Introduction to Profit Margins

Profit margin represents the percentage of net sales that remains after all operating expenses have been accounted for.

What’s covered in the article

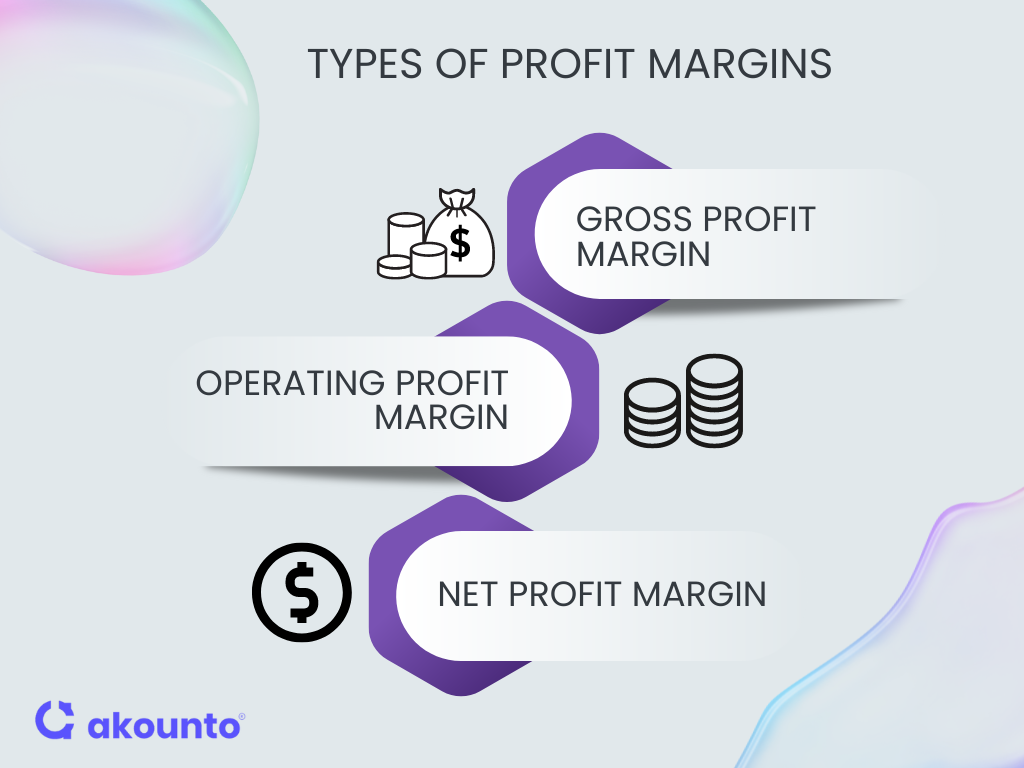

Profit margin is a critical financial metric, offering insights into a company’s financial health and operational efficiency, and can be categorized into three primary types:

- The gross profit margin

- The net profit margin

- The operating profit margin

The gross profit margin focuses on the relationship between net sales and the COGS (cost of goods sold), providing a snapshot of how efficiently a business can produce its goods.

The net profit margin delves deeper, considering all expenses, both operational and non-operational, to reveal the actual profitability of a business.

The operating profit margin, meanwhile, narrows its lens to purely operational costs, shedding light on the efficiency of the company’s core business operations.

For small business owners, understanding these metrics is paramount.

A higher profit margin, especially in industries known for high gross margins, often signifies optimal business operations and a strong market position.

A margin below the industry’s ideal profit margin might indicate inefficiencies or heightened competition.

Understanding the different profit margins is essential for any business aiming to gauge its financial health and operational efficiency. These margins, each with its unique focus, provide insights into various facets of a company’s profitability.

Types of Profit Margins

Understanding the different profit margins is essential for any business aiming to gauge its financial health and operational efficiency.

Gross Profit Margin

The gross profit margin offers a preliminary insight into a company’s production efficiency. It measures the percentage of revenue that surpasses the cost of goods sold.

