Defining Accounts Receivable

Accounts receivable (AR) is an accounting term that refers to the money owed to a business by the customers for goods or services provided but not yet paid for.

What’s covered in the article

The unpaid invoices are recorded as an asset on the company’s balance sheet, signifying an expectation of future cash inflows.

The working of accounts receivable is closely tied to the payment terms agreed upon between the business and its customers.

A business usually extends credit to the customers, allowing them to receive goods or services before making a payment, thus creating accounts receivables. It is a common practice in various industries to facilitate smoother transactions and to build a loyal customer base.

It also necessitates keeping track of outstanding invoices to ensure timely payments. The management of accounts receivable involves several steps, from invoicing clients for goods or services rendered to receiving payment. The cycle begins when a client receives an invoice and ends when the client pays it off, settling their outstanding balance.

By understanding the intricacies of accounts receivable, businesses can better manage their cash flow, extend appropriate credit terms, track payments, and ensure the business can meet its short-term obligations.

Accounts Receivable Process

The accounts receivable process starts with the sale of goods or services to customers on credit terms. Once a transaction is completed, an invoice is generated and sent to the client, marking the beginning of the accounts receivable cycle.

The invoice specifies the accounts receivable balance, the due date for payment, and other terms.

The accounts receivable balance is entered as a current asset on the balance sheet, indicating the amount clients owe to the business. Accountants must update AR records at the end of each accounting period to reflect payments received and any adjustments for bad debts.

Businesses must keep track of the due dates and unpaid invoices and follow up with certain customers who have overdue accounts.

The accounts receivable process also includes provisions for bad debts. Bad debts are amounts that are unlikely to be collected and need to be written off.

Identifying bad debts early in the accounting period can help businesses take appropriate measures, such as turning the accounts receivable (AR) over to a collection agency.

Payment collection is the final step in the accounts receivable process. Payments received are recorded, and the accounts receivable balance is adjusted accordingly. Some businesses also offer discounts or incentives for early payments to encourage the timely settlement of accounts.

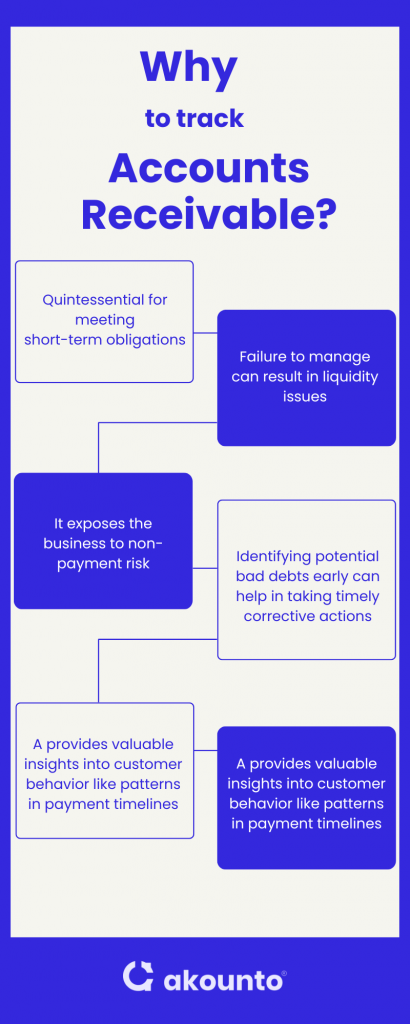

Need to Track Accounts Receivable

Accounts receivable is not just an asset account on the balance sheet but a dynamic component that requires constant monitoring and management for business success.

When clients owe money for goods or services, these amounts are recorded in the asset account, known as accounts receivable, representing the money typically collected within a short period and quintessential for meeting short-term obligations.

When a business extends credit to a customer, it essentially invests resources with the expectation of future payment. Failure to manage accounts receivable asset account effectively can result in liquidity issues, making it challenging to cover operational costs or invest in growth opportunities.

Another compelling reason is the risk of bad debt. While extending credit can attract more customers, it also exposes the business to non-payment risk. Monitoring average accounts and identifying potential bad debts early can help in taking timely corrective actions, such as tightening credit policies or employing collection agencies.

Tracking A provides valuable insights into customer behavior like patterns in payment timelines can indicate customer reliability, helping businesses make informed decisions on extending or restricting credit terms.

