What is a Cost Recovery Method?

The cost recovery method is a revenue recognition method where the profit is not recognized until all payments are received and the seller’s cost is recovered.

The cost recovery method is also known as the collection method of revenue recognition.

What’s covered in the article

The goal of the cost recovery method is to match the expenses of an asset with the revenue it generates.

The cost recovery is made through depreciation, a generally accepted accounting principle involving allocating an asset’s cost over time.

The cost recovery method does not recognize the profit in the sale of a product or service unless the total product costs, during its production, is recouped through sales.

To calculate cost recovery, let’s see an example. Suppose a business purchases a machine for $100,000 that it anticipates using for ten years. In that case, it will employ the cost recovery model by installment accounts receivable to cover all the costs of the machine and other expenses over those ten years.

What is Revenue Recognition?

The revenue recognition method in accounting refers to the specific guidelines and principles businesses follow when recognizing and recording revenue in their financial statements. This method outlines the criteria for when and how a company can record revenue. The cost recovery method is one of the types of revenue recognition methods.

Different revenue recognition methods businesses can use include accrual, cash, and hybrid methods. The accrual method is most commonly used, which recognizes revenue streams when earned, not when actually received.

The cash method recognizes revenue when it is received, regardless of when it was earned. The hybrid method is a combination of the accrual and cash methods.

Bad Debts and Cost Recovery

Bad debts refer to the total money a company is owed by customers or clients but is unlikely to collect for a long period. This can occur when a particular client is unable or unwilling to pay their outstanding balances, or a company cannot locate a debtor.

In accounting, bad debts are recorded as an expense on the company’s income statement, reducing the net income and profitability. This is done to offer an accurate view of the company’s financial performance, as it is no longer expecting to receive payment for these debts.

However, if a company can collect on bad debt, it is a form of cost recovery. For example, if a company recorded uncovered costs for services sold to a particular client and later received the due payments, it will reverse the expense and consider the recovered amount as revenue.

When to Use Cost Recovery Method?

Businesses use the cost recovery method (collection method) when there is a high degree of ambiguity regarding the recovery of a receivable. By spreading the cost of the asset over its useful life, a business can accurately determine the cost of using the asset in its financial statements.

One benefit of using the cost recovery method is it allows business owners to postpone the due date for paying taxes. This is because the tax will not be payable for it until the full cost of the goods sold is recovered. This can result in some savings for the business.

Cost recovery is not similar to having a good profit margin. A good profit margin is related to generating returns above cost recovery. While cost recovery is intended to only recover expenses.

Calculating Cost Recovery

Cost recovery is when your revenue exceeds the input cost for a product or a service. For calculating cost-recovery you must know the cost incurred for rendering the services and manufacturing or selling the product.

Step 1: Calculate Product Input Costs

To arrive at the total product input costs, consider all the direct and indirect costs. Consider all the invoices, bills, purchase orders, etc. Add software and hardware costs, add any cost incurred for transport, packaging, etc. Proportionally allocate the cost of marketing and advertising.

Step 2: Adding Up Total Revenue

Revenue is the total incoming or gross receipts from the sale of services or products for a given timeframe. It can also be called total receivables.

Step 3: Deduct Input Costs from Total Revenue Received

The difference between revenue received and input cost should be positive for a company or a business to recover the cost. If the input cost is higher than the revenue earned, then there is a profit, otherwise it’ll be a loss.

Cost Recovery Method Example

Let us see the cost recovery method example illustrating how to calculate cost recovery:

XYZ Company manufactures high-end kitchen appliances and uses cost recovery accounting.

In the first quarter of the year, XYZ sold 100 units of the latest kitchen range at $500 per unit. The cost of producing each unit was $400.

XYZ’s accounting team records the revenue for the first quarter as follows:

Revenue = 100 units x $500/unit = $50,000

The actual cost of goods sold for the first quarter is calculated as follows:

Cost of goods sold = 100 units x $400/unit = $40,000

The gross profit for the first quarter is calculated as follows:

Gross profit = Total Revenue – Cost of goods sold = $50,000 – 40,000 = $10,000

XYZ’s accounting team records $10,000 gross profit as a liability in journal entries, as the company has not yet collected payment from its customers.

