Understanding Assets in Accounting

What’s covered in the article

Assets represent resources controlled by a business due to past events, expected to generate future economic benefits.

These resources, ranging from cash and bank accounts to office equipment and manufacturing machinery, are vital components of a company’s balance sheet.

The accounting equation, a fundamental principle, states that assets are the total liabilities and equity. This equation ensures that a company’s balance sheet remains balanced, highlighting the interrelation between its financial components.

Assets can fall into multiple categories, such as current or non-current, tangible or intangible, and operating or non-operating. Each category has distinct characteristics, but all assets share three key properties:

- Physical existence or non-physical presence.

- The potential to generate economic benefits.

- The capacity to influence the company’s market value.

Not all assets have a physical existence. Intangible assets, like brand equity, goodwill or intellectual property, lack physical presence but hold significant economic value.

Tangible assets, like office supplies or wasting assets, have a clear physical existence. Properly categorizing and valuing these assets is paramount for accurate financial reporting and informed decision-making.

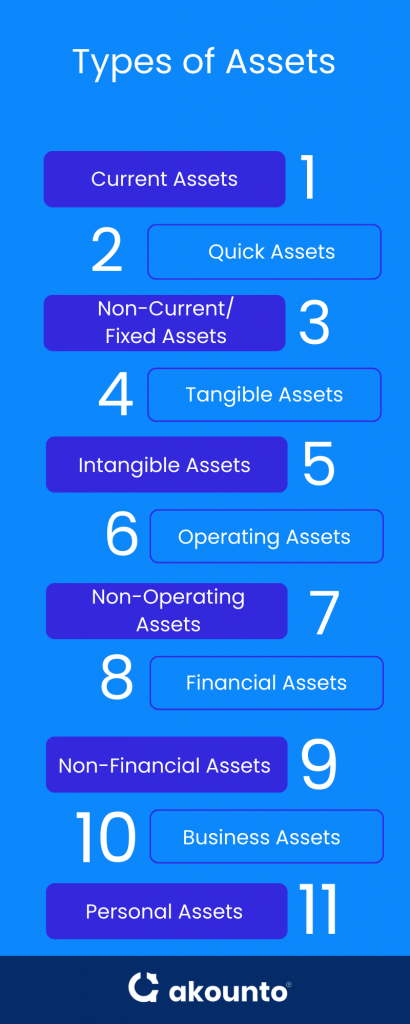

Types of Assets

Assets are classified into various types, each with unique characteristics and significance. Knowing about the types of assets is important to gain a comprehensive understanding.

Current Assets

Current assets are short-term assets expected to be converted to cash or used up within a year. Examples of current assets include:

- Cash and cash equivalents

- Marketable securities

- Accounts receivable

- Inventory Savings accounts and short-term investments like treasury bills also fall under the current assets category, offering liquidity to businesses.

Quick Assets

Quick assets are a type of current assets, excluding inventory and prepaid expenses. They represent assets that can be swiftly converted to cash. This category primarily includes:

- Cash equivalents

- Marketable securities

- Accounts receivable

Non-Current Assets/Fixed Assets

Fixed (non-current) assets are long-term assets that aren’t expected to be converted into cash within a year. Fixed assets include:

- Tangible assets like buildings, land, and manufacturing equipment.

- Intangible fixed assets such as patents or copyrights.

Tangible Assets

Assets with a physical presence or existence are called tangible assets. Examples are:

- Machinery

- Office equipment

- Real estate properties’ value, except land, is often subject to accumulated depreciation over time.

Intangible Assets

Lacking physical existence, intangible assets hold significant economic and future economic benefits. Examples of intangible assets encompass:

- Brand equity

- Intellectual property

- Goodwill

Operating Assets

Essential for a company’s normal operations, these assets are used to generate revenue. They include:

- Manufacturing equipment

- Office Supplies

- Resources that directly contribute to a company’s core business activities.

Non-Operating Assets

Non-operating assets are not essential for daily business operations but can generate income. Examples of non-operating assets are:

- Marketable securities

- Vacant land intended for sale

Financial Assets

Representing a contractual obligation, these assets derive their value from a contractual claim. They include:

- Stocks

- Bonds

- Bank deposits

Non-Financial Assets

Unlike financial assets, their value doesn’t stem from a contractual claim. Tangible (like vehicles) and intangible (like a brand’s reputation) assets can be non-financial.

Business Assets

Assets are essential for the functioning and growth of a business. They can be tangible, like machinery, and intangible, such as a company’s reputation or trademark.

Personal Assets

Owned by individuals rather than businesses, these encompass properties like:

- Homes

- Personal vehicles

- Jewelry

- Non-physical assets like education or skills.

Each asset type plays a pivotal role in determining a company’s economic value and prospects on the company’s balance sheet.

Accounting Treatment

The treatment of assets in accounting is governed by specific principles and standards to ensure clarity, consistency, and transparency in financial reporting.

At the heart of this treatment lies the accounting equation:

Assets = Liabilities + equity.

This equation ensures that a company’s balance sheets always balance out, reflecting the true monetary value of a business’s assets.

Assets, whether they are tangible assets like machinery or intangible assets such as patents, must be accurately represented on balance sheets.

Under the GAAP and International Financial Reporting Standards (IFRS) guidelines, tangible assets like fixed assets are typically recorded at their fair market value and then depreciated over time. Intangible assets, given their lack of physical presence, are amortized.