Tracking every account receivable is indispensable for effective cash flow management, risk mitigation, and informed decision-making.

Accounts Receivable Turnover Ratio: Formulae and Interpretation

The accounts receivable turnover ratio computes the number of times or duration within which a business is able to collect its accounts receivables. Thus, it reflects the efficiency of a company’s credit and collection policies by indicating how often or how quickly the business turns its receivables into cash.

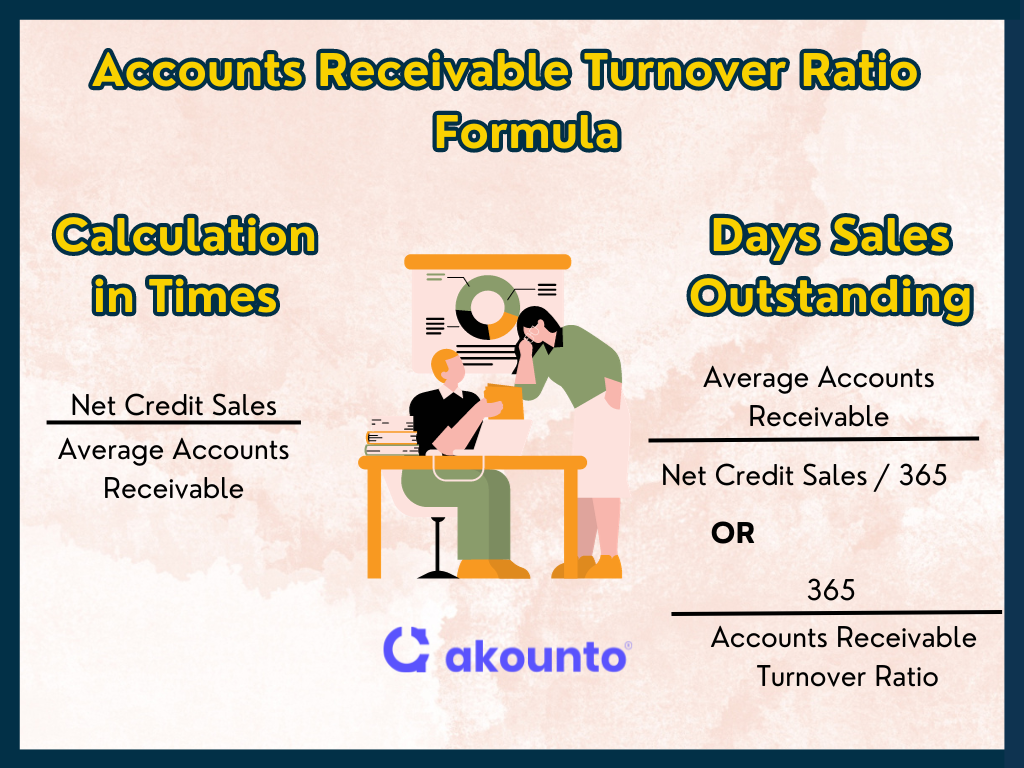

The Accounts Receivable Turnover Ratio can be calculated in two formats:

As a frequency or

In terms of number of days.

Calculation in Times

The accounts receivable turnover ratio, when measured in frequency, is calculated by dividing net credit sales by average account receivables:

Accounts Receivable Turnover Ratio Formula = Net Credit Sales/ Average Accounts Receivable

Here,

Net Credit Sales = Credit Sales minus sales returns and sales allowances.

Net Credit Sales = Gross Credit Sales – Sales Return – Sales Allowances

(Note: It is crucial to include only credit sales since cash sales do not contribute to accounts receivable.)

Average Accounts Receivable Formula = (Opening Accounts Receivable Balance + Ending Accounts Receivable Balance)/ Divided by 2

Calculation in Days

Learn to Calculate Accounts Receivable Turnover in Days or Days Sales Outstanding (DSO).

Days Sales Outstanding = Average Accounts Receivable/ (Net Credit Sales / 365)

Day sales outstanding indicates the average number of days taken by the company to collect the outstanding receivables i.e., the credit sales. A lower DSO suggests quicker collection, enhancing the company’s cash flow.

In the above calculations, the average accounts receivables was used. It is the average amount of credit that is extended to the customers, which is still outstanding and yet to be collected.

Components of the Formula:

- Net Credit Sales: This refers to the total credit sales minus any returns or allowances. It is essential to use net credit sales rather than total sales to get an accurate measure of the money that is expected to be collected.

