What are Business Expenses?

Business expenses are the costs incurred during the regular operations of a business which are necessary to ensure smooth business operations and to generate revenue. Some business expenses can be deducted from a company’s revenues to determine its taxable income, reducing overall tax liability.

What’s covered in the article

For small business owners, understanding, categorizing and managing business expenses helps in budgeting, financial planning, and maximizing tax deductions.

Business expenses can vary widely depending on the nature and scale of the business. For instance, a digital marketing agency might have high online advertising costs, while a brick-and-mortar store might have higher rent or mortgage payments.

For a small business, understanding the nuances of these expenses is paramount. It aids in effective budgeting, strategic financial planning, and maximizing tax deductions during tax filing. The Internal Revenue Service (IRS) offers provisions for certain business expenses, termed deductible business expenses, to be subtracted from a company’s revenues. This subtraction determines its taxable income, potentially reducing the overall tax liability.

Not all business expenses qualify for these deductions. It’s crucial to categorize business expenses accurately. Proper categorization ensures compliance with state and local taxes, allows businesses to track spending patterns, and makes informed financial decisions. Moreover, understanding the distinction between business deductions and non-deductible expenses can save money for the business, especially during tax time.

Some expenses are investments a company makes to serve its customers, grow its market share, and achieve its financial goals.

Tax Deductible Business Expenses

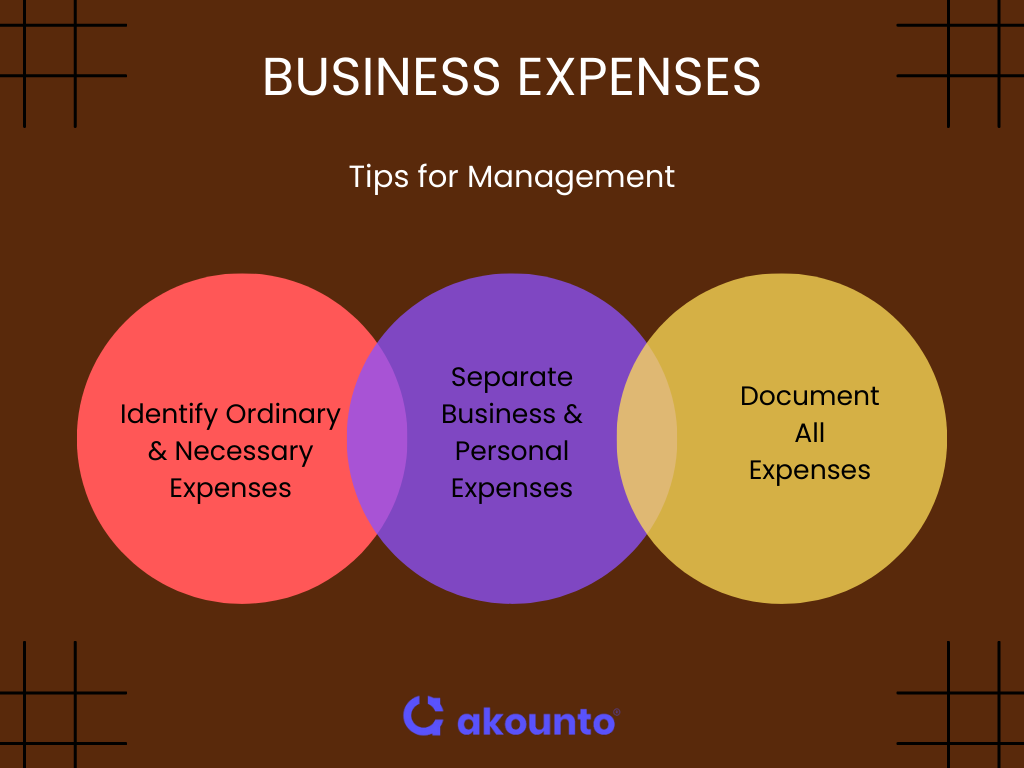

Understanding which business expenses are tax deductible can significantly impact your tax return. The Internal Revenue Service (IRS) defines these as “ordinary and necessary” expenses. But what does this mean?