In the second quarter, XYZ received client’s payments for the 100 units sold in the first quarter. The accounting team records the payment as follows:

Revenue = 100 units x $500/unit = $50,000

The sale transaction for the second quarter remains unchanged at $40,000. The gross profit for the second quarter is calculated as follows:

Gross profit = Total Revenue – Cost of goods sold = $50,000 – $40,000 = $10,000

The gross profit for the second quarter is recorded as a gain in the income statement, and the liability for it in the first quarter is removed from the balance sheet.

Using the cost recovery method referred to, XYZ could delay the revenue recognition and the corresponding tax payment until it receives money from its customers. This potentially saved the company on tax payments in the short term.

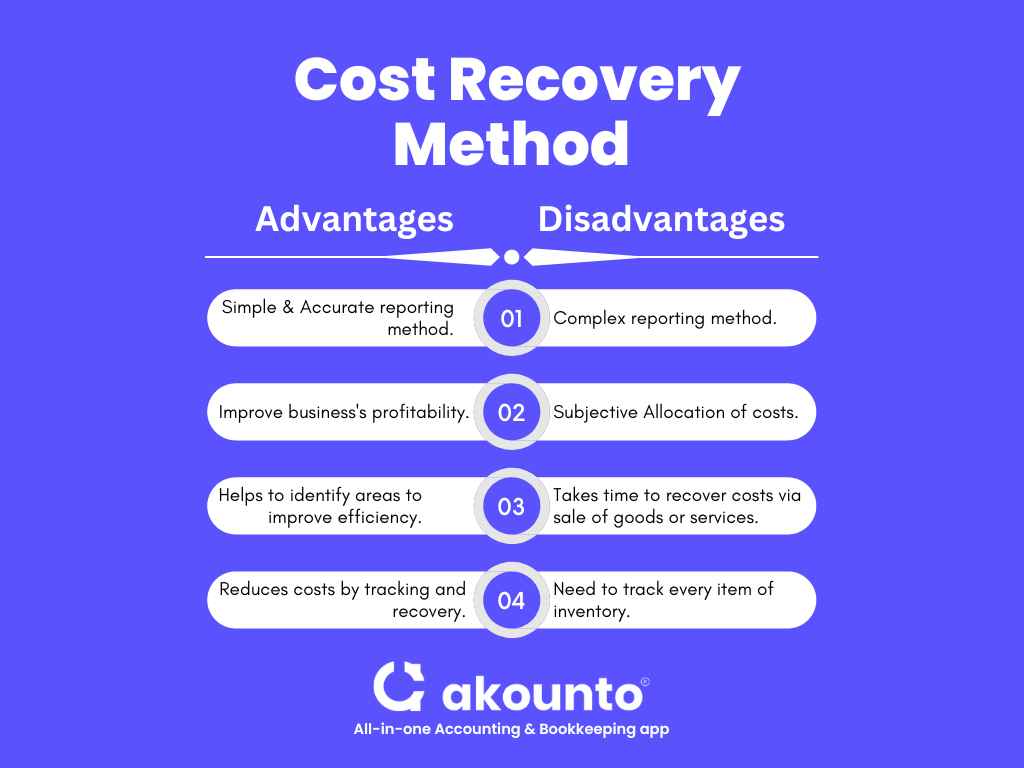

Advantages and Disadvantages of the Cost Recovery Method

Advantages

- Accurate financial reporting: The cost recovery method helps to accurately reflect the costs associated with producing goods or services, which is important for reporting income and the financial performance of a business.

- Improved profitability: By recovering production costs, the cost recovery method can help improve a business’s profitability.

- Increased efficiency: Businesses can identify areas to improve efficiency and reduce costs by tracking and recovering costs. The cost recovery method thereby helps in optimizing the business operations.

Disadvantages

- Complexity: The cost recovery method can be complex as it requires businesses to track and allocate costs to specific products or services.

- Subjectivity: The allocation of costs to specific products or services can be subjective, as it may require estimates and assumptions. The cost recovery method can be more effective if each inventory item is individually tracked, as it happens in a specific identification method.

- Timing: The cost recovery method may not accurately reflect the financial performance of a business in the short term, as it may take time to recover costs through the sale of goods or services.

Conclusion

The cost recovery method provides valuable insights into a company’s financial performance and helps to align revenue recognition with the cost incurred by the company.

Akounto is a comprehensive accounting software offering various features, including invoicing, recordkeeping, and more. Read other recommended articles on accounting methods with ease on Akounto’s blog.