Gross Profit Margin Formula

Gross Profit Margin=(Gross Profit / Net Sales)×100

A higher gross profit margin signifies that the business retains a substantial portion of its sales after accounting for the direct costs related to production.

Operating Profit Margin

This margin delves deeper, accounting for not only the cost of goods sold but also other operational expenses like salaries, rent, and utilities. It offers insights into the profitability derived from the company’s core operations.

Operating Profit Margin Formula

Operating Profit Margin=(Operating Profit / Net Sales)×100

A robust operating profit margin suggests that the company efficiently manages its core business activities and related costs.

Net Profit Margin

The net profit margin encompasses all operational and non-operational expenses to provide a holistic view of the company’s overall profitability.

Net Profit Margin Formula

Net Profit Margin=(Net Profit / Net Sales)×100

A high net profit margin means that the company excels in managing its total expenses, ensuring a healthier profit for each dollar earned.

These profit margins are invaluable business tools, offering detailed insights into production efficiency, operational management, and overall financial prowess.

Factors Influencing Profit Margin

Profit margin isn’t a static financial metric. Profit margins vary based on a myriad of factors, both internal and external to a business. Understanding these determinants is crucial for any business owner aiming to optimize profitability and maintain a healthy profit margin.

- Cost of Goods Sold (COGS): The direct costs of producing goods or services significantly influence the gross profit margin. Raw materials, direct labor, and factory overhead expenses fall under this category. A surge in raw material prices or increased labor costs can adversely affect the company’s gross profit margin.

- Operating Expenses: Beyond the direct costs, businesses incur operating expenses like rent, salaries, utilities, and administrative costs. Efficient management of these expenses is vital to maintain a robust operating profit margin.

- Pricing Strategy: The price at which goods or services are sold directly impacts the net profit margin. While higher prices can lead to higher margins, they must be justified by value to retain loyal customers.

- Sales Volume: Even with a good profit per unit, if the total sales volume is low, the overall profit might not be substantial. Conversely, low-margin ventures with high sales volumes can still be lucrative.

- Overhead Costs: These are the indirect costs of running a business, including administrative expenses and other non-production-related costs. Keeping overhead costs in check is essential for a healthy net profit margin.

- Cash Flow Management: Efficient cash flow management ensures a business has enough liquidity to pay for its short-term obligations and invest in growth.

- Market Competition: In highly competitive markets, businesses might need to reduce prices, impacting their profit margins. Offering unique value propositions can allow for premium pricing even in competitive scenarios.

- Economic Factors: External factors like inflation, interest rates, and economic downturns can influence a business’s profit margin. For instance, during economic recessions, consumers might cut back on spending, affecting the total revenue of businesses.

- Customer Loyalty: Loyal customers often mean repeat business. Investing in customer loyalty programs can lead to consistent sales and, consequently, stable profit margins.

Regularly reviewing the income statement for small business owners can provide insights into these influencing factors. By understanding and managing these determinants, businesses can strive for higher profit margins, ensuring long-term financial health and sustainability.

Understanding a good profit margin requires a deep dive into industry-specific benchmarks. Net profit margins vary considerably across industries, and for many new business owners, gauging how much revenue should translate into profit can be challenging. Industry averages offer a guiding compass.

Examples: Average Profit Margins by Industry

Tech Sector

High-profit margins are the norm in the technology sector, especially in software companies. With minimal direct costs post the initial development phase, these businesses can achieve net profit margins above 20%. Their ability to scale without proportionate increases in costs is a significant advantage.

Retail Industry

The retail landscape is vastly different. Here, business expenses such as inventory management, storefront maintenance, and staff salaries often squeeze net profit margins. Given the industry’s challenges, a retailer celebrating a net profit margin of 5% is not uncommon.

Construction Industry

Construction, an industry dominated by high direct costs, from raw materials to labor, operates on relatively thin margins. A good profit margin in this sector might hover around the 5-7% mark. The tangible nature of their output and the unpredictability of project complications can impact profitability.