Ordinary and Necessary Expenses

An “ordinary expense” is accepted and common in a trade or business. A “necessary expense” is helpful and appropriate for your business. These expenses include anything you need to run your business, such as equipment, fuel, and bookkeeping services.

For example, the maintenance, fuel, and tolls associated with your delivery vehicles would be considered ordinary and necessary if you run a delivery business. Similarly, for a dog-walking business, dog treats, leashes, harnesses, dog training classes, and travel to and from client homes all qualify.

Avoiding Personal Expenses

It’s crucial to differentiate between business and personal expenses. Deducting personal expenses as business ones can lead to complications with the IRS. For example, a brief family dinner where work is discussed doesn’t qualify as a deductible business expense.

Documentation is Key

Many business owners make the mistake of not documenting their expenses. For meals, it’s essential to note the date, amount spent, participants, and the business discussed. For automobile expenses, documentation of mileage or expenses is necessary. Without proper documentation, you risk losing these deductions during an IRS audit.

Potential Red Flags

Certain expenses might raise eyebrows at the IRS. For instance, while meals with clients or networking events are deductible, family dinners are not, even if business is discussed. Similarly, while travel for business conventions is deductible, blending it with a family vacation can lead to scrutiny.

Broad Classification of Expense Categories

Based on Purpose

Capital Expenditure

These are large-scale expenses that a business incurs as an investment to acquire or upgrade physical assets, such as machinery, property, or technology. For example, if a manufacturing company purchases a new assembly line machine, it’s a capital expenditure. This type of expense is considered an investment in the business’s future operations.

Revenue Expenditure

These are routine and recurring expenses essential for the day-to-day functioning of a business. From the electricity bills of an office to the monthly salaries of employees, these expenses directly relate to the business’s operational activities. A cafe purchasing coffee beans or a corporate office paying for supplies, internet bills are examples of revenue expenditure.

Based on Frequency

Fixed Expenses

These costs don’t change regardless of the business’s activity level. Rent or mortgage payments, insurance premiums, and salaries are typically fixed expenses. For example, a software company might have fixed expenses in the form of monthly server hosting fees.

Variable Expenses

These expenses fluctuate based on the business’s activity or output. If a clothing brand produces more garments, its raw material costs will rise, making it a variable expense. Similarly, a call center might have phone bills that vary based on customer interactions.

Periodic Expenses

These don’t occur regularly but arise occasionally. Whether it’s a business license renewal or the costs associated with a one-off marketing campaign, these expenses are sporadic. For example, a tech firm might have periodic expenses when upgrading its software licenses.

Categorizing business expenses aids in financial planning and budgeting and in identifying areas for potential savings. Properly categorized expenses simplify tax filing, ensuring businesses take advantage of all available tax deductions.

Common Business Expense Categories

1. Office Expenses

Office expenses are a significant component of the business expense categories, encompassing the costs incurred to maintain and run an office environment. Managing these expenses efficiently can lead to substantial savings for many business owners, especially those operating small businesses.

Typical expenses include office supplies – pens, paper, printers, and stationery. Utilities such as electricity, water, and internet services also fall under this category.

Investing in accounting software like Akounto can help automate the tracking and managing of these expenses, ensuring they remain tax deductible. Business owners must monitor and categorize these expenses accurately, ensuring smooth operations and maximizing potential tax benefits.

2. Employee Related Costs

For any business owner, managing employee-related costs is paramount to financial stability. These costs, integral to the business expense framework, extend beyond mere salaries. They encompass a spectrum of expenses, including employee benefits like health insurance, retirement plans, and wellness programs.

Businesses must account for payroll taxes and mandatory contributions to state and federal programs. While these expenses can be substantial, they are pivotal in attracting and retaining top talent, driving business success.

It’s crucial to note that many of these costs, when accurately documented, qualify as tax-deductible expenses, offering potential savings during tax season. Properly managing these expenses ensures a harmonious balance between employee satisfaction and fiscal responsibility.

3. Business Travel Expenses

Managing employee-related costs is pivotal to maintaining a balanced budget for small business owners. These costs, integral to the business expense categories, go beyond mere salaries. They encompass a range of expenses, including employee benefits like health insurance, retirement plans, and employee benefit programs such as wellness initiatives.

