Defining a Company’s Accounts Payable

When a company purchases goods or services without immediate payment, it generates an accounts payable.

Accounts Payable refers to the financial obligations a company needs to fulfill that come in the form of vendor invoices representing money a company owes to its suppliers or creditors. The nature of these liabilities can be diverse, ranging from vendor payments for office supplies to more substantial expenses like machinery or equipment.

What’s covered in the article

Accounts payable is the promise that the company pays its due debts. The business’s reputation and credibility rely heavily on how effectively it manages and fulfills these obligations. After receiving the vendor invoices, the company must ensure timely payments to maintain a healthy relationship with the supplier.

Invoice Processing

When a business purchases goods or services, the vendor sends an invoice detailing the cost and terms of the purchase. This document initiates the accounts payable process, and it’s crucial to manage these invoices effectively for accurate accounts.

Invoice processing involves several steps, starting with receiving the vendor invoice. The accounts payable department (AP Department) verifies the information in the invoice against the purchase order and any received goods or services. This step ensures that the invoice is accurate and legitimate, reducing the chance of paying fraudulent invoices.

Once the invoice is verified, it’s recorded in the accounting system. This recording creates a debit in the accounts payable, increasing the company owes. The AP Department maintains a master vendor file, which records all invoices and payments.

The payment date is determined by the payment terms outlined in the invoice. Early payment discounts may be available, providing a financial incentive for the company to pay the invoice before the due date.

Accounts Payable Process

The accounts payable process is essential to a company’s financial management strategy, ensuring transparency and accuracy in how the business handles the money it owes. It directly impacts the balance sheet, the cash flow, and the company’s overall financial health.

Here are the key steps in the accounts payable process:

- Invoice Receipt: When a business owes money for goods or services, it receives a vendor’s invoice. This document signifies the initiation of the accounts payable process.

- Invoice Verification: The AP Department checks the supplier invoices against purchase orders and delivery reports. The objective is to confirm that the goods or services were received and that the billed amounts are accurate.

- Recording of Accounts Payable: Once the invoice validation is complete, the accounts payable get recorded in the accounting system. This recording typically involves crediting the accounts payable (liability) account and debiting an expense account, impacting the balance sheet by increasing the company’s liabilities.

- Payment Scheduling: The AP Department determines the payment date, considering the invoice terms and the company’s cash flow needs. Internal controls are critical at this stage to prevent duplicate or missed payments.

- Payment Execution: The company pays the invoice as per the schedule. Paying bills promptly is crucial for maintaining good relationships with suppliers and ensuring an accurate depiction of financial statements.

- Record Updating: The company updates its accounting records after making the payment. The accounts payable recorded previously are reduced by the amount paid.

Recording in Company’s Balance Sheet

Recording accounts payable in the company’s balance sheet is a critical process, offering a clear picture of the money owed by the company. It impacts the analysis of the company’s liquidity, operational efficiency, and credit management.

Recording accounts payable in the balance sheet begins with invoice verification, as outlined in the previous section.

Upon the receipt and verification of an invoice by the Accounts Payable Department, an entry is made in the general ledger – the primary accounting record of a company. This entry debits the relevant expense account (asset account) and credits the accounts payable account, signifying an increase in the company’s obligations.

As a current liability account, accounts payable represent outstanding payments due within a typical one-year period.

The increase in this account shows that the company has purchased goods or services on credit, which it needs to pay off in the future. These credit purchases could be from vendors supplying raw materials, utility providers, or other entities involved in the company’s day-to-day operations.

Accurately recording these accounts payable in the balance sheet helps stakeholders understand the scale of the company’s short-term liabilities and its ability to meet these obligations. The accounts payable balance gives insights into the company’s purchasing activities, cash management strategies, and overall financial health.

Impact on Cash Flow Management

Accounts payable represents a critical element in any business’s cash flow and working capital management.

Accounts payable ap is directly related to a company’s operational cash flow – the cash generated or used in the company’s core business operations. When a company makes a credit purchase, it records an accounts payable and a corresponding expense, a debit to an expense account. This transaction doesn’t immediately affect the company’s cash reserves or cash flow.

The actual impact on cash flow occurs when the company pays invoices. The payment reduces the cash reserves, resulting in an operational cash outflow, evident in the cash flow statement. Hence, a higher accounts payable balance can temporarily boost a company’s operational cash flow as it delays cash outflows.

The management of accounts payable ap also plays a pivotal role in working capital management. Computed as current assets minus current liabilities, working capital measures a company’s short-term liquidity. Since accounts payable ap is a current liability, an increase in accounts payable will reduce the working capital, given that current assets remain constant.