Service Industries

Service-oriented businesses, whose primary operating income stems from expertise rather than physical goods, often enjoy 15-20% net profit margins. Compared to product-based businesses, their lower overheads allow for this higher profitability.

Financial Sector

With its reliance on operating income from investments and loans, the financial sector experiences fluctuating net profit margins. Market conditions heavily influence these margins. In prosperous years, high-profit margins are achievable but can wane during economic downturns.

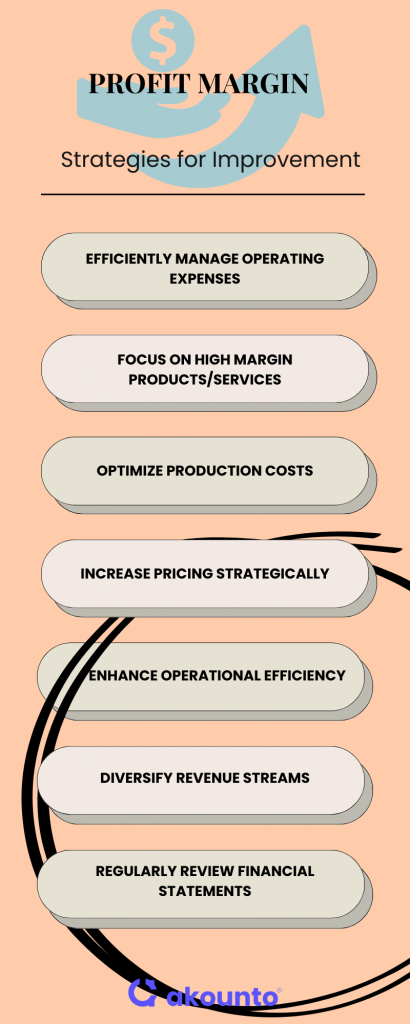

7 Strategies to Improve Profit Margin

Achieving a good profit margin is the aspiration of every business, but maintaining or improving this margin requires consistent effort and strategic planning. Here are seven strategies that can improve profit margins:

1. Efficiently Manage Operating Expenses

One of the most direct ways to improve profit margins is by managing operating expenses. Regularly reviewing the income statement can help identify areas of wastage or inefficiency. Businesses can significantly reduce their expenses by streamlining operations, renegotiating contracts, or even switching suppliers without compromising on quality or output.

2. Focus on High Margin Products or Services

Not all products or services offer the same profit margins. By identifying which ones bring in the highest net income relative to their costs, businesses can prioritize them in their sales and marketing efforts. This doesn’t mean neglecting other products but rather allocating resources where they yield the best returns.

3. Optimize Production Costs

Production costs can eat into profit margins, especially in manufacturing or product-based businesses. Businesses can achieve a good gross profit margin by adopting lean manufacturing principles, automating processes, or sourcing cost-effective raw materials. It’s about producing the same quality at a reduced cost.

4. Increase Pricing Strategically

While it might seem counterintuitive, raising prices can sometimes lead to a better profit margin without significantly affecting sales volume. This strategy requires an understanding of the market and the value proposition of the product or service. Customers who perceive added value are often willing to pay a premium.

5. Enhance Operational Efficiency

Operational inefficiencies can lead to increased operating costs. Businesses can enhance efficiency by adopting modern technologies, training staff, and streamlining workflows. This reduces costs and improves the quality of products/ services, which leads to higher customer satisfaction, referral, retention, and loyalty.

6. Diversify Revenue Streams

Depending on a single income stream can be risky. By diversifying revenue streams, businesses can cushion themselves against market fluctuations. This might mean introducing new products, expanding to new markets, or venturing into complementary services. A diversified portfolio often leads to a more consistent net income.