Businesses must account for payroll taxes and mandatory contributions to state and federal programs. Investing in employee training costs is also essential, ensuring staff are equipped with the latest skills and knowledge.

While these expenses can be substantial, they are crucial in attracting and retaining top talent, ultimately driving business success. Proper management and allocation of these costs can significantly impact a company’s bottom line.

4. Vehicle Expenses

These expenses, a notable segment of business expense categories, encompass costs related to transportation, accommodation, and meals during business trips. Travel expenses can include airfare, train tickets, and other transportation costs. Additionally, this category includes vehicle expenses, such as fuel, maintenance, and rentals. Businesses must maintain detailed records of these expenses, as many can be tax deductible.

By accurately tracking and categorizing these costs, businesses can ensure they deduct expenses related to travel, optimizing their financial strategies and maximizing tax benefits.

5. Professional Services

Relying on professional services is often indispensable for ensuring compliance, optimizing operations, and accessing specialized expertise. These services, a significant component of business expense categories, come with associated costs.

Professional fees, for instance, are charges by experts like accountants, lawyers, or consultants who provide specialized advice or services. Additionally, businesses might incur membership fees for joining industry associations or chambers of commerce, which offer networking opportunities and resources.

Obtaining business licenses, essential for legal operations in many sectors, also falls under this category. Businesses must track these expenses meticulously, ensuring they leverage the benefits while managing costs effectively.

6. Marketing and Advertisement

Effective marketing and advertisement are essential for small business owners aiming to enhance their brand’s visibility in the market. This segment of business expense categories encompasses costs associated with digital campaigns, social media promotions, and traditional advertising mediums. For instance, investing in online ads or leveraging platforms tailored for small businesses can amplify outreach.

7. Loans and Interest payments

For many businesses, especially startups, securing loans is a pathway to kickstart or expand operations. However, these loans come with the added responsibility of interest payments. Managing these expenses, a significant component of business expense categories requires diligent tracking and timely repayments.

By maintaining a good credit history and negotiating favorable terms, businesses can minimize interest costs, ensuring financial stability.

8. Inventory Related Expenses

For businesses dealing in tangible products, inventory management is central to operations. Inventory-related expenses, a crucial segment of business expense categories, include purchasing, storing, and managing stock costs.

Examples include warehousing fees, transportation costs for goods, and expenses related to inventory software. Efficient inventory management ensures timely product availability and minimizes holding costs, optimizing profit margins.

9. Cost of Goods Sold (COGS)

COGS is a crucial business expense category representing the direct costs related to producing goods sold by a business. It includes material costs, direct labor, and other direct costs related to producing goods.

For example, a small business manufacturing handmade candles would include the cost of wax, wicks, fragrances, and labor in its COGS. Accurately calculating COGS is essential for determining the actual profit of a business and for tax filing purposes.

10. Maintenance and Repair Costs

Maintenance and repair costs are expenses to keep business operations running smoothly. These can range from routine maintenance of equipment to unexpected repairs. For a brick-and-mortar store, this might include costs related to fixing a broken window or servicing an air conditioner.

Regular maintenance extends the life of equipment, potentially saving money in the long run. Business owners need to budget for these expenses as they can impact the business’s bottom line.

11. Rent or Mortgage Payments

A significant fixed expense for many businesses is rent or mortgage payments. Whether you’re leasing an office space downtown or have taken a mortgage on a commercial property, these costs are a consistent part of monthly outgoings.

For example, a retail store might have a lease agreement in a shopping mall, while a tech startup might have a mortgage on a standalone building. Businesses must negotiate favorable terms to ensure sustainability and profitability.

12. Non-Cash Expenses

Non-cash expenses, often overlooked in business expenses, are vital for accurate financial reporting and analysis. These expenses do not involve any actual cash outflow but are essential for determining the true profitability of a business.

Common examples include depreciation, where the cost of a tangible asset is spread over its useful life, and amortization, which pertains to intangible assets like patents or trademarks.

