What is a Receipt?

A receipt is a written or electronic document that serves as proof of purchase in a transaction between a buyer and a seller.

What’s covered in the article

A receipt includes the transaction date, purchased items, the bill amount, and payment method.

The purpose of a receipt is to serve as evidence of purchase and to document the transaction for accurate recordkeeping purposes. Receipts can be used for warranty claims, tax purposes, and reimbursement for business expenses.

Types of Receipts

There are several types of receipts, including cash register tapes, handwritten receipts, carbon copies, and packing slips.

The Internal Revenue Service (IRS) suggeststhat small businesses should retain the following receipts: (Gross receipts, Receipts from purchases and raw materials, Invoices, Credit card receipts, Cash register tape receipts, and Petty cash slips)

Cash Register Tape Receipts

Cash register receipts are printed slip receipts issued to customers when they purchase. These are commonly used in a retail environment, like department stores, where customers make purchases at a point of sale (POS) system.

Carbon Copies

Carbon copy receipt is when vendors write a receipt in receipt notebooks with a carbon layer behind each page. Many businesses, like service providers and contractors, commonly use carbon copy receipts to provide a copy to the customer while retaining one for their records.

Handwritten Receipts

A handwritten receipt is a type of receipt that is issued by a seller or service provider in which the details of the transaction are handwritten on the receipt page.

Packing Slips

A packing slip receipt is a document in a shipped product package that provides information about the order and the items included in the package. It includes the item name, quantity, price, and order number.

Other than the ones mentioned above, some common receipt types to know of are:

- sales receipt

- payment receipt

- rent receipt

- donation receipt

- tax receipt

- service receipt

- petty cash receipt

- credit card receipt

- gross receipts

The specific type of customer receipts a business uses will depend on the transaction’s nature and the parties’ requirements.

Contents of a Receipt

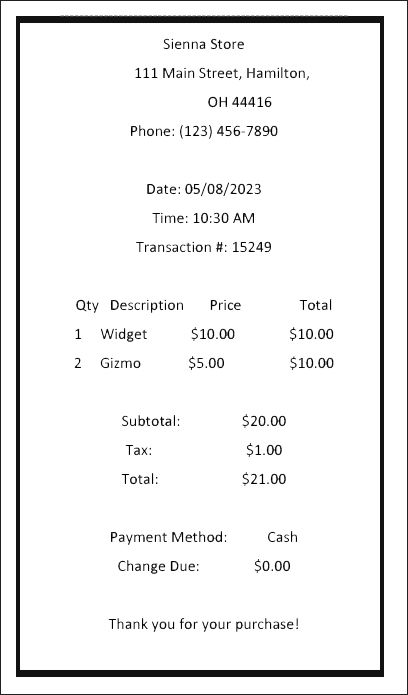

A typical receipt contains several important information about the underlying transaction, including:

- Name & Address of the seller: Identifies the seller from whom the goods or services are purchased.

- Transaction Date: The purchase date of goods or services.

- Item Description: Gives information about the purchase’s quantity, price, and applicable discounts.

- Amount Paid: The total purchase cost, including any taxes or fees of the goods.

- Payment Method: indicate how the customer has paid for the purchase, such as online bank transfer, cash sales, or by cheque.

- Return Policy: Outlines the terms of the seller in case the customer needs to return or exchange the purchased items.

Example

When is a Receipt Issued?

A receipt is issued at the time of payment or upon transaction completion. It serves as proof of payment and includes important information such as the transaction date, the amount paid, and a description of the goods or services purchased.

A receipt may be issued electronically, as an email or text message, while in others, it may be a physical document, such as a printed receipt from a cash register or a handwritten receipt.

Importance

- The receipt provides a transaction record and serves as proof of payment.

- Helps prevent payment disputes.

- Used for accounting and sales tax purposes.

- Provides proof of purchase and payment (buyer side), which is important for warranty or guarantee claims and for returning or exchanging items.

- Used for budgeting and tracking certain expenses,

- Receipts are necessary for tax deductions or reimbursements.

- Required by law or industry regulations. For example, in many countries, businesses must issue receipts for certain types of transactions, such as those involving sales tax, and failure to do so can result in penalties or fines.

- A receipt provides a clear record of exchanging goods or services for payment.

How Long Is A Receipt Valid For?

The validity of a receipt mainly depends on the purpose for which you need it.

For tax purposes, keeping receipts for at least three years is recommended. The IRS can audit tax returns up to three years after filing them.

For warranties or returns, the validity of the receipt may depend on the specific terms and conditions set forth by the manufacturer or retailer. For example, some may require you to keep the receipt for only a few months, while others may ask you to keep it for a year or more.

It’s a good practice to keep receipts for business-to-business dealings or important transactions longer. And if you’re unsure whether you should keep a particular receipt, it’s better to err on caution and hold onto it for a while.

Digital Receipts and IRS Requirements

IRS mandates digital receipts must include the same information as traditional paper receipts, like the vendor’s name and address, transaction date, the amount paid, and a description of the goods or services purchased.

Digital receipts must be easily accessible and stored to allow easy retrieval. Businesses should also ensure that their systems are secure and tamper-proof.

A business owner must retain the receipts for at least three years post-filing taxes. It means there should be a system for storing and retrieving these receipts (like Cloud), and you must be able to provide them to the IRS upon request.

Are the receipt and invoice the same?

No, a receipt and an invoice are not used for the same purpose.

An invoice is a payment request issued by a seller to a buyer before a transaction occurs. It outlines the goods or services that will be provided, along with the terms of the sale, including the price, payment terms, and due date.

A seller issues a receipt to a buyer after a transaction occurs. It acts as proof of payment and includes details such as the transaction date, the amount paid, and a description of the goods or services purchased. It is against the money received for a service or product.

An invoice is a document that initiates a transaction, while a receipt is a document that confirms that the transaction has been completed and payment has been made.

Conclusion

Receipts are vital in documenting financial transactions and expense management. Businesses and customers need to understand what a receipt is as it contains information on return policies, warranties, and other important details. Accurate recordkeeping of the receipts also allows business owners to track their business’s financial performance, record deductible expenses, and prepare tax returns.

Looking for a reliable and user-friendly platform for accounting, invoicing, taxation and other information to grow your small business? Check out the Akounto blog section. We provide helpful tips and insights on managing the business finances.