- Average Accounts Receivable: This is calculated by adding the beginning and ending accounts receivable for a specific period, usually a year, and dividing by 2. The average accounts receivable gives a more balanced view of the accounts that are expected to be collected during that period.

The ratio measures the number of times accounts receivable are turned into cash over a set period. This is crucial for understanding the liquidity and efficiency of the company’s credit policies.

A high turnover ratio is generally a positive indicator, signifying that the company is efficient in converting its accounts receivable into cash. It suggests that customers pay their invoices promptly, reducing the day’s sales outstanding and minimizing the risk of bad debt.

A low ratio could be a red flag, indicating potential issues such as delayed customer payments or an excessive amount of money tied up in accounts receivable.

The accounts receivable turnover ratio helps in identifying how quickly the average number of accounts is being paid off, thereby providing insights into the company’s credit policies and customer behavior. For instance, a declining ratio over time could signal that customers are taking longer to pay, affecting the company’s cash reserves and increasing the risk of bad debt.

Learn to Calculate Accounts Receivables Turnover

Example 1

Let’s assume Company A has the following financial data for a year:

Total Sales: $500,000

Credit Sales: $400,000

Sales Returns: $20,000

Opening Accounts Receivable Balance: $50,000

Ending Accounts Receivable Balance: $70,000

First, calculate the Net Credit Sales:

Net Credit Sales = Credit Sales −Sales Returns

= $400,000 − $20,000 = $380,000

Calculating Average Accounts Receivable:

Average Accounts Receivable Formula = (Opening Balance + Ending Balance) divided by 2

= ($ 50,000+ $ 70,000) divided by 2 = $60,000

Accounts Receivable Turnover Ratio Formula = Net Credit Sales divided by Average Accounts Receivable

= $380,000 divided by $60,000 ≈ 6.33 times.

Company A has accounts receivable turnover rate of approximately 6.33 times a year, indicating a relatively efficient collection process.

Example 2

Consider Company B with the following data for a particular accounting period :

Total Sales: $750,000

Gross Credit Sales: $600,000

Sales Returns: $30,000

Opening Accounts Receivable Balance: $80,000

Ending Accounts Receivable Balance: $100,000

Computing Net Credit Sales: $ 600,000 − $ 30,000 = $ 570,000

Average Accounts Receivable = $ 80,000 + $ 100,000 divided by 2 = $ 90,000

Using Accounts Receivables Turnover Formula = Net Credit Sales/ Average Accounts Receivable

= $570,000 divided by $90,000 = 6.33 times.

Days Sales Outstanding (DSO) or Receivable Turnover Formula in days = 365 divided by Turnover Ratio

= divided by 6.33 ≈ 57.66 days.

Company B’s receivable turnover in days is approximately 57.66 days i.e. days to collect its receivables, suggesting a moderate collection pace.