Examples of Accounts Payable

Example 1

Cat Technologies Inc. is a retail company that purchased computer components for Grand AI on credit. Cat Technologies also holds valid sales tax exemption certificates too.

The purchase is on credit, and the invoice is received from Grand AI.

The details of the transactions are as follows:

- 1 Aug: Purchased computer components worth $5,500 from Grand AI on credit.

- 5 Aug: Received invoice with sales tax exemption from Grand AI.

- 15 Aug: Invoice Paid as per the terms of credit.

Solution

The ledger accounts related to the entries for the transactions are shown below:

| Date | Description | Debit | Credit |

| Aug 1 | Purchased computer components on credit | Inventory (Computer components) $5,500 | Accounts Payable (Grand AI) $5,500 |

| Aug 5, 23 | Received Invoice from Grand AI | Accounts Payable (Grand AI) $5,500 | Accounts Payable Invoice $5,000 |

| Aug 15 | Made payment to Grand AI for the outstanding invoice | Accounts Payable (Grand AI) $5,500 | Cash (or Bank) $5,500 |

On the company’s Balance Sheet, the Accounts Payable will be listed under current liabilities, which represents money owed to its suppliers. The sales tax exemption will not directly impact the balance sheet as it relates to tax treatment and compliance.

The company would maintain a record of the sales tax exemption certificate, which is usually provided by the relevant tax authority. This certificate serves as documentation to justify the exemption from sales tax on the purchase.

Example2

XYZ Manufacturing, a company that produces furniture, purchases raw materials from its supplier, ABC Materials Inc. The total amount of the purchase is $10,000, and ABC Materials Inc. offers an early payment discount of 2% if the payment is made within 10 days. The standard credit terms allow XYZ Manufacturing to pay within 30 days.

Transactions are as follows:

- Dec 1: Purchased raw materials on credit from ABC Materials Inc.

- Dec 5: Made an early payment to ABC Materials Inc. and availed of the early payment discount.

- Dec 20: Made the remaining payment to ABC Materials Inc. within the standard credit terms.

Solution

| Date | Description | Debit | Credit |

| Dec 1 | Purchased raw materials on credit from ABC Materials Inc. | Inventory (Raw Materials) $10,000 | Accounts Payable (ABC Materials Inc.) $10,000 |

| Dec 5 | Made an early payment to ABC Materials Inc. and availed the early payment discount | Accounts Payable (ABC Materials Inc.) $10,000 | Cash (or Bank) $9,800 |

| Purchase Discounts $200 | |||

| Dec 20 | Made the remaining payment to ABC Materials Inc. within the standard credit terms | Accounts Payable (ABC Materials Inc.) $200 | Cash (or Bank) $200 |

Accounts Payable Turnover Ratio

This ratio provides insight into a company’s short-term liquidity. It measures how quickly a company pays off its suppliers by comparing the total cost of sales or total purchases with the average accounts payable during a specific period.

The formula for the Accounts Payable Turnover Ratio is:

Accounts Payable Turnover Ratio = Total Cost of Sales / Average Accounts Payable

The AP team calculates this ratio regularly to monitor the company’s efficiency in making payments owed to its suppliers. A high turnover ratio could indicate that the company is paying off its suppliers faster, which could be due to early payment incentives or a company policy of paying cash quickly to maintain healthy supplier relationships.

On the other hand, a low turnover ratio might suggest that the company is taking longer to pay its bills. This could be because of cash flow issues or a deliberate strategy to hold cash longer for other uses. However, a low ratio could harm the company’s relationship with suppliers.

By tracking the Accounts Payable Turnover Ratio, businesses can manage their accounts payable more effectively, improving their credit balance, cash management, and overall financial health.

Accounts Payable vs Accounts Receivable

Accounts Payable deals with the money a company owes to its suppliers, while Accounts Receivable deals with the money owed to the company by its customers. For more differences related to accounts payable vs accounts receivable, refer to the table below:

| Feature | Accounts Payable | Accounts Receivable |

| Definition | Represents money owed or obligation to pay that arises due to credit purchase. | Accounts receivable represents money owed to a company by its customers or clients for goods or services sold on credit. |

| Nature | Liability – It is an obligation for the company to pay the outstanding amount. | Asset – It is money that the company is yet to receive and is considered an asset. |

| Involves | The company is the debtor. | The company is the creditor. |

| Initiated By | Accounts Payable is initiated by purchasing goods or services on credit. | Accounts Receivable is initiated by selling goods or services on credit. |

| Relation with Sales | No direct relation with sales; it is related to the purchase of goods or services. | Directly related to sales; it represents revenue generated from sales transactions. |

| Management Focus | Focuses on managing payments to vendors and suppliers. | Focuses on managing collections from customers. |

| Impact of Delays | Delays in payment may strain vendor relationships or lead to late payment penalties. | Delays in collections may impact cash flow and affect the company’s working capital. |

Using Accounting Software

Given its complexity and significance, the management of accounts payable can be streamlined using modern accounting software. Such software automates the recording and management of accounts payable, simplifying business transactions and improving accuracy.