While these expenses don’t affect the cash flow directly, they play a pivotal role in tax deductions and the overall financial health of a business. Recognizing and accurately accounting for non-cash expenses ensures that financial statements reflect a comprehensive view of a company’s operations, aiding in informed decision-making and strategic planning.

13. Training and Education Expenses

Training and education is a strategic business expense that fosters employee growth and enhances skill sets. These expenses, often overlooked, are pivotal for businesses aiming to stay competitive and innovative. Whether it’s specialized training programs, workshops, or courses, they serve clear business purposes by elevating the proficiency of the workforce.

Most of these costs are tax-deductible, meaning businesses can deduct them from their taxable income. By recognizing and allocating funds for training and education, businesses empower their teams and optimize their financial strategies.

14. Insurance premiums

Insurance premiums, an integral component of business expenses, represent businesses’ costs to secure various insurance policies. These policies act as a safety net, safeguarding businesses against unforeseen adversities and potential financial setbacks.

Workers’ compensation insurance is one of the most common forms of business insurance. This specific coverage protects businesses from potential liabilities if an employee gets injured, ensuring that medical expenses and lost wages are covered.

Another essential coverage is disability insurance to support employees who become disabled and cannot work. This not only ensures the well-being of the employees but also mitigates the financial strain on the business.

It’s worth noting that insurance premiums, especially those related to safeguarding business operations, can be considered a tax-deductible expense.

15. Bad Debt Expenses

Bad debt expenses are an unfortunate yet common component of the business expense landscape. These expenses arise when a business cannot recover amounts owed by clients or customers, turning receivables into losses.

Businesses must categorize expenses like these accurately within their financial statements, ensuring clarity in their fiscal health. Falling under common expense categories, bad debts highlight the importance of rigorous credit policies and proactive financial management to mitigate potential revenue losses.

Using Accounting Software

Leveraging accounting software has become indispensable for businesses aiming to manage their finances efficiently. Such software aids in meticulously tracking common business expenses, from utility costs and transportation expenses to entertainment expenses.

It simplifies recording charitable contributions, ensuring timely tax payments, and generating a comprehensive business expenses list. This streamlines financial operations and ensures accuracy, reducing the risk of oversights or errors.

By integrating accounting software into their financial management practices, businesses can achieve a clearer overview of their fiscal health and make informed decisions.

Best Practices for Managing Business Expenses

- Budget Regularly: Set clear financial boundaries by creating and updating a detailed budget. This helps in anticipating expenses and allocating funds effectively.

- Use Accounting Software: Implement modern accounting software to automate expense tracking, generate reports, and ensure accuracy in financial statements.

- Regular Expense Audits: Periodically review and analyze all expenses to identify any discrepancies, unnecessary costs, or opportunities for savings.

- Maintain Clear Documentation: Keep organized records of all transactions, receipts, and invoices. This aids in tax filing and ensures readiness for potential audits.

- Separate Business and Personal Finances: Use dedicated business bank accounts and credit cards to avoid mixing personal and business expenses.

- Review Vendor Contracts: Periodically renegotiate contracts with suppliers and service providers to ensure you’re getting the best value for your money.

- Implement Expense Policies: Establish clear guidelines for employee spending, travel, and reimbursements to prevent misuse and overspending.

- Monitor Cash Flow: Regularly track cash inflows and outflows to ensure liquidity and to anticipate any potential financial challenges.

- Leverage Tax Deductions: Stay informed about tax-deductible expenses and ensure you claim all eligible deductions to maximize savings.

- Invest in Employee Training: Educate employees about the importance of cost-saving and efficient expense management to foster a company-wide culture of fiscal responsibility.

- Evaluate ROI: Regularly assess the return on investment for major expenses to ensure that funds are being allocated to high-impact areas.

Conclusion

Managing business expenses is a cornerstone of successful financial planning and strategic decision-making for any enterprise, especially small businesses. With a myriad of expense categories, from office utilities to employee benefits, business owners must have a comprehensive understanding and meticulous tracking system. Leveraging tools like accounting software can significantly streamline this process, ensuring accuracy and compliance.

To learn more about business topics, visit Akounto’s Blog.