What is Revenue?

Revenue refers to gross income generated from normal business operations, usually sales. Revenue is also known as top-line or gross sales revenue.

What’s covered in the article

The company’s revenue refers to the top line because, from it, various deductions will be made, which include:

- Costs and expenses.

- Interest payments.

- Depreciation, etc.

After making the deductions from the top line, the net income (net revenue) is derived. If the net income is positive, then it represents profit; otherwise, it is a loss. From profits, the dividends are distributed.

Revenue is represented in the company’s income statement. Accountants further classify revenue to get deeper insights into the revenue-generating efficiency of a company’s operations.

Wealth creation and profits are the goals of commercial enterprises, and revenue is the foremost indicator and contributor towards this goal.

Revenue for businesses comes from the sale of goods and services. For non-profit organizations, revenue comes from grants, donations, fundraisers, membership fees, etc. Government revenue comes from taxes (direct and indirect), fines, penalties, fees, sovereign loans, etc.

Revenue directly contributes to profits. The general thumb rule is, “The higher the revenue, the higher the profits.” A keen investor focuses on operating margins, profit margins, and key ratios like Earnings Per Share (EPS), P/E Ratio (Price-to-Earnings Ratio), and P/S Ratio (Price-to-Sales Ratio).

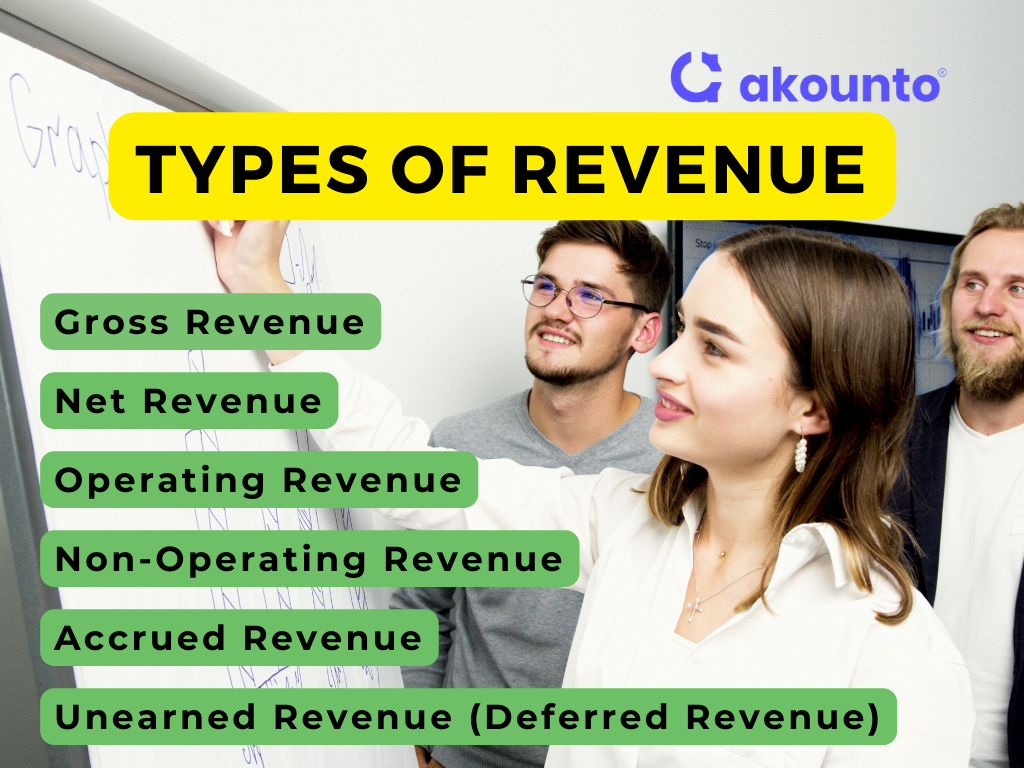

Types of Revenue?

Gross Revenue

Gross revenue means the money brought in my total sales from selling goods or services without deducting any costs or sales taxes. Gross revenue is used interchangeably with sales revenue.

Gross revenue, along with cash flow, represents the company’s capacity to generate revenue and helps the investors analyze the financial performance of the company. It is from gross revenue that all the expenses and costs will be paid.

Net Revenue

Net revenue or net income is also called the bottom line. The bottom line refers to the money left from the gross revenue after deducting expenses and costs related to the core business operations.

Net revenue is not the same as net profit. There are many other expenses and costs, like noncash expenses, that are yet to be deducted from net revenue to derive net profit.

Operating Revenue

Operating revenue refers to the money earned through the core business operations. Operating revenue primarily includes revenue from sales, i.e., revenue earned from sales of goods or services.

In any company, the operating revenue forms the major portion of total revenue.

Some common operating revenue sources are:

- Sales of goods or services

- Service revenues

- Membership fees

- Revenue from intellectual property like trademarks, patents, royalties, etc.

Non-Operating Revenue

Non-operating revenue refers to the money generated from the core activities of a company.

The accountants need to classify between operating and non-operating revenues to distinguish between the company’s revenue generated from business operations vs revenue generated from one-time or non-recurrent activities.

Some common examples of non-operating revenue sources are:

- Profit or loss from securities sales.

- Dividend income.