Accounts payable automation software can handle various tasks, from capturing and organizing invoices to scheduling and making payments. When an invoice arrives, the software scans and captures the relevant financial data, automatically creating a debit in the accounts payable. This automation reduces manual data entry, minimizing errors and speeding up the payment process.

The software also tracks the money owed to suppliers, offering real-time visibility into the company’s liabilities. It allows businesses to monitor their outstanding accounts payable expenses, facilitating more accurate budgeting and cash flow forecasting.

Accounting software can schedule payments based on due dates, ensuring that payments are made promptly. This feature helps avoid late payment penalties and supports maintaining healthy relationships with suppliers.

Accounting software can be valuable for businesses, particularly in managing their accounts payable. It simplifies the payment process, enhances data accuracy, and offers valuable insights into a company’s financial health.

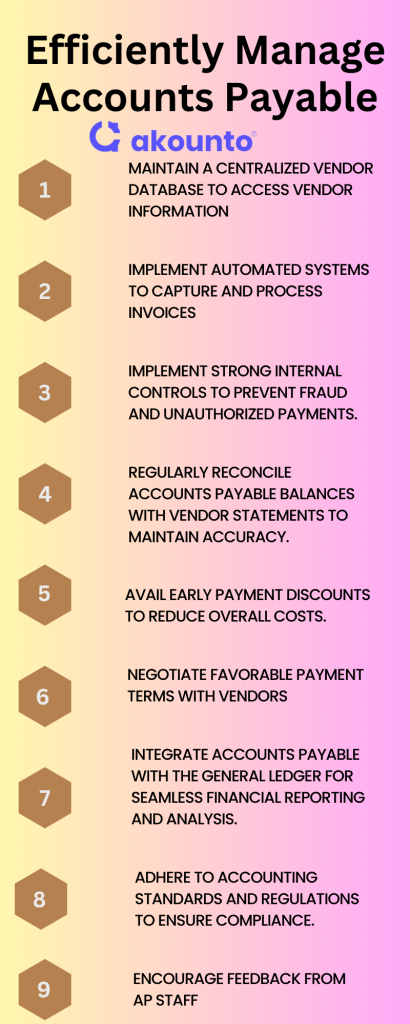

Best Practices

Managing accounts payables efficiently is crucial for any purchasing company to maintain strong financial controls and positive vendor relationships.

The following are the best practices that an ap team can follow to optimize the ap process:

Effective Vendor Management

- Regularly communicate with vendors regarding services purchased and pay invoices within the agreed-upon terms.

- Maintain a centralized vendor database to access vendor information when needed easily.

Streamlined Invoice Processing

- Implement automated systems to capture and process invoices, reducing manual errors and saving time.

- Use technology to match invoices with purchase orders and general ledger entries for proper validation.

Segregation of Duties and Internal Controls:

- Ensure clear segregation of duties in the AP process, separating invoice approval, data entry, and payment processing.

- Implement strong internal controls to prevent fraud and unauthorized payments.

Timely and Accurate Data Entry

- Train AP staff to promptly and accurately enter payable records into the accounting system.

- Regularly reconcile accounts payable balances with vendor statements to maintain accuracy.

Optimize Payment Terms

- Negotiate favorable payment terms with vendors to manage cash flow efficiently.

- Avail early payment discounts to reduce overall costs.

Automated Early Payments

- Utilize automated systems to identify and schedule early payments, maximizing discounts and improving vendor relationships.

Integration with General Ledger

- Integrate accounts payable with the general ledger for seamless financial reporting and analysis.

- Ensure that all payable transactions are accurately reflected in the company’s financial statements.

Financial Reporting and Analysis

- Generate regular AP reports to analyze outstanding liabilities and track payable aging.

- Use this data to forecast cash flow and make informed financial decisions.

Compliance and Audit Readiness

- Adhere to accounting standards and regulations to ensure compliance.

- Prepare for audits by maintaining organized payable records and supporting documentation.

Continuous Process Improvement

- Regularly review the AP process to identify areas for improvement and implement necessary changes.

- Encourage feedback from AP staff to address challenges and enhance efficiency.

Conclusion

Effectively managing accounts payable ensures timely payments, strong vendor relationships, and accurate financial records. By implementing best practices and leveraging modern accounting software, businesses can optimize their AP process, improve cash flow management, and maintain a healthy financial position.

To learn more about topics similar to accounts payable, visit the Akounto Blog section today.