If an employee takes a client out for a meal or arranges an event to entertain a client, these costs can be considered reimbursable. However, companies often have strict policies about reasonable spending in these situations.

Tracking and Managing Reimbursable Expenses

Here are some key aspects to consider:

Accurate Record Keeping

Accurate record-keeping is the first step in managing reimbursable expenses. Employees should keep original receipts and other proof of their expenses. This not only helps in validating the expense but also is essential for tax purposes.

Use of Accounting Software

Modern accounting software can significantly simplify tracking and managing reimbursable expenses. These tools can automate manual data entry, making it easier to record reimbursable business expenses accurately. They can also help categorize expenses, making it easier to distinguish between different types of costs, such as office expenses, travel expenses, and medical expenses.

Regular Expense Reports

Regular expense reports are a crucial part of managing reimbursable expenses. These reports provide a detailed account of all expenses incurred by an employee, making it easier for the accounting department to verify and process reimbursements.

Clear Communication

Clear communication between the finance team and other team members is essential for effectively managing reimbursable expenses. Employees should be aware of what constitutes a reimbursable expense, how to record these expenses, and how to submit their expense claims.

Tax Considerations

Reimbursable expenses can have tax implications for both the company and the employee. For instance, some reimbursed expenses may be taxable income for the employee. Therefore, it’s crucial to understand the tax rules surrounding reimbursable expenses and to record and report these expenses accurately.

Regular Audits

Regular audits of expense claims can help prevent fraud and ensure that all reimbursements are justified and in line with company policy. This can also help identify any patterns of excessive spending or other issues that must be addressed.

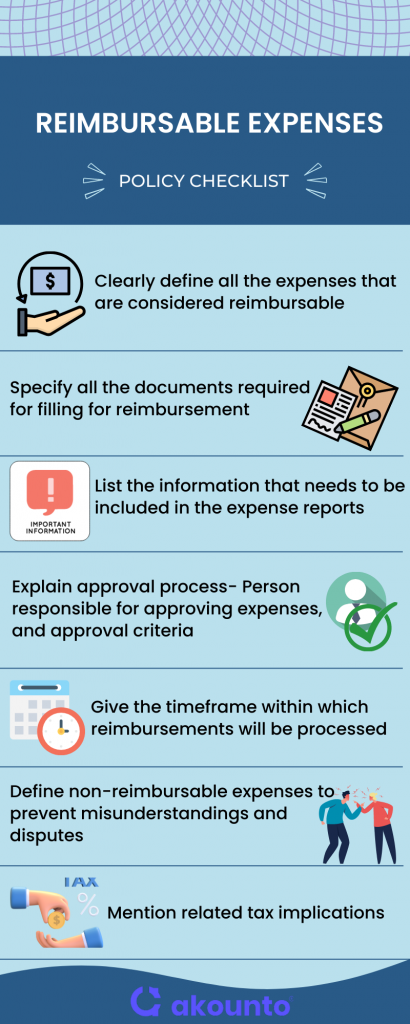

Formulating Policy for Reimbursable Expenses

A well-defined reimbursable expenses policy is a cornerstone of effective expense management. It provides clear guidelines for employees and ensures consistency in handling business expenses across the organization. Here are some key elements that a comprehensive policy should include:

- Clear Definitions: The policy should clearly define what constitutes a reimbursable expense within the business context, providing common examples, such as travel expenses, office supplies, and professional development costs.

- Documentation Requirements: The policy should specify the type of documentation required for expense reimbursement. This typically includes original receipts, invoices, or other proof of payment. It should also specify the information that needs to be included in an expense report, such as the date of the expense, the purpose of the expense, and the total cost.

- Approval Process: The policy should outline the process for approving expense reimbursements. This includes who is responsible for approving expenses, the criteria for approval, and the timeframe within which reimbursements will be processed.

- Non-reimbursable Expenses: Just as it’s important to define what expenses are reimbursable, the policy should also clearly state what expenses are not eligible for reimbursement. This can help prevent misunderstandings and disputes.

- Tax Implications: The policy should guide the tax implications of reimbursable expenses. This can help employees understand how their reimbursements might affect their taxable income and can assist the company in accurately reporting these expenses for tax purposes.

A well-crafted policy helps manage business expenses effectively and ensures fair treatment of employees. It provides a clear framework for employees to follow when incurring expenses on behalf of the company, ensuring that they are adequately compensated for their out-of-pocket costs.

Tax Implications

Understanding the tax implications of reimbursable business expenses is crucial for businesses and employees. It can impact the company’s tax deductions and the employee’s taxable income. Here are some key points to consider:

Employee Expenses

When employees spend on behalf of the company, these costs are typically not considered taxable income for the employee, provided they are reimbursed under an accountable plan.

An accountable plan requires employees to adequately account for their employee expenses and return any excess reimbursements within a reasonable time. If these conditions are met, the reimbursed expenses are not reported as income, and employees are not subject to income tax.

Business Expenses

For businesses, billable expenses are typically considered business expenses and are, therefore, tax-deductible. This means the company can deduct these costs from its taxable income, reducing its overall tax liability. It’s important to note that to claim these deductions, the company must keep accurate records of these billable expenses and the reimbursements made to employees.

Taxable Reimbursements

Reimbursements can be considered taxable income for the employee. This typically happens when the expenses are reimbursed under a non-accountable plan, where the employee does not need to adequately account for their expenses or return excess reimbursements. In these cases, the reimbursements are reported as income to the employee and are subject to income tax and payroll taxes.

Tax Deductions

If an employee does not receive a reimbursement for a business expense, or if the reimbursement is included in their taxable income, the employee may be able to claim a tax deduction for these expenses. However, the rules for these deductions can be complex, and employees should consult with a tax professional to understand their options.

Use Cases

- Reimbursable Expense: John, a sales executive, travels to a client meeting. He pays for his flight, hotel, and meals using his personal credit card. Upon returning, he submits his expense report with all receipts. His company reimburses him for these business travel expenses.

- Unreimbursed Expense with Tax Deduction: Sarah, a freelance designer, purchases a new laptop for her work. Her client doesn’t reimburse this expense. However, she deducts this cost as a business expense at tax time, reducing her taxable income.

- Reimbursement Treated as Income: Mike receives a flat monthly car allowance from his employer to cover his travel expenses. He doesn’t need to submit any receipts. The IRS treats this allowance as income, and Mike pays taxes on it.

- Partly Reimbursed Expense: Emma attends a conference for professional development. She pays for the registration fee and her meals. Her company has a policy to reimburse only the registration fee. Emma gets reimbursed for the registration but bears the cost of meals herself.

Conclusion

Understanding and managing reimbursable expenses is crucial for businesses. From business travel to purchases made on personal credit cards, it’s essential to accurately record reimbursable expenses. As tax time approaches, finance teams must ensure that team reimbursements are handled correctly.

While most companies have policies in place, continuous review and improvement of these policies can lead to more efficient expense management.

Akounto helps maintain expense records and generate reports, allowing businesses to make sound business decisions and timely reimburse employees. Visit the website to know more.