Introduction to Accumulated Depreciation

Accumulated depreciation is the cumulative depreciation expense for an asset recorded over time to a specific date. Accumulated depreciation is a contra asset with a credit balance, which is shown in the balance sheet under related fixed assets.

What’s covered in the article

Estimated reading time: 8 minutes

Accumulated depreciation is subtracted every year from the historical cost of the asset to arrive at the “carrying value” of that asset, also called the asset’s “net book value.” Therefore, accumulated depreciation offsets the related fixed asset.

Accumulated depreciation increases overtime as depreciation expenses get added up year after year for a particular asset. At the end of the useful life of the asset, when it is sold or scrapped, the accumulated depreciation is reversed and removed from the balance sheet.

Asset’s Carrying Value = Historical Cost – Accumulated Depreciation

Every asset has an estimated “useful life.” The company expects to either sell the asset or sell in the scrap at the end of the useful life, generating a value known as “salvage value”. By the end of the useful life, the carrying value of the asset should match the salvage value.

Depreciation represents the gradual reduction in the value of an asset due to factors such as wear and tear, obsolescence, or the passage of time. It is an essential aspect of financial reporting as it accurately reflects the diminishing value of assets over their useful lives.

IFRS “IAS 16 — Property, Plant and Equipment,” deals with measuring the carrying value of assets, recognizing assets, depreciation expenses, and any impairment losses for related assets.

Accumulated Depreciation in Accounting

Accumulated depreciation plays a significant role in accurately reflecting the value of an asset and adhering to accounting rules. It represents the cumulative depreciation recorded for a fixed asset over time, considering factors such as wear and tear, obsolescence, and the passage of time.

Accounting rules require that the depreciation expense be spread over the asset’s estimated useful life to match expenses and sales properly. The portion of the asset’s cost is recognized as depreciation expense in the year of purchase and throughout its remaining useful life.

The depreciation expense is allocated appropriately, aligning with recognizing expenses in the same period as the associated revenue.

Each year, the depreciation expense account is debited with the calculated amount, reflecting the portion of the asset’s value being expensed. Simultaneously, the accumulated depreciation account is credited for the same amount. This process continues over the asset’s useful life, resulting in the gradual buildup of accumulated depreciation.

The accumulated depreciation account carries a credit balance as a contra-asset account. It appears on the balance sheet after the deduction from the gross amount of reported fixed assets. The net book value is determined by reducing the accumulated depreciation from the asset’s original cost, indicating the asset’s current worth.

Accumulated depreciation accounts for a depreciation expense incurred in earlier years up until the current period, reflecting the total amount of depreciation charged against the asset’s value, considering it’s remaining useful life.

By accurately tracking accumulated depreciation, businesses can assess the asset’s true value, make informed financial decisions, and ensure compliance with accounting standards and regulations.

Accumulated depreciation is crucial in determining an asset’s salvage value. As the accumulated depreciation increases, the asset’s carrying value approaches its salvage value, ultimately determining the point at which the asset is fully depreciated and no longer carries any value on the balance sheet.

Methods

Different depreciation methods are employed by businesses to distribute the cost of an asset and calculate accumulated depreciation. Three commonly used methods are the

- Straight Line Method,

- Double Declining Balance Method, and

- Modified Accelerated Cost Recovery System (MARCS).

Straight Line Depreciation Method

The Straight Line Method is a widely used depreciation method that evenly distributes the cost of an asset over its estimated useful life. Under this method, the depreciation expense remains constant throughout the asset’s life. The formula for calculating accumulated depreciation using the Straight Line Method is straightforward: Annual Depreciation Expense = (Cost of Asset – Estimated Residual Value) / Useful Life.

Double Declining Balance Method

The Double Declining Method is basically an accelerated depreciation method that allows for higher depreciation expenses in the starting years of an asset’s life. It assumes that the asset will generate more revenue in its initial years and therefore allocates a larger portion of its cost to those years. The formula for calculating accumulated depreciation under this method involves applying a fixed percentage, typically twice the straight-line rate, to the asset’s net book value.

Modified Accelerated Cost Recovery System (MARCS)

MARCS (Modified Accelerated Cost Recovery System) is a depreciation method commonly used for tax purposes in the United States. It assigns different recovery periods to various categories of assets, such as tangible assets and intangible assets.

MARCS follows a predetermined schedule provided by tax regulations, allowing businesses to calculate accumulated depreciation and deduct it from their taxable income accordingly.

Accumulated Depreciation Formula

The accumulated depreciation formula using the Double Declining Method is as follows:

Depreciation Expense = (Book Value – Accumulated Depreciation) x Depreciation Rate

The Depreciation Rate is determined by doubling the straight-line depreciation rate. The formula for calculating the straight-line depreciation rate is:

Straight-Line Depreciation Rate = 1 / Useful Life

Example

Question: A computer system has an original cost of $2,000 and an estimated useful life of four years. Calculate the accumulated depreciation for this asset using the Straight Line Method, Double Declining Balance Method, and Modified Accelerated Cost Recovery System (MARCS).

Straight Line Method

Under the Straight Line Method, the annual depreciation expense is calculated by dividing the acquisition cost of the asset by its useful life.