The debit and credit rules dictate that when assets increase, they are debited, and when they decrease, they are credited.

Current assets, including cash equivalents, represent a company’s short-term liquidity and are expected to be converted into cash within a year. On the other hand, operating assets are crucial for a company’s daily operations, aiding in generating revenue.

It’s essential to differentiate between the various types of assets, from cash equivalents to operating assets, to ensure compliance with both GAAP and IFRS standards. Proper accounting treatment reflects the true value of assets in accounting and fosters trust among stakeholders.

Valuation

The valuation of assets in accounting requires a deep understanding of the asset’s nature and the most appropriate valuation method. It’s the process of determining the current worth of an asset or a company.

Depreciation Method

This method primarily concerns tangible assets, especially fixed assets like machinery or buildings. Assets that physically exist tend to lose value over time due to wear and tear. The depreciation method allows businesses to allocate the cost of these assets over their useful life. Various methods can be employed to calculate depreciation, each offering a different approach to expense allocation.

Standard Cost Method

This method is predominantly used for the valuation of inventory. Instead of valuing assets at their actual cost, the standard cost method uses predetermined costs. It’s a way of streamlining the accounting process, especially in manufacturing settings where actual costs fluctuate. Any difference between the standard and actual costs is treated as a variance.

Market Value Method

As the name suggests, this method values assets based on their current market value. It’s most applicable to assets like stocks or bonds with a clear market price. Determining the market value might require expert appraisal for types of assets like real estate or unique capital assets.

List of Financial Ratios Related to Assets in Accounting

These ratios provide insights into a company’s operational efficiency, liquidity, and overall financial health concerning its assets.

- Current Ratio: Measures a company’s ability to cover its short-term liabilities with its short-term assets.

- Quick Ratio (Acid-Test Ratio): Evaluates a company’s short-term liquidity by considering only the most liquid assets (excluding inventory).

- Asset Turnover Ratio: Assesses the efficiency of a company’s use the assets in generating sales revenue.

- Return on Assets (ROA): Indicates how effectively a company converts its assets into net income.

- Fixed Asset Turnover: This shows the efficiency of a company’s use of its fixed assets in generating sales.

- Inventory Turnover: Measures the number of times an inventory is sold and replaced over a period.

- Days Sales in Inventory (DSI): This represents the average number of days to sell inventory.

- Total Asset Turnover: Compares a company’s total revenue to its total assets to evaluate asset efficiency.

- Debt to Asset Ratio: This shows the proportion of a company’s assets financed by debt.

- Net Working Capital Ratio: Measures the difference between current assets and current liabilities, indicating a company’s short-term financial health.

- Receivables Turnover Ratio: Assesses how effectively a company extends credit and collects debts.

- Days Sales Outstanding (DSO): This represents the average number of days it takes to collect payment after a sale.

Using Accounting Software for Asset Management

Accounting software plays a pivotal role in efficient asset management, offering a streamlined approach to tracking and managing various types of assets. Whether dealing with current assets like cash and accounts receivable or non-current assets like property and equipment, these tools provide real-time insights and accurate data recording.

For businesses with a diverse portfolio, distinguishing between operating assets used in daily operations and non-operating assets, which aren’t directly tied to core business activities, can be challenging. Accounting software like Akounto simplifies this task, ensuring that assets are correctly categorized, be they as capital assets or under any other asset classification.

These platforms aid in understanding the economic benefit derived from intangible assets like patents or copyrights. They provide clarity on how assets contribute to generating revenue and their future economic value. This is especially crucial for non-physical assets that hold significant value for the company.

Limitations of Assets

- Types of Assets: While assets are categorized into various types for clarity, this classification can sometimes lead to confusion. For instance, an asset might fit into multiple categories, making it challenging to determine its exact nature and value.

- Non-Current Assets: These assets, like machinery or real estate, are held for extended periods. Their value might fluctuate over time due to market conditions, making it difficult to ascertain their precise worth at any given moment.

- Tangible and Intangible Assets: While tangible assets have a physical presence, intangible assets do not. This distinction can lead to challenges in valuation. For example, how does one accurately value a brand’s reputation or a patent?

- Historical Cost: Assets are often recorded at their historical cost. However, this might not reflect their current market value, leading to company financial statement discrepancies.

- Future Economic Value: An asset’s future economic value can be speculative. Factors like market demand, technological advancements, or regulatory changes can impact an asset’s future worth.

- Capital Asset: The value of a capital asset can be influenced by external factors like inflation rates or geopolitical events, making its long-term valuation uncertain.

- Asset Classification: Proper asset classification is crucial for accurate financial reporting. However, misclassifications can occur, leading to potential misrepresentations in financial statements.

- Non-physical Assets: Assets without a physical presence, such as copyrights or goodwill, can be challenging to value. Their worth is often subjective and can

- vary based on market perception or industry trends.

Conclusion

Assets represent the resources a business controls, expected to yield future benefits. From tangible assets like machinery to intangible ones such as brand equity, understanding the various types of assets and their implications is crucial for accurate financial reporting and informed decision-making. As businesses evolve, so does the complexity of managing these assets, emphasizing the need for clear classification, valuation, and accounting practices.

To learn more about business topics, visit Akounto’s Blog.