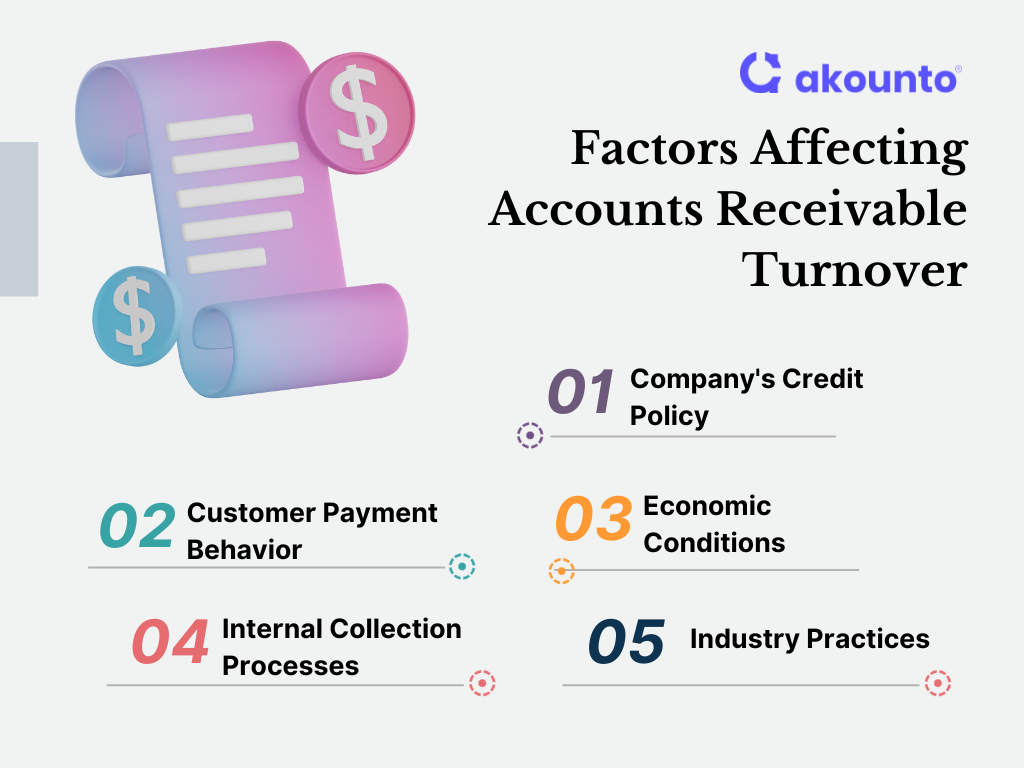

Factors Affecting Accounts Receivable Turnover

Accounts Receivable (AR) is a current account asset on a company’s balance sheet reflecting the credit sales yet to be collected. As in accrual accounting, the revenue is already registered for accounting purposes, but cash is still pending to be recovered. The following are the factors affecting a company’s accounts receivable turnover:

Company’s Credit Policy

A stringent credit policy where there are credit checks and guidelines before allowing credit sales usually leads to low accounts receivable turnover because the credit is given to highly creditworthy customers.

In the case of lenient policies, there increased sales volume but also led to a higher amount of outstanding receivables, potentially increasing the risk of bad debts.

Customer Payment Behavior

Monitoring long-term customer payment trends is helpful in managing accounts receivables. The payment behavior of customers reflects that customers who consistently pay on time reduce the average accounts receivable balance, improving the AR turnover ratio. Whereas, customers with a history of late payments or defaults can increase the accounts receivable balance, indicating potential cash flow issues.

Do you know American Express (AMEX) uses AI and algorithms to detect customer behavior and avoid any fraud?

Economic Conditions

During an economic downturn/ crisis or recession, customers may delay payments or default, resulting in inflating the accounts receivable balance and adversely affecting the company’s cash flow.

In a booming economy, the payments are received faster, and the extra sales cover up any shortcomings or inefficiencies in the collection cycle, the companies are often lenient in extending credit with easy payment terms.

Internal Collection Processes

The efficient internal collection process comprises effective invoicing procedures, regular follow-ups, and efficient handling of disputes, which can lead to timely collections. Inefficient processes, including delayed invoicing or lack of follow-up, can result in an increased receivable balance and a lower AR turnover ratio.

Industry Practices

Industries with longer project lifecycles may have inherently longer receivable periods compared to those with quick turnover products or services. The average collection period is aligned with the industry standards.

The average collection period will be much different in a steel or manufacturing industry as compared to retail, food, white goods, services, etc.

The companies must strategically manage their credit policies, monitor customer payment behaviors, adapt to economic conditions, streamline internal collection processes, and understand industry-specific practices to maintain a healthy accounts receivable balance and ensure robust financial health.

Advantages of Accounts Receivable Turnover Ratio

Liquidity Assessment: The accounts receivable turnover ratio highlights the liquidity position of a company. A high accounts receivable turnover signifies an efficient collection of outstanding receivables, resulting in a positive cash flow.

Credit Policy Evaluation: The accounts receivable turnover ratio is a single-point metric that highlights the effectiveness of the company’s credit policies. A high accounts receivables turnover ratio represents stringent credit policies and a strong and creditworthy customer base, while a low turnover ratio signifies a lenient or conservative credit policy where there is ample scope for optimization.

Investor Attractiveness: The accounts receivables turnover ratio helps the investors gauge the company’s efficiency in managing receivables, influencing investment and credit decisions.

Benchmarking Tool: The accounts receivables turnover ratio acts as a benchmark for intra-industry/ sector comparison with peers and competitors to identify best practices.

Financial Health Indicator: The accounts receivable turnover ratio provides insights into the company’s finances, particularly its ability to convert receivables into cash, which is needed for meeting its short-term obligations.