- Profit or loss due to fluctuations in foreign exchange.

- Writing down of an asset.

Accrued Revenue

Accrued revenue is the income earned but not received.

Accrued revenue is the concept related to the accrual accounting method, where the company must recognize revenue in the period when it is generated and not when the cash is received. This revenue recognition principle leads to the creation of accrued and deferred revenue items in the company’s financial statements.

Usually, accrued revenue is more common in service-based industries like consultancies, where services delivered in one accounting period are paid in the next accounting period. Often, service revenue forms the major source of accrued revenue. It is often categorized as accounts receivable in financial statements.

Unearned Revenue (Deferred Revenue)

Unearned revenue refers to income received in advance for goods or services yet to be delivered; because of this, it is shown as a current liability in the balance sheet.

As the goods and services are being delivered, the deferred/ unearned revenue is then transferred to the income statement for the same amount.

Revenue: Calculation and Formula

Revenue recognition differs from company to company based on the business model. Heavy industry’s revenue will be different from that of an FMCG and much different from that of a local retail store.

For accounting purposes, the fundamental base of calculating revenue is based on the units sold and the selling price.

Gross Revenue Formula

Gross Revenue Formula = Number of units sold * Price Per Unit

Net Revenue Formula

Net Revenue = Gross Revenue – Discount – Sales Returns – Allowances

When the company has multiple products, then the sales transactions of all the products are combined to calculate the company’s total revenue.

Example of Revenue

A company’s income statement depicts the revenue generated in a given accounting year. Usually, it comprises sales revenue.

|

Income Statement (Sample for showing Revenue) |

|

|

Year Ended Month DD, |

YEAR |

|

Revenue: |

|

|

Product |

XXXX |

|

Service and other |

XXXX |

|

Total revenue |

XXXX |

|

Cost of revenue: |

|

|

Product |

XXXX |

|

Service and other |

XXXX |

|

Total cost of revenue |

XXXX |

|

Gross margin |

XXXX |

|

Research and development |

XXXX |

|

Sales and marketing |

XXXX |

|

General and administrative |

XXXX |

|

Operating income |

XXXX |

|

Other income, net |

XXXX |

|

Income before income taxes |

XXXX |

|

Provision for income taxes |

XXXX |

|

Net income |

XXXX |

|

Earnings per share: |

|

|

Basic |

XX |

|

Diluted |

XX |

|

Weighted average shares outstanding: |

|

|

Basic |

XX |

|

Diluted |

XX |

Revenue Recognition Principle ASC 606 and IFRS 15

ASC 606

The revenue recognition principle given by FASB (Financial Accounting Standards Board) is applicable to public, private, and non-profit entities. ASC 606 states that the entity should recognize revenue (consideration) that is related to the goods and services delivered to the customer. The entity should be entitled to receive the revenue.

ASC 606 gives 5 steps to apply the revenue recognition principle:

- Identification of contract (with customer)

- Identifying the “performance obligation” around which the contract is made.

- Ascertaining the transaction price.

- Mapping the transaction price with the performance obligation.

- Recognizing revenue only when the performance is delivered.

The revenue must be recognized when the customer gets the goods or services.

IFRS 15

International Accounting Standards Board, in May 2014, gave IFRS 15, which establishes guidelines for reporting revenues covering the amount, timing, and nature.

IFRS 15 is applicable to all contracts with customers except for certain specified contracts like leases (IFRS 17), joint arrangements (IFRS 11), insurance contracts IFRS 4; etc.

It gives a similar 5-step model to that given by ASC 606, thereby converging IFRS and ASC.

Deductions from Revenue

- Returns and Allowances: These are the sales returns that customers send back. Allowances are reductions in the price of goods or services due to defects or other issues.

- Discounts and Sales Tax: Discounts are reductions in the original selling price given to customers. A sales tax is levied on the selling price.

- Cost of Goods Sold (COGS): Direct costs related to manufacturing or purchasing the goods.

- Operating Expenses: OpEx are the costs incurred for running a company’s routine operations, like rent, salaries, etc.

- Interest and Taxes: This includes interest payments against debts and taxes to be paid for the income.

Revenue and Cash Flow are Different

A company’s revenue is the total income generated from the core business operations, while cash flow refers to the net flow of cash and cash equivalent in a business.

Revenue is basically the total sales revenue on a broader level, while cash flow comprises cash from investing activities, cash from operating activities, and cash from financing activities. Revenue can be further classified into operating and non-operating revenue.

Cash flows track the movement of cash, while revenue measures the income generated via sales.

Revenue can be recognized even if no cash has been received by the company, as seen in the accrual basis of accounting. Cash flow recognizes the flow of cash on payment or receipt of cash.

Revenue is shown on the income statement, while for cash flows, there are separate cash flow statements, which are a part of the company’s financial statements.

Conclusion

For a small business and a growing startup, it is important to know and differentiate between the types of revenue. Calculating revenue is important for interpreting the financial performance of investors, shareholders, owners, etc. There are accounting guidelines and principles that lay down how and when to recognize revenue and adhere to international practices of financial reporting. It is important for a business owner to maintain proper financial records and follow accounting guidelines.

Visit Akounto’s blog and learn more about finance and accounts, as well as tips and insights to manage your finances efficiently.