The annual depreciation expense would be $500 ($2,000 / 4). Therefore, the accumulated depreciation at the end of each year would be as follows:

- Year 1: $500

- Year 2: $1,000

- Year 3: $1,500

- Year 4: $2,000 (fully depreciated)

Double Declining Balance Method

Using the Double Declining Balance Method, we first determine the depreciation rate, which is double the straight-line rate. In this case, the depreciation rate would be 50% (2 * (1 / 4)). The accumulated depreciation at the end of each year would be as follows:

- Year 1: $1,000 (50% of $2,000)

- Year 2: $1,500 (50% of the remaining book value: $2,000 – $1,000)

- Year 3: $1,750 (50% of the remaining book value: $1,500 – $750)

- Year 4: $2,000 (fully depreciated)

Modified Accelerated Cost Recovery System (MARCS)

Under MARCS, different assets have assigned recovery periods. Let’s assume the computer system falls under a three-year recovery period. The depreciation deductions for each year would be as follows:

- Year 1: $666 ($2,000 / 3)

- Year 2: $888 ($2,000 / 3)

- Year 3: $444 ($2,000 / 3)

The accumulated depreciation at the end of each year would be as follows:

- Year 1: $666

- Year 2: $1,554 ($666 + $888)

- Year 3: $1,998 ($666 + $888 + $444)

These calculations illustrate how accumulated depreciation accumulates over time under different depreciation methods. It is important to note that these examples are for illustrative purposes, and actual depreciation amounts may vary based on a business’s specific circumstances and depreciation policies.

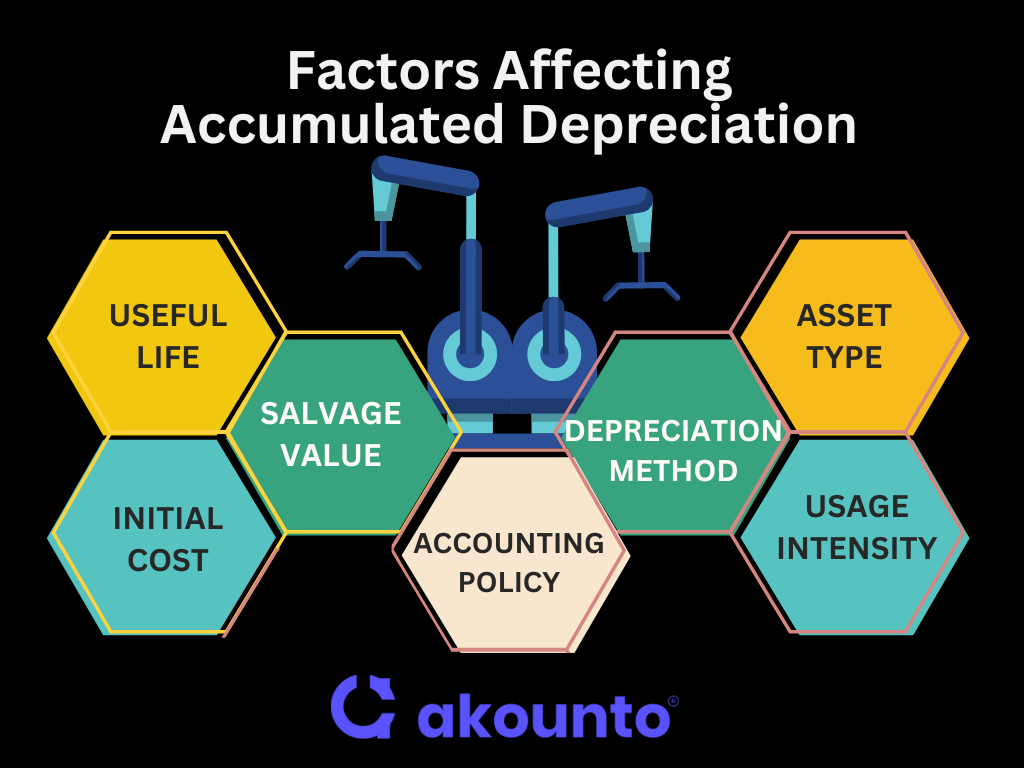

Factors Affecting Accumulated Depreciation

Useful Life

The estimated useful life of an asset plays a significant role in determining the depreciation period. Assets with longer useful lives are depreciated over an extended duration, spreading the cost over time.

Salvage Value

The anticipated value of an asset at the end of its useful life, known as the salvage value, impacts depreciation calculations. A higher salvage value reduces the depreciation expense, representing the value expected to be retained.

Initial Cost

The asset’s original cost, including any additional expenses incurred during acquisition, forms the basis for depreciation calculations. A higher initial cost results in higher depreciation amounts.

Depreciation Method

The chosen depreciation method, such as straight-line, declining balance, or units-of-production, affects how depreciation expenses are distributed over time. Each method employs a distinct formula to allocate depreciation.

Asset Type

Different types of assets, such as buildings, machinery, vehicles, or land improvements, have varying depreciation rates and useful lives. For instance, land is generally considered to have an indefinite useful life. It is not depreciated, while improvements made on land, such as buildings or infrastructure, are subject to depreciation.

Usage Intensity

Assets subjected to heavy usage or wear and tear tend to experience faster depreciation due to their higher rate of value decline. Factors such as the number of hours a machine operates or the mileage driven by a vehicle can impact the depreciation rate.

Changes in Accounting Policies

Any alterations in the accounting methods or policies for depreciation can affect the amount and timing of depreciation expenses reported on financial statements. Businesses must consider these changes and ensure adherence to relevant accounting standards.

Conclusion

Accumulated depreciation plays a crucial role in financial reporting and decision-making. It reflects an asset’s value decrease over time and impacts a company’s balance sheet. By accurately tracking accumulated depreciation and considering the applicable accounting method, businesses can make informed choices regarding asset management and effectively manage their tax liabilities.

For more informative articles on depreciation and other accounting-related knowledge, visit the Akounto blog today.