Limitations of Accounts Receivable Turnover Ratio

Business Cycle Variations: The change in the business cycle is not fully represented, as there can be seasonal variations in sales.

Focus on Credit Sales: With the accounts receivable turnover ratio focusing on the credit sales, the cash sales get neglected. If a company incurs cash sales as a majority of revenue, then this ratio is not helpful for any decision-making.

Inconsistencies Due to Credit Policy Changes: If there are changes in the credit policy, then comparing the accounts receivable turnover ratio with historical data is not possible.

Average Accounts Receivable Calculation: Fluctuations in receivable turnover can skew the whole ratio. Also, if a company uses gross sales instead of net sales, then this can misrepresent the state of finances.

Not a Standalone Indicator: To assess the short-term liquidity condition of the company, it is recommended to include other ratios like debtor’s turnover ratio, efficiency ratio, etc.

Potential for Inflation: A company might temporarily boost its sales at the end of a financial period through aggressive credit terms, superficially enhancing the turnover ratio.

Accounts Receivable Ageing

Accounts receivable aging is a methodical approach to understanding the financial health of a company’s receivables. This process involves categorizing all unpaid invoices or accounts based on their age.

The primary aim is to identify invoices that are overdue and require immediate attention.

The aging report is usually broken down into columns that represent different time frames, often in increments of 30 days. These columns help businesses pinpoint exactly how long an invoice has been outstanding, enabling them to take appropriate action.

For instance, invoices that have been unpaid for 30-60 days may require a simple reminder, while those exceeding 90 days might necessitate more stringent collection efforts.

It also aids in making informed decisions about extending credit to customers and helps in prioritizing collection activities.

Impact on Cash Flow and Company’s Financial Health

The impact of account receivable on cash flow and a company’s financial health cannot be overstated. When customers owe money for goods or services, these amounts are recorded in the revenue account, directly affecting the company’s cash flow.

Efficient management of accounts receivable ensures that the company has enough cash to meet its short-term obligations, which are often recorded in the liability account on the general ledger.

A high volume of unpaid invoices can lead to cash flow issues, affecting the total value of the company’s assets and its ability to invest in growth opportunities or even meet operational costs.

Prompt cash payments from customers can significantly improve liquidity, allowing the company to take advantage of new business opportunities or settle its accounts payable in a timely manner.

Poor management can result in a high volume of bad debts, which need to be written off, affecting the total accounts and, ultimately, the company’s bottom line.

Businesses must adopt effective strategies for invoice generation, setting payment terms, and ensuring that customers pay within the stipulated time frame to maintain a healthy cash flow and robust financial standing.

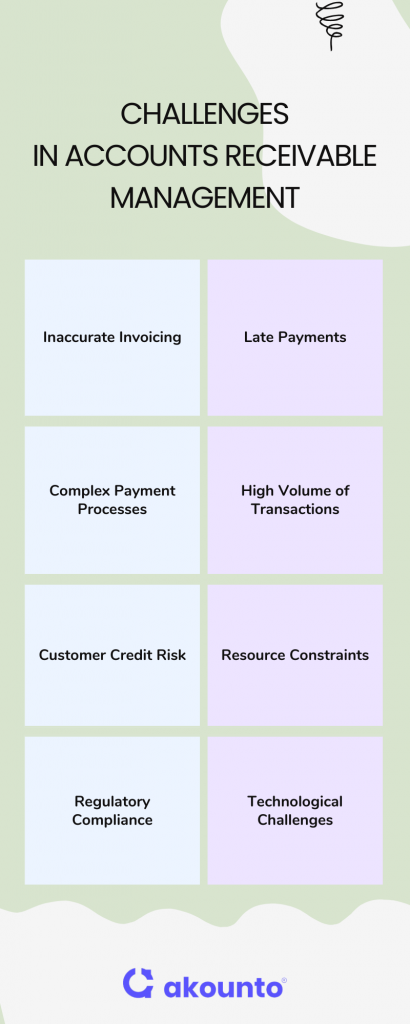

Challenges in Accounts Receivable Management

- Inaccurate Invoicing: Errors in invoices can lead to disputes, delaying the time it takes for customers to pay and affecting the company’s cash flow.

- Late Payments: Despite having clear payment terms, some customers may not pay on time, affecting the company’s ability to settle its accounts payable and other financial obligations.