7. Regularly Review Financial Statements

Regular reviews of financial statements, especially the income statement, can offer insights into the business’s financial health. It allows the small business owner to spot trends, identify areas of concern, and make informed decisions. Businesses can strategize more effectively by understanding where the money is coming from and where it’s going.

Understanding what is a good profit margin for one’s industry and then striving to achieve or surpass it is crucial. It’s equally important to remember that profit margins aren’t static. They require regular monitoring and proactive strategies to maintain or improve. By incorporating the strategies mentioned above, businesses can set themselves on a path to financial success.

Challenges for Small Business Owners

Small business owners face many challenges in their quest to achieve a healthy profit margin. These challenges can range from managing operating costs to understanding the intricacies of gross margins. Here are some of the most common obstacles they encounter:

- Understanding Gross Margin:

- Many new entrepreneurs struggle to grasp the concept of gross margin fully. It represents the difference between sales and the direct cost of making a product or service.

- A clear understanding of gross profit margins is essential as it provides insights into the basic profitability of a company’s core operations, excluding indirect costs.

- High Operating Costs:

- One of the daunting challenges for small businesses is managing and reducing operating costs.

- These costs can quickly erode profit margins, especially if they aren’t monitored and controlled effectively.

- Pricing Dilemmas:

- Pricing strategy is a delicate balance. Price too high, and you risk alienating customers; price too low, and you might face a lower profit margin or even losses.

- Finding the sweet spot where the price supports the company’s profit goals while remaining attractive to customers.

- Managing Direct Costs:

- Direct costs, like raw materials and labor, may fluctuate due to factors like consumer demand, supply chain disruptions, and economic conditions.

- Keeping these costs in check is vital for maintaining a healthy gross margin.

- Achieving Consistent Profitability:

- While some months might see high profits, others might witness a dip. This inconsistency can be challenging for small business owners who must plan for the future.

- Understanding factors influencing these fluctuations, such as seasonal demand or industry trends, can help better forecasting.

- Generating Sufficient Operating Income:

- Total operating income is a key indicator of a business’s health. It’s the income left after all operating expenses have been deducted from gross profit.

- Ensuring a consistent and sufficient operating income is essential for the long-term sustainability of a business.

- Competition and Market Pressures:

- In many industries, small businesses face stiff competition from larger players who can afford to operate with a lower profit margin due to economies of scale.

- Adapting to market pressures and finding unique value propositions can help small businesses discover their niche.

- Maintaining the Company’s Profit in the Face of Growth:

- As businesses grow, they often face increased expenses, be it hiring more staff, expanding operations, or investing in marketing.

- Ensuring that the company’s profit grows proportionally with the business scale is a challenge many entrepreneurs face.

The Role of Technology in Enhancing Profit Margins

- Automation: Implementing automated systems can significantly reduce manual tasks, decreasing labor costs and human errors. For instance, automating inventory management can prevent overstocking or stockouts, optimizing expenses.

- Data Analytics: Modern businesses leverage data analytics to gain an objective understanding of customer preferences and market trends. By understanding what the consumer wants, businesses can tailor their offerings, increasing sales and better profit margins.

- Digital Marketing: Traditional marketing methods can be costly. Digital marketing, on the other hand, offers a cost-effective way to reach a broader audience. For example, targeted ads can ensure that promotional content reaches the most relevant audience, ensuring a higher return on investment.

- E-commerce Platforms: The rise of online shopping platforms allows businesses to trade in the global market without the overhead costs of physical stores, enhancing the gross margin.

While technology offers multiple avenues to enhance a company’s profit, choosing the right tools aligned with the business model is essential. For those looking to keep a close eye on their financial metrics, investing in accounting software can be a game-changer, offering real-time insights and facilitating informed decision-making.

Conclusion

Understanding and optimizing profit margins is paramount. While the challenges, especially for small business owners, are numerous, a strategic approach rooted in financial understanding can pave the way for success. A healthy profit margin is a testament to a company’s operational efficiency and market position.

Employ Akounto‘s accounting software to effortlessly record your transactions and track your accounts.