- Complex Payment Processes: Companies often have to deal with complex payment processes that involve multiple steps, from invoice generation to receiving payment. This complexity can lead to delays and errors, affecting the overall efficiency of accounts receivable management.

- High Volume of Transactions: For businesses with a high volume of transactions, keeping track of each invoice and payment can become a cumbersome task. This can lead to missed follow-ups and, ultimately, unpaid invoices.

- Customer Credit Risk: The company must assess the creditworthiness of each customer, which can be time-consuming and may not always be accurate, leading to bad debts.

- Resource Constraints:An effective account receivable management requires dedicated resources for tracking, follow-up, and reconciliation. Many small businesses may not have the necessary resources, making it challenging to manage accounts receivable efficiently.

- Regulatory Compliance: Companies must also ensure that their AR processes are in compliance with local and international financial regulations. Non-compliance can result in penalties and can complicate the process of receiving payment from international customers.

- Technological Challenges: The lack of advanced tools and software can also pose a challenge in efficiently managing accounts receivable, especially for companies still relying on manual methods.

Tips to Improve Accounts Receivable Cycle

Optimizing accounts receivable collection includes a combination of timely invoicing, regular follow-ups, reminding on and before due dates, regular analysis, cash discounts, favoring upfront payment terms, strong customer relationships, penalties, multiple payment options, etc.

There are multiple strategies that a business can implement as per industry standards and commercial feasibility to optimize the accounts receivable turnover ratio and enhance financial stability.

Timely and accurate invoices with regular reminders help to increase the likelihood of getting paid early, thereby reducing average accounts receivables.

Use automated invoicing systems like Akounto to reduce any errors and delays, schedule sending invoices and payment reminders, and create recurring invoices.

Before extending credit to any customer, conduct a thorough credit check. You can get the details from a customer’s credit score. Additionally, regularly revise credit limits, discounts for cash payments, credit policies, etc.

Offering multiple payment options like credit cards, online, electronic fund transfer, PayPal, etc., provides convenient and friendly payment platforms that increase payment probabilities and help improve the accounts receivable turnover ratio.

Address disputes swiftly, and if needed, use dedicated collection agencies or maintain a separate department for the collection of outstanding debt and receivables.

Offer cash payment discounts or cash discounts, early payment discounts, etc., to incentivize early payment, thereby reducing the accounts receivable balance.

Identify customer payment trends and behavior to identify delinquent customers or to identify errors in the invoicing process.

Accounts Receivable Turnover and Financial Modeling

Financial modeling is a process to mathematically evaluate the impact of business decisions or investments by making different scenarios or models. It involves using historical data, assumptions, and forecasts to build dynamic financial statements and evaluate the potential impact of various financial decisions or scenarios.

The Accounts Receivable Turnover Ratio serves as a significant indicator of a company’s liquidity and operational efficiency and impacts a company’s cash flow and credit management, guiding strategic decision-making and forecasts.

Integration in Cash Flow Projections

Financial analysts build financial models to analyze past and current accounts receivable turnover ratios. These models help to project future cash flows and decide upon the timing of other cash flows vis a vis the pace at which a company collects receivables. It helps to plan liquidity and working capital management.

Impact on Balance Sheet Forecasts

The accounts receivable turnover ratio in financial modeling is used to forecast future cash flows and their impact on short-term worthiness. The accuracy of balance sheet forecasts should be realistic and take into account the changes in working capital. The degree of accuracy in the estimation reduces the variance and facilitates data-based decision-making.

Credit Policy Analysis

Financial models can simulate various scenarios, adjusting credit terms and policies to see how they might affect the receivable turnover. This analysis is crucial for determining optimal credit terms that balance sales growth with efficient cash collection.

Risk Assessment

The accounts receivable turnover ratio is also instrumental in assessing credit risk, where a lower accounts receivable turnover might indicate potential cash flow problems and higher credit risk, which can be factored into risk assessment models. This insight is vital for both internal management and external stakeholders, such as investors and creditors, who are keen on understanding the risk profile of the company.

Conclusion

Managing accounts receivable is important for maintaining a healthy cash flow and financial stability for any business. By understanding its intricacies and implementing effective strategies, companies can mitigate risks, improve liquidity, and pave the way for sustainable growth.

Using accounting software like Akounto helps you organize, manage and track your accounts receivable. Visit Akounto’s website to know more.